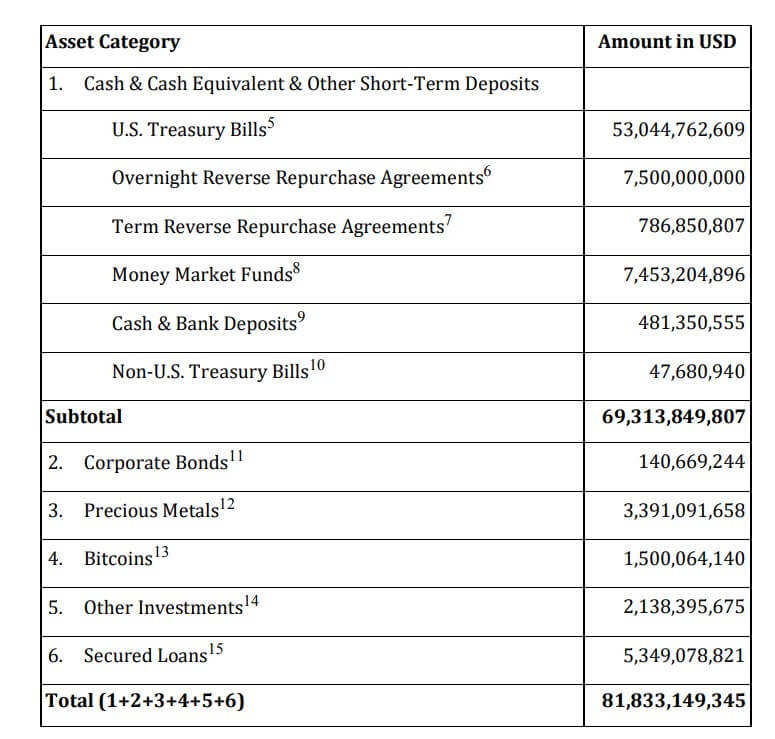

Stablecoin issuer Tether (USDT) stated it holds $1.5 billion price of Bitcoin (BTC) in its reserves

The stablecoin issuer additional revealed that it held $3.39 billion in treasured metals like gold. This accounts for 4% of its whole reserves.

An additional breakdown of the reserves – offered by the corporate for the primary time – confirmed the corporate had its reserves in in a single day repo and company bond allocations.

Tether stated nearly all of its investments, about 85%, are being held in money, money equivalents, and different short-term deposits.

Web revenue of $1.48 billion

In its newest Q1 2023 attestation, Tether reported a internet revenue of $1.48 billion, including that its extra reserves reached an all-time excessive of $2.44 billion

Talking on this milestone, Tether’s CTO Paolo Ardoino stated the expansion in its reserves and revenue mirrored the corporate’s “energy and stability.”

Ardoino added:

“We proceed to watch the risk-adjusted return on all belongings inside our portfolio on an ongoing foundation and anticipate to make additional adjustments as the general financial setting adjustments and the market cycle progresses as part of our regular, ongoing threat administration processes.”

Property exceed liabilities

In response to the report, Tether’s consolidated whole asset on the finish of 2023 Q1 was $81.8 billion, with the bulk in U.S. Treasury Payments. It reported its whole liabilities as of Could 9, 2023, to be $79.39 billion, of which $79.37 billion have been associated to the digital tokens it issued.

In the meantime, the corporate claims it’s now working to scale back its dependence on pure financial institution deposits for liquidity by leveraging “the Repo market as a further measure to make sure larger requirements of safety for its customers by sustaining the required liquidity.”

Ardoino stated:

“Tether continues to guage the worldwide financial setting and has taken mandatory steps to make sure that its prospects’ funds will not be uncovered to high-risk eventualities.”

The corporate reported $481 million in money and financial institution deposits.

Regardless of criticisms, USDT adoption has elevated following the current regulatory troubles batting its main rivals, USD Coin (USDC) and Binance USD (BUSD).

USDT’s circulating provide sits at $82.54 billion as of press time, in keeping with CryptoSlate information.

The publish Tether attestation exhibits $1.5B price of Bitcoin in reserves appeared first on CryptoSlate.