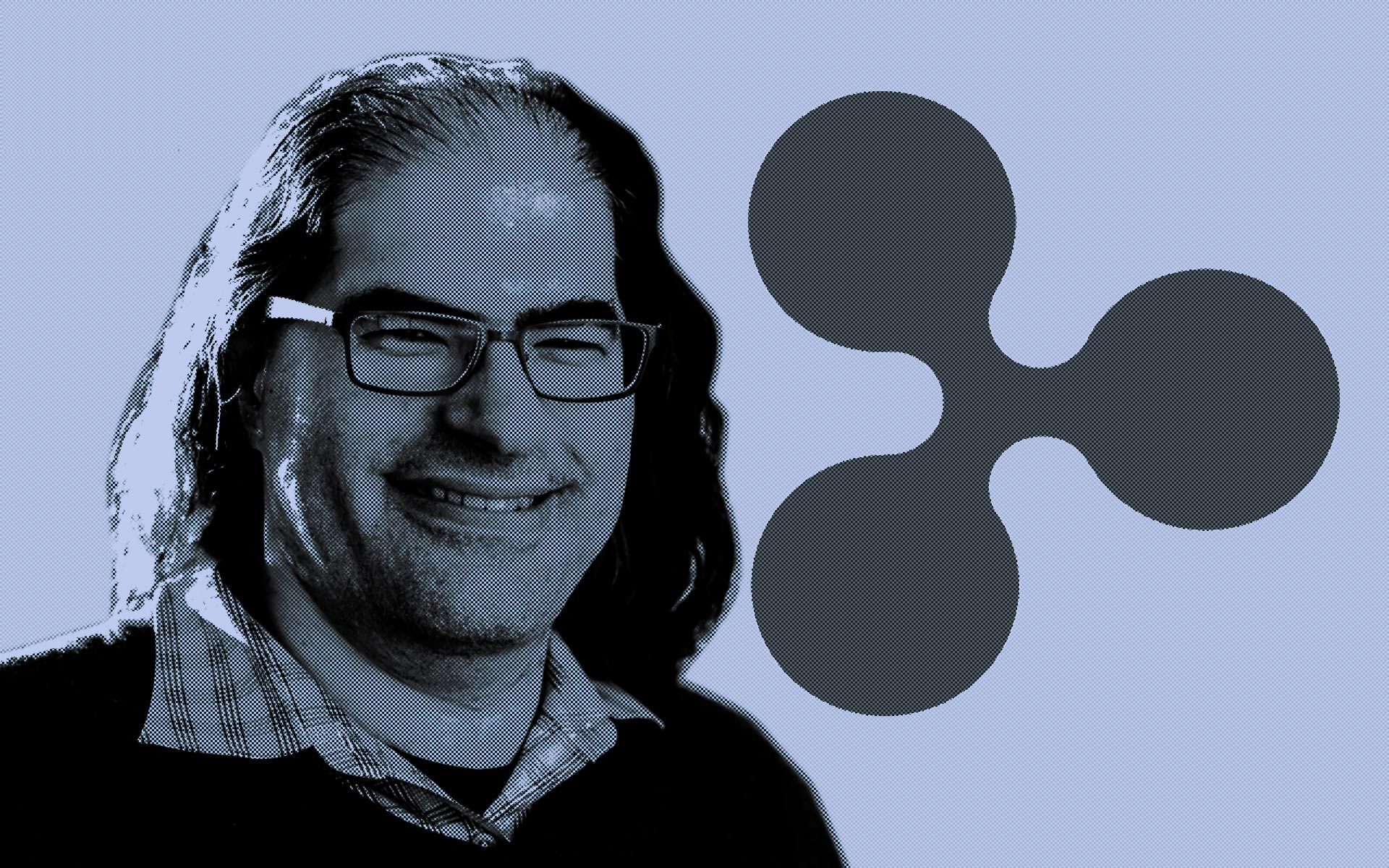

Ripple’s Chief Expertise Officer (CTO), David Schwartz, has all the time been fast to return to the protection of the crypto agency and its know-how. This time, he has defended Ripple builders implementing a newly proposed ‘Clawback’ characteristic on the XRP Ledger (XRPL).

Why The Clawback Function Is Crucial

In a tweet shared on his X (previously Twitter) platform, Schwartz talked about that whereas initially having reservations concerning the characteristic as he felt it was “redundant,” he later realized its significance because it differed from the current freeze characteristic.

The “clawback” modification is now eligible for voting. This allowers issuers of recent belongings particularly created with this characteristic enabled to claw again a specified amount of the asset from a holder.

Some ideas: … https://t.co/OmrerirRQz

— David “JoelKatz” Schwartz (@JoelKatz) October 2, 2023

Because the title suggests, the Clawback characteristic permits a token issuer to “claw again” tokens when there may be fraudulent exercise or for restoration functions, like when a consumer loses entry to their account.

Associated Studying: Bitcoin Funding Technique: Analyst Units Hefty Exit Worth

He famous that the clawback characteristic was primarily for use to meet authorized obligations, as within the case of a stablecoin difficulty fulfilling their redemption obligations or the place a courtroom order necessitates the necessity to use such a characteristic.

From this premise, he defined that this characteristic ensures that this occasion is represented on the ledger, in contrast to the freeze characteristic, which doesn’t spotlight why an asset was frozen. As such, this newest characteristic permits for higher accountability and makes audits much less advanced.

Moreover, he talked about that the freeze characteristic was extra of a “nuclear” possibility, in contrast to the clawback characteristic, which does much less injury and might seen as a viable and doubtless higher various.

Schwartz reiterated that this clawback didn’t apply to XRP and instructed that it was an possibility for stablecoin issuers, noting that different “blockchains which have stablecoins on them have some model of this clawback characteristic” and the way it helped solved an accountability drawback.

Token value retains $0.52 help | Supply: XRPUSD on Tradingview.com

XRP Ledger Function Receives Chilly Reception

Regardless of Schwartz’s justification of the characteristic, many nonetheless confirmed displeasure with it because it undermined the ethos of decentralization and customers’ privateness. One X consumer (@bigcjat) defined {that a} clawback characteristic appeared extra drastic, in contrast to the freeze characteristic, as the previous stripped customers of their tokens, in contrast to the latter, the place the consumer nonetheless maintained management of his tokens.

He went on to quiz whether or not this token was merely proposed due to the ‘latest partnership’ contemplating that the characteristic was by no means proposed prior to now. He then instructed that the crypto agency and its blockchain could have been compromised as he said, “Cash taints, even decentralized ledgers.

In response, Schwartz said that, to the perfect of his data, the driving power behind this characteristic was to make sure accountability as it could mirror the authorized obligation of an issuer. He isn’t conscious of anybody stating that they are going to solely accomplice with Ripple if the XRPL helps clawback.

Different customers weighed in on the dialog, with some exhibiting help for the characteristic, stating that stablecoin issuers wanted to implement such a characteristic. Alternatively, others argued that the clawback characteristic wasn’t mandatory, with a specific consumer stating that this threat is “akin to being SIM swapped.”

One other concern raised is that token issuers may use this characteristic maliciously, particularly when experiencing monetary difficulties. That specific consumer gave an instance of FTX with the ability to claw again their FTT tokens or a stablecoin issuer like Tether clawing again their USDT tokens within the occasion of economic issue.

The X consumer @bigcjat as soon as once more got here into the dialog and famous that Schwartz’s talks about “authorized obligation” solely undermine the essence of blockchain know-how as there was no want for a ledger if the “precise worth” and “guidelines” have been off the ledger.

Nevertheless, Schwartz famous “a number of advantages” to placing these transactions on the ledger. One among them is {that a} public blockchain ensures that “the whole authorized obligations of the issuer might be fully public in a verifiable method.”

The clawback characteristic will nonetheless have to be voted on by validators on the XRP Ledger earlier than it turns into applied. As soon as applied, stablecoin issuers should determine to allow it earlier than they’ll create their tokens on the community.

Featured picture from Bitcoinist, chart from Tradingview.com