The final two years have been very eventful for the crypto house. The trade witnessed astronomic crypto adoption, and Bitcoin (BTC) traded at an all-time excessive of over $69,000.

Nonetheless, regardless of this outstanding development, the trade has witnessed some adversarial occasions which have shaken traders’ confidence.

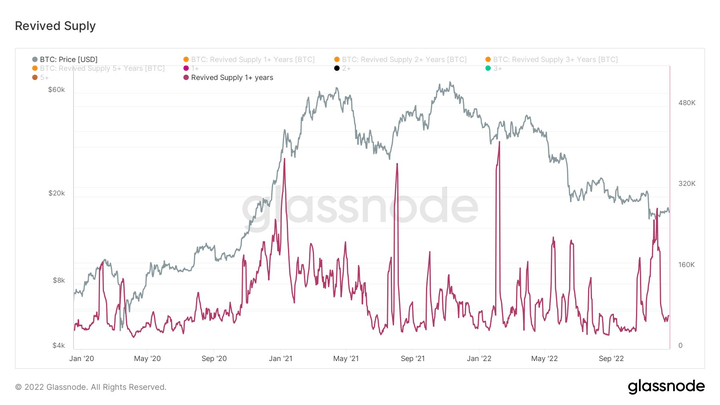

Utilizing Glassnode’s Revived Provide information, CryptoSlate can measure the occasions which have led to vital sell-offs for the flagship digital asset amongst long-term holders.

Revived Provide is the whole quantity of cash that returned into circulation after being untouched for at the very least one yr. In different phrases, it’s the complete switch quantity of cash that have been beforehand dormant for over a yr.

Lengthy-term holders are categorized as Bitcoin holders which have held onto the coin for at the very least six months.

The main sell-off occasions

Taking a look at occasions of the previous two years, long-term holders offered considerably over a seven days interval on 4 totally different events. The 4 occasions are:

- China’s Bitcoin mining ban in 2021

- The beginning of the 2021 bull run

- Russia’s Ukraine invasion in 2022

- FTX collapse in 2022

In line with the above chart, the best sell-off occurred after Russia invaded Ukraine. Throughout this era, long-term holders offered off 410,000 BTC.

Different large sell-off occasions occurred through the 2021 bull run when long-term holders offered 375,000 BTC and through China’s ban on bitcoin mining after they offered 367,000 BTC.

The fourth-highest sell-off occasion for the reason that COVID pandemic was after the FTX collapse in November. In line with the chart, BTC’s revived provide throughout that week was 280,000 cash–Chainalysis reported that realized losses touched $9 billion, the fourth highest of 2022.

Concern made holders promote

Moreover the sell-off at first of the 2021 bull run when traders took earnings, BTC’s revived provide usually peaked at a second of worry for traders. This was when real-life occasions brought about panic amongst holding, forcing them to dump Bitcoin.

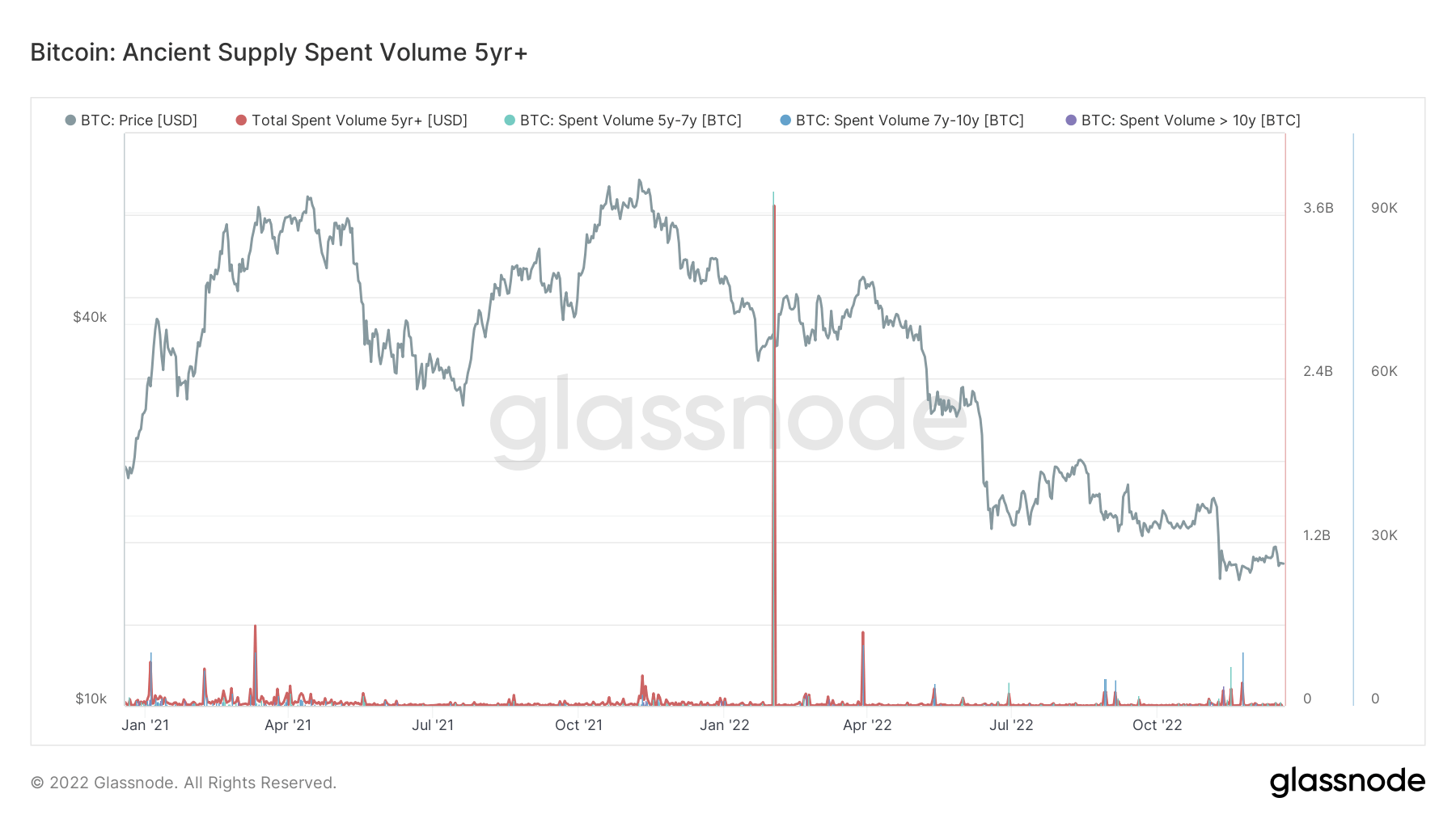

Peak worry occurs when Bitcoin, which has been dormant for 5 years or extra, will get offered. These cash are thought of historical cash, and holders have to be critically spooked to lose their conviction and promote.

Russia’s invasion of Ukraine seems to have had this impact on traders. Different occasions triggered sell-offs, reminiscent of the primary bull run, the second bull run on November 21, and Luna’s collapse in Could 2022.

In conclusion, long-term holders who offered in 2021 did for revenue, whereas those that offered in 2022 did due to worry.