Step by step, alongside the cryptocurrency trade, stablecoins are rising in power and recognition. Their progress outcomes from the soundness they provide in opposition to cryptocurrency volatility.

In the intervening time, USDT stays the most important stablecoin by market cap, as USDC, Binance USD, and DAI make up the highest 4.

Outstanding stablecoins after FTX collapse

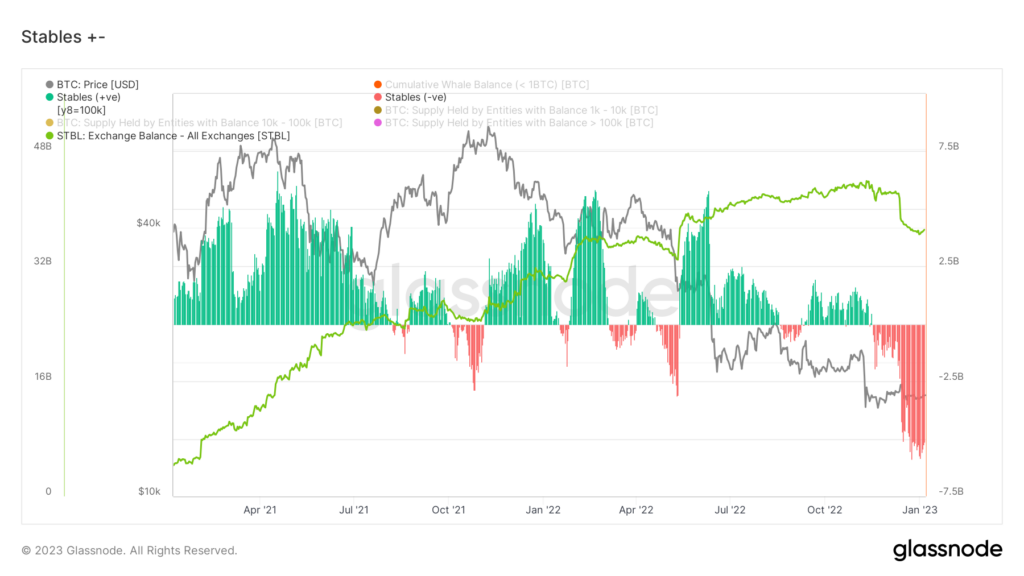

The whole thing of the stablecoin sector has a market cap of $138 billion, in keeping with CoinMarketCap. The large 4 stablecoins contribute greater than $130 billion to the determine, dominating the stablecoin market. Regardless of their progress and recognition, solely a minimal quantity of stablecoins are on cryptocurrency exchanges.

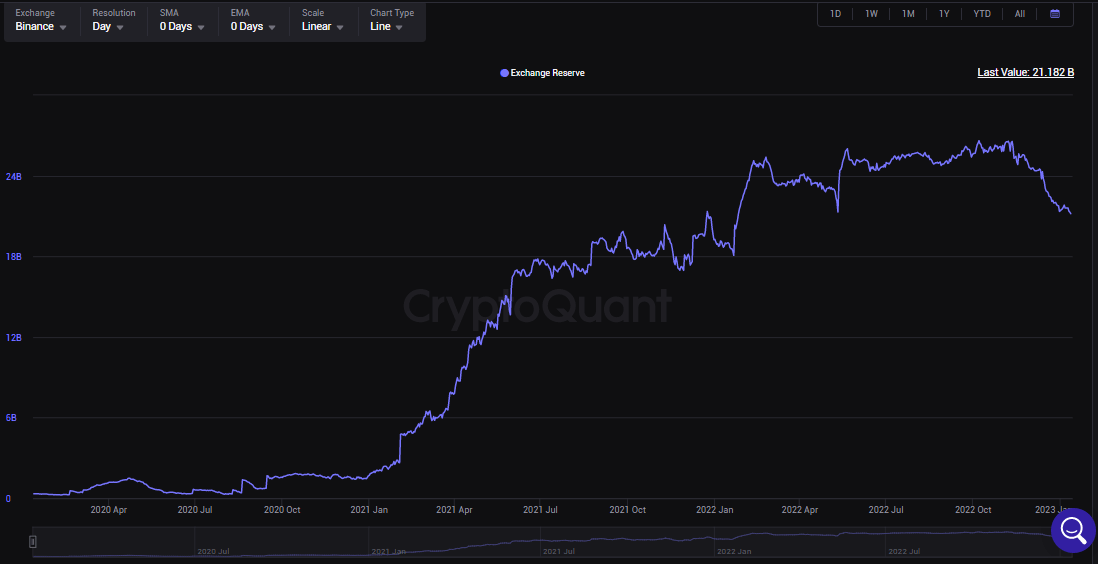

Presently, about 37 billion stablecoins are held in reserves of cryptocurrency exchanges. Binance is the very best contributor to this determine, with about $24 billion in stablecoins in its reserve. Coinbase has greater than $973 million, Huobi $709 million, Bitfinex $145 million, Gemini 98 million, and Gate.io $78 million.

As a result of market uncertainty and low belief in centralized exchanges after the collapse of FTX, about 3.93 billion stablecoins have left exchanges within the final 30 days.

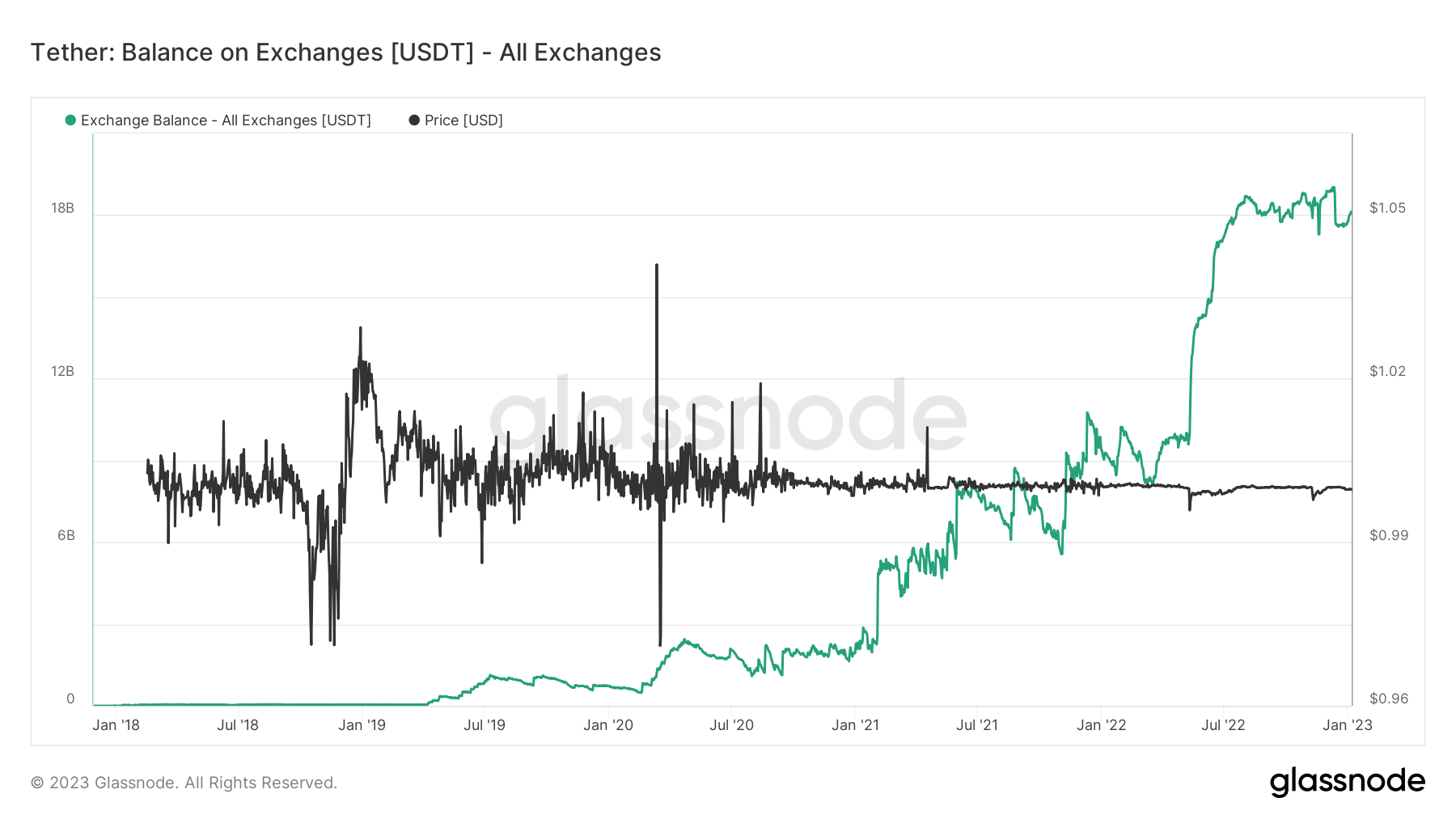

Regardless of the prevailing crypto winter, USDT has loved extra of a steady presence within the reserve of cryptocurrency trade. Since August 2022, USDT has largely stayed flat at $18 billion within the reserve of cryptocurrency exchanges.

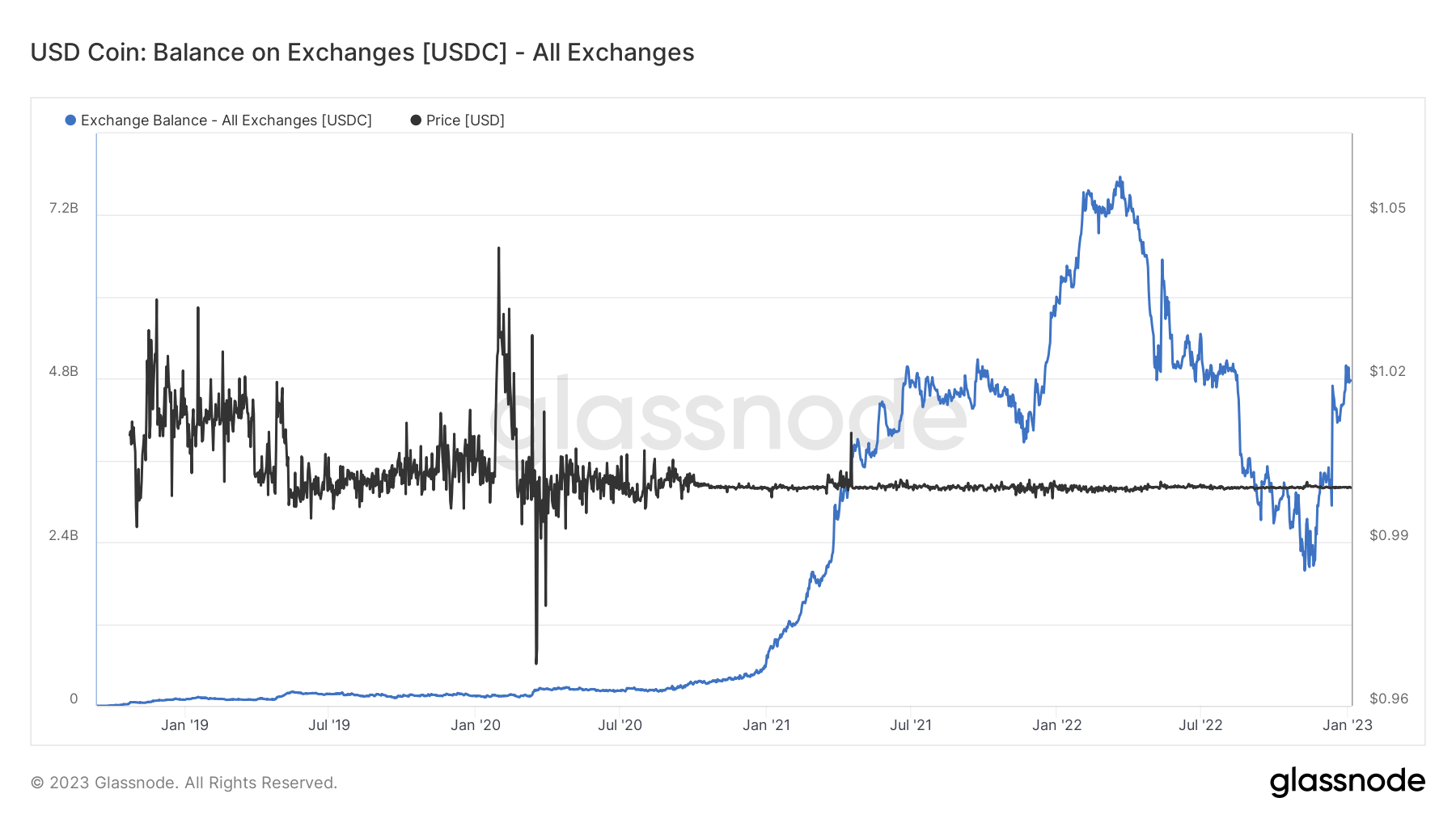

USDC, however, has loved some progress whereas attempting to curb USDT’s dominance within the stablecoin market. Because the collapse of FTX in early November 2022, the quantity of USDC within the reserve of cryptocurrency exchanges doubled to $5 billion.

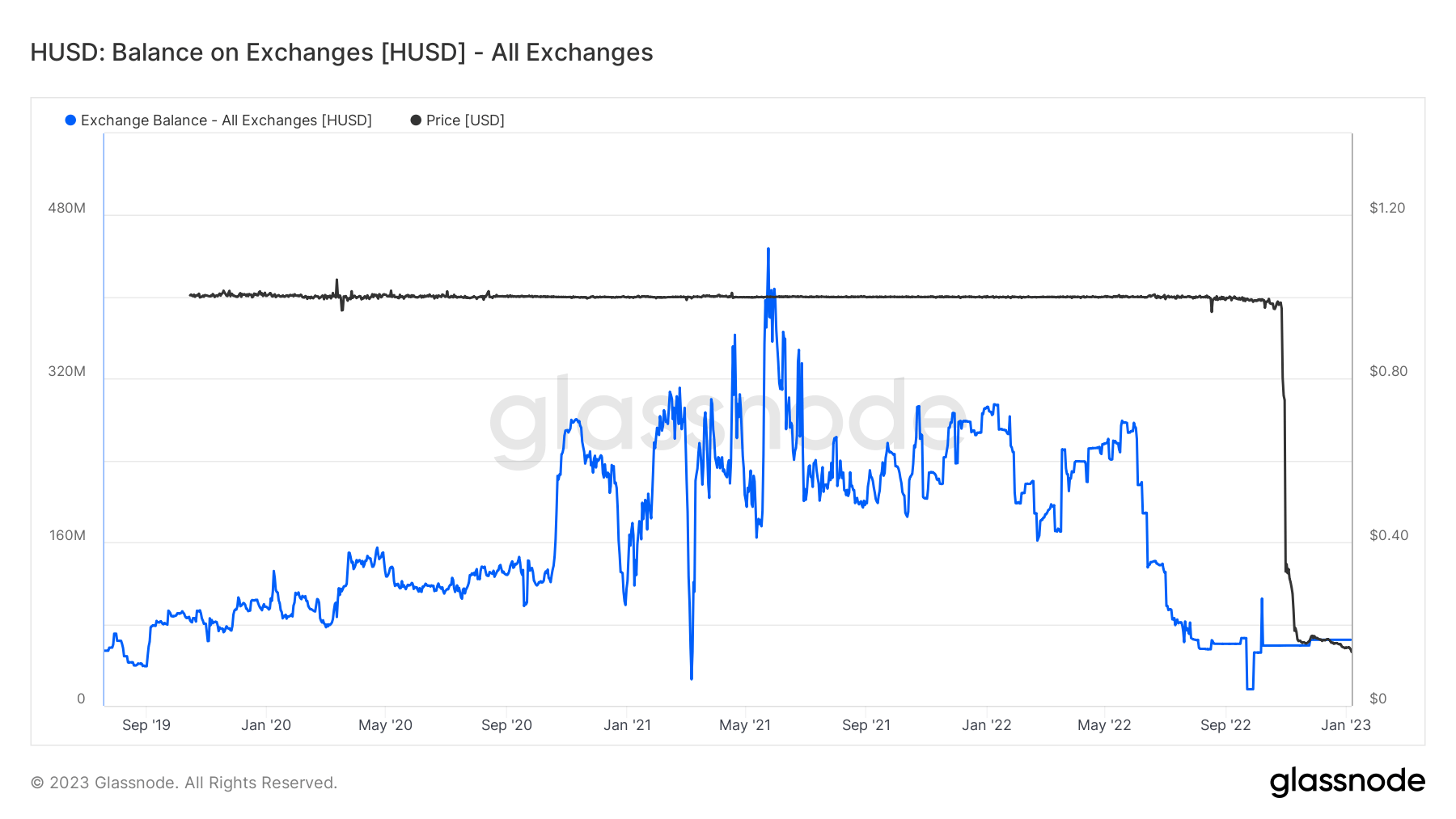

Nonetheless, the resilience the stablecoin sector has been having fun with for the reason that collapse of Terra Algorithm stablecoin UST is considerably below risk. Following the announcement of Huobi World to delist the HUSD stablecoin, the token has suffered a large decline.

Shortly after the announcement, the stablecoin fell 72% off its greenback peg, and now HUSD is buying and selling at 13 cents. In a pointy dip, the quantity of HUSD in cryptocurrency trade reserves is about to surpass its all-time low of $65 million.

Stablecoin reserve in centralized exchanges

Following the collapse of FTX, traders started to doubt the reliability of Centralized exchanges. As of January 12, Binance recorded about $5.202 billion outflow of stablecoin for the reason that collapse of FTX.

Likewise, inside two months after the demise of FTX, Coinbase Professional noticed a web outflow of $690 million, Huobi $277 million, Bitfinex $125 million, Gemini $398 million, and Gate.io $42 million.

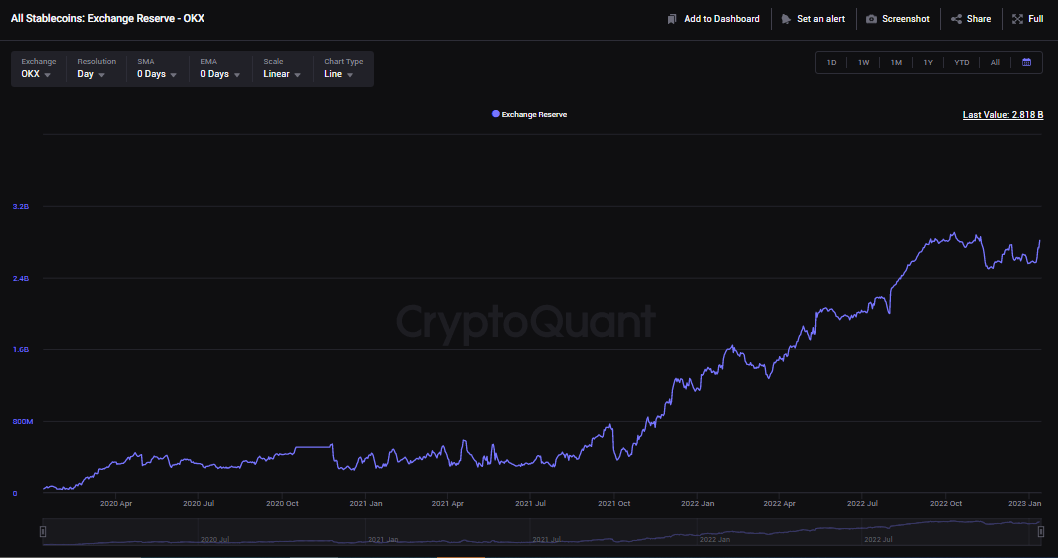

OKX, on the constructive aspect, didn’t file a deficit; as a substitute, the cryptocurrency trade loved a $43 million web influx.

Inside this era, cryptocurrency exchanges witnessed about $6.2 billion web outflow of stablecoin, with Binance struggling probably the most, in keeping with Cryptoquant. Nonetheless, the outflow can’t be thought-about vital since Binance held about $39.9 billion value of stablecoin, in keeping with its proof of reserve report from Nov. 10.

Exchanges like Binance and Crypto.com launched proof-of-reserves with Mazars in November to ascertain customers’ belief. Even so, the corporations later confronted backlash from the neighborhood as some argued that the report didn’t reveal the complete reserve of the exchanges.

In a harsh consequence, Binance, inside a day, witnessed a large withdrawal of stablecoins that amounted to about $2.1 billion.

It’s obvious from the charts that customers nonetheless have belief points with centralized exchanges since stablecoin reserves proceed to fall.