Perpetual futures are a singular spinoff product within the crypto market. In contrast to conventional futures contracts, which have a set expiration date, perpetual futures haven’t any expiration and purpose to imitate spot market costs. They obtain this by a mechanism often called the funding charge, which ensures that the futures value stays in step with the spot value. Given their shut tie to the spot markets and their potential to supply merchants leverage, understanding the dynamics of perpetual futures turns into paramount when analyzing Bitcoin’s value efficiency.

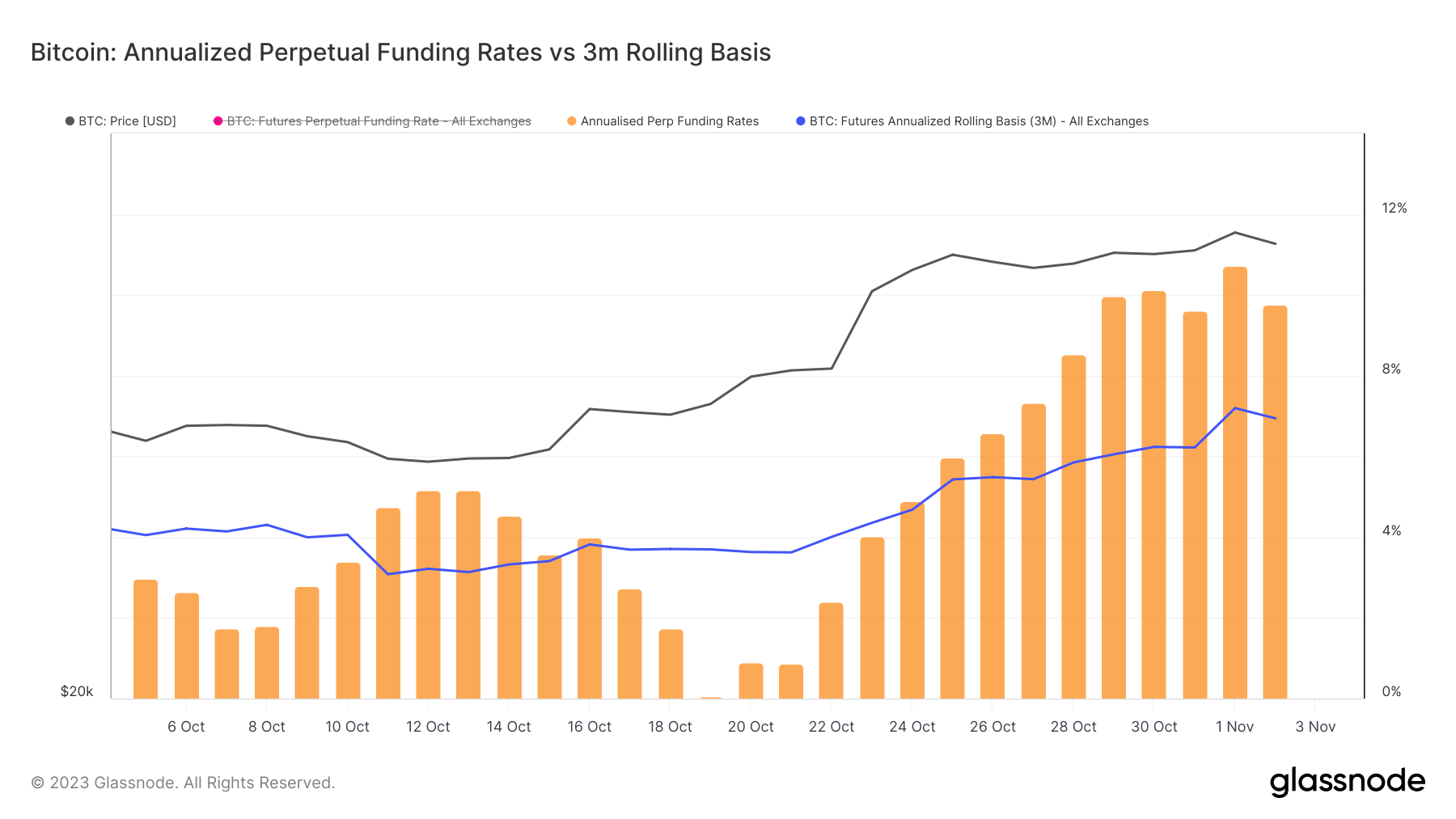

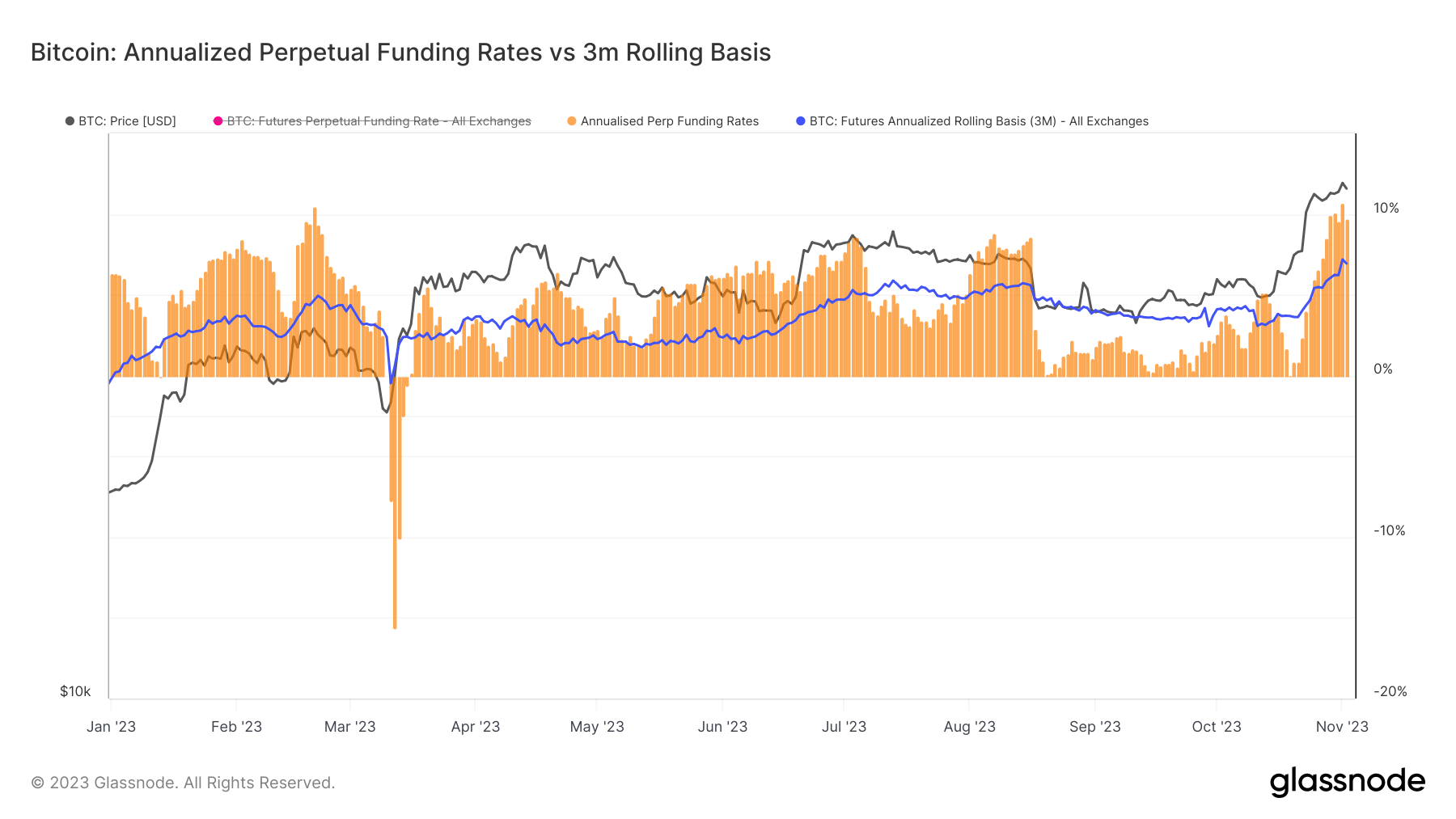

Between Oct.14 and Nov. 3, Bitcoin’s value skilled a substantial surge, shifting from $26,800 to $34,900. It even briefly touched $35,400 on Nov. 2. Accompanying this bullish transfer, the Bitcoin futures annualized three-month rolling foundation rose from 3.322% on Oct. 14 to a year-to-date all-time excessive of seven.194% on Nov. 2. Concurrently, the annualized perps funding charge escalated from 4.541% to 10.74% by Nov. 1, settling at 9.774% on Nov. 2—additionally its highest because the begin of the 12 months.

A rising three-month foundation signifies bullish sentiment for Bitcoin’s medium-term prospects. Merchants appear prepared to pay a premium on the futures, anticipating the value of Bitcoin to proceed its upward trajectory over the upcoming quarter. Then again, a pointy improve within the perpetual funding charge signifies excessive short-term bullishness. This may very well be attributed to a excessive demand for leverage by bullish merchants within the perpetual markets. The present vital differential between the perps charge and the three-month foundation suggests an over-leveraged market. Traditionally, durations the place the perpetual foundation soars above the 3-month foundation usually trace at excessive optimism amongst market individuals.

Whereas the present knowledge underscores a prevailing bullish sentiment, it additionally hints at potential vulnerabilities. A heightened demand in each perpetual and three-month futures would possibly recommend that merchants anticipate Bitcoin’s value to surge additional. The sturdy foundation improve underpins this sentiment, displaying sturdy confidence in Bitcoin’s future efficiency. Nevertheless, the disparities noticed, particularly within the perps charge, may also set the stage for potential value corrections if market sentiment shifts.

The publish Perpetual futures market paints a rosy medium-term image for Bitcoin appeared first on CryptoSlate.