A number of crypto personalities have steered Alt Season is nearing.

For instance, in a latest tweet, Ash WSB described a 4 part path to “FULL BLOWN ALTSEASON.”

It concerned Bitcoin stabilizing round $30,000, then the cash flowing into Ethereum — which has posted 9.7% features over the past 24 hours, tapping $2,130 to mark a 48-week excessive.

The third part is when (different) “massive caps are going parabolic” from cash flowing from Ethereum. Lastly, Alt Season kicks off when large-cap features trickle down into the remainder of the market.

At this level, each coin pumps whatever the fundamentals — creating mania and signaling the arrival of Alt Season, mentioned Ash WSB.

It needs to be famous {that a} universally acknowledged definition of Alt Season doesn’t exist. Nevertheless, as alluded to above, alt season is mostly recognized by altcoins posting manic features.

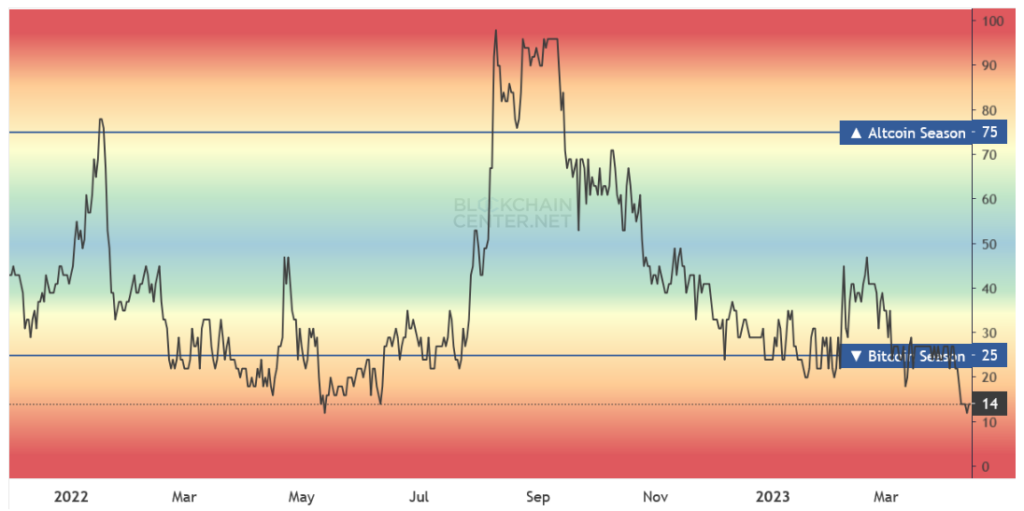

Nonetheless, Blockchain Middle — with its Altcoin Season Index — has quantified an goal definition of Alt Season.

Alt season

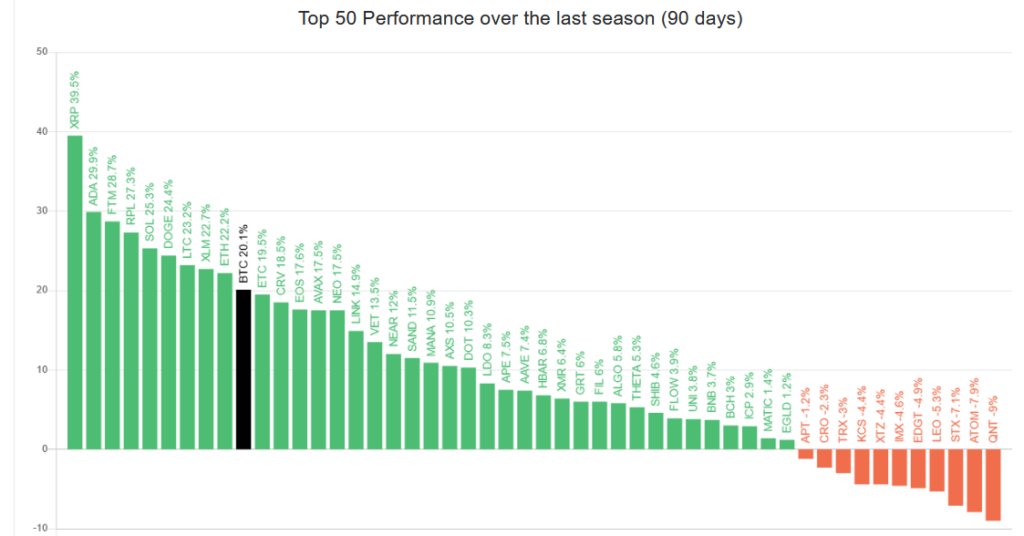

In accordance with Blockchain Middle, Alt Season is when at the least three-quarters of the highest 50 cash are outperforming Bitcoin over a operating three-month timeframe.

“If 75% of the High 50 cash carried out higher than Bitcoin over the past season (90 days) it’s Altcoin Season. Excluded from the High 50 are Stablecoins (Tether, DAI…) and asset backed tokens (WBTC, stETH, cLINK,…)”

The present 90-day efficiency of the highest 50 reveals solely 9 cash/tokens outperforming the market chief — XRP, ADA, FTM, RPL, SOL, DOGE, LTC, XLM, and ETH.

By Blockchain Middle’s definition, an extra 29 cash/tokens would want to outperform Bitcoin earlier than Alt Season will be formally known as.

Indexing this knowledge, Blockchain Middle has assigned a present rating of 14 — deep inside Bitcoin Season — spelling dangerous information for individuals who count on the upcoming arrival of Alt Season.

The chart beneath recognized the final Alt Season occurring between early-August 2022 and mid-September 2022.

How are issues trying?

Bitcoin dominance reached 48.9% of the market on April 11. The rejection at this stage has led to a downtrend — suggesting Section 1 of Alt Season is underway.

Nevertheless, the 47% zone represents robust assist and is one to observe earlier than declaring Section 1 full.

Ethereum dominance is at the moment hovering as a result of latest Shanghai improve. This will likely have sufficient momentum to hinder vital outflows to the opposite massive caps.

The chart beneath reveals ETH.D is on the cusp of testing 20.4% resistance — a break above this stage would hold Alt Season pegged at Section 2.

Nonetheless, whole market cap inflows are rising. The final seven days noticed an extra $108 billion (+9%) added to the whole market cap. Likewise, year-to-date whole market features had been $488 billion, to $1.28 trillion (+61%) — a stage not seen since Might 2022 —Bitco earlier than the Terra implosion.

This could counsel the crypto market has recovered from the contagion occasion.

The put up Right here’s why alt season could also be on the horizon appeared first on CryptoSlate.