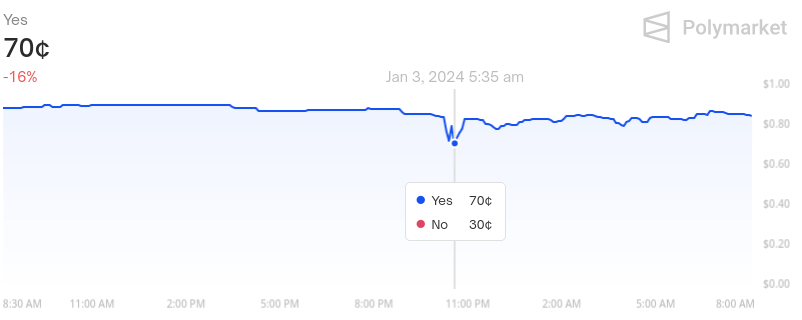

Betting odds on Polymarket in regards to the approval of pending spot Bitcoin exchange-traded funds (ETFs) briefly fell to 70% on Jan. 3.

On whether or not a spot Bitcoin ETF can be authorised by Jan. 15, Polymarket displayed a “sure” final result as priced at $0.70 at 1:30 p.m. UTC on Jan. 3. Polymarket knowledge and varied different experiences urged {that a} “sure” final result was priced at $0.89 on Jan. 2. Present Polymarket knowledge signifies that “sure” is at the moment priced at $0.84.

Up to now, Polymarket customers have guess $912,569 on this market, although it’s unclear what number of people have positioned bets in complete.

Contrarian report could also be answerable for drop

The decline in Polymarket’s “sure” odds could also be associated to a contrarian report from Matrixport analyst Markus Thielen revealed on Jan. 3.

Thielen argued that the U.S. Securities and Change Fee (SEC) might reject all pending spot ETFs for political causes. He famous that many SEC Commissioners are members of the Democratic celebration (which is usually thought-about anti-cryptocurrency) and highlighted SEC chair Gary Gensler’s hostility to crypto. Thielen additionally asserted that pending purposes don’t at the moment meet a vital requirement however didn’t establish the requirement in query.

Polymarket’s odds nonetheless characterize an amazing likelihood of approval. Its present 84% odds are roughly in keeping with a prediction from Bloomberg ETF analysts, who say there’s a 90% likelihood that the SEC approves at the least one ETF when it decides on Ark Make investments’s utility by a Jan. 10 deadline.

By the way, Bloomberg ETF analyst Eric Balchunas responded to Thielen’s report. As proof of approval, he famous that the SEC has labored extensively with candidates and that at the least three commissioners are in favor of approval.

Polymarket might characterize a extra balanced view than both supply. As a result of Polymarket’s odds are decided based mostly on consumer positions, they characterize the opinion of a number of people moderately than a single individual.

Bitcoin additionally noticed 8% flash crash

Declining Polymarket odds got here alongside an 7.9% flash crash that noticed the worth of Bitcoin (BTC) fall from $45,421 to $41,804 in a matter of hours.

As soon as once more, Thielen’s feedback might have contributed to that worth crash. Nonetheless, some have additionally pointed to CNBC character Jim Cramer’s optimistic feedback about Bitcoin as a probably harming costs. Cramer has developed a status for incessantly being incorrect, main some traders to behave opposite to his opinions based on the “Inverse Cramer impact.”

Bitcoin has since partially recovered to $42,967 as of 10:00 p.m. UTC. Any extra important information round a spot Bitcoin ETF will seemingly see additional fluctuations.