The US crypto area is in disarray. In March, its foreshadowing was already in full view when the celebrated regulation agency, Cooper & Kirk, launched the paper Operation Choke Level 2.0: The Federal Financial institution Regulators Come For Crypto.

Did the US market develop into so hostile to necessitate a crypto exodus? In that case, which different jurisdictions are poised to draw innovators, builders, and entrepreneurs within the FinTech and crypto area?

First, let’s check out the present crypto panorama.

Systemic Uncertainty Unfolding

Even earlier than Operation Chokepoint 2.0 sharpened into focus, it was slightly telling that the SEC refused to approve even a single spot-traded Bitcoin ETF. As market liquidity cornerstones go, that might be it.

As an alternative, regulators opted to empty liquidity. Crypto-friendly banks have been the primary to fall – Silvergate and Signature – albeit beneath suspicious circumstances, which Cooper & Kirk legal professionals discovered indicative of “regulatory overreach in opposition to the crypto business”.

Within the meantime, the Securities and Fee Change (SEC) has been on a rampage all through 2023. The watchdog company issued complaints in opposition to Bittrex, Kraken, Gemini and Paxos, with the ending strikes in opposition to Binance.US and Coinbase.

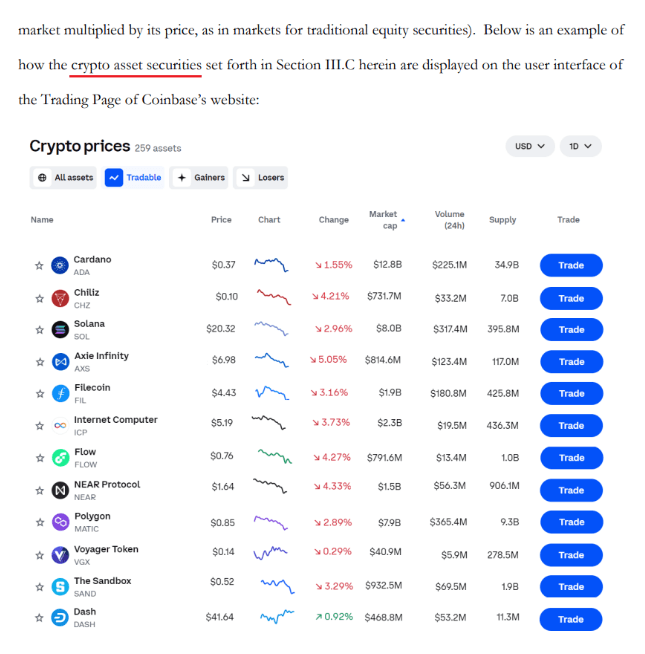

Charging Coinbase as an unregistered securities change seems to have opened the authorized uncertainty floodgates. The SEC authorized the change’s underlying enterprise mannequin, a prerequisite to go public beneath ticker COIN in April 2021. Nonetheless, as Coinbase expanded its crypto providing, the SEC views a portion of its providing as “crypto asset securities”: Concurrently, the SEC failed to offer readability when beforehand prompted. This seems to be the company’s gambit to determine guidelines from enforcement, making the most of the current legislative void. Whereas Coinbase is bringing the SEC to court docket to make clear securities, the harm is already underway.

Concurrently, the SEC failed to offer readability when beforehand prompted. This seems to be the company’s gambit to determine guidelines from enforcement, making the most of the current legislative void. Whereas Coinbase is bringing the SEC to court docket to make clear securities, the harm is already underway.

Robinhood will delist main cryptocurrencies Cardano (ADA), Solana (SOL), and Polygon (MATIC) on June 27, with extra prone to observe in keeping with the SEC’s interpretation. Binance.US halted all USD deposits, whereas Crypto.com is shutting down its institutional change.

The authorized uncertainty then triggered a torrent of liquidity pouring out, shrinking the full crypto market cap by $55 billion since Friday. Because the FUD within the US crypto area cement, which crypto-friendly areas are prone to profit essentially the most?

European Union (EU)

Though having formally entered a recession, the Eurozone is the primary main area to ship a complete authorized framework on digital belongings. In line with Eurostat, this market accounts for round 14% of the world’s commerce, alongside China and the US as the highest three.

The EU’s Market in Crypto-Asset (MiCA) rules will go into impact from June to December 2024. Due to this readability, Ripple CEO, Brad Garlinghouse, picked Europe as a “vital beneficiary of the confusion that has existed within the U.S.” in a current CNBC interview.

Likewise, Coinbase’s chief authorized officer, Paul Grewal, sees the US crypto crackdown as an “unbelievable alternative” for Eire and Europe, talking to the Irish Unbiased.

Years within the making, MiCA adopted a balanced, proactive strategy to crypto regulation. On one hand improvements are inspired, whereas monetary stability and client safety are thought-about. Listed below are a number of the key MiCA highlights to contemplate:

- Digital belongings exist on a spectrum, from e-money tokens (EMT) and asset-referenced tokens (ART) to crypto-assets and utility tokens.

- Based mostly on their market capitalization, necessities differ. As an example, smaller-cap and utility tokens are exempt from supplying a whitepaper (legal responsibility, tech, advertising).

- Nonetheless, suppose an ART (stablecoin) or EMT exceeds sure thresholds, comparable to €5 billion market cap, 10 million holders, or 2.5 million every day transactions exceeding €500 million quantity. In that case, they develop into “vital” gatekeepers to be regulated beneath the Digital Markets Act (DMA).

- All crypto firms are licensed as CASPs (crypto-asset service suppliers), sustaining a minimal of €125k liquidity threshold for custodians and exchanges and €150k for buying and selling platforms.

To take care of their licenses with the European Securities and Markets Authority (ESMA), CASPs need to report person transactions. This consists of transfers between CASPs and self-custodial wallets in the event that they exceed €1,000. However no matter transaction measurement, CASPs should document senders/recipients for hosted wallets beneath the so-called “Journey Rule”.

Whereas all this monitoring just isn’t preferrred, it’s a large step in legitimizing the business. No less than, in distinction with the US, by which the SEC Chair Gary Gensler not too long ago blanket-named crypto traders as “hucksters, fraudsters, rip-off artists”.

It additionally bears noticing that Switzerland stays a sandbox innovation zone but additionally interfaces with the Eurozone. This is the reason there are such a lot of distinguished foundations in Switzerland, comparable to Tezos and Ethereum.

Within the EU itself, many crypto firms have already develop into international.

Notably, the favored choices buying and selling platform Deribit within the Netherlands, LocalBitcoins in Finland, DappRadar in Lithuania, and Ledger, the {hardware} pockets supplier in France.

Hong Kong

China’s semi-autonomous proxy area, Hong Kong, is again on the crypto menu. Though mainland China banned cryptocurrencies to not intervene with the digital yuan, Hong Kong was greenlighted for retail crypto buying and selling on June 1st.

In fact, which means that Digital Asset Service Suppliers (VASPs) in Hong Kong should block retail merchants from mainland China. Every token they checklist will need to have excessive liquidity, be included in two main indices, and have one 12 months of buying and selling. Along with these primary necessities, VASPs should segregate buyer belongings, set publicity limits, observe cybersecurity requirements, and keep away from conflicts of curiosity.

The DeFi area may also thrive beneath the Securities and Futures Ordinance (Kind 7 license), with their tokens designated as both futures or securities. Following the brand new regime, many exchanges rushed to accumulate new HK VASP licenses: CoinEx, Huobi, OKX, Gate.io, and BitMEX, to call a number of.

Curiously, ZA Financial institution, the subsidiary of Chinese language state-owned Greenland as the most important HK digital financial institution, has additionally entered Hong Kong’s e-HKD Pilot Programme initiative. This showcases that China absolutely greenlights Hong Kong’s embrace of digital belongings for the lengthy haul.

Hong Kong can also be extraordinarily beneficiant within the crypto tax area. Whereas capital positive aspects tax is voided for taxpayers, companies are beneath the progressive tax regime of a most of 17%.

Singapore

One other extremely developed city-state, Singapore, has been the crypto hub since early, boosting crypto adoption for the complete Asia-Pacific area. And for a superb purpose. There isn’t any capital positive aspects tax, making it irrelevant if one is promoting or buying and selling cryptocurrencies.

Furthermore, as a result of the Financial Authority of Singapore (MAS) classifies them as “intangible property”, cryptocurrencies can be utilized for fee for items and companies, which is then considered as barter commerce. By the way, that is very simple to perform because of Singapore-native Alchemy Pay.

With that mentioned, the zero-tax regime doesn’t apply to companies. They’re topic to a flat company tax charge of 17%. However to one-up Hong Kong, Singapore has a three-year tax exemption for start-up corporations, which is especially useful for newer companies which need assistance constructing credit score,and due to this fact have restricted funding alternatives.

With its monetary and social stability, Singapore has served as fairly the crypto magnet. As an example, California-based OKCoin opened store in 2020. In fact, Coinbase and Binance even have Singapore workplaces, together with Crypto.com.

Whereas Crypto.com is hurrying to close down its institutional change within the US, citing the “present market panorama”, the aptly-named change had no hassle getting Main Cost Establishment (MPI) license from the MAS.

This makes Crypto.com not topic to thresholds for its Digital Cost Token (DPT) companies. Given the SEC’s hostile angle in the direction of these exchanges, it’s secure to say their fallback place is sound in Singapore.

Lastly, Singapore has held a pleasant strategy to integrating machine studying and synthetic intelligence know-how for a number of years. The Ministry of Training has already developed AI-powered studying and academic methods for college students. From how AI is predicted to spice up enterprise operations from communication to coaching and past, Singapore has demonstrated a proactive strategy to utilizing game-changing know-how.

With how AI is predicted to combine with and even assist the crypto business, Singapore could develop into a hotspot for brand new crypto initiatives.

Shane Neagle is the EIC of The Tokenist. Try The Tokenist’s free e-newsletter, 5 Minute Finance, for weekly evaluation of the most important tendencies in finance and synthetic intelligence.