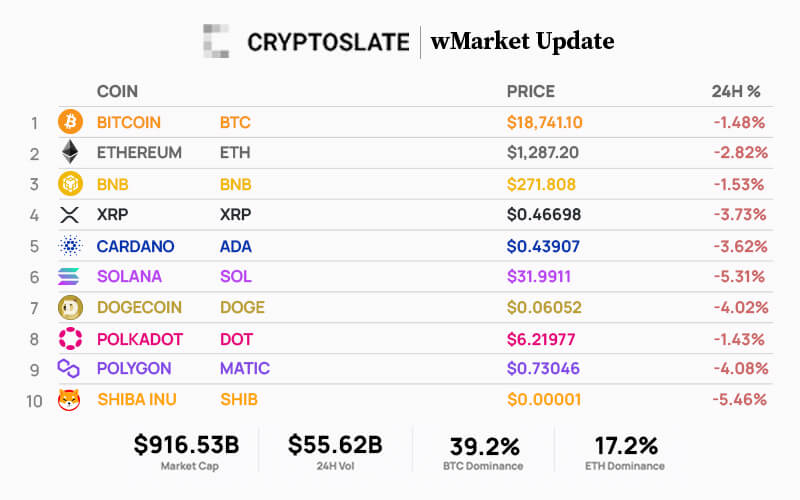

The whole cryptocurrency market cap noticed internet outflows totaling $34.27 billion. As of press time, it stood at $916.53 billion, down 3.6% over the weekend of Sept. 23.

Bitcoin’s market cap fell 3.3% over the reporting interval to $358.94 billion from $371.05 billion. In the meantime, Ethereum’s market cap was down 4.4% to $157.25 billion from $164.54 billion.

The highest 10 cryptocurrencies traded largely flat with sell-side bias over the interval. This sample continued over the past 24 hours, posting losses for the entire prime 10 cryptocurrencies. The largest loser is Shiba Inu, down 5.46%. As compared, Polkadot fared greatest — solely posting 1.43% losses over the interval.

The market cap of the highest three stablecoins — Tether (USDT), USD Coin (USDC), and BinanceUSD (BUSD) — remained steady over the interval, standing at $67.96 billion, $49.40 billion and $20.52 billion, respectively.

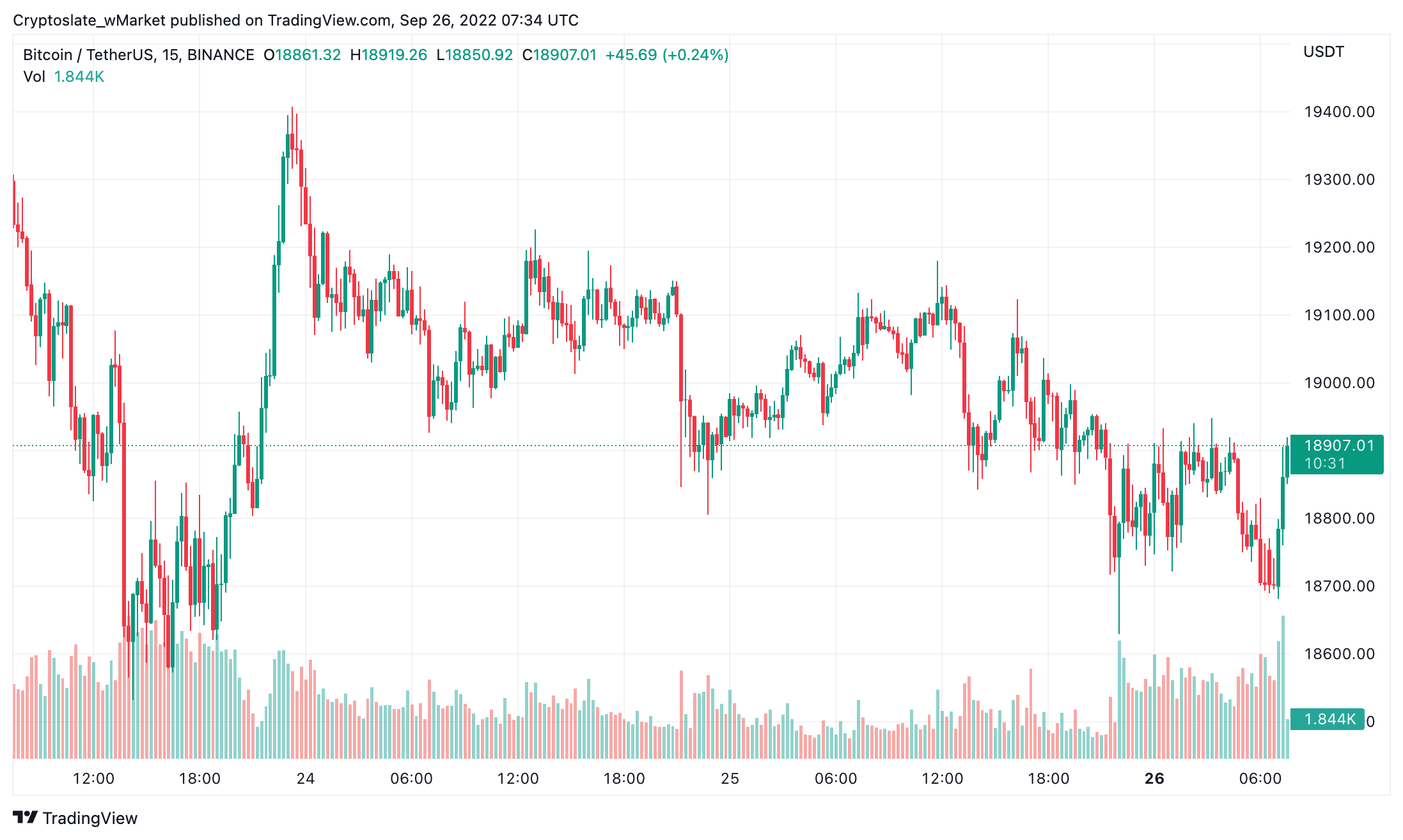

Bitcoin

Since Friday, Bitcoin was down 3% to commerce at $18,700 as of press time. Market dominance rose barely from 38.97% to 39.20% over the interval.

A Friday sell-off bottomed at $18,500, resulting in a bounce that peaked at $19,400. Since then, the market chief has been trending downward. Nonetheless, from 08:00 UTC on Sept. 26, BTC has seen robust progress with a retest of $18,900 resistance on the playing cards.

There have been no important developments since Sept. 23. Nonetheless, macro components proceed to exert stress on buyers.

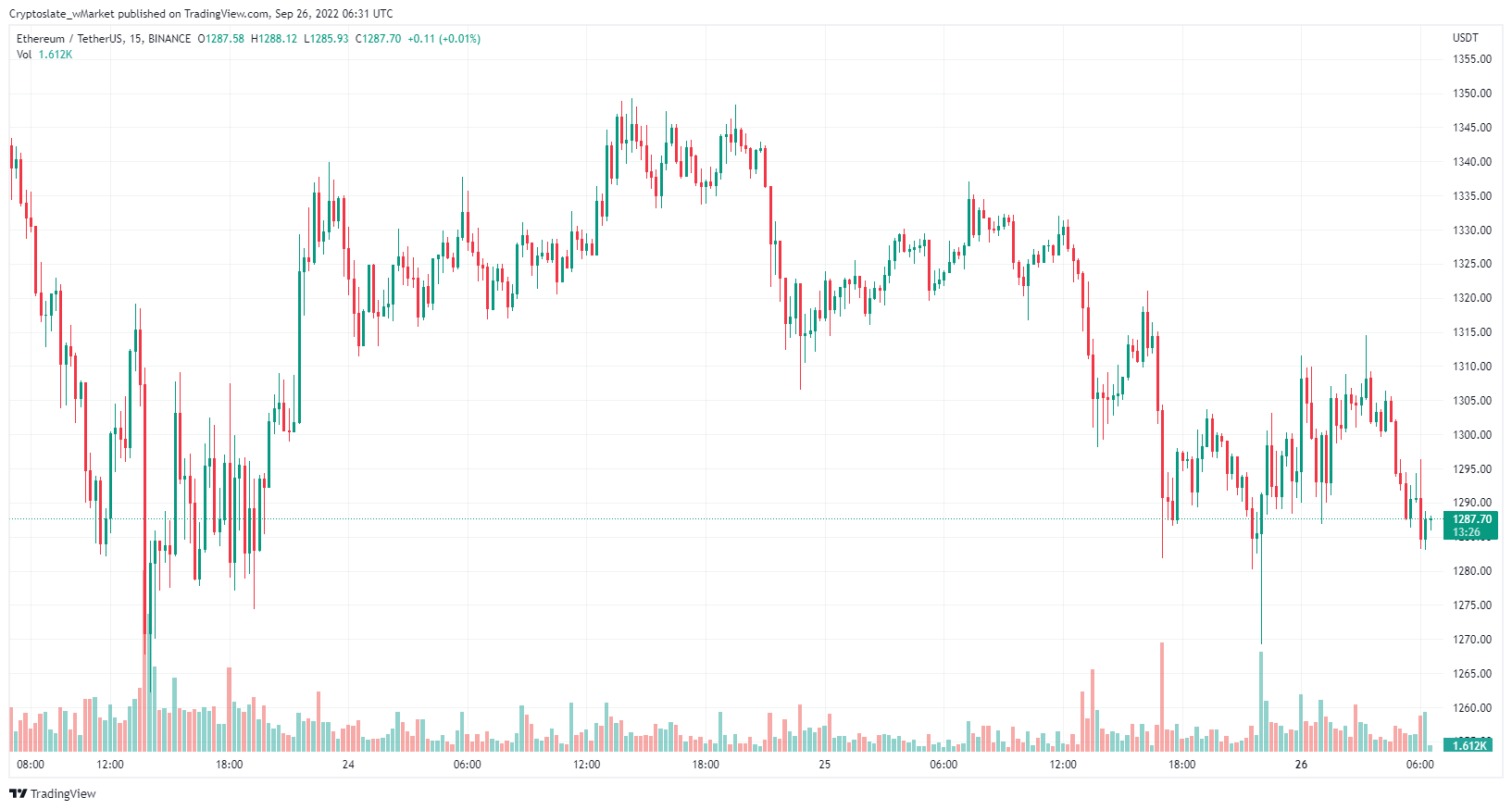

Ethereum

Ethereum fell 5.6% over the past three days to commerce at $1,287 as press time. Market dominance decreased barely from 17.32% to 17.20%.

ETH worth actions adopted an identical sample to BTC, bottoming at $1,260 on Sept. 23 within the early night (UTC,) resulting in a $1,350 peak on Sept. 24 lunchtime. A sluggish bleed adopted on Sept. 25, with robust shopping for as European markets opened.

Prime 5 gainers

Fruits

FRTS leads the highest gainers over the past 24 hours, buying and selling round $0.01123 as of press time — up 11.1% over the interval. The token has incessantly featured within the prime gainers and losers, suggesting excessive volatility recently. FRTS is down 99.9% from its December 2021 ATH. Its market cap stood at $236.55 million.

IOTA

MIOTA grew 9.5% over the previous 24 hours and was buying and selling at round $0.30900 on the time of publishing. With no new important developments, it’s unclear why the platform pumped right now. Its market cap stood at $858.88 million.

Injective Protocol

INJ recorded 5% features over the previous 24 hours to commerce at round $1.74379 at press time. The token is up 21% over the past seven days, and its market cap stood at $127.31 million.

Ocean Protocol

OCEAN is up 4.9% over the past 24 hours to commerce at $0.16925 on the time of publishing. There have been no new important developments just lately. Its market cap stood at $103.77 million.

Quant

QNT is up 4% because the final wMarket replace to commerce at $119.349 at press time. The token has posted robust efficiency over the previous month, up 26%. Its market cap stood at $1.44 billion on the time of writing.

Prime 5 losers

Terra Basic

LUNC is right now’s largest loser falling 14.7% over the previous 24 hours to commerce at round $0.00020 as of press time. Following an outstanding run, which noticed 52% features over the past month, rumors of shut ties with the Terra Labs Basis and ongoing woes relating to token burn assist proceed to harm the token worth. Its market cap stood at $1.21 billion.

TerraUSD

USTC sunk 9.9% over the previous 24 hours to $0.02719 at press time. The rebranded UST stablecoin continues to commerce under its peg worth and is equally troubled with the identical considerations as Terra Basic. Its market cap stood at $266.94 million.

Terra

LUNA plunged 7.7% in worth over the reporting interval to commerce at $2.26403. Interpol has issued a “purple discover” for founder Do Kwon, taking his manhunt to the worldwide degree. Its market cap stood at $288.61 million.

Chiliz

CHZ is down 7.3% over the previous 24 hours to round $0.24934 as of press time. The token has seen reasonable features just lately, up 9% over the past month. Its market cap stood at $1.5 billion.

Lido DAO

LDO declined by 7.1% to commerce at $1.59322. The Ethereum liquidity staking resolution has been trending downwards for the previous month, down 5% over this era. Its market cap was $498.6 million at press time.