Fast Take

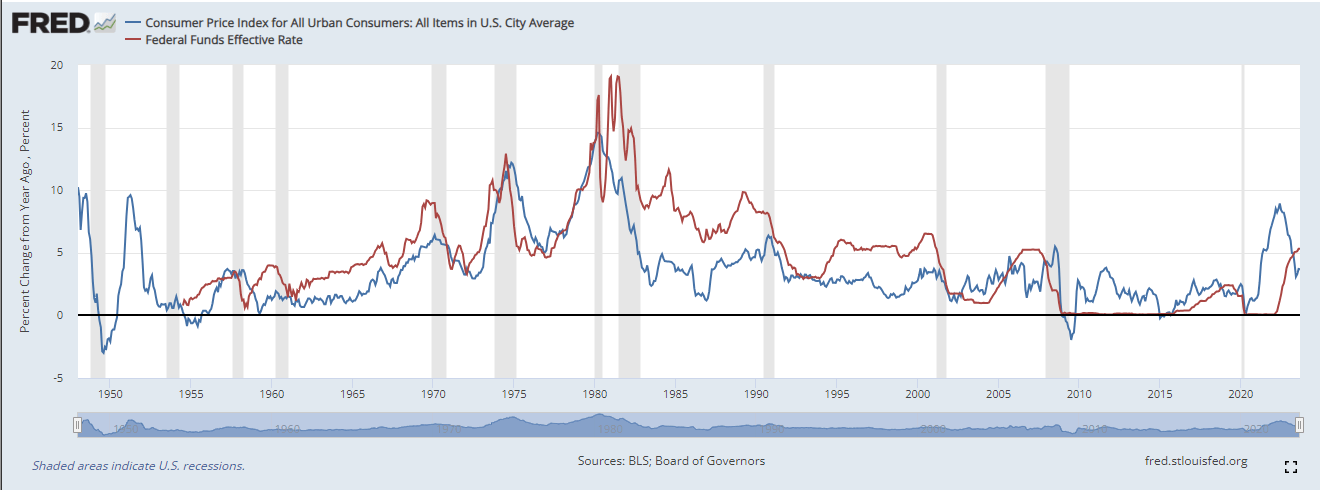

Since 2010, the U.S. monetary panorama has primarily been marked by the Client Worth Index (CPI) inflation charge outpacing the federal funds charge. Nevertheless, this development skilled an exception in 2019, and curiously, in Might 2023, when the nation entered a interval of optimistic actual charges – a state of affairs the place the federal funds charge, presently at 5.33%, exceeds the CPI inflation charge, presently recorded at 3.68%. Regardless of this dynamic, yields persistently proceed their upward trajectory throughout the yield curve.

Regardless of optimistic actual charges, the continual escalation in yields indicators that the measures taken by the Federal Reserve could also be inadequate in successfully curbing inflation and steering it again in direction of the designated 2% goal.

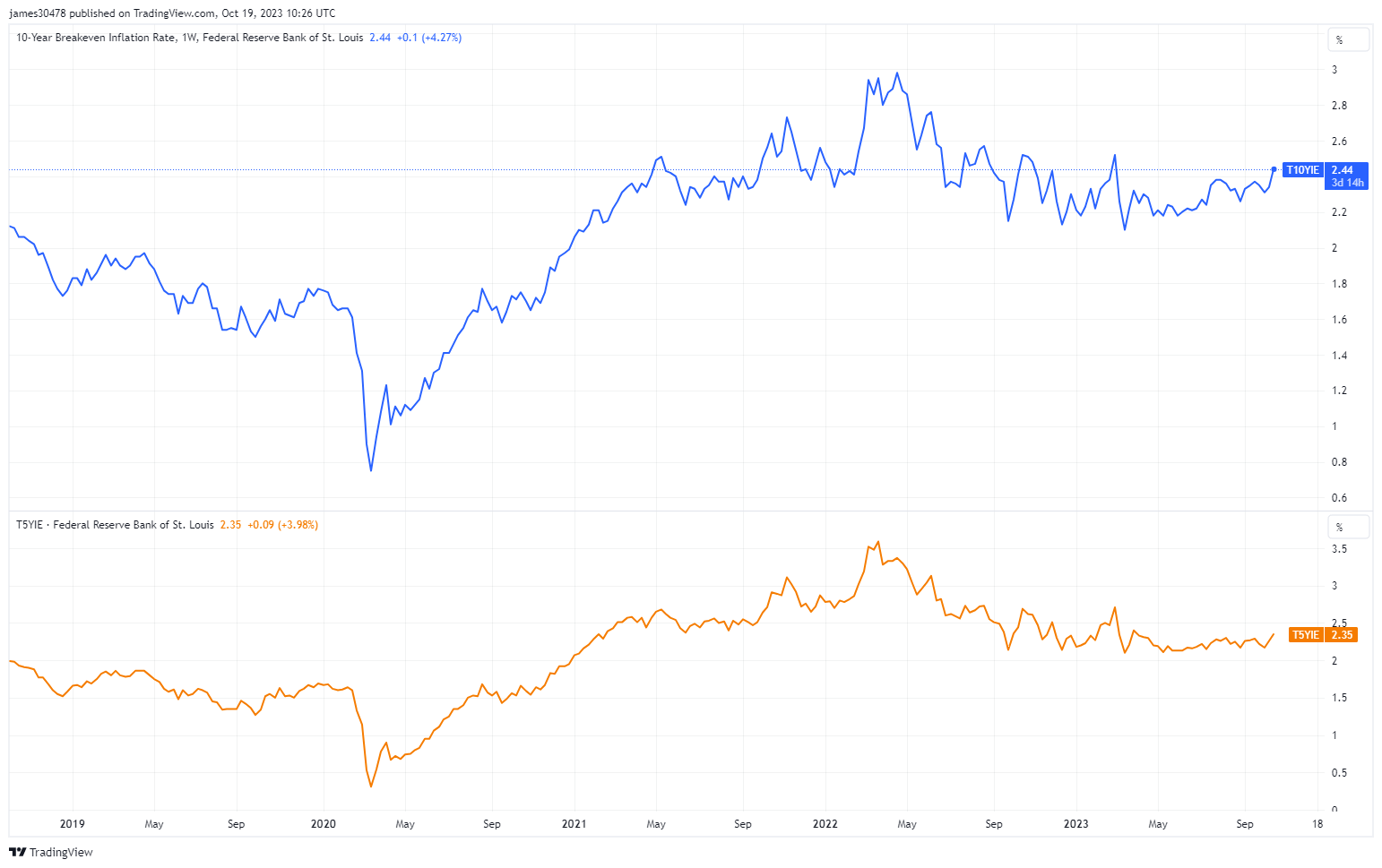

The bond market seems to solid doubt over the U.S. monetary authority’s claims of returning to the two% inflation benchmark. This skepticism is driving yields larger. Reinforcing this sentiment are the surging inflation expectations. In line with latest information, 10-year inflation expectations have reached 2.44%, marking the second peak this 12 months, whereas the 5-year expectations stand at 2.35%, exceeding the two% goal.

These developments immediate a compelling inference: To curb rising inflation, the Federal Reserve might must persist in augmenting charges, a technique which, paradoxically, would possibly contribute to the continuous rise of yields.

The submit The ten-year breakeven inflation charge has reached the second-highest degree in 2023 appeared first on CryptoSlate.