San Francisco’s SoFi Financial institution, a rising monetary establishment with 6.2 million prospects, has unveiled its substantial cryptocurrency holdings, demonstrating a proactive embrace of the evolving digital asset panorama.

BTC, ETH, and DOGE Lead the Approach

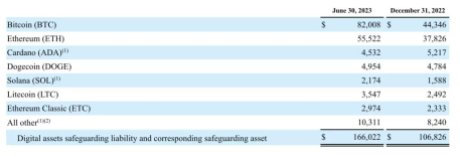

A latest report exhibits that the financial institution’s second-quarter earnings totaled $170 million in varied cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE).

Amongst its cryptocurrency investments, SoFi Financial institution boasts $82 million value of Bitcoin, solidifying its place in ‘digital gold.’ Ethereum follows carefully, with $55 million, showcasing the financial institution’s perception within the blockchain’s potential.

The meme-inspired Dogecoin takes the third spot with $5 million, whereas Cardano secures the fourth place with $4.5 million. The financial institution additionally diversifies with digital belongings like Solana (SOL), Litecoin (LTC), and Ethereum Basic (ETC).

SoFi Financial institution's crypto holdings | Supply: X

SoFi Financial institution’s distinctive proposition lies in its dedication to fee-free cryptocurrency investments, permitting prospects to allocate a portion of their direct deposits to digital belongings.

The financial institution additional incentivizes newcomers by providing a $100 crypto bonus upon registration. With a minimal funding threshold as little as $10, the platform fosters accessibility to quite a lot of cryptocurrencies past Bitcoin.

Whereas SoFi Financial institution’s modern method to cryptocurrency has garnered consideration, it faces regulatory scrutiny, significantly from the USA Federal Reserve. The regulatory physique has raised issues over the financial institution’s involvement in crypto-related actions, requiring alignment with established insurance policies. The financial institution has been given till January 2024 to make sure compliance, a course of that includes navigating regulatory capital therapy intricacies.

Based in 2011, SoFi Financial institution transitioned from its standing as a non-bank entity in 2019 to a fully-fledged monetary establishment the next yr.

BTC worth falls to $29,300 | Supply: BTCUSD on Tradingview.com

Strategic Development And Monetary Success

The earnings report highlights SoFi Financial institution’s enterprise acumen, mirrored in its robust second-quarter efficiency. With a outstanding 37% surge in income ($498 million) in comparison with the earlier yr, the financial institution showcases its capacity to thrive amidst a quickly evolving monetary panorama.

SoFi Know-how Inventory additionally witnessed a 17% surge in July following its Q2 report. “On account of this development in high-quality deposits, now we have benefited from a decrease price of funding for our loans,” SoFi CEO Anthony Noto mentioned.

SoFi isn’t the one financial institution that has made its manner into cryptocurrencies. Main US banks like Wells Fargo, JP Morgan, and Goldman Sachs, amongst others, have additionally taken the plunge to supply entry to digital belongings and cryptocurrencies for his or her shoppers.

Different notable entrants into the trade embrace BlackRock and ARK Make investments, which have filed purposes for Spot Bitcoin ETFs with the SECs. On August 13, the primary of those, the ARK Make investments utility, shall be deliberated on to be accepted or rejected by the SEC. Nevertheless, the regulator may additionally find yourself extending the deadline.

Featured picture from BitIRA, chart from Tradingview.com