Fast Take

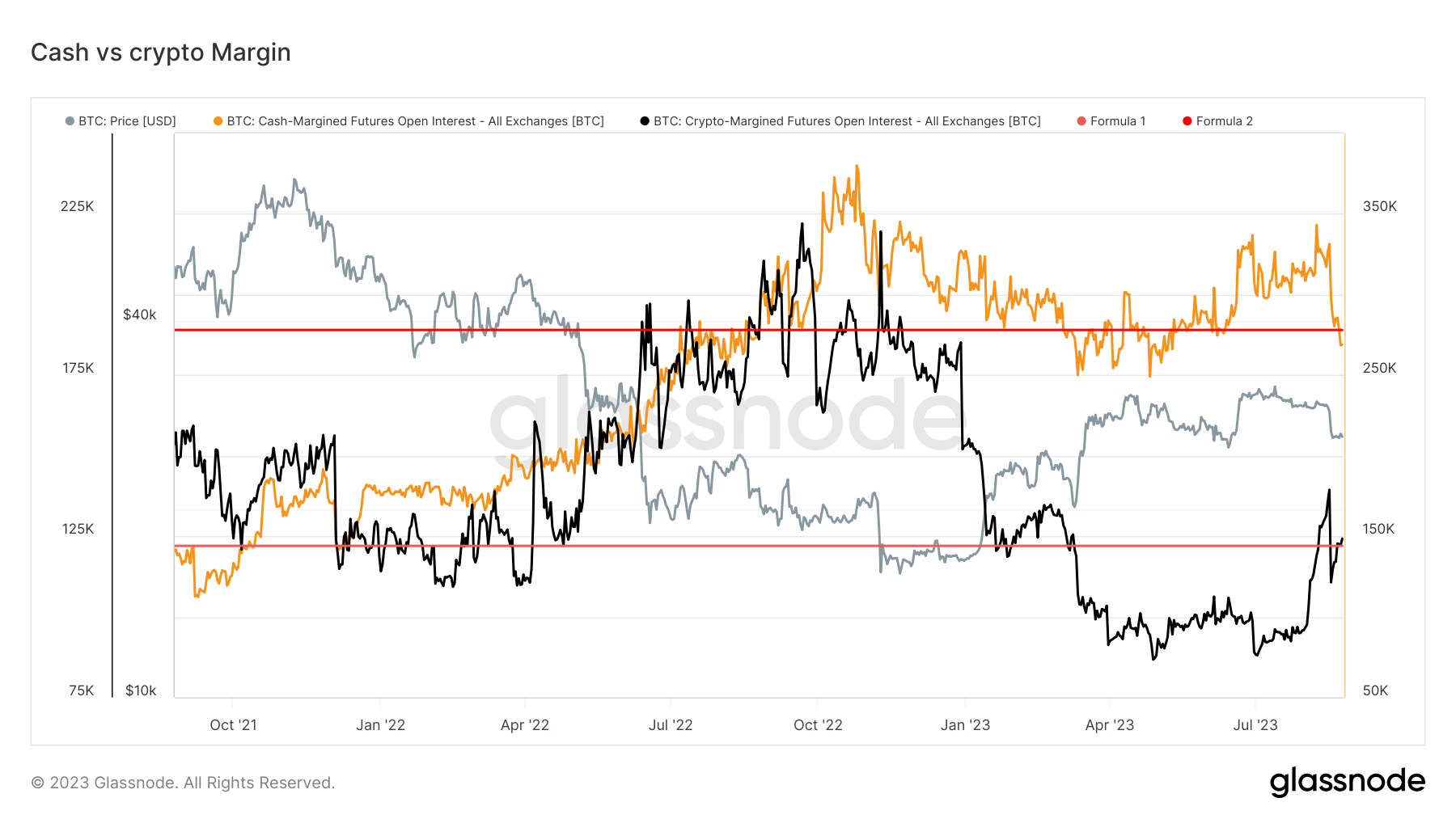

A notable divergence in futures contracts open curiosity, margined in USD or USD-pegged stablecoins versus these margined in native cash like Bitcoin, is starting to emerge. Stablecoins in query embody USDT and BUSD. The rising chasm reveals contrasting preferences and danger assessments by gamers within the crypto area.

Crypto margin, underpinned by collateral resembling Bitcoin, is surging to year-to-date highs, indicating an elevated willingness amongst merchants to tackle larger dangers. In distinction, money margin, linked to USD or USD-pegged stablecoins, is edging in the direction of year-to-date lows. This development signifies a defensive stance, probably in response to perceived uncertainty or volatility.

Curiously, the crypto margin as a proportion stands at 32%. With every spike on this determine, Bitcoin has traditionally registered a brand new native low, hinting at a possible correction or value consolidation in response to elevated margin buying and selling exercise.

The submit Surge in Bitcoin-margined futures alerts gambler’s rush amidst market uncertainty appeared first on CryptoSlate.