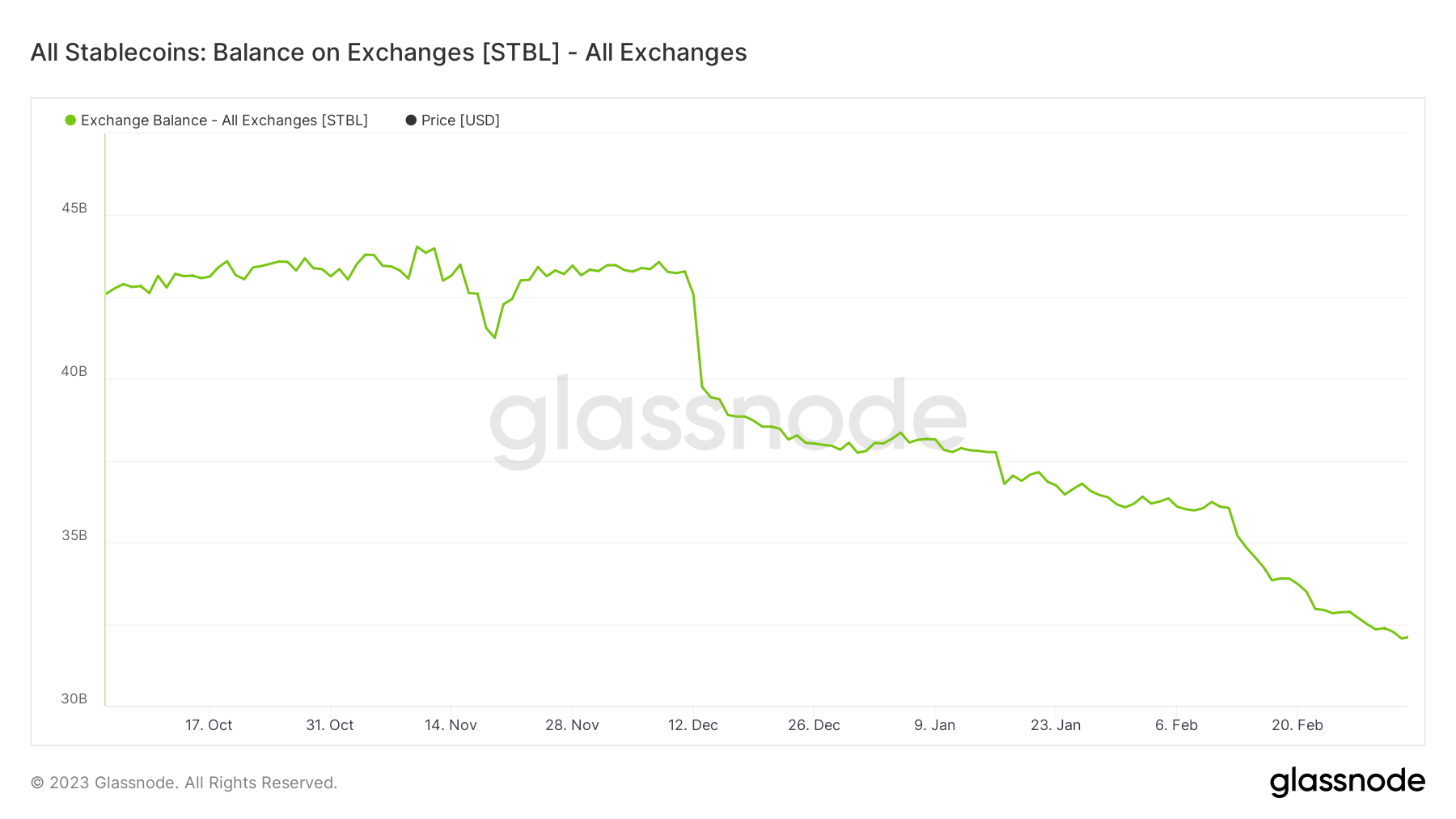

Following the FTX catastrophe in November, the stablecoin market has considerably modified, dropping $12 billion in worth.

Extra not too long ago, the difficulty was compounded by troubles at BUSD because the New York Division of Monetary Companies (NYFDS) ordered Paxos to stop token issuance.

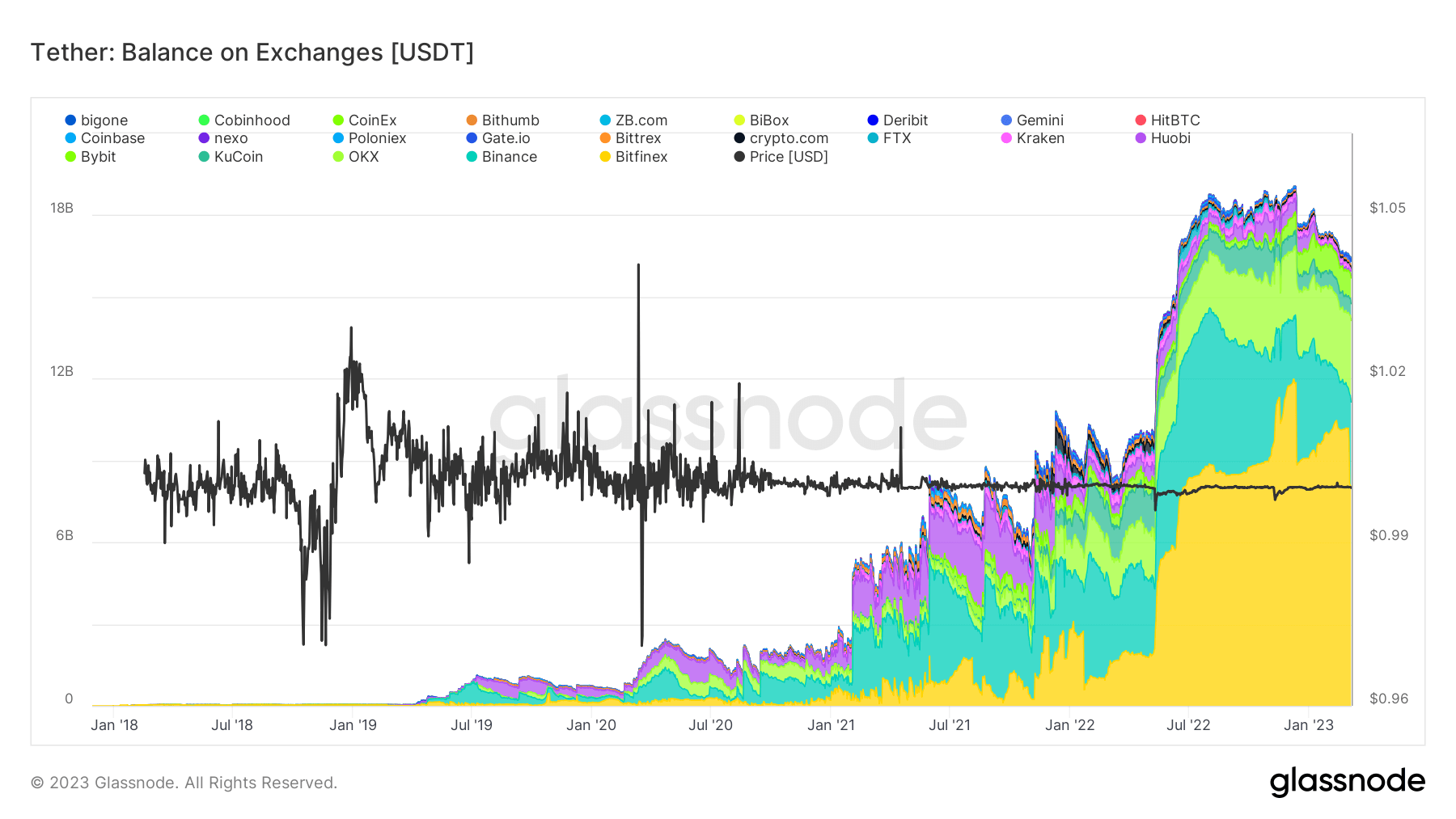

Glassnode information analyzed by CryptoSlate confirmed Tether has emerged because the clear winner out there restructuring, regardless of ongoing, long-running suspicions concerning the token’s means to fulfill its liabilities.

Stablecoin roundup

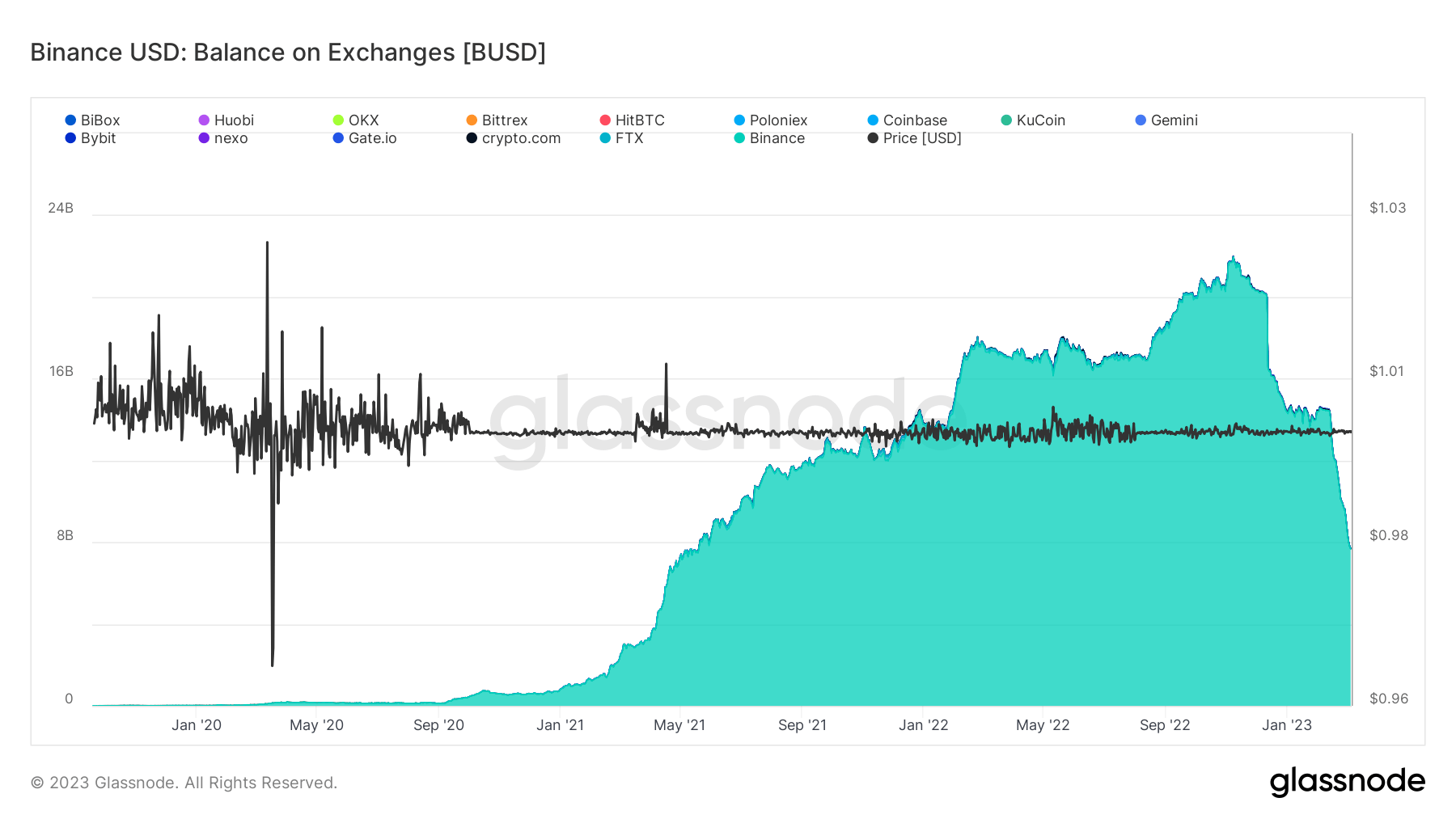

Since November 2022, the market dominance of BUSD has halved, sinking from 14% market share to 7% over the previous 4 months.

The chart under exhibits balances held on exchanges peaking at $22 billion round mid-November 2022. Following that, because the FTX saga took maintain, a pointy dip discovered a assist degree of round $14 billion.

Nevertheless, as rumors of BUSD’s reserve discrepancies circulated, one other sell-off occurred, dropping the present change steadiness to lower than $8 billion.

Apparently, since November 2019, Binance has held the overwhelming majority of BUSD constantly, with different exchanges barely that includes.

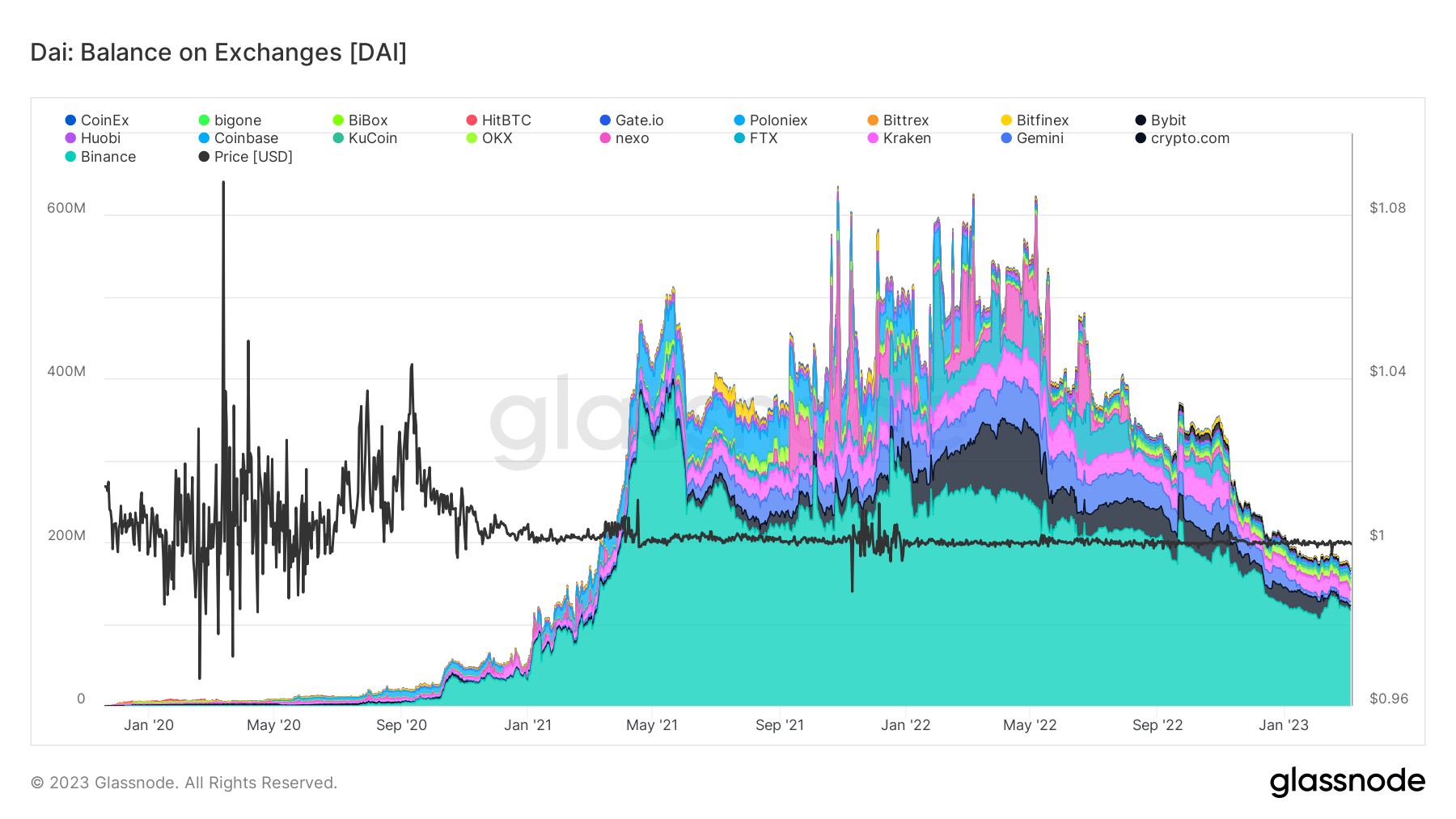

In the meantime, DAI’s market dominance has held comparatively flat, accounting for about 4% of the market since November 2022.

Nonetheless, as depicted within the chart under, DAI held on exchanges has been trending downwards since Might 2022.

Binance holds essentially the most DAI, at 120 million of the 160 million whole. However having shed its 2021 and 2022 holdings is now heading again to late 2020 ranges.

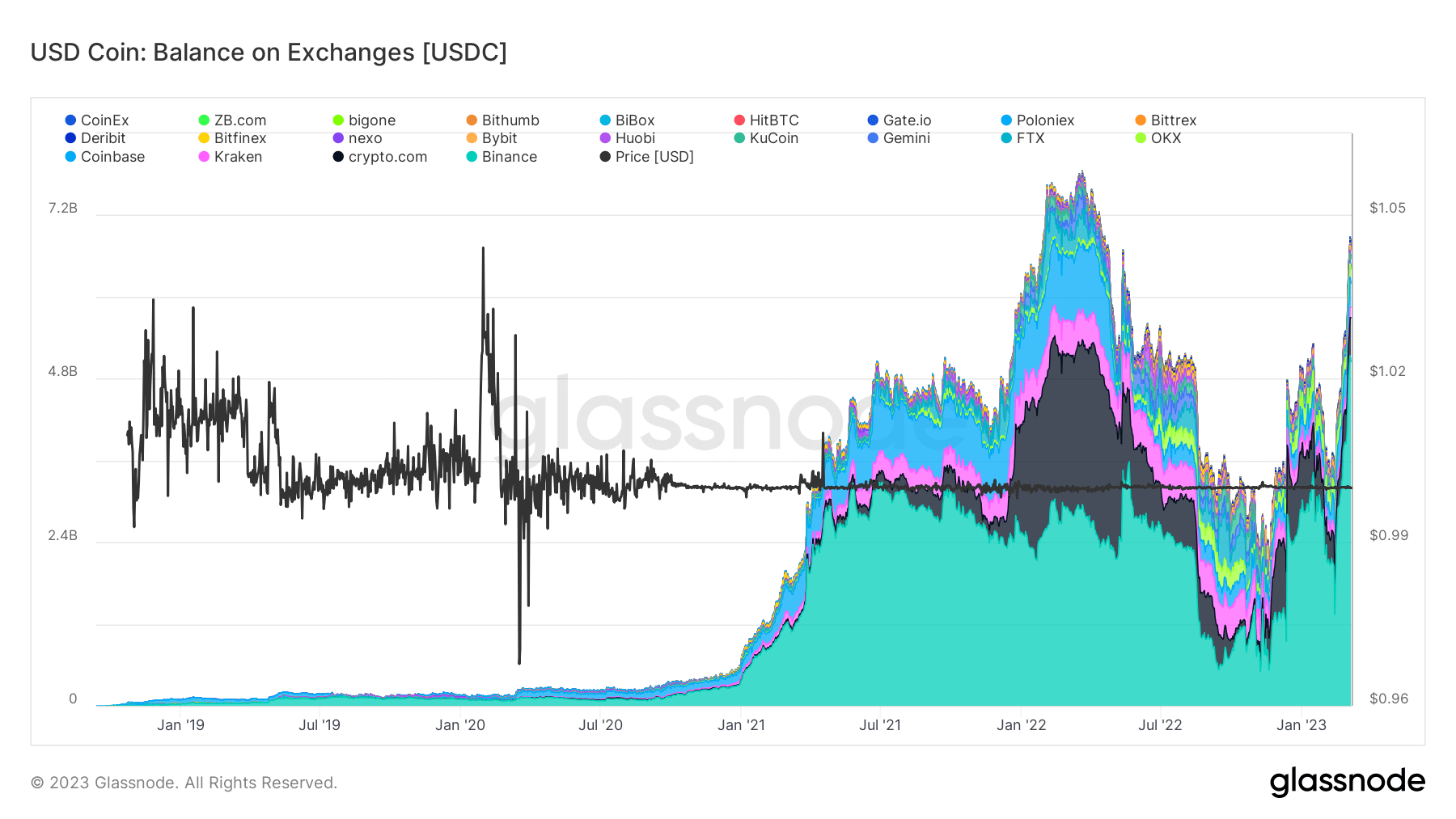

USDC has skilled a web profit from BUSD’s downfall, with dominance rising to 34% of the stablecoin market.

The steadiness held on exchanges has spiked to close April 2022 highs. The bulk is held on Binance, at present accounting for five billion tokens, with Crypto.com coming in second at 645 million.

Tether shines

Tether has seen essentially the most vital profit from altering stablecoin market dynamics. The chart under exhibits a major uptrend within the USDT steadiness on exchanges.

Market dominance now exceeds 55%, with Bitfinex holding the bulk stake, rising its share from 1.8 billion in June 2022 to over 10 billion at current.

Nevertheless, this week noticed Bitfinex offload roughly $2 billion of USDT, however round $16 billion stays on exchanges.

Whereas USDC’s dominance stays flat, USDT has added practically 8% market share over the previous 5 months, making it the main dollar-backed stablecoin by a major margin.