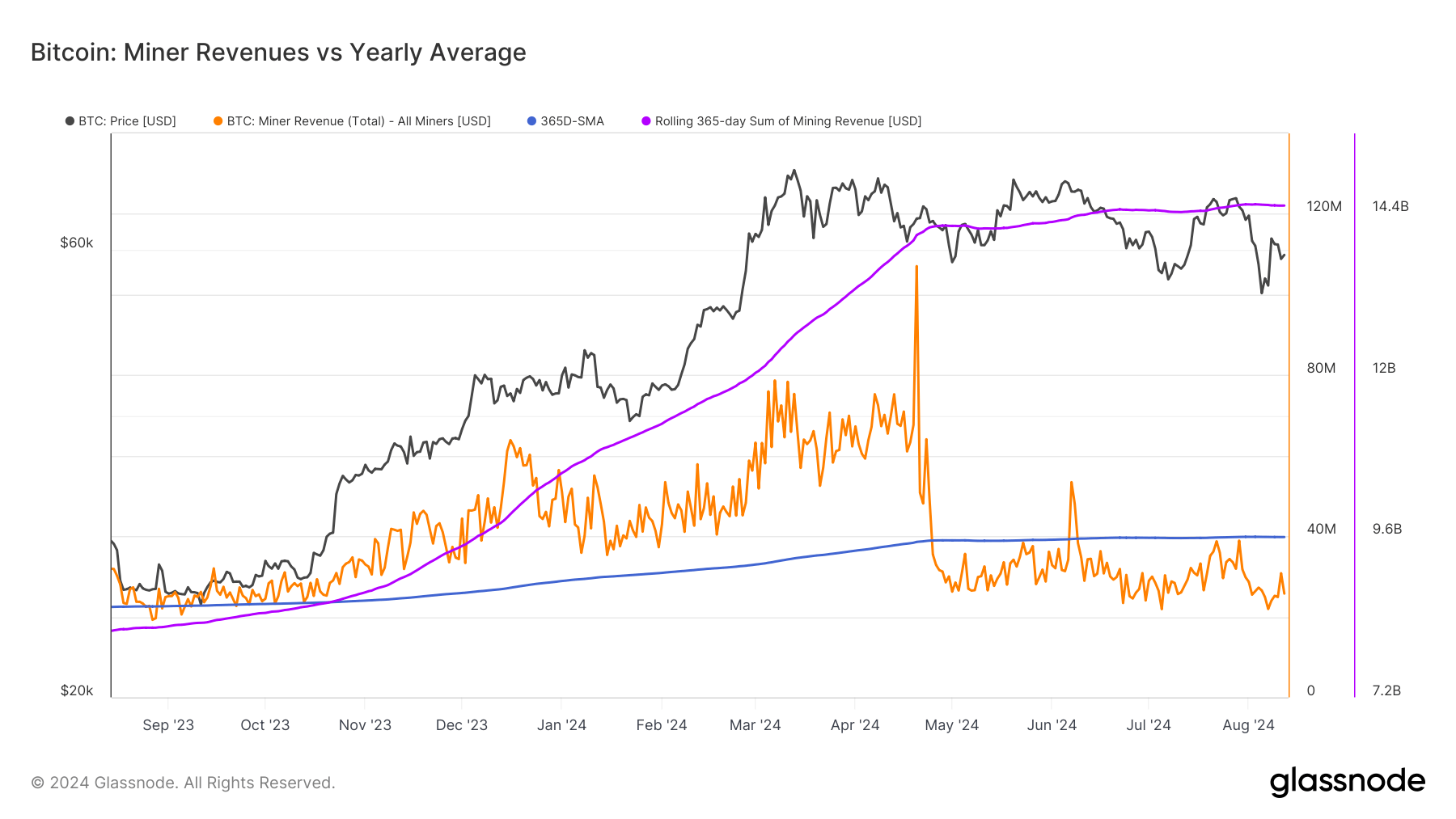

Miner revenues function a barometer for the general state of the Bitcoin ecosystem, reflecting the fragile steadiness between mining prices, Bitcoin value, and community problem. Since Apr. 24, miner income has persistently been beneath its 365-day easy transferring common (SMA), with solely two temporary exceptions in early June.

This extended interval of below-average income culminated on Aug. 7, when miner income plummeted to its lowest degree since September 2023. Whereas this sustained downturn will be attributed to a number of components, final week’s drop resulted from a big drop in Bitcoin’s value.

Bitcoin noticed important volatility in August, dropping from $65,360 in the beginning of the month to beneath $50,000 on Aug. 5 earlier than partially recovering to $54,000 inside 24 hours. Vital value fluctuations like this instantly impression miner income, because the USD worth of every mined Bitcoin decreases with the value.

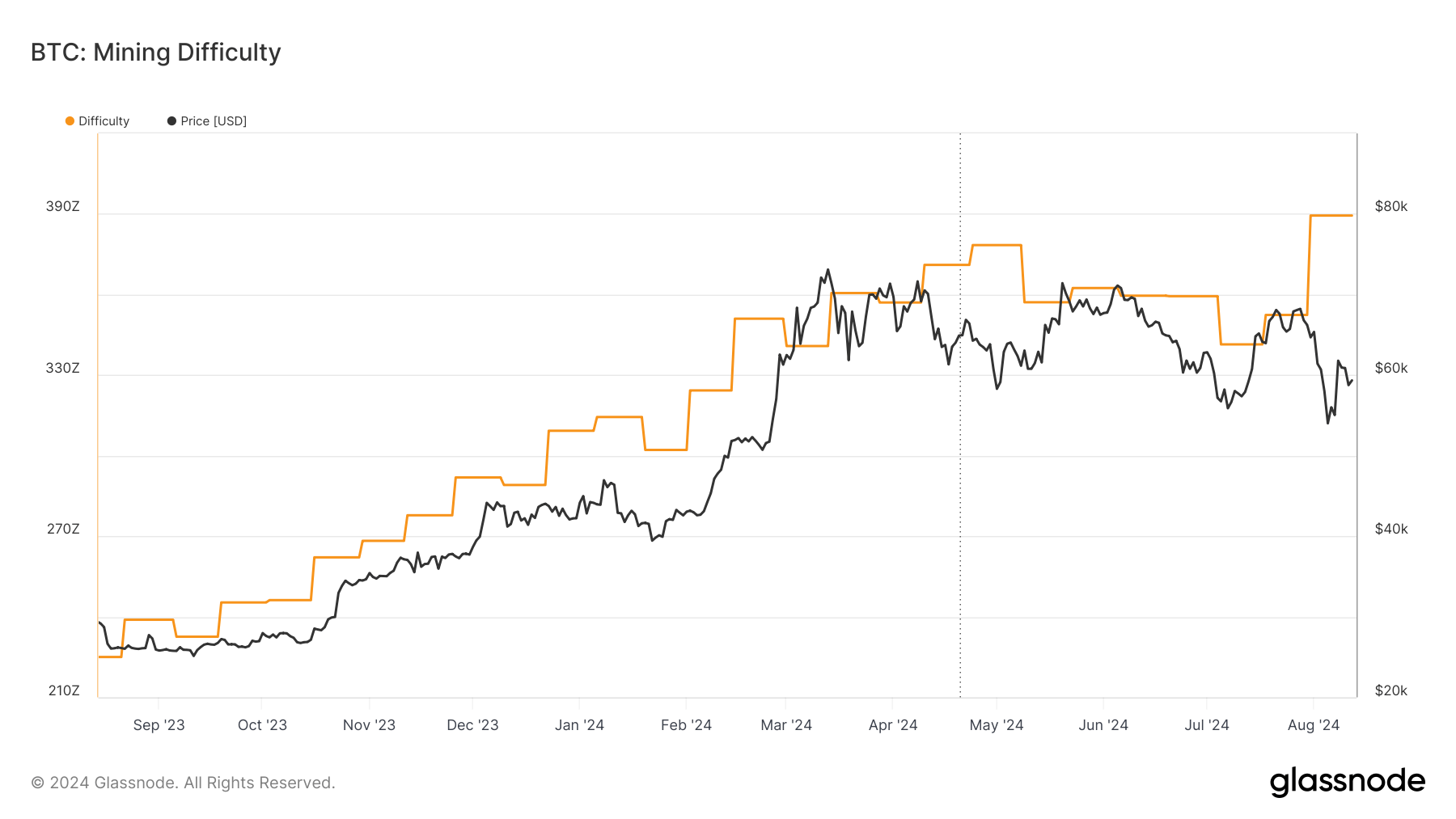

Bitcoin mining problem has additionally been growing this month, requiring extra computational energy to mine every Bitcoin and additional squeezing revenue margins.

This short-term volatility is a part of a long-term pattern that started with Bitcoin’s halving in April. The halving diminished the block reward from 6.25 BTC to three.125 BTC, halving the variety of new Bitcoins coming into circulation. This structural change has impacted miner revenues and profitability, forcing the business to adapt to a brand new financial actuality whereas juggling short-term volatility.

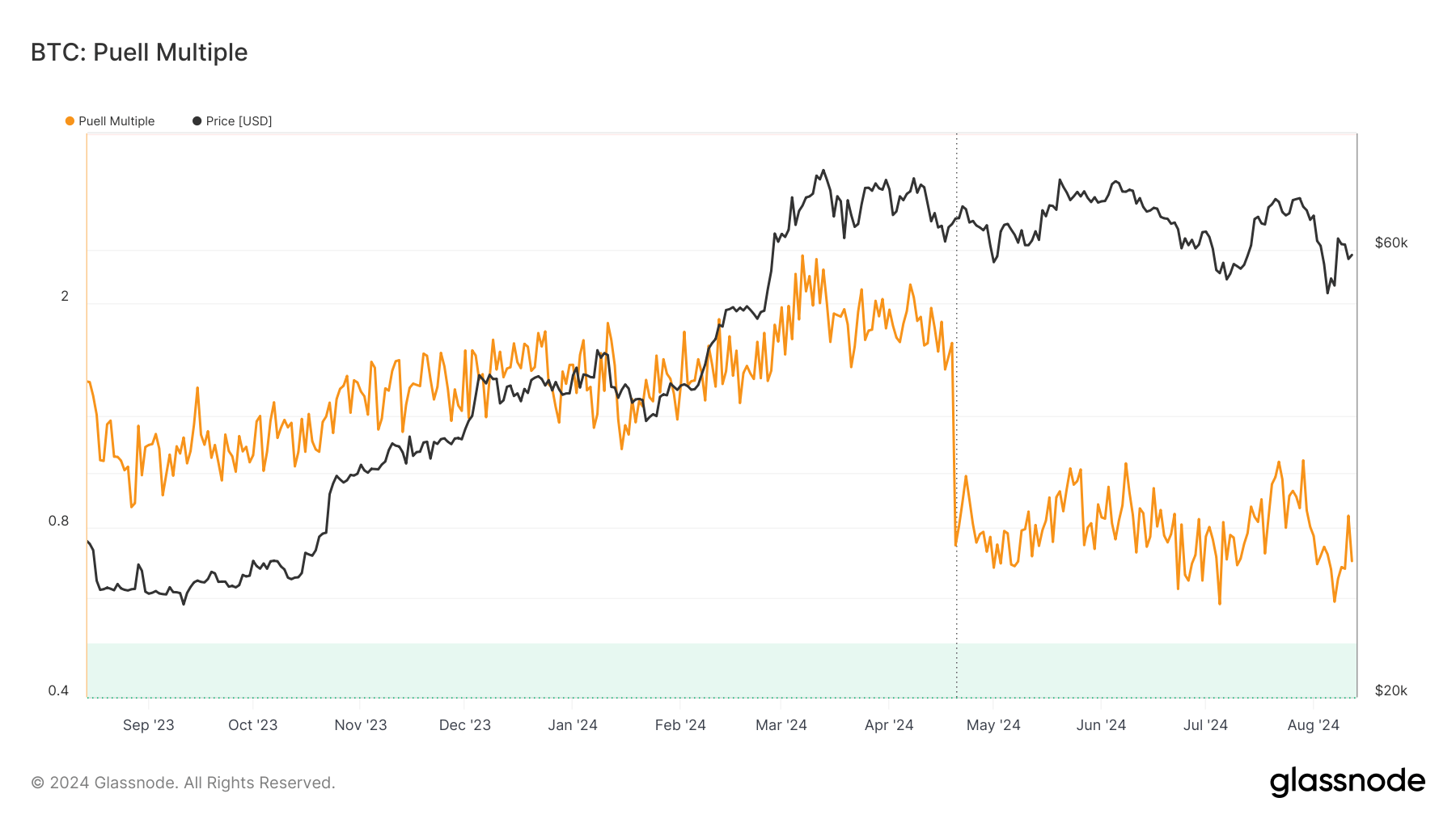

To higher perceive the implications of those adjustments, we are able to flip to the Puell A number of, a beneficial metric for assessing miner profitability and market circumstances. The Puell A number of is calculated by dividing the day by day issuance worth of bitcoins (in USD) by the 365-day transferring common of day by day issuance worth. This metric helps determine intervals of miner stress and potential market turning factors.

On Aug. 5, the Puell A number of dropped to 0.5910, its lowest degree since Jan. 3, 2023. This sharp decline from 1.0525 on Jul. 29 signifies that the day by day issuance worth fell considerably beneath the yearly common. An much more dramatic drop occurred instantly after the halving, with the a number of plummeting from 1.6999 on Apr. 19 to 0.7441 on Apr. 20.

Traditionally, a Puell A number of beneath 0.5 has signaled market bottoms and introduced engaging shopping for alternatives for buyers. The present worth of 0.7, whereas not but beneath this threshold, means that miners are underneath appreciable strain and that the market might need approached a backside. Nonetheless, it’s essential to notice that the current halving occasion has essentially altered the issuance, doubtlessly affecting how we interpret the Puell A number of within the close to time period.

The mixture of below-average income and a low Puell A number of reveals important stress within the Bitcoin mining business. Miners are at present incomes much less USD per Bitcoin mined, pushing much less environment friendly operations in the direction of the brink of unprofitability. The diminished rewards post-halving have intensified competitors amongst miners for the obtainable Bitcoin, resulting in elevated hash charges and mining problem.

If these circumstances persist, the market may even see one other capitulation occasion, the place miners are compelled to promote a big a part of their reserves or shut down operations altogether. This state of affairs may enhance market volatility as miners liquidate holdings to cowl operational prices. Nonetheless, it could additionally drive effectivity enhancements throughout the business as miners search cheaper power sources and improve to extra environment friendly {hardware}.

From a market perspective, the present state of miner revenues and the Puell A number of carries a number of implications. as famous, intervals of miner stress and low Puell Multiples have typically signaled an excellent shopping for alternative for long-term buyers. Moreover, miners working at or close to breakeven ranges could also be much less inclined to promote their Bitcoin holdings, doubtlessly lowering general market provide and supporting costs.

The stress on the mining ecosystem may result in a extra environment friendly and resilient business in the long run, a pattern we’ve already begun seeing amongst massive, public miners. As much less environment friendly operations are compelled out of the market, those who stay will doubtless be higher outfitted to climate future market fluctuations.

The publish Puell A number of drops as miner revenues hit 10-month low appeared first on CryptoSlate.