Monitoring unrealized revenue and loss is a cornerstone of market evaluation. Whereas realized revenue and loss supply a snapshot of the market’s previous habits, unrealized revenue, and loss present a window into the market’s potential trajectory. This distinction turns into much more pronounced after we zero in on short-term holders.

Quick-term holders, outlined as entities holding Bitcoin (BTC) for lower than 155 days, play a pivotal position in shaping the market dynamics. Their habits, pushed by latest market tendencies and short-term targets, profoundly influences Bitcoin’s worth. Conversely, worth actions may also sway their choices, making a suggestions loop that stabilizes or destabilizes the market.

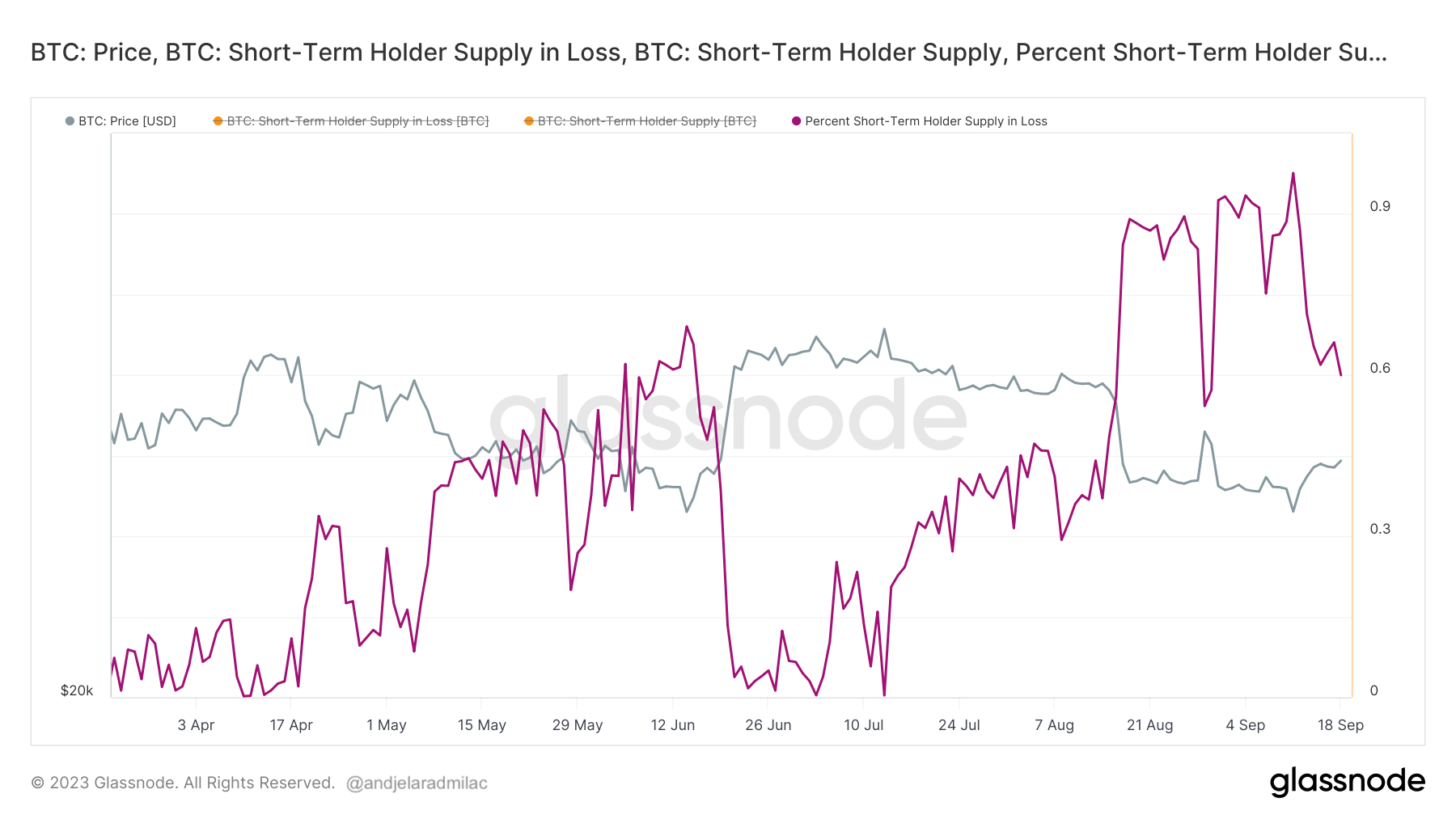

Current knowledge from Glassnode sheds mild on the state of short-term holders. Following Bitcoin’s transient dip to $25,000 on Sep. 11, the proportion of short-term holder provide in loss rose to 97.61%. Bitcoin’s restoration to $27,000 diminished the availability loss to 59%. On Sep. 19.

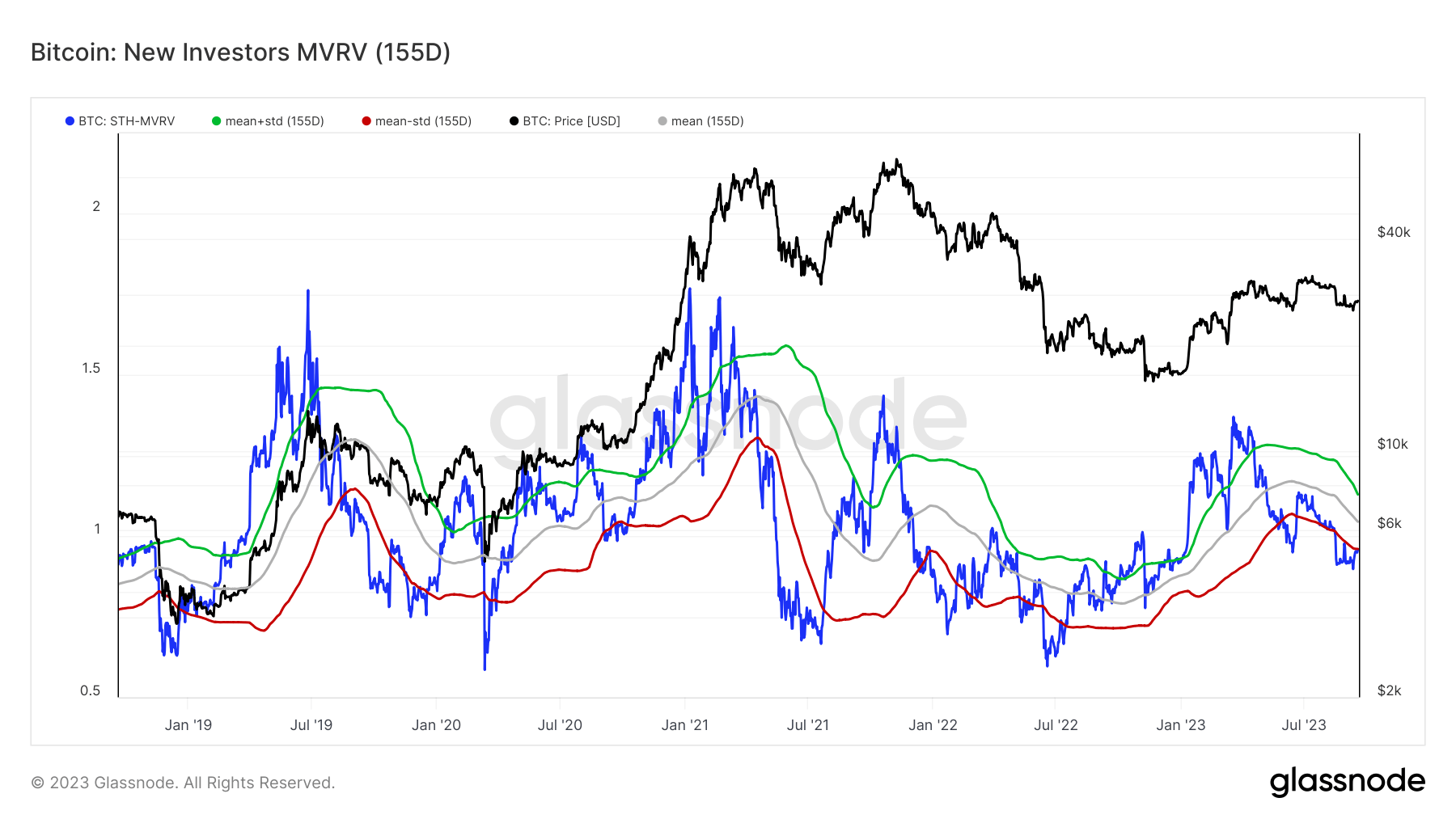

The MVRV ratio reveals short-term holders’ unrealized revenue or loss relative to the asset’s market worth.

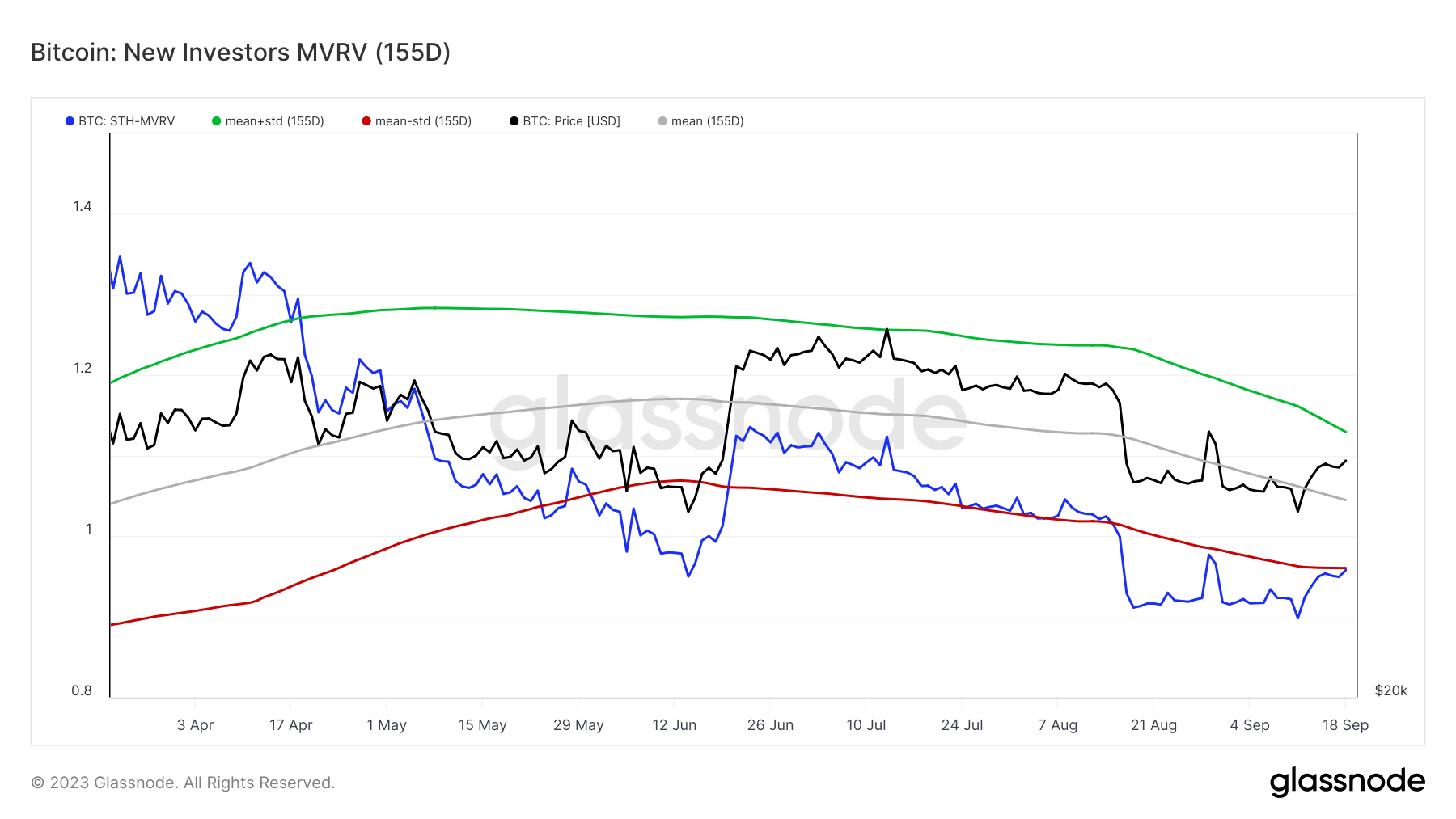

By juxtaposing the extremes in STH-MVRV in opposition to its 155-day common, we will create higher and decrease bands for the indicator. The higher band represents the imply plus one normal deviation, whereas the decrease band is the imply minus one normal deviation.

These bands present that most of the market’s highs and lows correlated with vital deviations exterior these boundaries. This means that latest traders had been both reaping substantial earnings or nursing vital losses throughout these intervals.

As of Sep. 11, the STH-MVRV ratio hovers at 0.95, brushing in opposition to the decrease band. It’s price noting that the STH-MVRV dipped under this decrease threshold on Aug. 15, coinciding with Bitcoin’s worth slide from $29,000 to $26,000. The ratio has remained under this band since then.

The present place of the STH-MVRV ratio, coupled with the proportion of short-term holder provide in loss, suggests a heightened state of vendor exhaustion. Within the context of Bitcoin’s worth, vendor exhaustion implies that the promoting stress begins to wane as most short-term holders who wish to promote have already accomplished so. Traditionally, such eventualities have typically paved the best way for worth recoveries as promoting pressures diminish.

The publish Quick-term holders present indicators of vendor exhaustion appeared first on CryptoSlate.