Fast Take

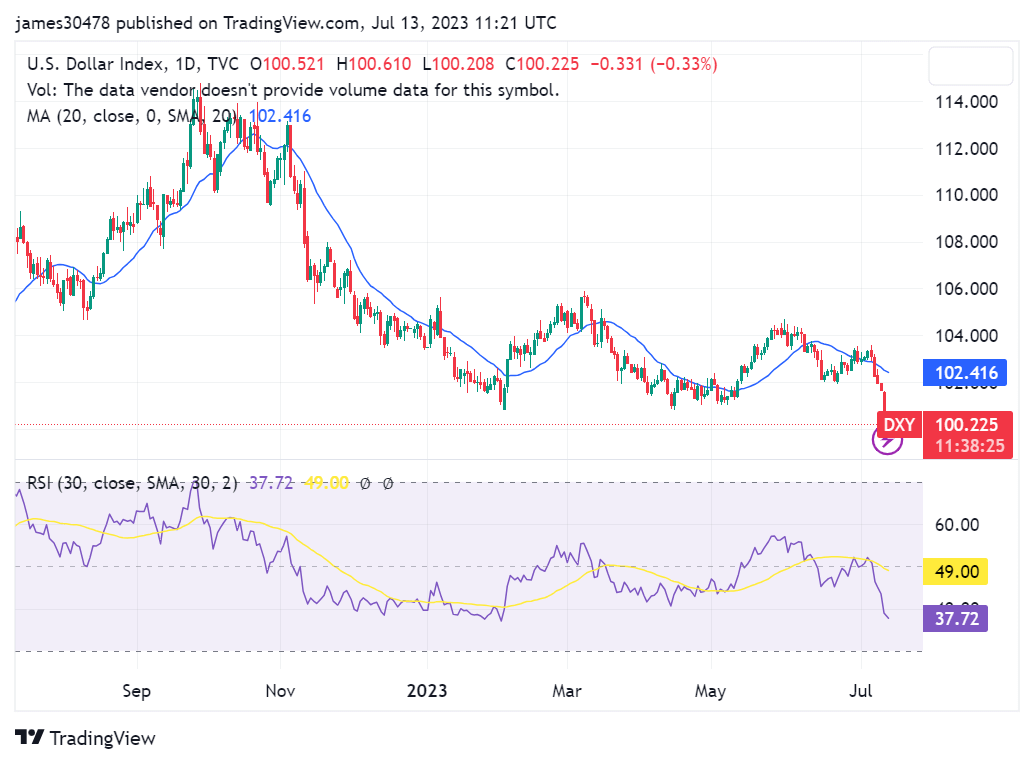

The U.S. Greenback Index (DXY) has been experiencing a downward pattern, edging virtually beneath 100 for the primary time since its vital rise in April 2022. A 12 months prior, in Could 2021, the DXY index had sunk as little as 90, solely to climb to a powerful excessive of 114 by October 2022.

This sharp enhance resulted from the Federal Reserve’s choice to lift rates of interest quickly and considerably, marking the very best hike in a four-decade span. The rapid consequence was a considerable dip in threat property.

Regardless of this, inflation is presently on a disinflationary trajectory. Market forecasts are predicting one other modest enhance of 25 foundation factors from the Federal Reserve, nudging charges to a spread of 5.25 – 5.50%.

Within the overseas change markets, main currencies such because the British Pound (GBP), Japanese Yen (JPY), and Euro (EUR) are rallying. The GBP has made a big leap to hit the $1.30 mark. Conversely, the JPYUSD change fee has dropped beneath 140¥.

This shift is paving the way in which for risk-on property to rally, a pattern already noticeable in U.S. equities.

Nonetheless, Bitcoin maintains its distinct lack of correlation to U.S. equities. Moreover, Bitcoin has additionally proven its lowest correlation to gold, as per the 30-day shifting common (30DMA). Due to this fact, it seems that Bitcoin’s time to shine might have to attend a little bit longer.

The put up The shifting tides in world forex and asset markets appeared first on CryptoSlate.