The largest information within the cryptoverse for Nov. 15 contains UK lawmakers probing Binance over FTX collapse, on-chain sleuth ZachXBT calling out Gate.io for overlaying up 2018 hack, and Three Arrows Capital transferring $20 million price of ETH and stablecoins.

UK Treasury Committee to probe Binance’s function in FTX collapse

Main crypto change Binance is beneath investigation within the U.Ok. for its alleged function within the FTX collapse. U.Ok. lawmakers have known as on the change to defend its determination to dump $500 million price of FTT tokens and to again out of the tried buy of FTX.

The lawmakers have requested Binance to submit inner discussions and paperwork regarding its tried buy of FTX.

Binance consultant Daniel Trinder stated the change will submit the requested paperwork however could withhold sure data.

Bahamas supreme courtroom appoints liquidators for FTX belongings

The Supreme Courtroom of Bahamas has authorised the appointment of Kevin Cambridge and Peter Greaves of PricewaterhouseCoopers as liquidators of FTX’s remaining belongings.

In response to the authority, the liquidators will pace up the liquidation course of in a bid to guard the curiosity of FTX collectors, shoppers, and stakeholders.

3AC pockets shifts over $20M in ETH, stablecoins over previous 6 days, fueling rumors of revival try

A pockets linked to the collapsed Three Arrows Capital (3AC) reportedly obtained about $20 million price of ETH, USDT, and USDC between Nov. 9 and Nov. 11.

The current inflows into the 3AC pockets have raised issues that the 3AC founders could also be seeking to elevate new funds to revive their operations.

ZachXBT calls out Gate.io for protecting 2018 hack beneath wraps

Again on April 18, 2018, North Korean hackers reportedly attacked Bter.com (now Gate.io) and stole over $230 million together with $10,777 price of Bitcoin from the change’s chilly pockets.

‘In response to on-chain sleuth ZachXBT, Gate.io coated up the 2018 hack, claiming that the crypto change was resistant to assault by anybody.

ZachXBT highlighted a report by @1A1zP1 which revealed how Gate.io misplaced Bitcoin, Ethereum, Zcash, Dogecoin, Ripple, Litecoin, and Ethereum Basic which totaled $234.3 million.

Over $500M flew out of Solana in every week, DeFi TVL down 63%

Following the FTX collapse, DeFiLlama information exhibits that Solana’s complete worth locked (TVL) has declined by 63.2% as over $500 million was withdrawn throughout DeFi protocols within the ecosystem.

During the last seven days, lending platform Solend misplaced 87.6% of its TVL, Liquid staking protocol Lido misplaced 71.77% whereas staking protocol Marinade Finance misplaced 54.73% of its TVL

Sam Bankman-Fried ends weird tweet thread and we’re nonetheless none the wiser

Former FTX CEO Sam Bankman-Fried’s (SBF) one-worded tweet collection which began on Nov. 14 has lastly ended, amidst speculations that he could also be struggling mentally.

Regardless of rumors that SBF’s reminiscence loss could also be as a result of a excessive consumption of stimulants like amphetamines, many crypto neighborhood members consider that the weird tweet was a deliberate troll to evade authorized actions for his crimes.

FTX hacker begins potential Pump & Dump rip-off as troll messages & cryptic tokens despatched to Uniswap

A pockets handle recognized as FTX Hacker created the meme token labeled “WHAT HAPPENED” to imitate obscure tweets despatched by Sam Bankman-Fried.

The hacker has reportedly despatched the WHAT HAPPENED token for buying and selling on Uniswap, in an try and pump and dump on unsuspecting meme coin buyers.

Solana Basis reveals minimal publicity to FTX

The Solana Basis stated it held about 3.43 million FTX tokens (FTT), 134.54 million Serum (SRM) tokens, 3.24 million shares of FTX Buying and selling inventory, and about $1 million price of money on FTX earlier than it stopped processing withdrawals.

Total, the Solana basis’s belongings held on FTX are at the moment price roughly $35 million.

FTX’s ex-CEO Sam Bankman Fried claims Alameda had extra belongings than liabilities only a few days earlier than chapter submitting

A current tweet by former FTX CEO Sam Bankman-Fried claimed that his empire had adequate assets to repay prospects as of Nov. 7, earlier than issues went uncontrolled.

12) To the most effective of my data, as of post-11/7, with the potential for errors:

a) Alameda had extra belongings than liabilities M2M (however not liquid!)

b) Alameda had margin place on FTX Intl

c) FTX US had sufficient to repay all prospectsNot everybody essentially agrees with this

— SBF (@SBF_FTX) November 15, 2022

Bankman-Fried added that he was working with regulators and related groups to refund prospects.

Analysis Spotlight

Bitcoin purchase strain mounts as stablecoin change provide strikes greater

Stablecoin metrics analyzed by CryptoSlate all level to a potential shopping for strain that will trigger the Bitcoin worth to rebound.

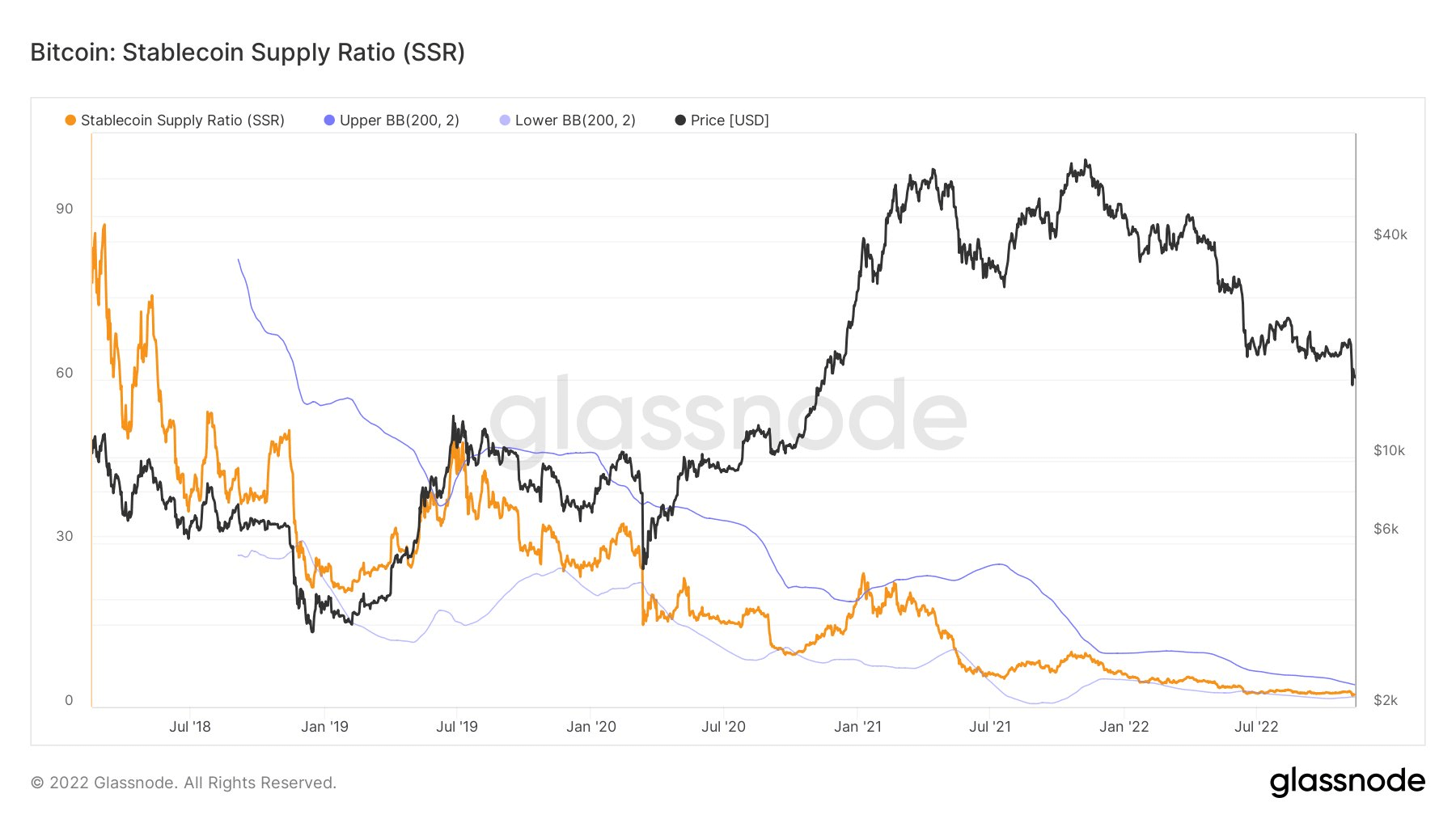

Beginning with the stablecoin provide ratio (SSR), a excessive SSR signifies promoting strain, and a low SSR means excessive potential shopping for strain.

From the chart, the SSR is at the moment at a low of two.28, which means that for each $1 stablecoin, there’s $2.28 of Bitcoin. That is thought of a sign of elevated shopping for strain for the flagship cryptocurrency.

As well as, the stablecoin change internet circulate quantity has surged to over $1 billion, indicating buyers’ readiness to benefit from low costs to build up extra Bitcoin.

Equally, the stablecoin steadiness on exchanges just lately reached a peak of $46 billion, which is taken into account bullish for Bitcoin.

Information from across the Cryptoverse

New York Fed launches digital greenback pilot

The Federal Reserve Financial institution of New York has partnered with Citigroup, HSBC Holdings, Mastercard, and Wells Fargo to conduct a 12-week digital greenback pilot, in keeping with Reuters.

The mission tagged “the regulated legal responsibility community”, will discover easy methods to use digital greenback tokens to hurry up settlement time in forex markets.

FTX contagion leads BlockFi to chapter; Liquidity change to halt withdrawals

As a result of FTX collapse, crypto lender BlockFi is on the verge of submitting for chapter, in keeping with The Wall Road Journal.

Equally, Liquidity change introduced that it will likely be halting all withdrawals as a result of FTX’s chapter state.

Paradigm writes off FTX funding to zero

Paradigm co-founder Matt Huang stated his firm has written off all its fairness funding into FTX to $0, because the FTX battles by its chapter state.

Sino Capital reviews minimal publicity to FTX

Funding agency Sino Capital stated it had a mid-seven determine locked up in FTX, however didn’t make investments any of its liquidity suppliers’ capital into FTX.

Binance didn’t leak API keys resulting in Skyrex assault

Binance CEO Changpeng Zhao “CZ” acknowledged that his change was not accountable for leaking the API keys exploited to hack Skyrex change earlier on Nov. 13.

Skyrex added that it was working to forestall future hack incidence, because it seeks to compensate all affected customers.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 3.03% to commerce at $16,807, whereas Ethereum (ETH) elevated barely by 2.83% to commerce at $1,252.