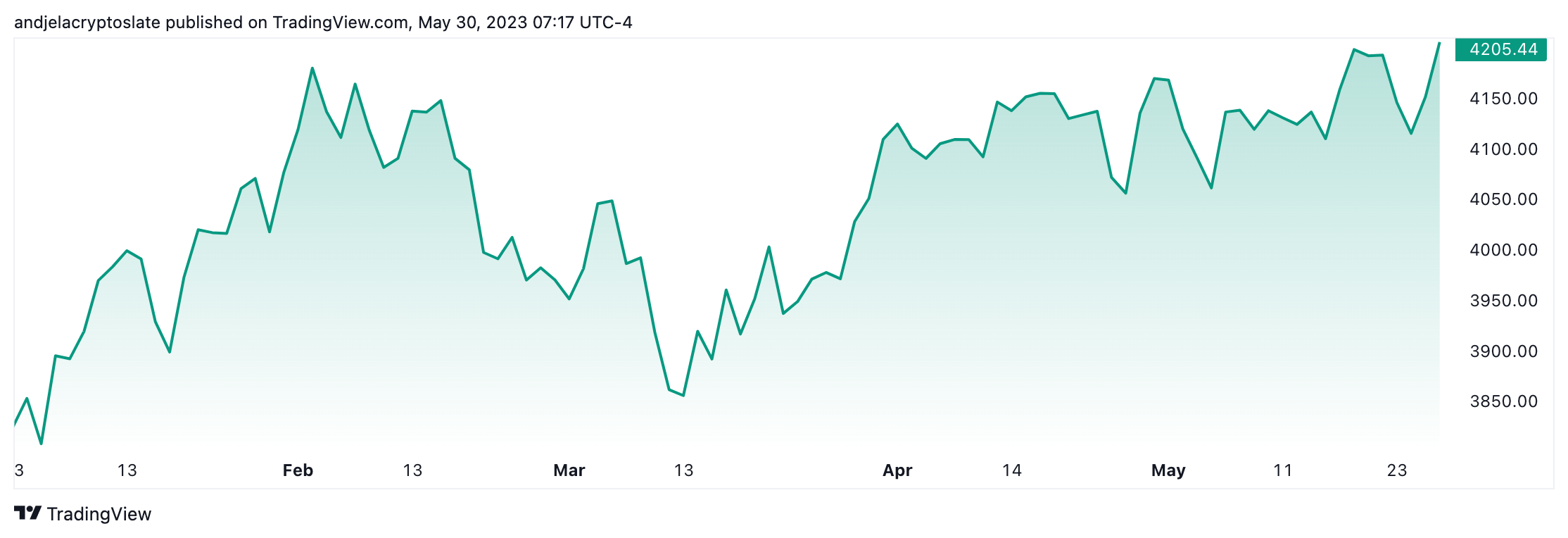

The S&P 500 index, a key barometer of U.S. equities, stood at 4,151 factors on the closing bell on Could 29, displaying a year-to-date (YTD) share progress of 9.15%, standing at odds with the rising inflation and potential recession.

In parallel, the crypto market, as measured by its complete market capitalization, witnessed substantial oscillations, ending the month at a commanding $1.16 trillion. Regardless of periodic downturns, the general YTD progress fee for the crypto market stands at a powerful 45.3%.

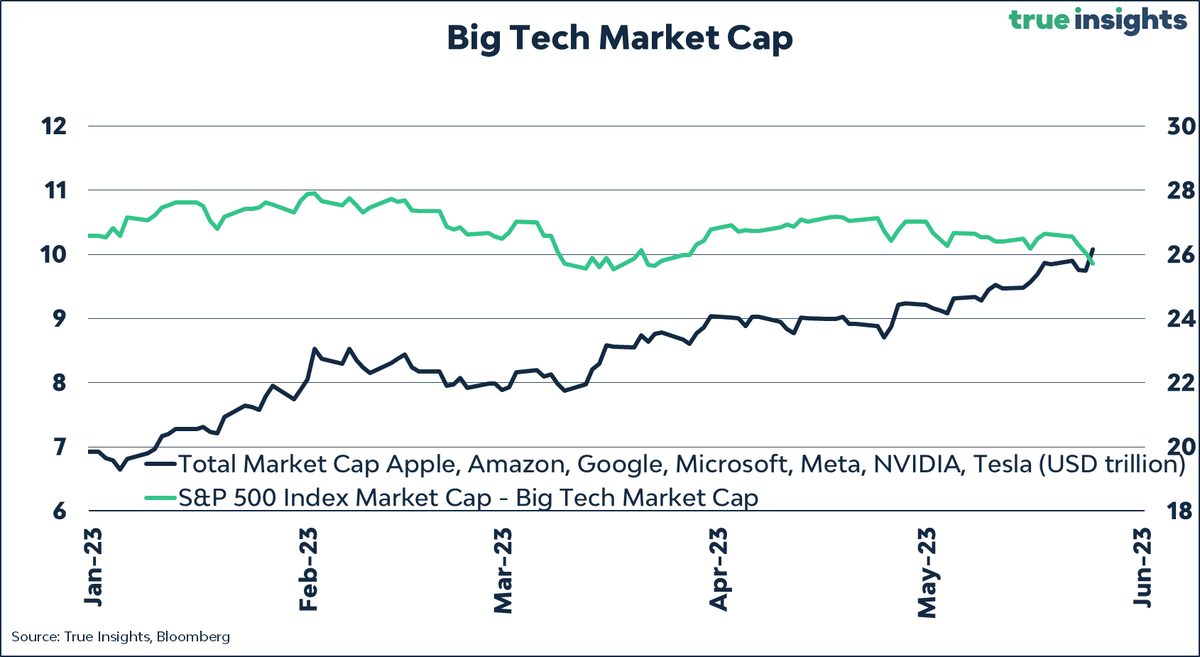

Nevertheless, the S&P 500’s efficiency doesn’t illustrate precise market circumstances. A more in-depth look reveals the disproportionate affect of tech behemoths Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla — which type a good portion of the index’s complete market cap — on the index’s general efficiency.

The mixed market capitalization of those shares has elevated by $3.16 trillion, representing a 46% YTD progress fee.

When these corporations are faraway from the YTD efficiency calculation, the S&P 500 paints a distinct image, with the YTD share progress dropping to only 3% and indicating a extremely skewed dependency on these entities for its strong efficiency.

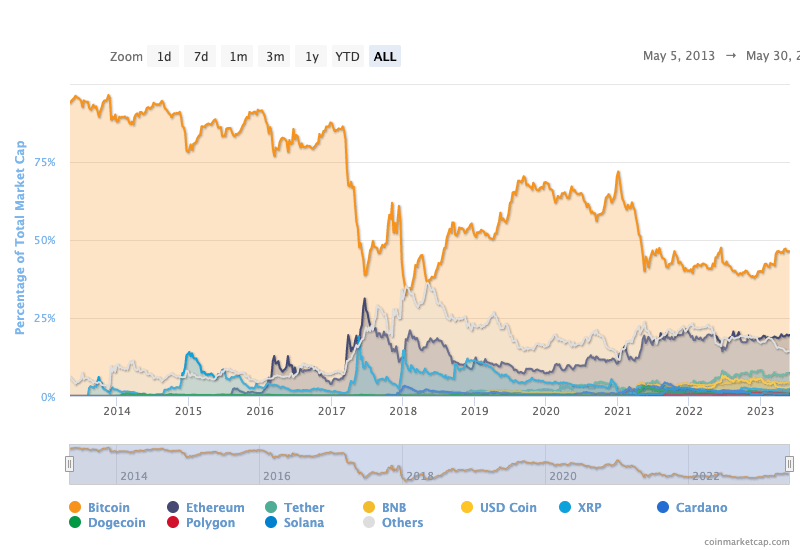

Nevertheless, the crypto market can be dominated by a major participant: Bitcoin. As of Could 23, 2023, Bitcoin alone accounted for $542.7 billion of the full crypto market cap. Its sheer dimension and affect typically overshadow the efficiency of different cryptocurrencies available in the market.

Actually, Bitcoin’s dominance stands at roughly 46% of the whole crypto market cap, reflecting its standing as the unique and most generally adopted cryptocurrency. The determine considerably shapes the crypto market’s dynamics, illustrating Bitcoin’s resilience and rising recognition.

After we exclude Bitcoin’s market cap from the full, the remaining crypto market cap involves $617.3 billion, indicating a decrease YTD progress fee of 29.1% for the remainder of the market and highlighting the numerous influence Bitcoin has on the general crypto market progress.

Evaluating the performances of the S&P 500 and the crypto market presents insightful parallels. Each are extremely concentrated, with choose entities massively influencing their respective market caps. This disproportionate affect factors to fascinating issues relating to the variety and resilience of those markets.

Nevertheless, the resilience proven by the crypto market, even amidst a world disaster, underlines its potential as a formidable contender towards conventional markets.

As we proceed to traverse via 2023, the unfolding efficiency of those markets will unquestionably stay beneath the lens, making for an intriguing remark for market watchers and members.

The submit Tech giants’ and Bitcoin’s dominance skew S&P 500, crypto market progress charges appeared first on CryptoSlate.