Bitcoin quick liquidations proceed to pile up as BTC strikes greater.

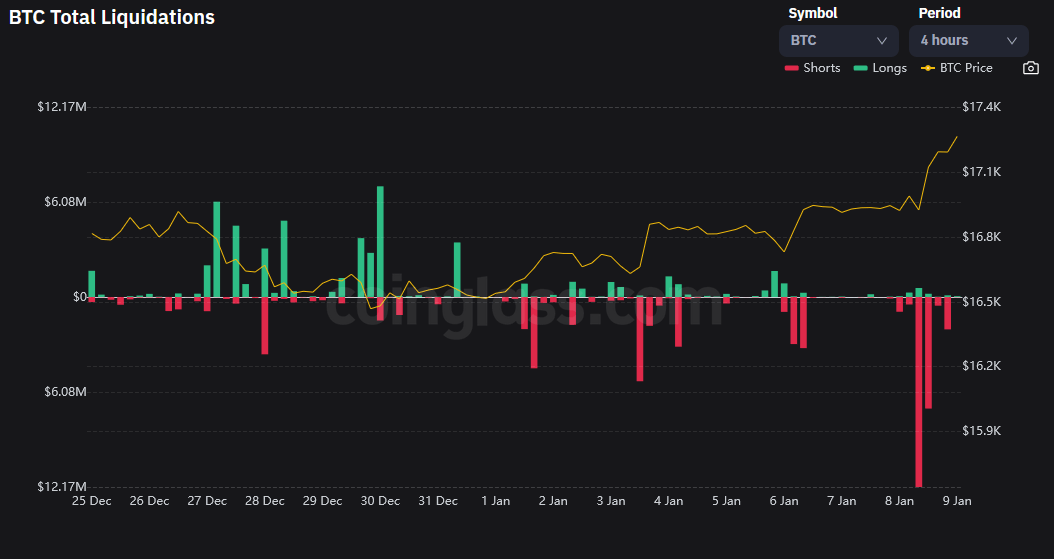

Coinglass confirmed that $53.24 million in shorts had been liquidated for the reason that flip of the 12 months. Against this, $11.98 million in longs had been liquidated over the identical interval.

The four-hour chart confirmed the divergence between shorts and longs taking impact predominately on Jan. 8 – 9, as Bitcoin was rejected at $17,000, solely to make a decisive break of this stage a number of hours later.

Is the bull market again?

Over the previous week, complete market cap inflows have are available in at roughly $46.6 billion, a 5.8% improve. The earlier occasion of the same influx was pre-FTX scandal, when market cap inflows totaled $82.8 billion over the week beginning Oct. 24, 2022.

The seemingly renewed urge for food for crypto investing has led some to invest that the bull market has returned. Nonetheless, with prevailing macro uncertainty and the distinct lack of sustained legs greater, others have referred to as this a suckers’ rally.

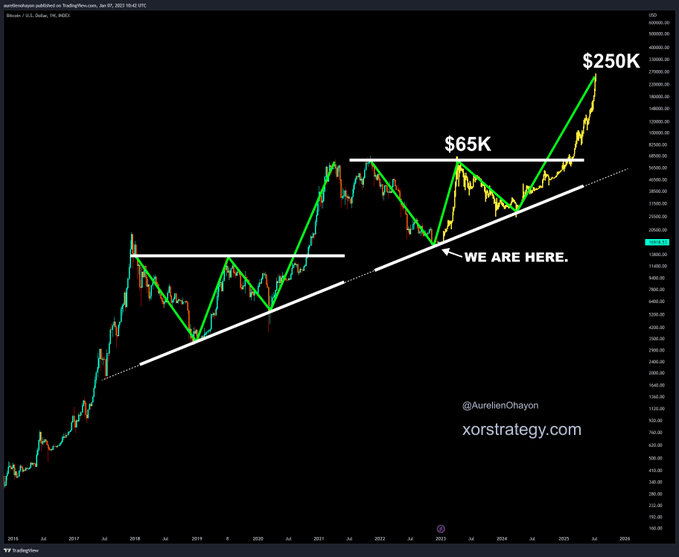

Nonetheless, some technical analysts had been already bullishly optimistic even earlier than the weekend bump in capital inflows. For instance, @AurelienOhayon posted a chart exhibiting BTC respecting a 2019 trendline, predicting a bounce to $65,000 by summer time this 12 months.

Equally, YouTuber @rovercrc posted an evaluation exhibiting Bitcoin in a falling wedge, which usually breaks to the upside roughly 90% of the time. The tweet was accompanied by the phrases:

“THE NEXT #BITCOIN BULL RUN CAN START ANY MOMENT!”

Bitcoin dominance takes a tumble

Curiously, Bitcoin’s 24 hours features got here in at simply 1.6%. Compared, Gala and Zilliqa are at present main the highest 100, up a staggering 62.8% and 49.3% over the identical interval, respectively.

Since Jan. 8, Bitcoin dominance has dipped as capital inflows made their manner into altcoins, shifting from 41.72% to as little as 40.8% on Monday.