Earlier analysis carried out by CryptoSlate steered the Ethereum Merge can be a buy-the-rumor, sell-the-news occasion.

With that coming to go, as ETH sunk 20% during the last seven days, what does a present evaluation of the derivatives market reveal?

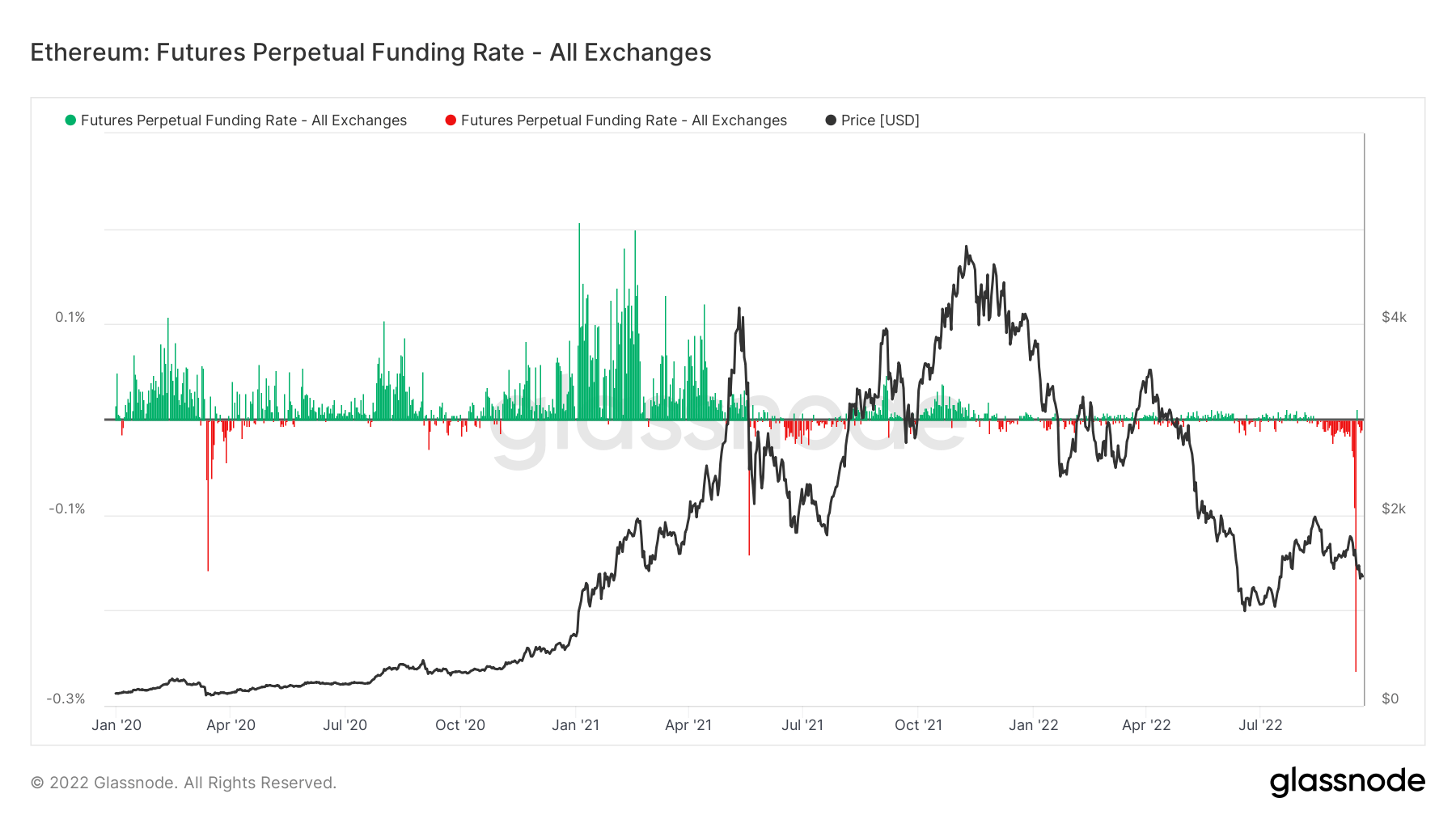

Ethereum Futures Perpetual Funding Price

Perpetual Funding Charges consult with periodic funds made to or by derivatives merchants, each lengthy and quick, based mostly on the distinction between perpetual contract markets and the spot worth.

During times when the funding price is optimistic, the value of the perpetual contract is larger than the marked worth. Subsequently, lengthy merchants pay for brief positions. In distinction, a detrimental funding price reveals perpetual contracts are priced under the marked worth, and quick merchants pay for longs.

They differ from normal futures contracts in that the perpetual aspect means merchants can maintain positions with out the contract expiring. However the function of funding charges is to function a mechanism for preserving contract costs according to spot markets.

The chart under reveals that because the Merge approached, merchants had been paying nearly 1,200% annualized funding charges to quick Ethereum. The size of shorting surpassed the degrees seen through the top of the covid disaster.

Submit-Merge, the funding price has reverted to close impartial, suggesting short-term hypothesis is over, and the funding premium has vanished accordingly.

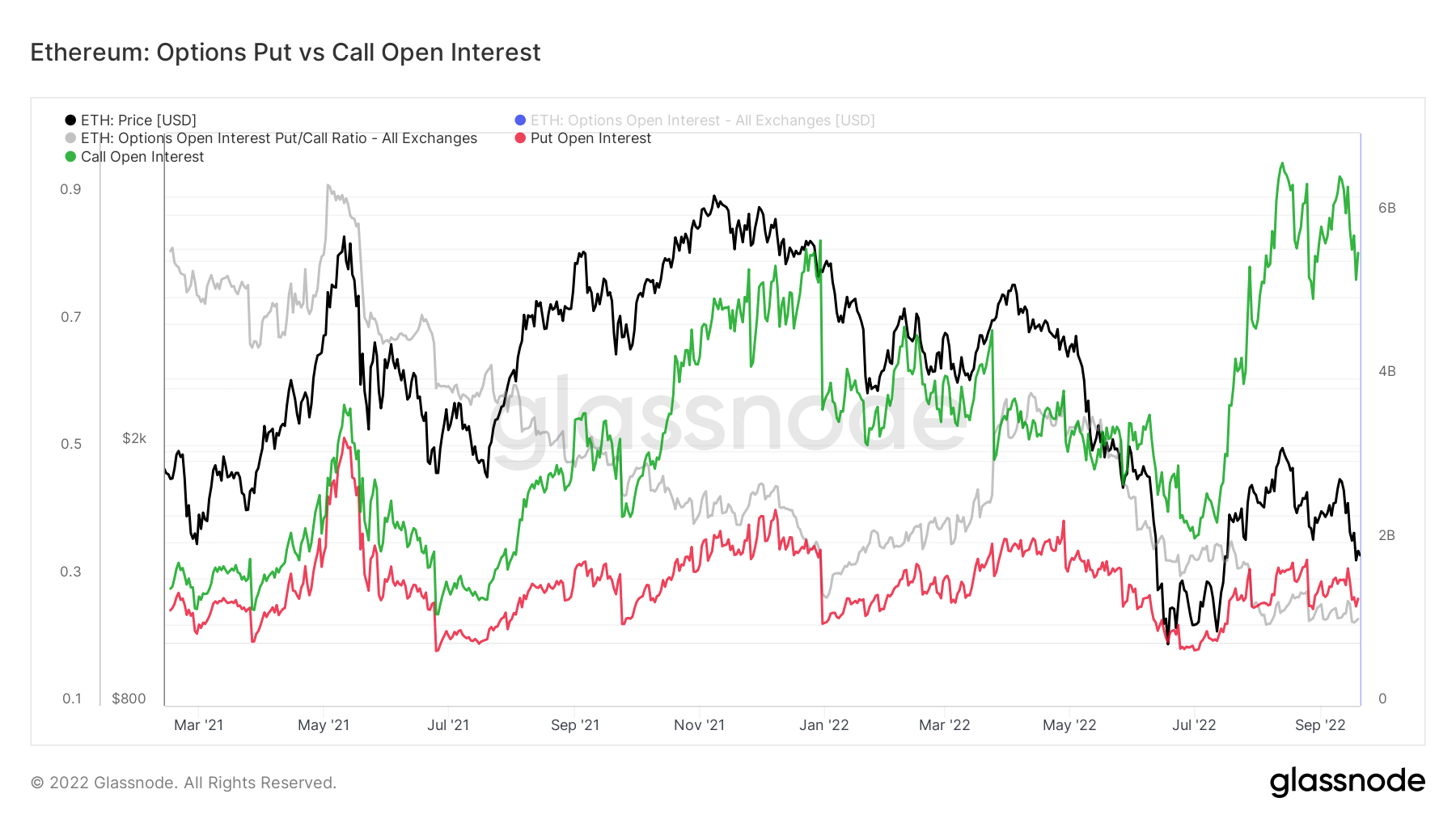

Choices Put vs. Name Open Curiosity

Open Curiosity refers back to the variety of energetic choices contracts. These are contracts which were traded however not but liquidated by an offsetting commerce or project. A put possibility is the proper to promote at a selected worth by a specified date, whereas a name is the proper to purchase at a selected worth by a specified date.

The chart under confirmed each put and name choices have sunk post-Merge. Calls stay elevated, with greater than $5 billion nonetheless in pressure, whereas places stay comparatively muted.

This implies merchants are nonetheless prepared to go lengthy regardless of the post-Merge worth correction.