Fast Take

Bitcoin’s valuation, usually seen as speculative, might be dissected extra precisely by means of the lens of the ‘realized worth‘ metric.

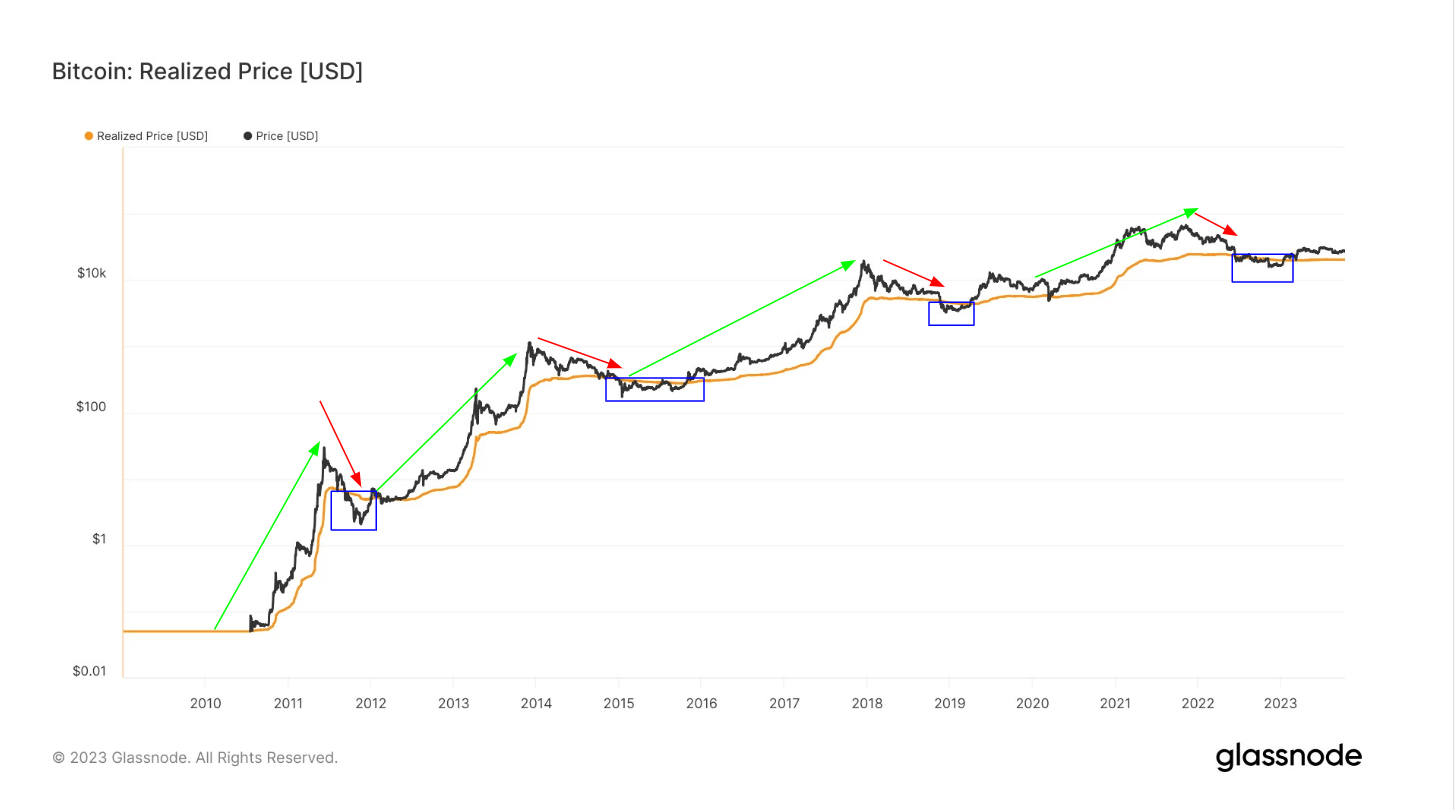

This measure, reflecting the typical price at which all present Bitcoin holders bought their cash, negates the impacts of volatility, thus providing a extra lifelike view of Bitcoin’s worth over time.

Historic knowledge reveals distinct cycles whereby Bitcoin’s market worth traded beneath its realized worth, as proven by the blue bins within the chart under.

Particularly, it noticed important drops in worth throughout the next intervals:

- September to December 2011 – Worth fell as little as $2.33

- January to October 2015 – Worth plunged to $310

- December 2018 to March 2019 – Worth dropped to a low of $3,500

- June 2022 to December 2022 – Worth reached a low of $15,500

Following these intervals, Bitcoin has persistently traded above the realized worth, illustrating a sturdy rebound sample.

As of 2023, Bitcoin’s worth at $26,800 is taken into account truthful in opposition to the realized worth of $20,300. This continuous sample of ‘greater highs’ demonstrates the inherent resilience of this digital asset.

Historic Bitcoin Realized Worth Projections.

Projecting the following backside cycle primarily based on Bitcoin’s realized worth presents an intriguing thought experiment. Whereas historic efficiency can not conclusively predict future worth motion, understanding cycle patterns permits for a extra holistic view of the Bitcoin market.

Historic knowledge exhibits that in 2011, the underside realized worth was $4.50, which surged 55x to $250 within the 2015 backside cycle.

Subsequently, the underside in 2019 noticed a 22x enhance to $5,500.

The 2022 cycle bottomed at $20,000, marking a 3.6x enhance.

If we comply with this sample of halving the multiplier with every cycle, the following backside, hypothetically, may very well be round $36,000, reflecting a 1.8x enhance in comparison with the 2022 backside.

Finally, this train permits us to check what Bitcoin’s valuation may appear to be ought to it comply with comparable patterns as earlier cycles after the upcoming 2024 halving. Whereas the longer term stays unsure, contextualizing Bitcoin’s present place relative to previous realized worth knowledge supplies a extra specific framework to anticipate prospects.

The publish Subsequent cycle’s hypothetical $36k Bitcoin ground, exploring historic knowledge to venture future benchmarks appeared first on CryptoSlate.