2022 is coming to an finish, and our workers at NewsBTC determined to launch this Crypto Vacation Particular to offer some perspective on the crypto business. We can be speaking with a number of guesses to grasp this 12 months’s highs and lows for crypto.

Within the spirit of Charles Dicken’s basic, “A Christmas Carol,” we’ll look into crypto from completely different angles, take a look at its doable trajectory for 2023 and discover frequent floor amongst these completely different views of an business which may help the way forward for funds.

We kicked us this particular with an institutional guess, asset administration agency Blofin. In early December, they wrote an essay referred to as “Disaster, Survival, and Evolution: Writing After November’s Crypto Markets” which impressed this sequence.

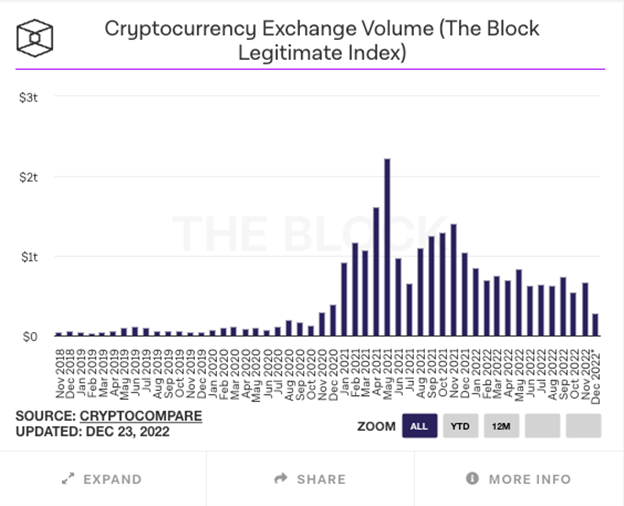

Blofin: “One of many obvious alerts is that in December 2022, month-to-month crypto spot volumes have returned to 2020 ranges.”

Of their essay, the agency argues that the crypto business has been closely impacted by the collapse of hedge fund Three Arrows Capital, FTX, Terra (LUNA), and others. These occasions compelled crypto buyers into inactivity as their confidence within the sector shattered.

Blofin: “There is no such thing as a doubt that crypto is the long run route of finance. Nonetheless, a sequence of earlier occasions have proven that if buyers’ cash can’t be protected, they are going to ultimately hand over the crypto market (…).”

However there may be mild on the finish of the tunnel for Bitcoin and different cryptocurrencies; albeit an extended restoration is forward, the nascent asset class will emerge from its ashes. For Blofin, the crypto business is getting ready to a important evolution. As soon as accomplished, the sector will rise once more on the again of latest institutional help. That is what they advised us:

Q: What’s probably the most vital distinction for the crypto market at present in comparison with Christmas 2021? Past the value of Bitcoin, Ethereum, and others, what modified from that second of euphoria to at present’s perpetual worry? Has there been a decline in adoption and liquidity? Are fundamentals nonetheless legitimate?

A: Probably the most vital distinction comes from two features: liquidity and investor confidence. In 2021, the liquidity of the crypto market remains to be adequate, and the influence of the liquidity contraction within the danger asset market has not but absolutely manifested. In 2022, with the Fed’s (U.S. Federal Reserve) steady rate of interest hikes, Luna’s collapse, 3AC Capital’s (Three Arrow Capital) chapter, and chapter 11 of the FTX alternate, the liquidity of the crypto market is principally squeezed dry. One of many obvious alerts is that in December 2022, month-to-month crypto spot volumes have returned to 2020 ranges.

As well as, the blow to investor confidence from a sequence of occasions in 2022 can be enormous. At Christmas 2021, establishments and retail buyers really feel they’ve so much to do within the crypto market. On the finish of 2022, even skilled funding establishments have misplaced a lot as a result of collapse of exchanges. Consequently, they not belief the crypto business; they really feel that there are Ponzi schemes and scammers in every single place. Ultimately, establishments select to withdraw funds, adopted by retail buyers.

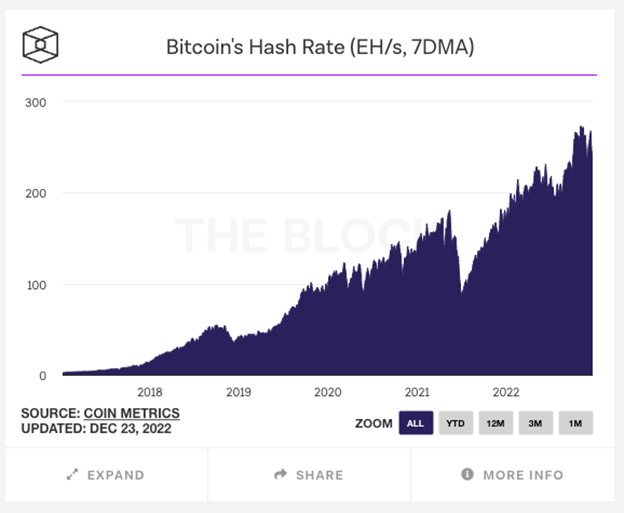

Nevertheless, the variety of buyers within the crypto asset market remains to be excessive. Many individuals are simply not energetic in a bear market, however that doesn’t imply they’ve left the crypto market. They’re watching and ready for the perfect time to purchase the dip. Non-Zero on-chain addresses are nonetheless rising steadily, and the hash price of miners has not been considerably affected by the bear market in 2022.

The affect of fundamentals remains to be legitimate for the crypto market, however it’s primarily focused on the macro perspective. Throughout the bear market interval, liquidity is concentrated in BTC and ETH, and it’s tough for altcoins to acquire extra liquidity. Subsequently, macro elements equivalent to rate of interest hikes and powerful USD considerably influence BTC and ETH. On the similar time, due to the unhealthy liquidity standing, enhancements within the fundamentals of altcoins and challenge tokens are tough to result in sustained efficiency enhancements.

Q: What are the dominant narratives driving this variation in market situations? And what must be the narrative at present? What are most individuals overlooking? We noticed a serious crypto alternate blowing up, a hedge fund considered untouchable, and an ecosystem that promised a monetary utopia. Is Crypto nonetheless the way forward for finance, or ought to the group pursue a brand new imaginative and prescient?

A: In our opinion, the adjustments available in the market in 2022 rely on the place of the crypto market within the danger asset system. There is no such thing as a doubt that crypto property are on the tail finish of the chance asset market as a result of excessive volatility ranges of the crypto market and the “Wild West” period it’s in. Subsequently, as soon as there may be any hassle, it’s simpler for buyers to decide on to promote and kind a run, inflicting a extra vital disaster.

The crypto market in 2022 is considerably just like the Nasdaq within the late Nineteen Nineties. Adventurers and warriors gained lots of wealth earlier than 2000 and in 2021, which stimulated extra folks to return and take dangers. Most individuals ignore the dangers and find yourself with nothing.

Subsequently, compliance and safety must be an integral a part of the long run narrative of the crypto market. There is no such thing as a doubt that crypto is the long run route of finance (quicker velocity, extra programmatic, extra world, extra cheap credit score system, and extra substantial innovation potential). Nonetheless, a sequence of earlier occasions have proven that if buyers’ cash can’t be protected, they are going to ultimately hand over the crypto market and won’t proceed to pay for the potential of the market and new applied sciences, even when these applied sciences have potential and attractiveness.

Q: If you happen to should select one, what do you assume was a big second for crypto in 2022? And can the business really feel its penalties throughout 2023? The place do you see the business subsequent Christmas? Will it survive this winter? Mainstream is as soon as once more declaring the loss of life of the business. Will they lastly get it proper?

A: The collapse of FTX is the end result of the 2022 bear market within the crypto market. The incident interrupted the sluggish restoration means of the crypto market and aroused widespread concern from regulators in main markets such because the US and the EU. As well as, many establishments have closed down as a result of collapse of FTX or encountered operational difficulties and urgently want rescue.

It may be anticipated that in 2023, the aftermath of the FTX incident could ultimately trigger some establishments to go bankrupt, and extra regulatory insurance policies may also be launched. As well as, from a macro perspective, as a result of continuation of excessive rates of interest, it’s tough for the crypto market to usher in new liquidity, and it’ll take longer to get well.

Nevertheless, within the above questions, we have now talked about some traits of the crypto market which can be tough to get replaced by conventional markets (quicker velocity, extra programmatic, extra world, extra decentralized, extra cheap credit score system, and extra substantial innovation potential). Subsequently, so long as buyers have buying and selling wants, the crypto business will live on, however it should grow to be extra compliant and safe.

Q: To summarize for our readers, what sectors have been probably the most resilient on this disaster? Which of them are the almost certainly to get well in 2023? And the way do you see the evolution of the nascent business enjoying out?

A: Contemplating the diploma of acceptance, mainstream currencies equivalent to BTC and ETH are nonetheless probably the most resilient sectors within the crypto market. Public chains and crypto infrastructure are additionally some of the resilient sectors within the crypto market sooner or later, for all purposes within the crypto market want their help.

As well as, the alternate sector can be fairly resilient, for because the market stabilizes and step by step recovers, the buying and selling wants of buyers nonetheless exist and can begin to develop once more. Trying again on the historical past of the crypto market, many exchanges will go bankrupt in every bear interval, however new exchanges will emerge within the bear market and shine in a brand new spherical of bull.

Nevertheless, it’s tough to find out who would be the first to get well in 2023. Since there may be nonetheless a very long time earlier than the liquidity faucet reopens, the present liquidity scarcity scenario remains to be tough to enhance. The crypto market will possible proceed to consolidate at a low degree for a very long time.

The crypto market is now on the finish of the “Wild West”. Because the crypto market continues to develop and mature, after the occasions of 2022, lawmakers will step by step have examples to assist, and the regulatory and compliance framework may also take form. The above could restrict the crypto market’s improvement in some instructions, however it is usually good for the long-term progress of the crypto market. Below the compliance framework, extra funds from conventional markets and different sources can enter the crypto market, and the builders of the crypto market can have extra alternatives to acquire funding.

As of this writing, Bitcoin trades at $16,800 with sideways motion throughout the board. Picture from Unsplash, chart from Tradingview.