Fast Take

- Stablecoin demand appears to be like extraordinarily weak — particularly on this present market surroundings.

- Patrick Hansen from Circle believes the stablecoin demand is rising. Nevertheless, the info signifies that this isn’t the case.

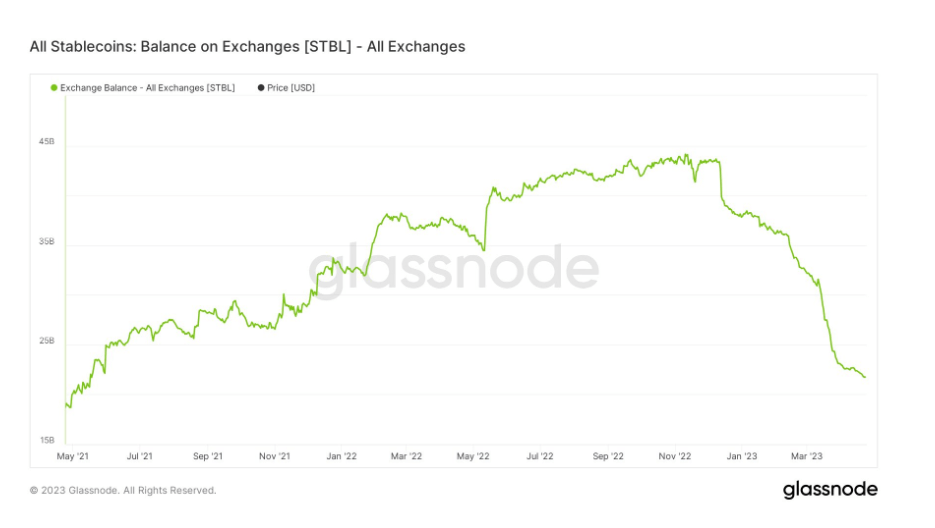

- Stablecoin stability on exchanges has dropped significantly from its peak in November 2022. From $44 billion to beneath $22 billion — which has both been transformed for fiat or Bitcoin.

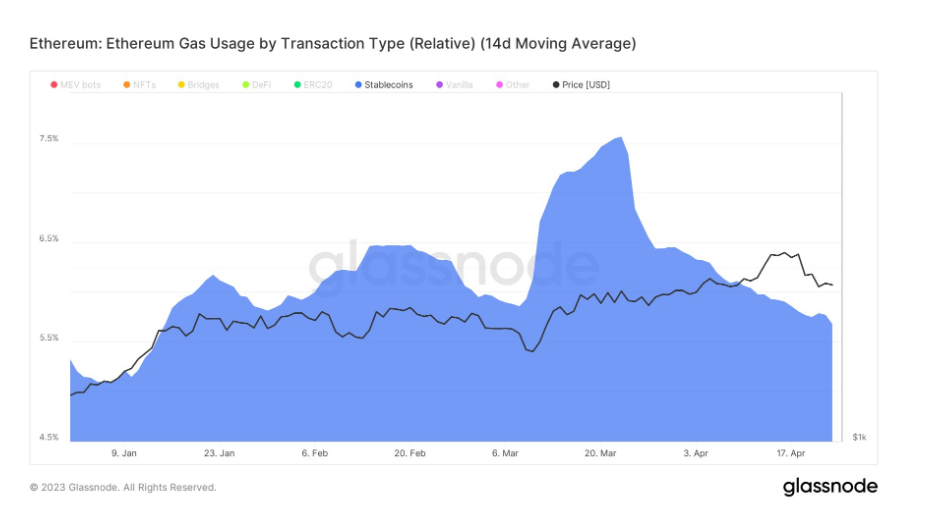

- Subsequent, gasoline utilization on Ethereum for Stablecoins has additionally significantly dropped because the SVB collapse in March. This represents simply 6% of the full gasoline utilization from 7.5%.

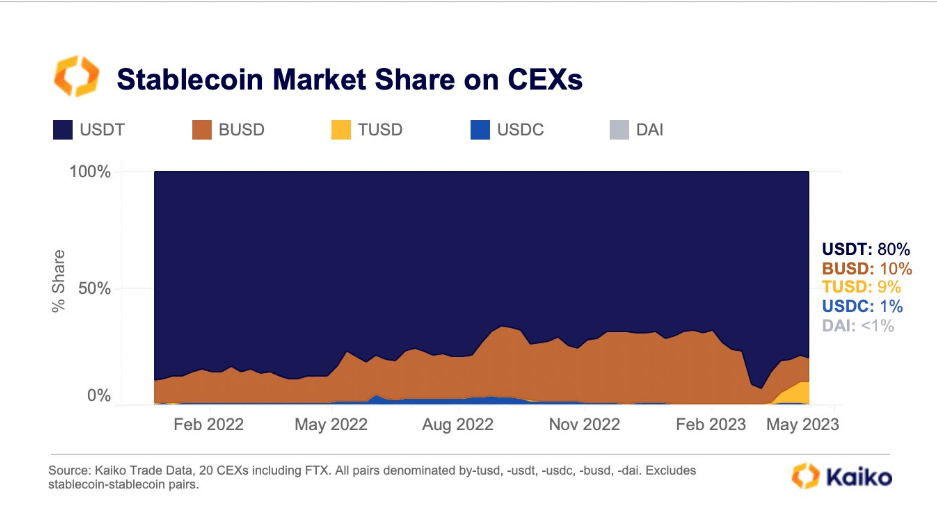

- Whereas in line with Kaiko analysis, TUSD now accounts for 10% of worldwide stablecoin commerce quantity on centralized exchanges. Practically all this quantity is from the BTC-TUSD pair on Binance — which has zero charges.

The put up The stunning fact behind stablecoin demand: A steep drop contradicts business expectations appeared first on CryptoSlate.