After a late-summer rally, the crypto markets pulled again in September, bringing many metrics associated to the well being of the GameFi business down with it.

- The quantity of quantity passing by GameFi protocols reached historic lows

- Funding nonetheless remained sideway

- Only a few new GameFi tasks had been launched

Then again, the variety of energetic GameFi customers jumped, largely resulting from arcade app Arc8 on Polygon and, to a lesser extent, a number of smaller tasks on BNB.

Nonetheless, even well-performing tasks in September didn’t see giant will increase of their token costs. The market cap of GameFi tokens continues to say no.

Key Findings

General Market

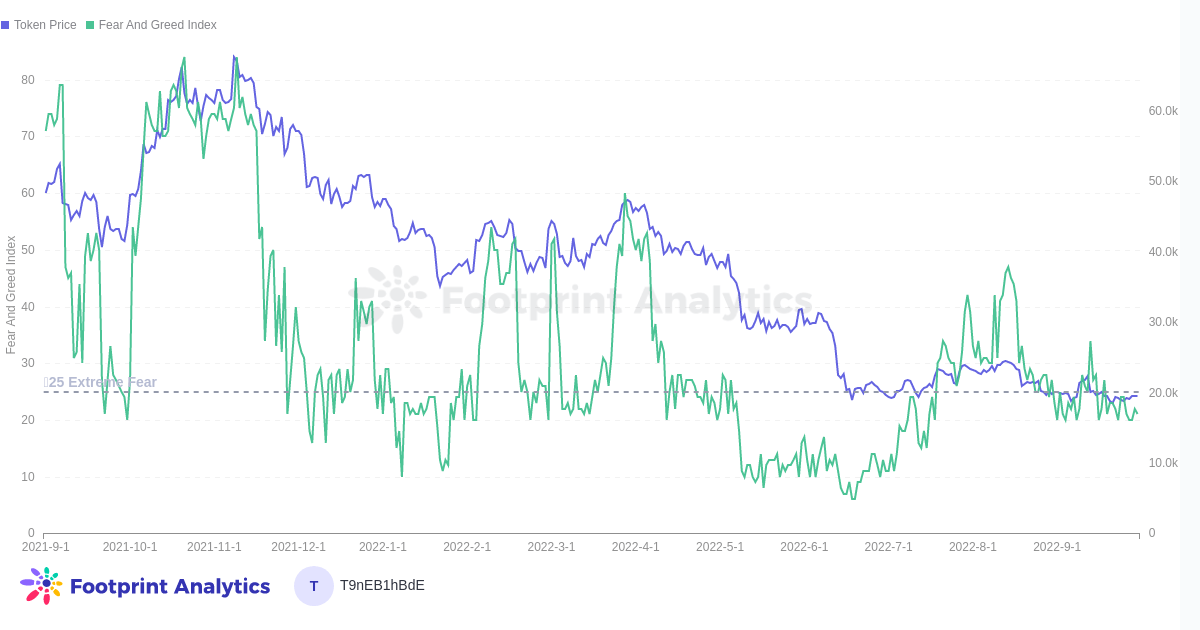

- The Worry and Greed index fell again to excessive worry

- Ethereum was simply 20% away from yearly lows on Sept. 22 when it hit $1,245.

- Within the GameFi house, this pull-back manifested itself as much less funding within the house and a dearth of recent tasks launched

- The variety of GameFi tasks grew by 1.3%, an all-time low for the business

- Out of the 4 largest chains for blockchain video games (BNB, ETH, Polygon, Wax), BNB had essentially the most new tasks, 12 in whole

- Ethereum, WAX and Polygon had 2, 3 and 4 new tasks, respectively

Financing & Funding

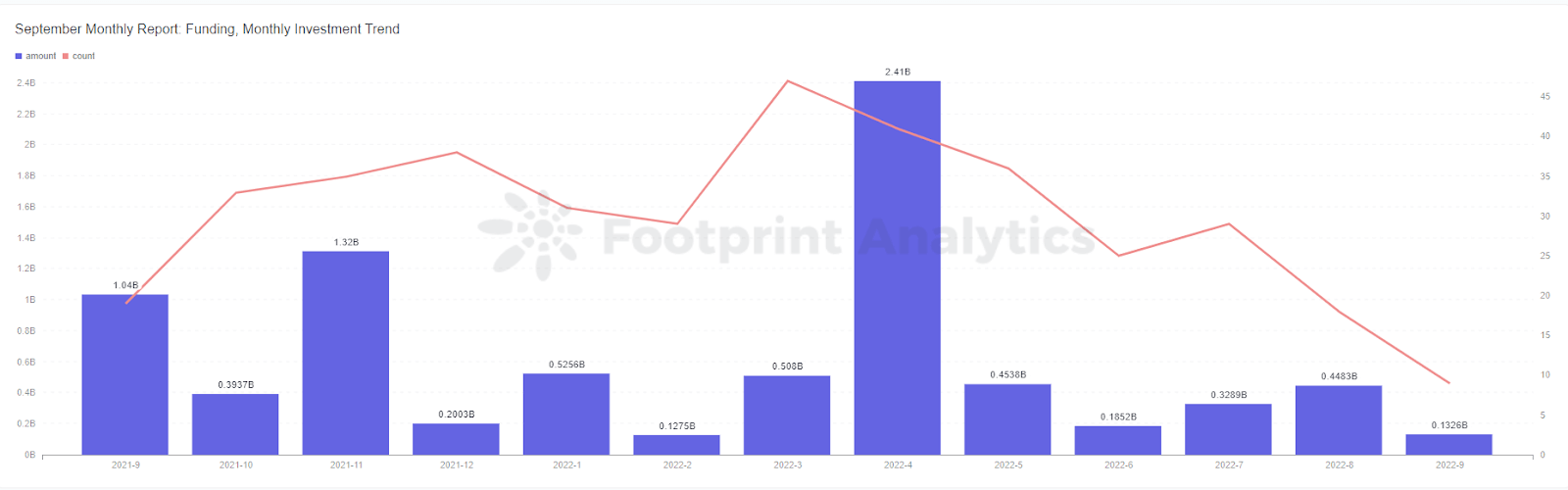

- The quantity of funding raised within the GameFi house dropped 20% MoM from $0.448B to $0.133B.

- Unbiased sport studio Theorycraft acquired the month’s largest funding with a $50 million B spherical. The founding staff consists of names from Blizzard, Riot Video games and Ubisoft. The enterprise into GameFi highlights the development of established gaming firms and builders getting into into Web3, even throughout extreme market circumstances.

- The month’s second funding spherical was closed by Revolving Video games, one other blockchain sport studio.

- Animoca Manufacturers continued to pour cash into the house, changing into one of many greatest funders and backing the funding for Revolving Video games and Thirdwave in September.

- Immortal Sport raised the month’s second funding spherical with $15.5M by TCG, together with different tech and leisure VC specialists.

GameFi Quantity & Customers

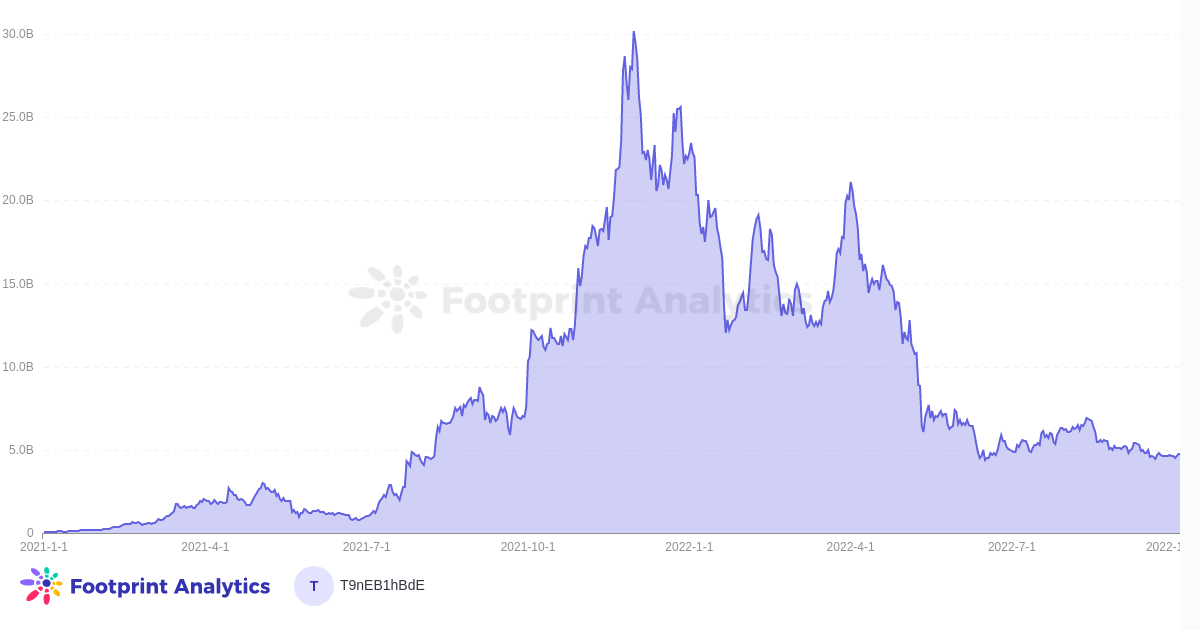

- The full quantity in GameFi dropped 40% % MoM to succeed in an all-time low because the starting of the bear market

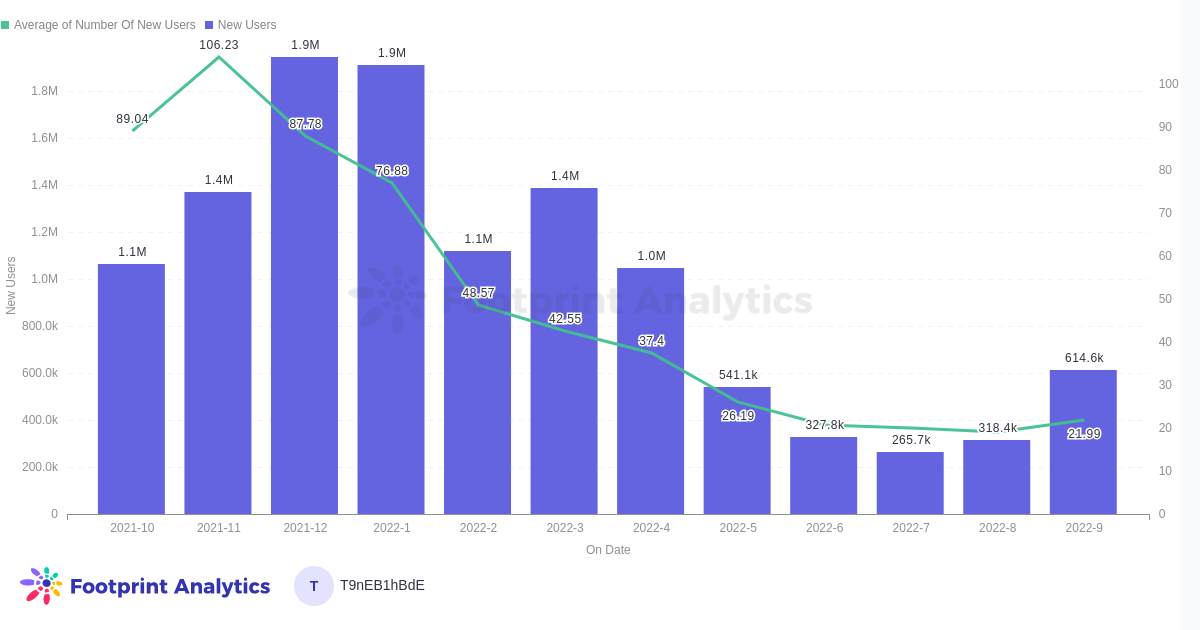

- Counterintuitively, the variety of avid gamers has elevated sharply MoM

- This means a decline within the quantity per consumer, which is mirrored within the GameFi Quantity and Transactions per Consumer knowledge

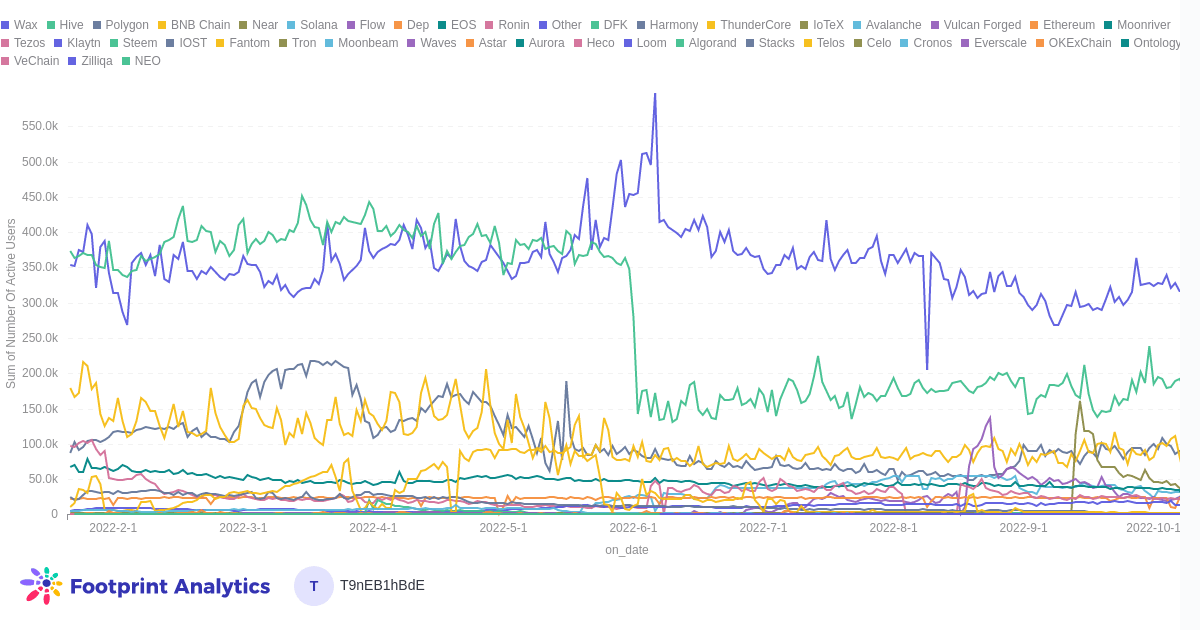

- Ronin—and, by extension, Axie Infinity—misplaced 11% of market share for gaming quantity. One the opposite hand, Polygon and BNB gained 5% and seven% respectively

- MAU jumped by 27%, 43% of which had been new customers (614.6K in whole)—the biggest MoM improve since March

- This improve was pushed largely by new gamers on Polygon (88% of recent gamers in September), a overwhelming majority of whom performed Arc8, a mobile-first arcade sport

Initiatives Overview

- The rise of individuals enjoying Arc8 drove Polygon’s vital progress in October; Arc8 is a mobile-first GameFi arcade by blockchain studio GAMEE

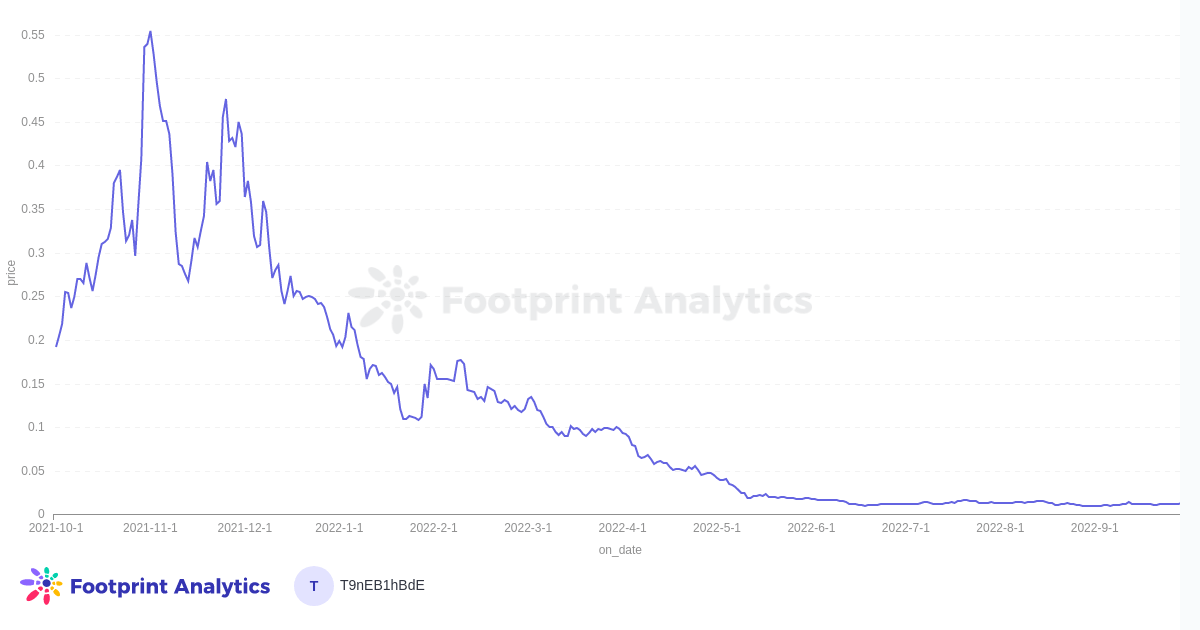

- In contrast to what would have doubtless occurred early within the yr, when a breakout efficiency by a sport would generate hype and result in jumps in token worth, GMEE—Arc8’s native token—didn’t see a major worth improve, growing by 20-30% MoM. It’s nonetheless 97% beneath its ATH and round 20% beneath its June worth when it had the same variety of energetic customers.

- Splinterlands and Alien Worlds proceed to be the 2 most-played video games in GameFi, with general quantity remaining comparatively steady

Crypto Macro Overview

After sharply leaping to virtually attain “greed” ranges on the Worry & Greed Index in August, the index fell again to a state of utmost worry in September.

The worth of Ethereum fell because the hype round The Merge died down—although this can be purely incidental; the S&P Index additionally had a pointy drop within the second half of the month.

Funding in GameFi dries up

Essentially the most hanging knowledge in September pertains to funding and funding. It declined from $0.448B in August to $0.133B in September.

Whereas the top of summer time is a really tough time to acquire funding (and thereby shut offers in September) the hole between this yr and final is just too monumental to disregard. The collapse in funding could have trickle-down results for studios, ecosystems and builders, who will doubtless be way more conservative this winter.

Polygon overtakes BNB due to Arc8

Polygon closed the hole with BNB, a spot which seemed to be widening at an accelerated tempo because the starting of summer time.

Lively customers for Arc8 elevated to June numbers, however this didn’t replicate within the mission’s token, GMEE, which was nonetheless round 20% decrease than firstly of summer time.

Extra avid gamers, much less cash

One of many greatest surprises of the month was the sharp progress in new GameFi customers.

The logical query is, why did the quantity lower regardless of the variety of new customers growing.

The 2 tasks which drove essentially the most new customers in September had been:

Nonetheless, neither noticed their tokens respect correspondingly. The worth of GameFi tokens continues to drop, mirrored by the final decline of GameFi token market cap.

Abstract

Because the macro-economic atmosphere continues to turn out to be increasingly more difficult, September was a tough month for the GameFi business.

Even robust consumer numbers didn’t assure will increase in token costs, and funding within the sector has been reduce to a small fraction of what it was months in the past. In different phrases, if developments proceed, discovering sources of revenue to maintain tasks alive will likely be tough. Unsurprisingly, there have been virtually no new GameFi tasks launched—and no main ones.

This piece is contributed by Footprint Analytics neighborhood.

Oct. 9 2022, Daniel

Information Supply: September 2022 GameFi Report (ENG)

The Footprint Group is a spot the place knowledge and crypto lovers worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or every other space of the fledgling world of blockchain. Right here you’ll discover energetic, various voices supporting one another and driving the neighborhood ahead.

Footprint Web site: https://www.footprint.community

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data