Crypto funding agency Pantera Capital launched a ‘12 months Forward’ letter to traders on Jan. 23, wherein it disclosed knowledge showcasing the blockchain trade’s resilient nature.

CEO of Pantera Capital, Dan Morehead, shared an outline of the corporate’s outlook on 2023 wherein he said;

“Blockchain’s resilience within the face of a horrible macro marketplace for danger belongings and historic idiosyncratic disasters is spectacular.”

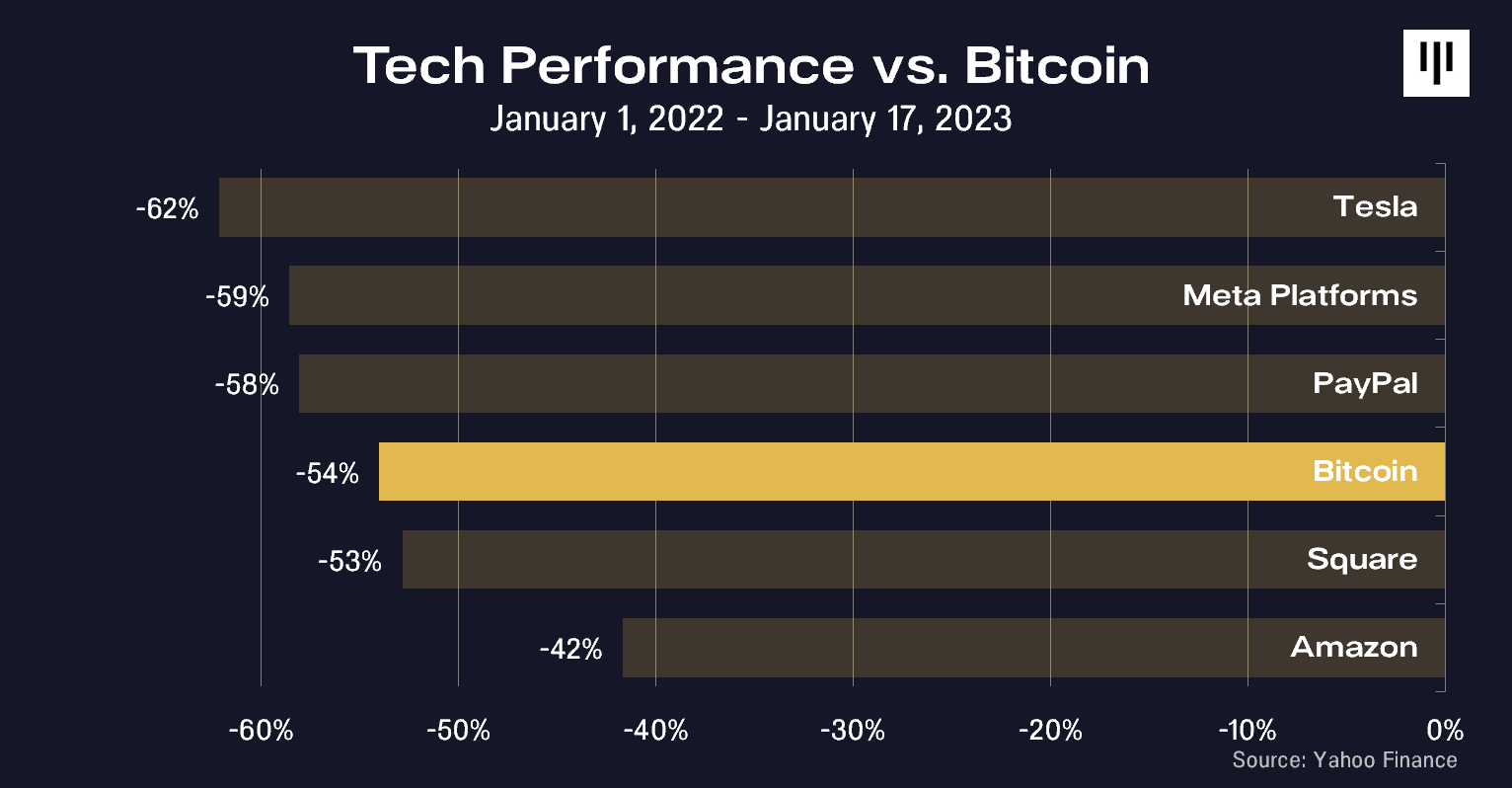

Compared to the most important firms within the tech trade, Bitcoin has outperformed Tesla, Meta, and PayPal over the previous 12 months. Pantera’s knowledge, nonetheless, minimize off on Jan. 17, which means that it doesn’t account for the continued rally in Bitcoin’s worth. As of press time, Bitcoin is now down 48%, placing it forward of Sq. on the under chart.

Within the letter to traders, Morehead said that he was not shocked that Bitcoin had carried out so nicely, citing his expertise of three earlier bear markets. Additional, he revealed that he believes the underside of the market has already been and gone.

“I imagine that it has already bottomed and we’ll see blockchain belongings proceed their 13-year 2.3x per 12 months appreciation development quickly.”

The resilience of DeFi over CeFi

Joey Krug, the CO-CIO of Pantera, shared his outlook for 2023 within the letter, calling 2022 “in all probability the most important 12 months of upheaval in crypto historical past.” Evaluating 2022 with 2014, Krug in contrast the crypto tasks that failed final 12 months to people who collapsed following the primary Bitcoin halving. Particularly, Krug remarked, “many tasks and corporations that exemplified the antithesis of crypto’s elementary rules blew up.”

Krug went on to determine a core subject inside many ‘crypto’ firms which have thrived lately. Crypto is constructed on permissionless know-how and was all the time designed to take away the necessity for belief. Nevertheless, many firms that failed in 2022 required customers to belief them – a belief that appears to have been exploited.

“Precise crypto — like on-chain, good contract, protocol-based crypto — actually mitigates these issues since you don’t want at hand all of your cash over to at least one entity that claims, belief us.”

Additional, Krug took a shot at those that argue in opposition to the relevancy of good contracts and the problems of ‘dangerous’ DeFi lending. Assuredly, he identified that “it’s not the pc program’s fault in case your mortgage doesn’t receives a commission again” because of a poorly designed good contract.

Amid failing centralized exchanges, Kurg famous that decentralized exchanges that have been concerned in lending to “largely unknown counterparties didn’t blow up.” In an trade that has been closely examined all through the previous 12 months, it was CeFi that “blew up,” not DeFi. The businesses using blockchain know-how to safe their lending actions continued working whereas FTX, Voyager, BlockFi, and Celsius failed.

Krug attributed DeFi’s success to its trustless nature and extra resilient danger administration system.

In 2023 Krug famous that “regardless of decrease costs, I feel the house is clearly in a a lot better place than ever.” The advance within the underlying infrastructure and developer instruments was praised by Pantera’s CO-CIO, who believes the world’s monetary methods will finally all be constructed on blockchain rails.

“The common particular person may have apps on their cellphone that give them entry to DeFi, the place they’ll be capable to have interaction in monetary transactions with out banks/brokers, with decrease charges, world liquidity, and markets working 24/7.”

Work all through 2023 and past ought to deal with making DeFi as straightforward as attainable and growing liquidity within the ecosystem. Krug highlighted that these points will “take one other two to 3 years to be solved.” Subsequently, his outlook for 2023 is that will probably be a time to construct.

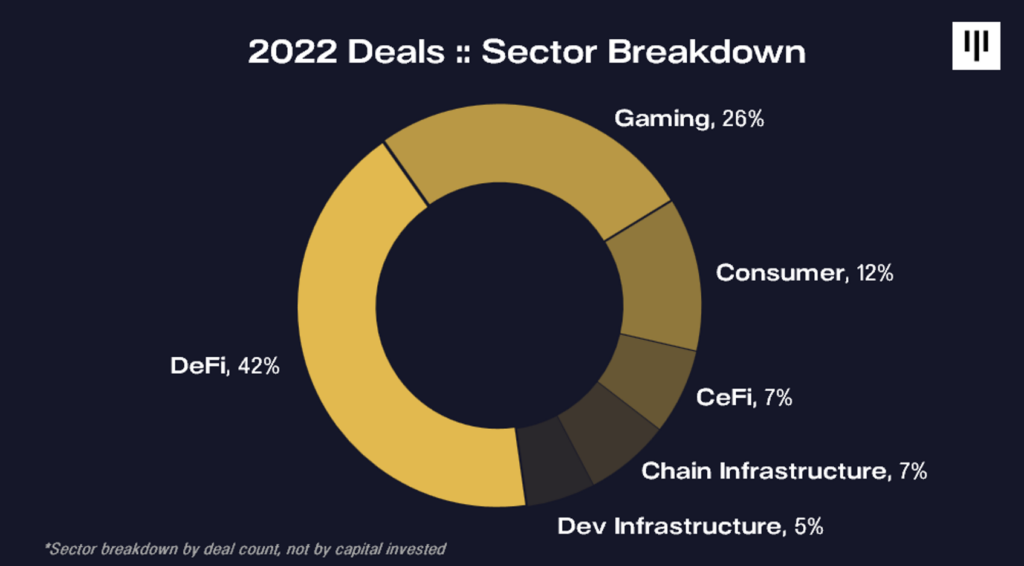

Blockchain sector breakdown

Paul Veradittakit, a Normal Companion at Pantera Capital, additionally summarized his views with a breakdown of essential 2022 metrics. The chart under reveals the extent of funding throughout the crypto trade, revealing DeFi and Gaming because the sectors with essentially the most important deal rely.

Pantera is very bullish on the crypto house in 2023; it famous, “we imagine this can be a great time to begin an organization within the blockchain house.” Additional, the letter revealed $121 billion that was raised within the first half of 2022 is now awaiting deployment to the crypto sector.

The full letter features a detailed assessment of 2022 and will be discovered on Pantera’s web site.