Fast Take

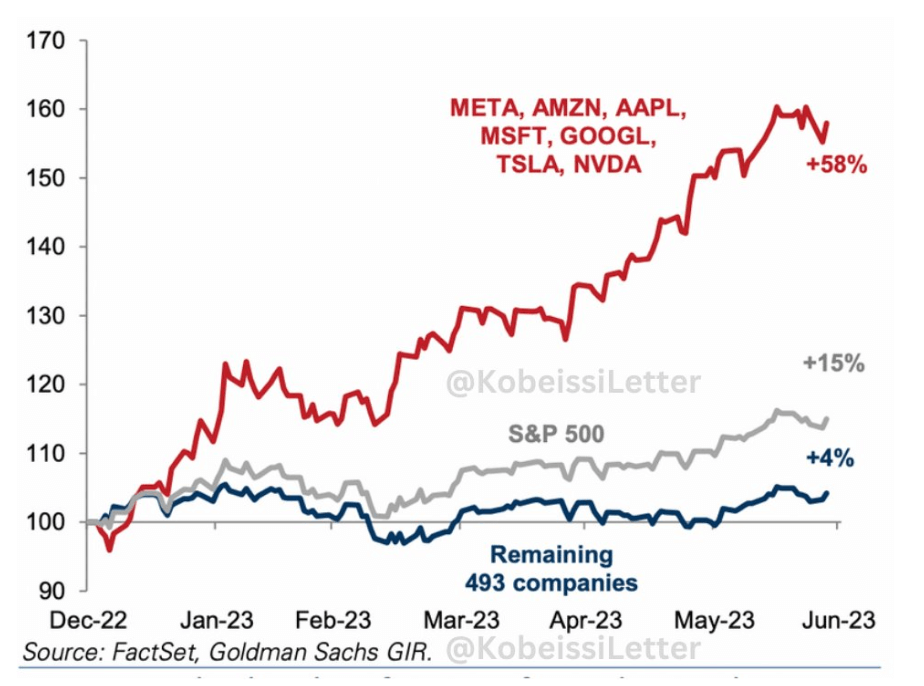

In response to the worldwide markets publication, the Kobessi Letter, the year-to-date efficiency of the S&P 500 exhibits a putting disparity of the underlying belongings behind its spectacular acquire of 15%.

Seven tech giants – Meta (Fb), Amazon, Apple, Microsoft, Google, Tesla, and Nvidia – are collectively up by a staggering 58%. In distinction, the remaining 493 corporations listed on the index have seen solely a modest enhance of 4% in the identical interval.

Historic Market Developments: A Seasonal Sample?

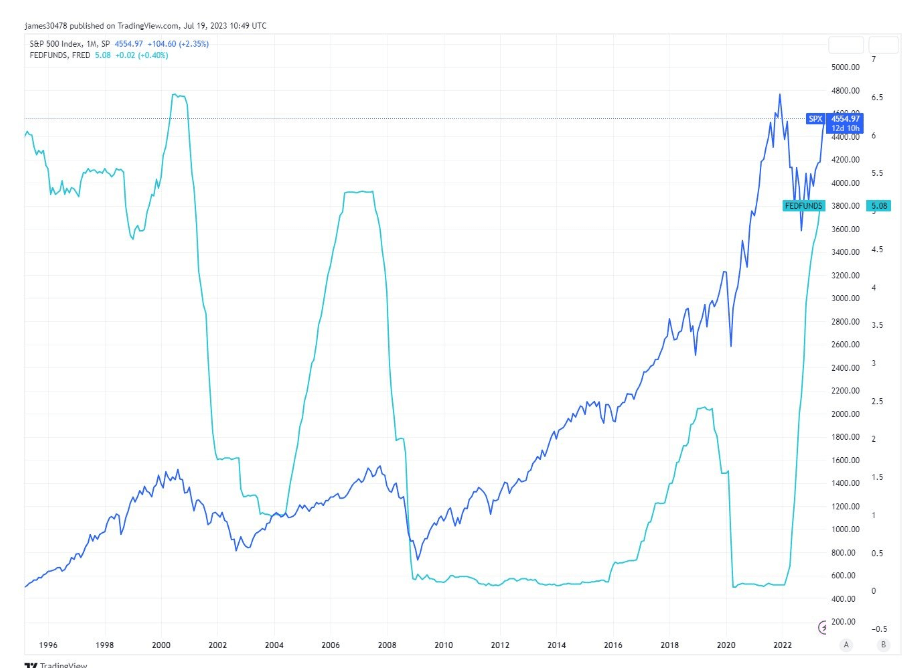

A notable sample emerges when exploring the historic efficiency of the S&P 500 (SPX) across the final three recessions. Every time, the SPX peaked simply after the summer season months whereas the fed began to chop charges. Particularly:

- The 2000 peak occurred in August.

- The 2007 peak happened in October.

- The 2018 peak occurred in September.

This pattern prompts the query: Will this post-summer peak sample persist in future recessions? As at all times, whereas historic patterns can present perception, they shouldn’t be thought of a assured prediction of future efficiency.

The publish Tech titans and seasonal developments: A deeper look into S&P 500 efficiency appeared first on CryptoSlate.