Fast Take

- As a result of economic system being constructed on credit score, each progress, and growth are requirements. As such, central banks’ greatest concern is deflation and stagflation. Take the U.Ok. for instance — although this may be attributed to many Western nations.

Three metrics that contribute to stagflation;

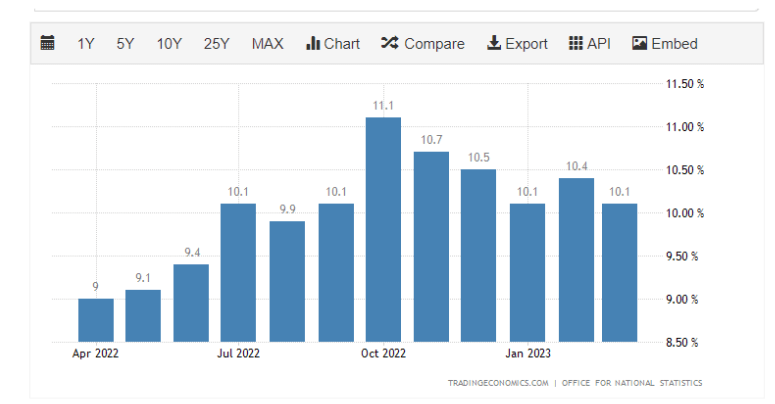

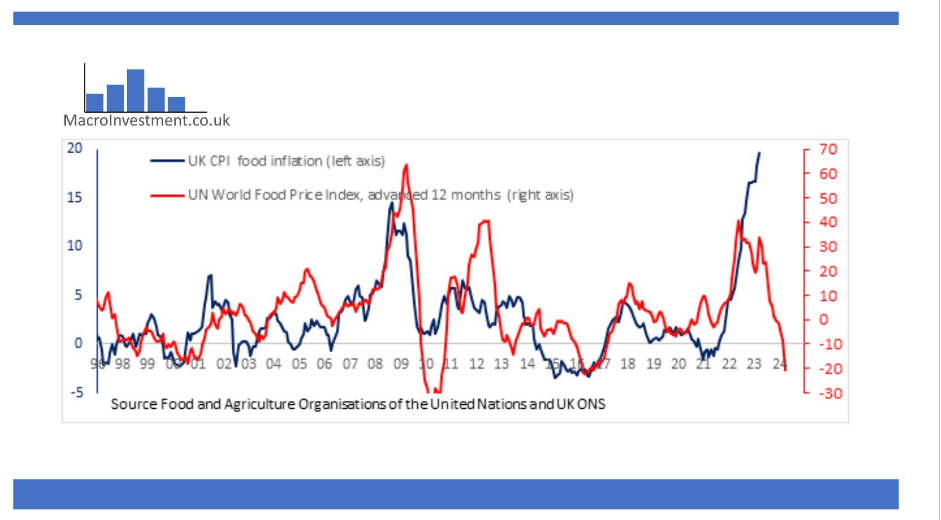

- Persistent excessive inflation: Inflation has been increased than the CPI purpose of two% for over a yr now, and the most important fear for central banks is entrenched inflation. For instance, within the U.Ok., CPI Inflation has been double digits for nearly a yr — whereas core inflation has been as excessive as 6% for over a yr.

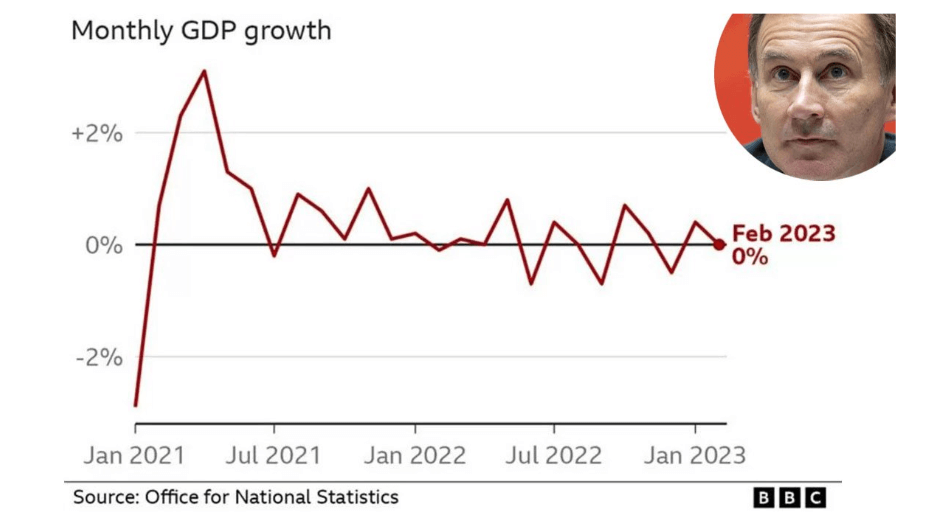

- Stagnant demand in a rustic’s economic system: U.Ok. actual GDP continues to be beneath This fall 2019.

- Excessive unemployment: We aren’t right here but, however the U.Ok. unemployment price did spike from 3.7% to three.8%. As rates of interest proceed to rise and keep elevated, this can additional stress the labor market.

Stagflation was final seen within the Nineteen Seventies, and shopper good costs are inclined to rise — whereas asset costs are inclined to deflate. Central banks are getting caught between a rock and a tough place.

CryptoSlate beforehand coated an perception into asset costs between the Nineteen Seventies and the 2020s.

The publish The central banks’ dilemma: inflation, stagflation, and the cryptocurrency response in right this moment’s economic system appeared first on CryptoSlate.