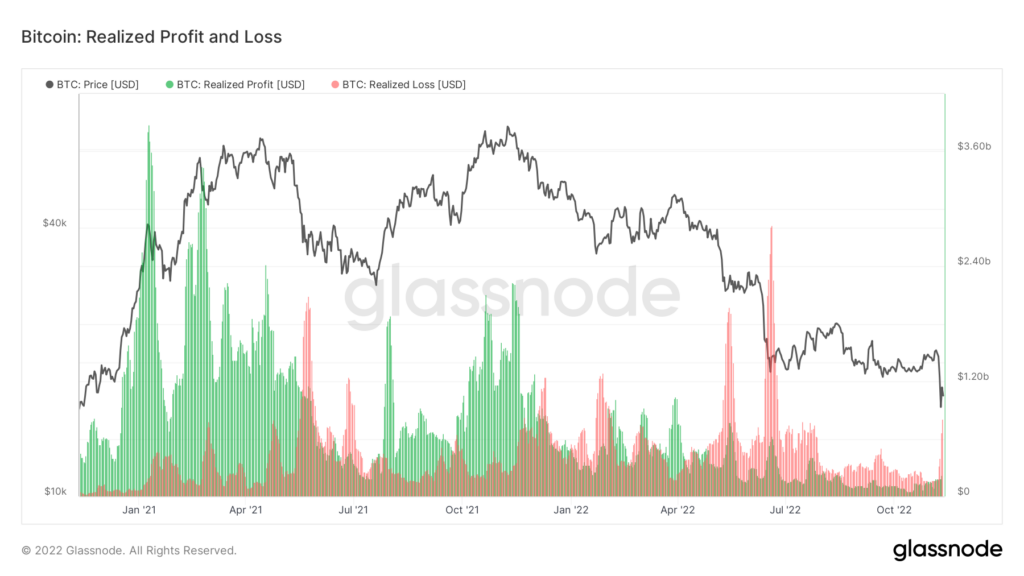

Bitcoin traders have locked within the fourth-largest spike in realized losses in 2022 throughout the present market downturn. Over $1 billion {dollars} has been locked in since Nov. 9 as traders panic sells amid excessive market uncertainty.

Realized losses spike

CryptoSlate analyzed on-chain knowledge from Glassnode to determine the affect on realized revenue and losses all through the present market turmoil. The chart beneath highlights the amount of realized returns because the begin of the 2021 bull run.

The Greater Values point out a better every day quantity of realized revenue or loss with pink sections representing losses and inexperienced signifying earnings. The chart focuses solely on realized revenue and loss which means cash that had been purchased at one worth and offered at one other.

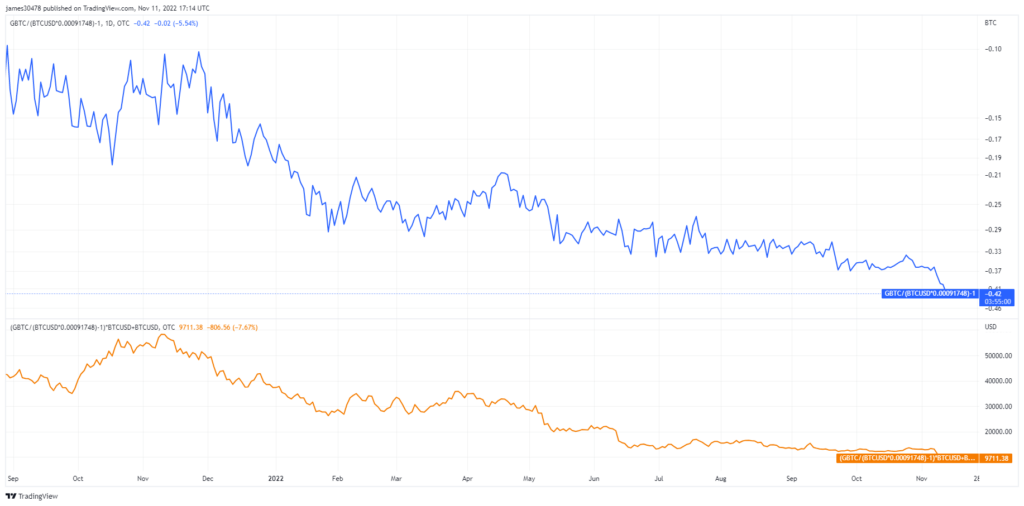

Grayscale Bitcoin Belief Low cost Document

The Grayscale Bitcoin Belief was additionally hit onerous by the downturn as GBTC at present trades at a 41% low cost to its NAV (Internet Asset Worth). The funding car began the 12 months at only a 17% low cost however has been on a downtrend all through the whole lot of 2022. Buying shares in GBTC as of press time is equal to purchasing Bitcoin at $9,771.

Traditionally, GBTC has traded at a premium as traders who had been unable to purchase Bitcoin immediately flocked to the funding car to realize publicity to the world’s largest cryptocurrency by market cap. The premium went over 100% in December 2017 and eventually moved unfavourable for the primary time in February 2021. The present worth is at an all-time low for the Belief as curiosity within the product dwindles amid worth capitulation.