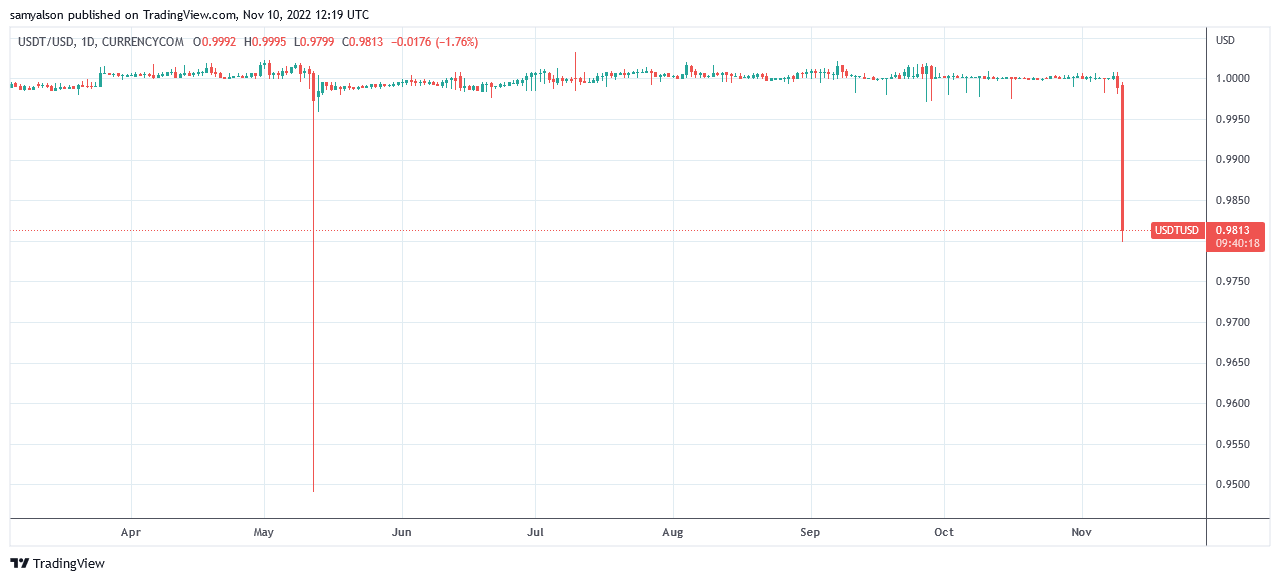

The Tether (USDT) stablecoin confirmed indicators of wavering on Nov. 10, sinking as little as $0.9806 as market uncertainty continues to reign.

The fallout from FTX’s insolvency woes has piled on promote strain throughout crypto markets. The seven-day efficiency for the highest 100 tokens has seen double-digit losses throughout the board. The exceptions are a number of stablecoins — PAX Gold and OKB.

Unsurprisingly, FTT leads the losses, down 88% over the previous week.

In one other twist to the sage, on-chain evaluation confirmed FTX’s buying and selling arm Alameda borrowed 250,000 USDT from Aave early on Nov. 10.

Twitter person @mhonkasalo speculated that Alameda could possibly be shorting the asset within the expectation of additional drops.

Since 2017, Tether has considerably misplaced its greenback peg on 9 events, the worst being a drop to $0.92 in April 2017.

A tweet from @celestius_eth identified it’s recognized Alameda held a major stack of Tether. He puzzled whether or not pressured liquidation would stretch Tether’s skill to cowl redemptions.

#Alameda acquired round $36.6B #Tether previously yr. That is about 38% of all outbound quantity ever.

Simply think about #Alameda nonetheless has a great deal of Tether and is pressured to liquidate all remaining property, can Tether cowl that?

Supply: https://t.co/feqe6oVOMF#FTX #SBF #CZBinance pic.twitter.com/rXE2WymiRZ

— celestius.eth (@celestius_eth) November 10, 2022

Commenting on the state of affairs, Bitfinex and Tether CTO Paolo Ardoino referenced the fallout from the Celsius collapse, during which Tether additionally wavered, including that enough reserves are held.

“On this time, as soon as once more Tether goes to show to everybody that its reserves are liquid and steady. We’re able to redeem any quantity that involves us.”

TRON DAO Reserve chimed in, saying it’ll assist defend the peg by buying 1 billion USDT tokens.

To safeguard the general blockchain business and crypto market, TRON DAO Reserve will buy complete 1 billion USDT. You may even see the change of stability on https://t.co/L52UWqhmkR and all of the reserve will probably be in CEXs.

— TRON DAO Reserve (@trondaoreserve) November 10, 2022