The highest 4 stablecoins — USDT, USDC, BUSD and DAI — recorded exponential progress all through 2021 and the primary three months of 2022, reaching a peak market cap of $160 billion. Nevertheless, progress hit a wall in Could, when Terra LUNA collapsed, and the collective market cap of the highest 4 is down a major quantity.

The highest 4

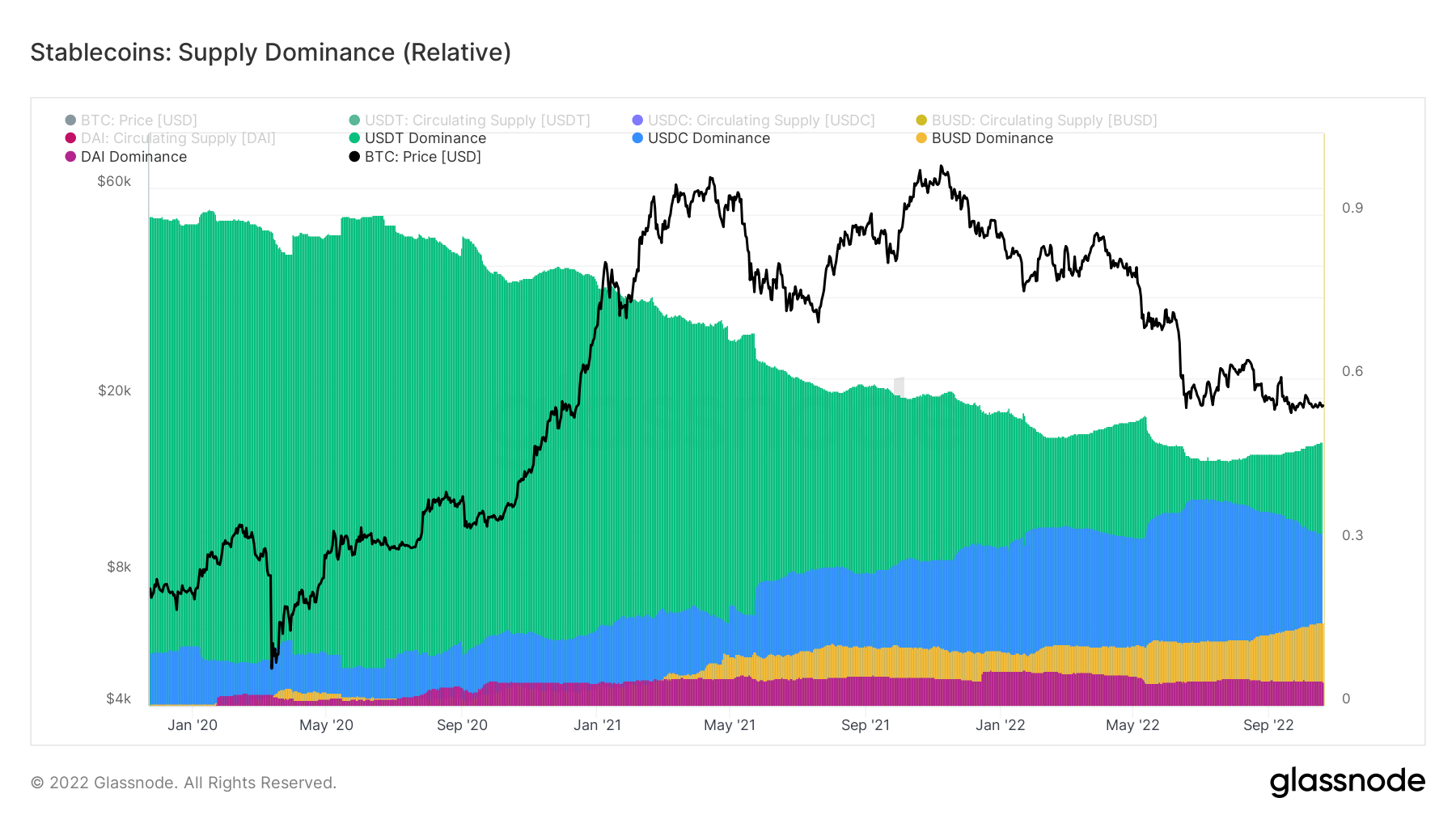

Tether’s (USDT) market share stood at 90% n 2020 however has since known as to roughly 50% as different stablecoins gained floor within the trade. The chart beneath exhibits the highest 4 stablecoins by their market shares because the starting of January 2020.

In early 2020, USDT claimed over 90% of the stablecoin market share, whereas Circle’s USD Coin (USDC) claimed the vast majority of the remaining 10%.

Nevertheless, as of October, USDT’s market share has fallen to roughly 50%, with USDC and Binance USD (BUSD) making up a lot of the remaining majority.

Stablecoin provide

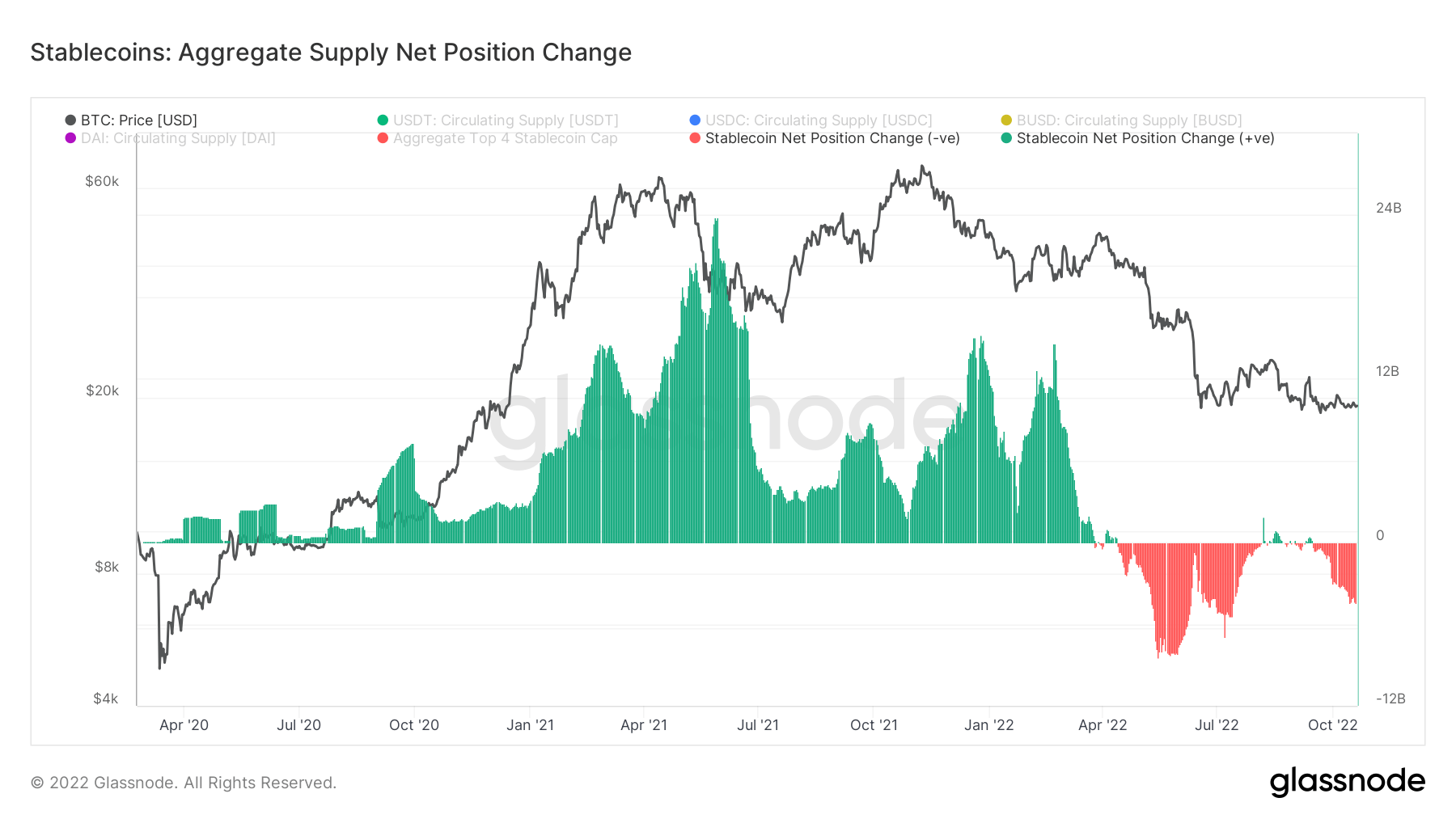

Stablecoins have been steadily leaving exchanges since Could, with solely transient durations of respite between August and September.

Stablecoins leaving exchanges often means they’re being offered for fiat to fulfill debt obligations or being moved into a distinct asset class as traders lose belief n crypto.

Prime 4 stablecoins vs. Ethereum

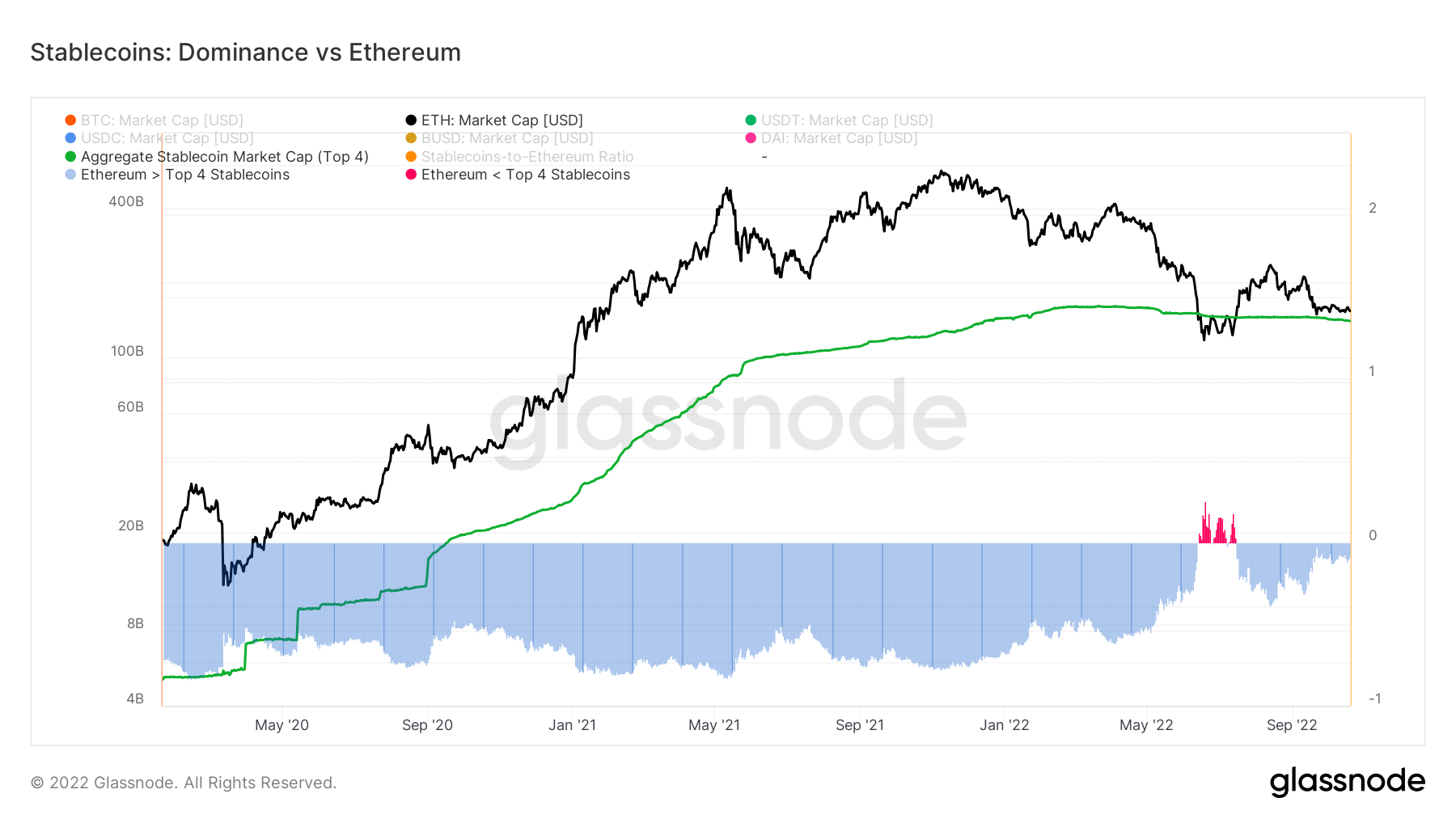

Ethereum’s (ETH) dominance excessive 4 stablecoins has been on a downtrend since Could, with stablecoins changing into extra dominant n June — when ETH hit its lowest worth for the yr.

The highest 4 stablecoins claiming dominance at such a interval point out that traders had been inclined to change Ethereum for stablecoins in an effort to guard themselves.

After the lack of confidence brought on by the collapse of Terra’s algorithmic stablecoin, this flip in direction of stablecoins is a constructive improvement in restoring belief.