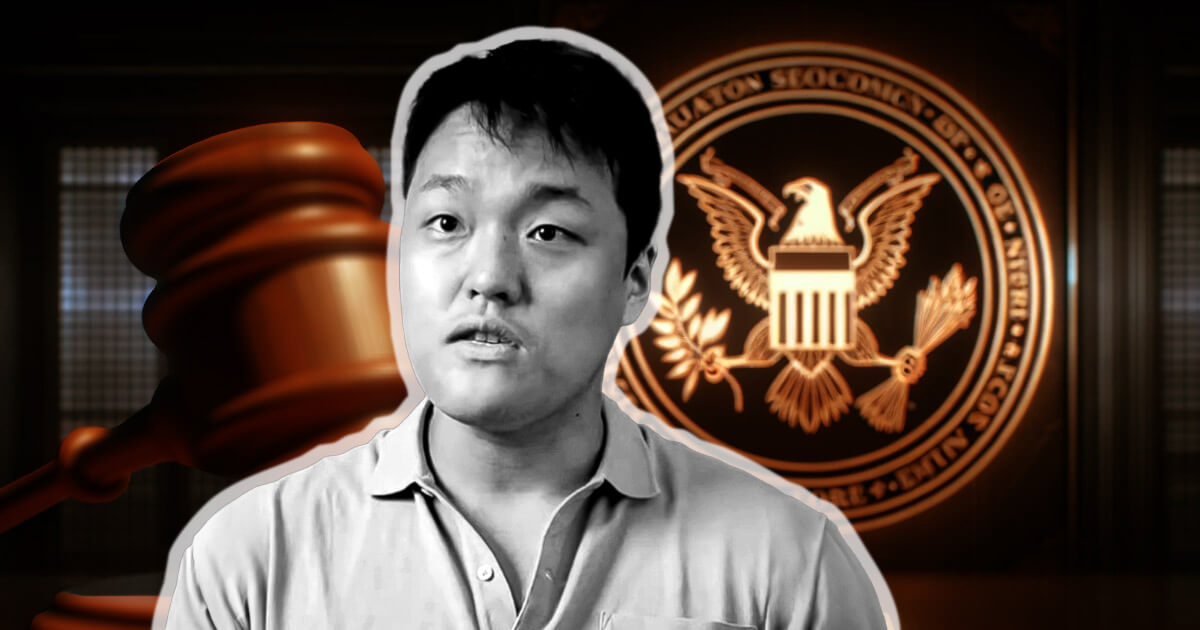

Terraform Labs and its co-founder Do Kwon filed a movement for abstract judgment with a federal courtroom, asking the choose to dismiss the SEC’s securities fraud lawsuit towards it.

Terraform Labs collapsed in Might 2022 after its native token LUNA misplaced 99% of its worth when the linked algorithmic stablecoin UST misplaced its peg to the greenback. The occasion prompted greater than $60 billion in losses for traders and has led to lawsuits in a number of nations, together with South Korea and the U.S.

Kwon was arrested in Montenegro in 2023, the place he’s presently serving a four-month sentence for using solid paperwork. Each the U.S. and South Korea are looking for extradition so he might be prosecuted for his position within the collapse.

Movement to dismiss

Terraform argued within the submitting that the SEC had didn’t show that Terraform Labs was promoting securities or committing fraud. The corporate claims that the regulator has supplied no proof to again any of the allegations made within the lawsuit.

In accordance with the submitting:

“After two years of investigation, the completion of a discovery interval that resulted within the taking of greater than 20 depositions, and the trade of over two million pages of paperwork and knowledge, the SEC is evidentiarily no nearer to proving that the defendants did something unsuitable.”

Moreover, the corporate raised issues concerning the regulator utilizing an evaluation performed by a Rutgers College economics professor as the premise for its lawsuit as it’s “conceptually and methodologically flawed.”

The Mizrach Report — named after the writer Bruce Mizrach — claims that the UST re-peg in 2021 was attributable to the exercise of a “Buying and selling Agency” that was in partnership with Terraform Labs.

Nevertheless, Terraform argues that the SEC has no admissible proof to help this declare. The corporate additional acknowledged:

“A number of the SEC’s analytical modeling, notably with respect to Professor Mizrach’s opinions, yield such absurd outcomes that they’re the form of “junk science” that has been repeatedly condemned by the Supreme Courtroom and the Second Circuit.”

It’s unclear whether or not the movement — filed with Choose Jed Rakoff of the U.S. District Courtroom for the Southern District of New York — will probably be granted. Terraform’s earlier try to have the case dismissed was unsuccessful.

Terraform co-founder trial

In the meantime, the trial of Terraform Labs co-founder Daniel Shin started in South Korea on Oct. 30. Shin is going through prices of unlawful fundraising and violating capital market legal guidelines.

Shin denied all prices towards him and stated the collapse was primarily attributable to Kwon’s “unreasonable” administration of Anchor Protocol — a DeFi lending protocol that allowed customers to borrow and lend UST.

Shin defended himself by stating that he severed ties with Kwon again in 2020 and, due to this fact, shouldn’t be blamed for the failure of the Terra ecosystem.