Blockchain safety firm Elliptic revealed that round $4 billion had been laundered by decentralized exchanges, cross-chain bridges, and coin swaps since 2020.

Based on the report, the unlawful use of DEXs normally comes within the type of coin swapping. This could possibly be swapping tokens to keep away from asset freeze, swapping for ETH, or swapping tokens to bridge them to a different community.

Elliptic acknowledged that roughly $3.3 billion was laundered by these exchanges. A 3rd of such circumstances was swapping a token for an additional utilizing DEX. The agency continued that the fourth quarter of 2021 noticed essentially the most exercise, with $374.3 million swapped.

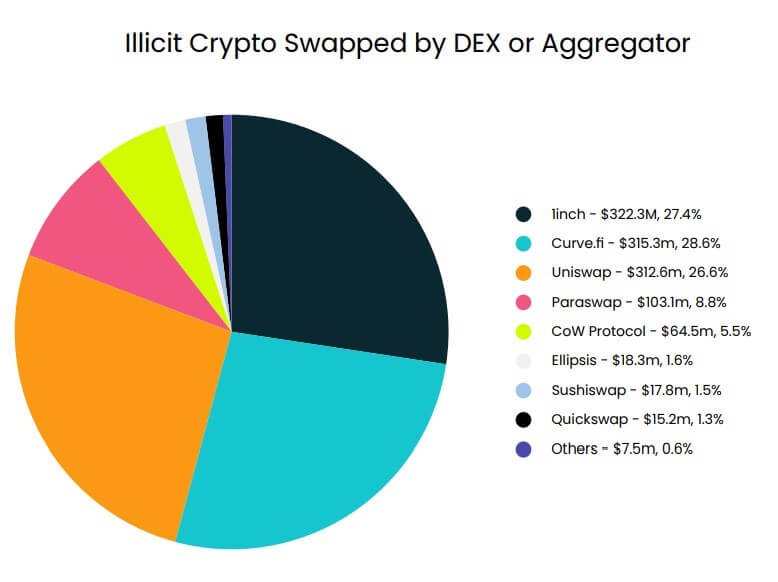

The report revealed that 1inch, Curve.fi, and Uniswap had been answerable for greater than 75% of all illicit crypto swaps, whereas Paraswap and CoW Protocol had been answerable for about 14% of such acts.

In the meantime, the report famous that swapping tokens for mixing was quite common earlier than the sanction of Twister Money. Because the mixer’s ETH contract had the most important quantity, many used DEXs to swap stolen belongings into ETH.

Nevertheless, the report clarified that using DEX by criminals doesn’t absolutely symbolize what these exchanges are used for. Even with the expansion, most use circumstances are nonetheless for authentic functions.

“Whereas the quantity of stolen funds processed by DEXs – $1.2 billion – is substantial, this determine corresponds to the present common each day buying and selling quantity of Uniswap alone. The first makes use of of DEXs are overwhelmingly authentic and serve an important function in in the present day’s more and more related crypto ecosystem. DEXs are due to this fact right here to remain”

Nevertheless, the report famous the necessity to handle the dangers of felony exploitation, particularly within the face of sanctions. It solely takes a transaction from a sanctioned entity for a DEX to be in a possible breach.