Fast Take

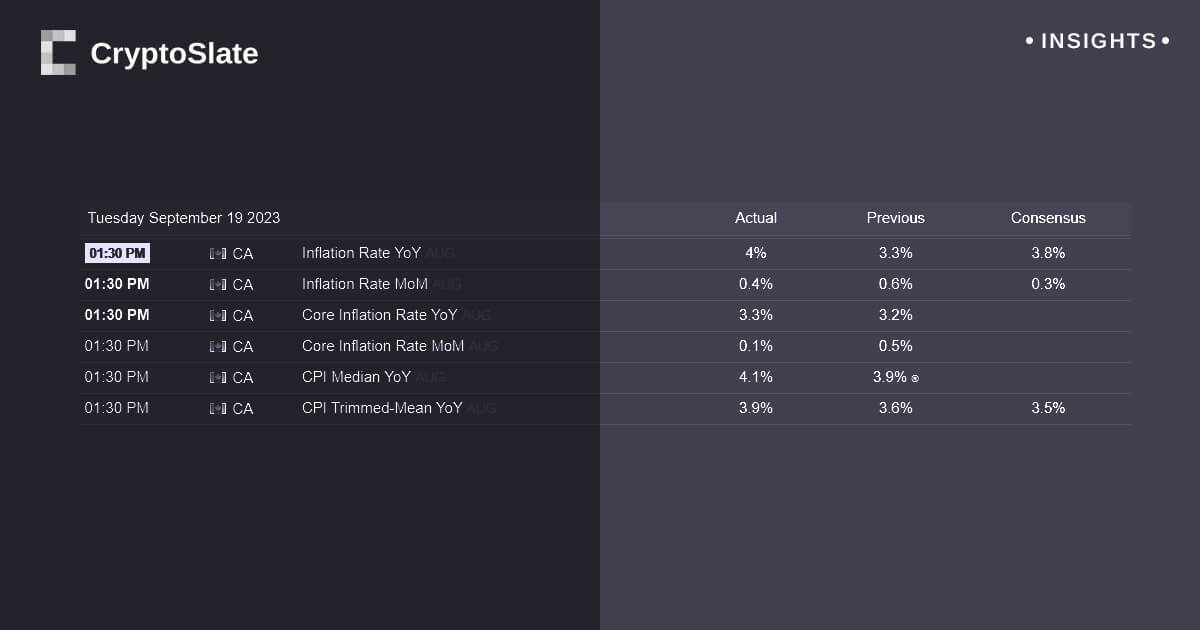

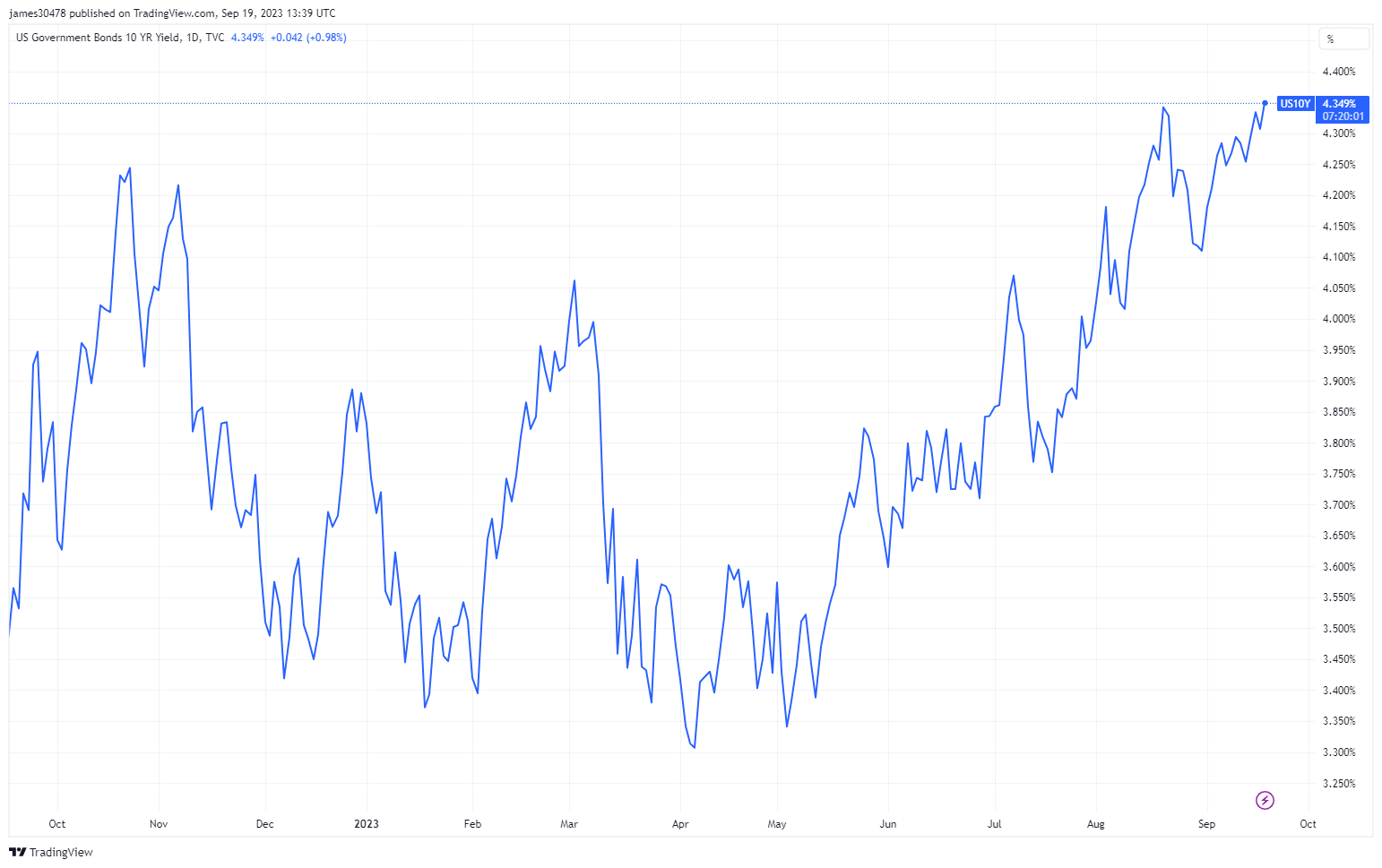

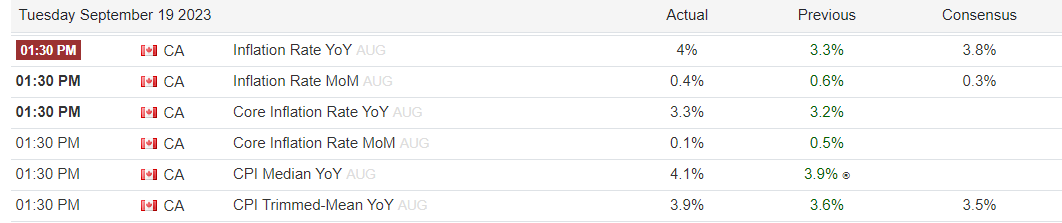

The trajectory of the 10-year treasury yield took a stunning flip because it charted a brand new cycle excessive at 4.3%. This was propelled by an unexpectedly excessive Client Worth Index (CPI) print for Canada, which emerged as a major variable within the monetary panorama.

Bucking predictions, inflation rose past the anticipated 3.8% to achieve 4%. This deviation from projected figures signifies a sturdy inflationary setting, underpinning the upward pattern in treasury yields.

In the meantime, the monetary sphere anticipates the forthcoming U.S. Federal Open Market Committee (FOMC) choice. The prevalent conjecture is that the committee will go for a price pause, sustaining the fed funds price between 5.25% and 5.50%.

This choice may probably present some stability amidst the inflation-induced volatility and may be a key issue influencing the longer term route of treasury yields.

The publish Sudden inflation surge in Canada propels 10-year treasury yield to new highs appeared first on CryptoSlate.