Former FTX CEO Sam Bankman-Fried (SBF) launched a Substack report during which he detailed his model of accounts of what occurred at FTX.

SBF claimed that “no funds had been stolen” and attributed the collapse to Alameda’s incapability to hedge in opposition to a market crash adequately.

SBF restoration plan for FTX

SBF took to Twitter earlier on Jan. 12 to argue that FTX may nonetheless get well — SBF’s Substack report helps these claims.

The previous CEO — who’s presently confined to his guardian’s home in line with the phrases of his bail — aligned the failure of FTX to “someplace between that of Voyager and Celsius.”

He gave three causes for the “implosion,” stating Alameda had $100 billion in belongings, which we subjected to each a market crash and “an excessive, fast, focused crash precipitated by the CEO of Binance.”

“a) Over the course of 2021, Alameda’s steadiness sheet grew to roughly $100b of Internet Asset Worth, $8b of web borrowing (leverage), and $7b of liquidity readily available.

b) Alameda didn’t sufficiently hedge its market publicity. Over the course of 2022, a collection of huge broad market crashes got here–in shares and in crypto–resulting in a ~80% lower out there worth of its belongings.

c) In November 2022, an excessive, fast, focused crash precipitated by the CEO of Binance made Alameda bancrupt.”

Similarities to the impression of the Three Arrows Capital (3AC) collapse on exchanges similar to Celsius and Voyager had been made to Alameda’s position within the downfall of FTX.

Nonetheless, SBF didn’t straight handle the argument that Alameda ought to by no means have had entry to buyer funds within the first place when making the comparability.

FTX.US solvency

SBF made a robust assertion concerning the state of FTX.US, claiming that:

“It’s ridiculous that FTX US customers haven’t been made complete and gotten their funds again but.”

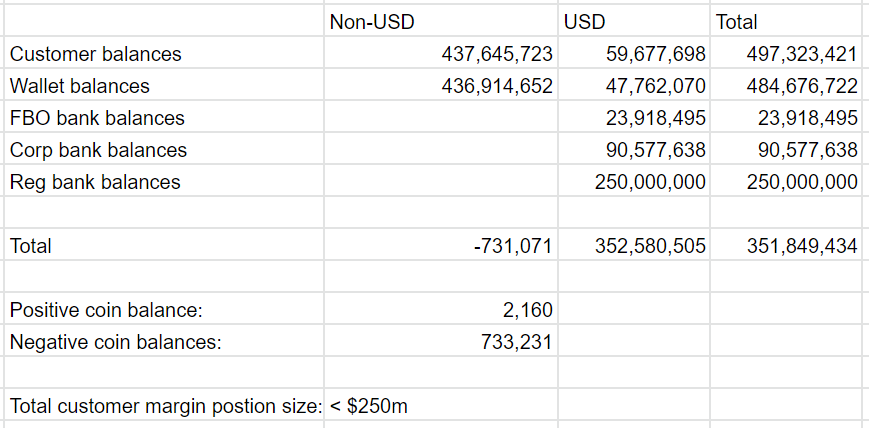

FTX.US allegedly had over $350 million money “past buyer balances,” in line with SBF.

Under is a duplicate of the spreadsheet shared by the previous CEO within the report. The figures characterize the corporate’s state on the time of SBF’s elimination.

The potential for FTX.US clients to be made complete has been constantly backed by SBF, as he claimed the U.S. arm of the corporate has by no means been bancrupt.

Authorized conspiracy

SBF continued his narrative that the authorized corporations concerned within the insolvency have conspired to power by means of chapter proceedings to garner authorized charges.

“[Sullivan & Crowell] and the [General Council] had been the first events strong-arming and threatening me into naming the candidate they themselves selected as CEO of FTX.”

Whereas authorized agency Sullivan & Crowell maintained that it “had a restricted and largely transactional relationship with FTX,” SBF revealed that he was shut sufficient to the agency to work out of its workplaces when he was in New York.

U.S. Senators — together with Sen. Elizabeth Warren — have publicized their issues over Sullivan & Crowell’s involvement within the case going ahead.

A letter printed by a bunch of Senators said there have been “issues concerning the impartiality” of the agency.

“Put bluntly, the agency is just not ready to uncover the knowledge wanted to make sure confidence in any investigation or findings.”

SBF denies stealing from clients

Within the report, SBF backed his ‘not responsible’ plea by publicly stating that he didn’t steal person funds and is keen to make use of his Robinhood shares to make clients complete.

“I didn’t steal funds, and I actually didn’t stash billions away. Practically all of my belongings had been and nonetheless are utilizable to backstop FTX clients.”

In contradiction to the claims that SBF appropriated person deposits to fund dangerous bets by Alameda Analysis, the previous CEO pointed to international market situations as the basis reason for the collapse.

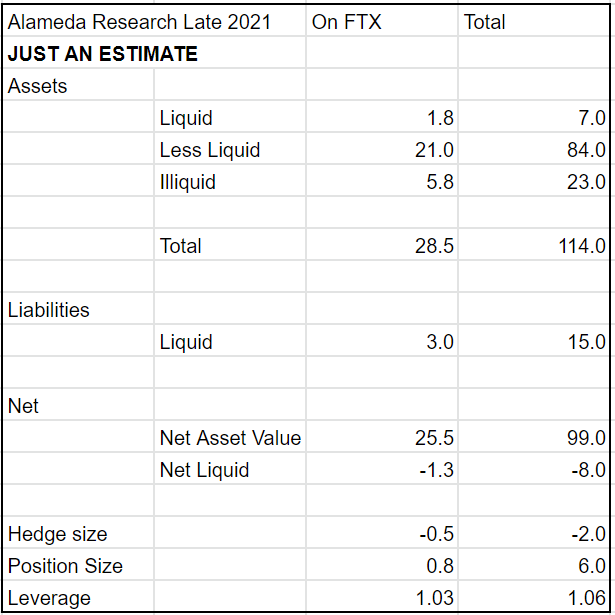

The desk beneath showcases Alameda’s steadiness sheet in billions, in line with SBF.

Primarily based on the knowledge, SBF alleges that its holdings of “SOL alone was sufficient to cowl the web borrowing.”

SBF argued that Alameda’s “~$8b illiquid place… appeared affordable and never very dangerous.” Nonetheless, after a 94% decline in web asset worth throughout 2022, “the hundred billion of belongings had only some billion {dollars} of hedges,” which was inadequate to help its wants.

As a substitute of taking any precise possession of the occasions, SBF recounted an inventory of macro elements that affected Alameda’s place, together with taking a shot at former Alameda co-CEO, Sam Trabucco.

“–BTC crashed 30%

–BTC crashed one other 30%

–BTC crashed one other 30%

–rising rates of interest curtailed international monetary liquidity

–Luna went to $0

–3AC blew out

–Alameda’s co-CEO give up

–Voyager blew out

–BlockFi virtually blew out

–Celsius blew out

–Genesis began shutting down

–Alameda’s borrow/lending liquidity went from ~$20b in late 2021 to ~$2b by late 2022”

Alongside these occasions, SBF cited liquidity points within the crypto markets as liable for Alameda’s troubles.

“Liquidity dried up–in borrow-lending markets, public markets, credit score, non-public fairness, enterprise, and just about the whole lot else. Practically each liquidity supply in crypto–together with practically the entire borrow-lending desks–blew out over the course of the yr.”

With the scene set to showcase Alameda’s sturdy place of roughly $10 billion in web asset worth in October 2022 in a turbulent bear market, SBF continued the article to go on the offensive in opposition to Binance CEO CZ.

November 2022

SBF started a bit titled ‘The November Crash’ by singling out C.Z.’s tweets and P.R. marketing campaign in opposition to FTX.

“Then got here CZ’s fateful tweet, following a particularly efficient months-long PR marketing campaign in opposition to FTX–and the crash.”

Till November 2022, SBF claimed that Alameda’s hedges “to the extent they existed, had labored.” Nonetheless, what occurred subsequent was allegedly focused straight at FTX and Alameda.

“The November crash was a focused assault on belongings held by Alameda, not a broad market transfer.”

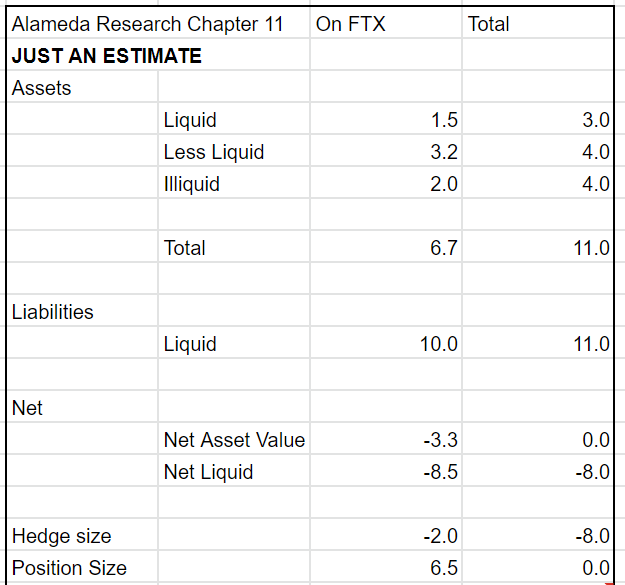

It was on Nov. 7, 2022 and Nov. 8, 2022 that SBF believes that Alameda first grew to become “clearly bancrupt.” The desk beneath particulars Alameda’s steadiness sheet on the time of the Chapter 11 submitting, in line with SBF.

As soon as Alameda grew to become bancrupt, SBF argued that the pursuing financial institution run tipped the steadiness inflicting the group to break down. At this level within the report, SBF lastly acknowledges the direct hyperlink between Alameda and FTX as he confirmed that “Alameda had a margin place open on FTX; and the run on the financial institution turned that illiquidity into insolvency.”

Nonetheless, SBF failed to deal with whether or not the Alameda margin place was associated to buyer funds or FTX-owned belongings. In truth, SBF seems to be positioning the occasion to make comparisons with 3AC, in opposition to which no felony expenses have been filed. SBF is going through as much as 100 years in jail for his involvement within the collapse.

“No funds had been stolen. Alameda misplaced cash on account of a market crash it was not adequately hedged for–as Three Arrows and others have this yr. And FTX was impacted, as Voyager and others had been earlier.”

SBF ended the report by stating that he had meant to element the report’s content material on the U.S. Home Monetary Providers Committee on Dec. 13, 2022, however was unable on account of his arrest.

SBF has promised extra data sooner or later. As well as, updates will possible be made to the brand new substack account, which may be discovered right here.