Methodology

Token unlocks are vital occasions which have the facility to sway the market.

CryptoSlate checked out value information for six completely different crypto tasks, starting from high-cap to mid-cap, to raised perceive how their token unlocks affected the market.

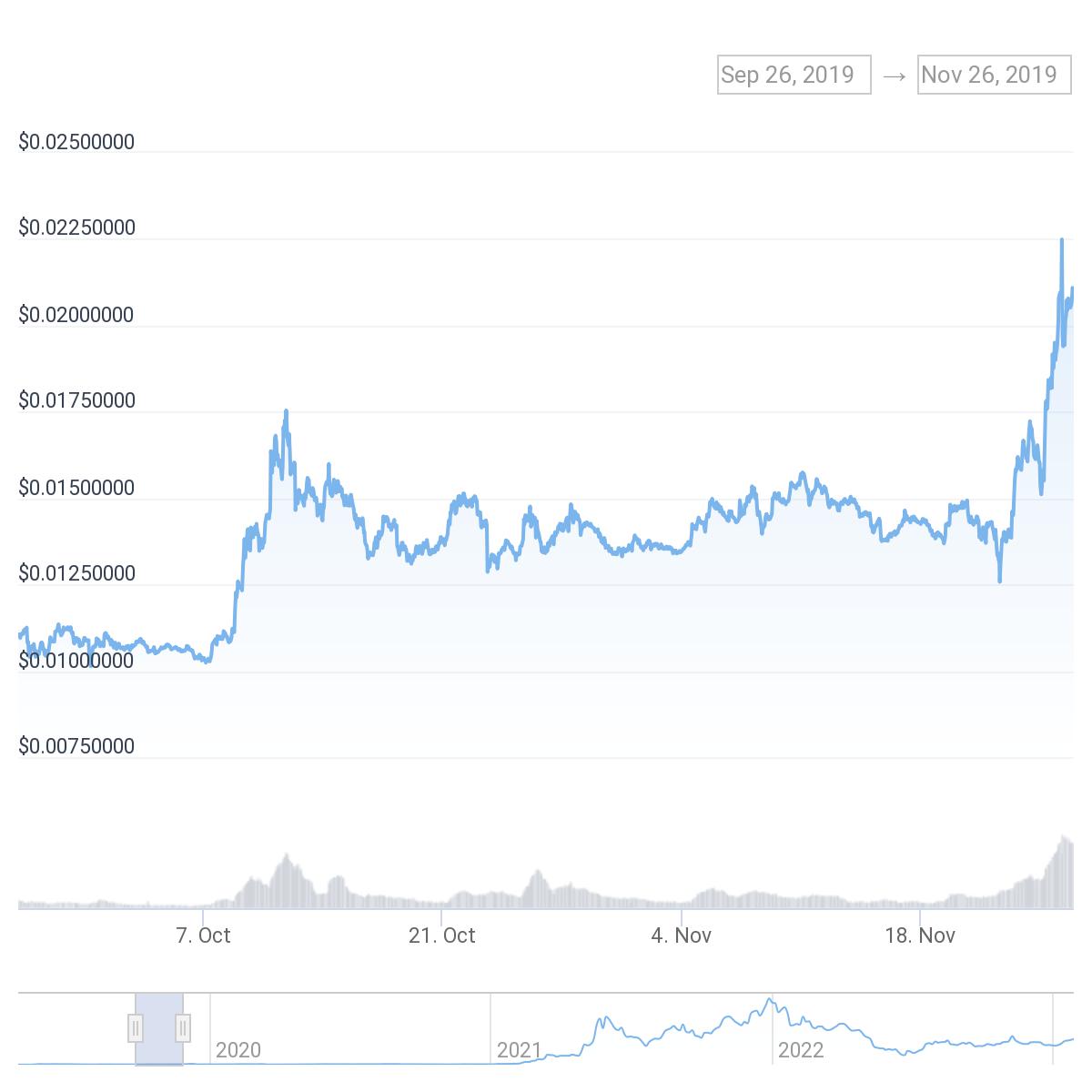

Polygon (MATIC)

On Oct. 26, 2019, the Polygon community unlocked 190 million MATIC. The tokens had been distributed to personal traders and early supporters who participated in Polygon’s funding rounds.

The worth motion MATIC noticed within the month and week main as much as the unlock matches the pattern seen in most token unlocks. The market was gearing up for the token unlock, making a shopping for strain that pushed its value up virtually 30%.

After the tokens had been airdropped, elevated promoting strain saved MATIC’s value comparatively flat. Nonetheless, within the month following the unlock, MATIC noticed its value improve by over 80%.

- 30 days earlier than TU: $0.0108

- 7 days earlier than TU: $0.0138

- Day 0 of TU: $0.0135

- 7 days after TU: $0.0137

- 30 days after TU: $0.0244

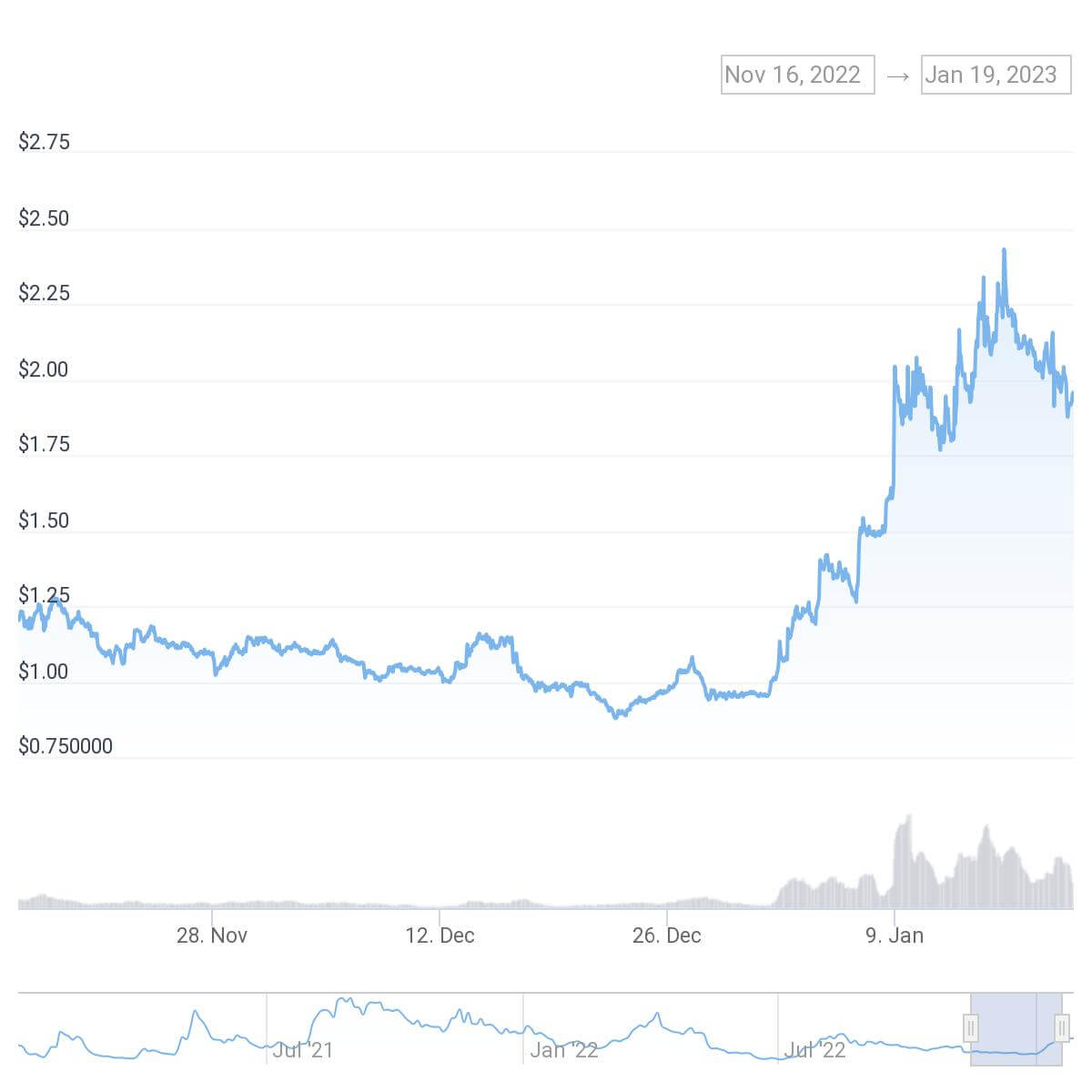

LidoDAO (LDO)

Lido has seen its reputation improve considerably in 2022, as Ethereum’s transition to a PoS community made it its most useful participant. Its LDO token noticed a notable uptick forward of the Merge, so the month main as much as its December token unlock noticed little constructive value motion.

On Dec. 18, 2022, 1.65 million LDO tokens had been unlocked and distributed to the undertaking’s workforce, traders, and validators.

The week after the token unlocks marked the end result of LDO’s promoting strain, which noticed its value virtually double within the month following the unlock.

- 30 days earlier than TU: $1.22

- 7 days earlier than TU: $1.03

- Day 0 of TU: $0.98

- 7 days after TU: $0.97

- 30 days after TU: $2.01

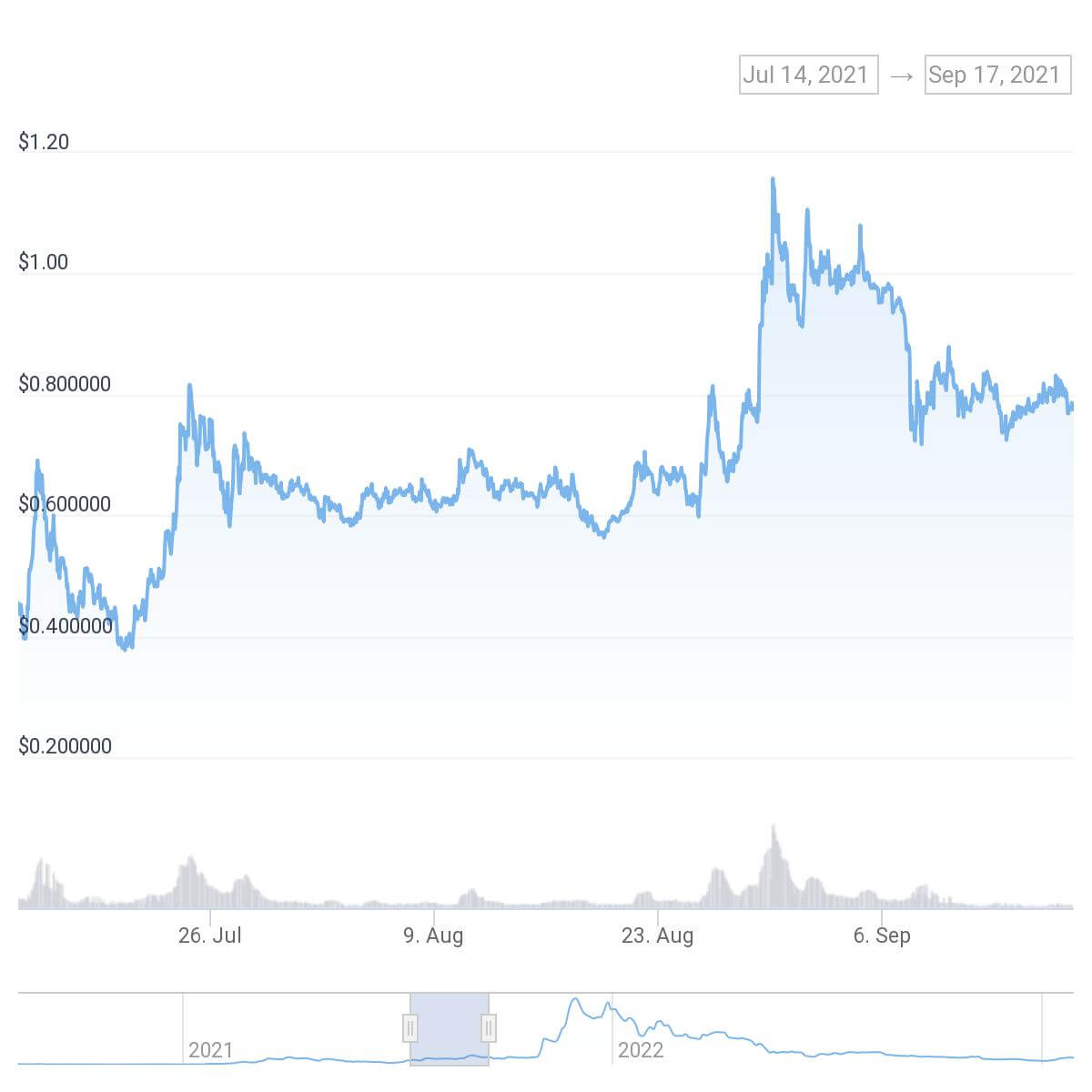

The Sandbox (SAND)

The Sandbox was among the many first main metaverse platforms to hit the market and loved notable success in 2020 and 2021.

A 12 months after its high-profile token sale on Binance Launchpool, Sandbox unlocked 397.7 million SAND tokens on Aug. 16, 2021. The tokens had been distributed to traders, advisors, and the corporate reserves, growing the undertaking’s liquidity and recognition.

SAND adopted the identical pattern as Polygon’s MATIC did, the place growing shopping for strain forward of the unlock pushed its value to yearly highs. A quick value consolidation was a constructive value motion that noticed the token acquire virtually 30% within the month following the unlock.

- 30 days earlier than TU: $0.48

- 7 days earlier than TU: $0.62

- Day 0 of TU: $0.64

- 7 days after TU: $067

- 30 days after TU: $0.82

1inch Community (1INCH)

The 1inch Community peaked in the course of the 2020 DeFi Summer time, capitalizing in the marketplace’s newfound fascination with decentralized finance.

Desirous to capitalize on its success, the DEX launched its native token 1INCH in late 2020, allocating round 97.5 million tokens to varied group initiatives. 1INCH surged in worth all through 2021 because the change noticed a file variety of customers and a rising transaction quantity.

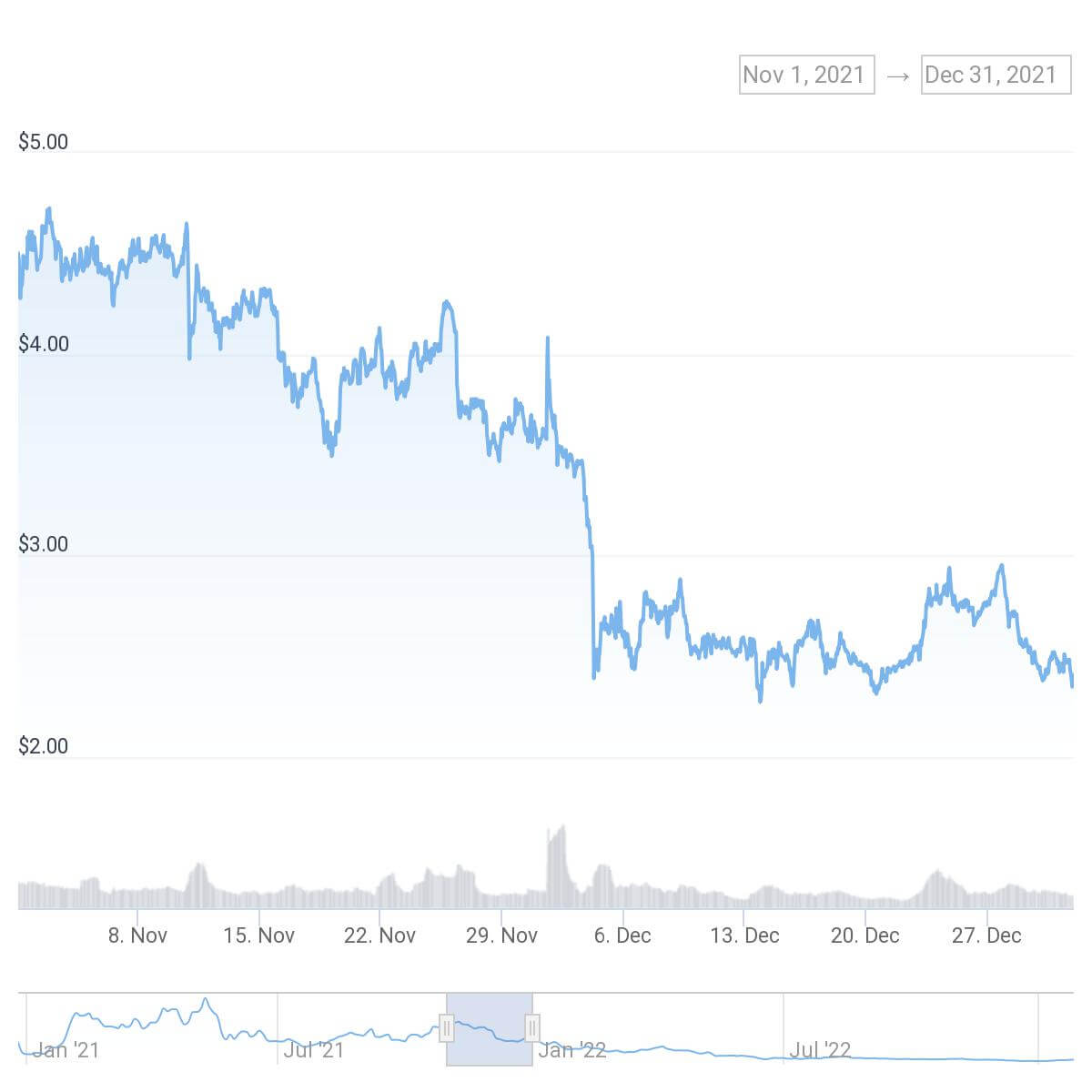

The 231.7 million tokens allotted to the 1inch workforce, its advisors, and outdoors traders had been unlocked on Dec.1, 2021. This was adopted by a good bigger unlock distributed to seed traders and the corporate’s reserves, which noticed one other 295.2 million tokens hit the market.

- 30 days earlier than TU: $4.58

- 7 days earlier than TU: $3.99

- Day 0 of TU: $3.69

- 7 days after TU: $2.72

- 30 days after TU: $2.39

STEPN (GMT)

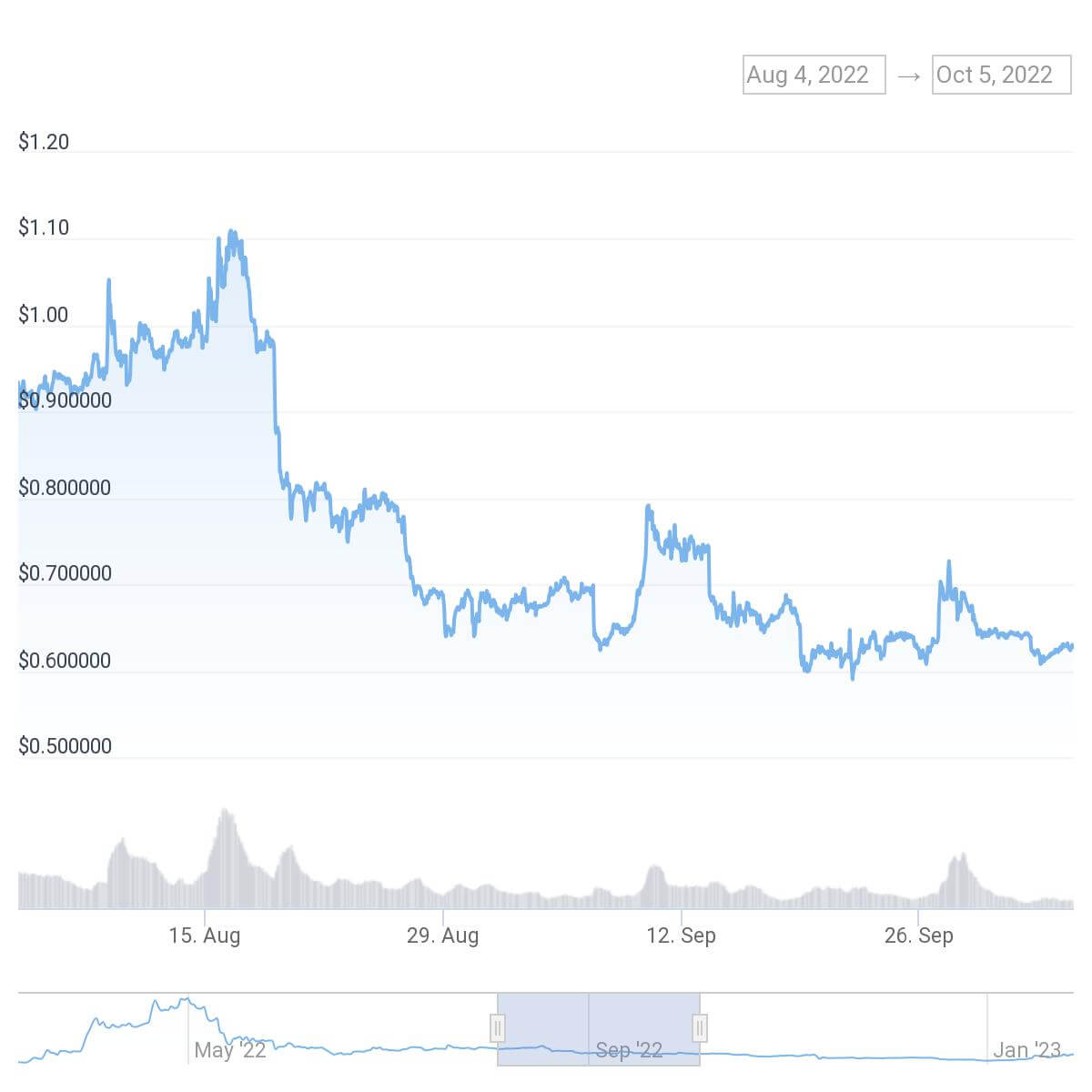

A pioneer within the move-to-earn house, STEPN was one of many best-performing platforms within the first half of 2022. Its native token GMT reached its all-time excessive in April, as 1000’s of customers rushed to the platform to capitalize on its enticing reward mannequin.

At first of September 2022, a complete of 4.2 million GMT tokens had been distributed to customers as a part of its move-to-earn reward program. The occasion was adopted by weekly unlocks of round 5 million GMT tokens distributed to customers.

- 30 days earlier than TU: $0.93

- 7 days earlier than TU: $0.65

- Day 0 of TU: $0.69

- 7 days after TU: $0.73

- 30 days after TU: $0.62

Takeaways

The worth actions earlier than, throughout, and after main token unlocks present a repeating pattern.

The vast majority of tokens see shopping for strain ramping up towards notable scheduled unlocks, which is then adopted by a value correction. Generally, this value correction is short-lived and shortly turns right into a sluggish and regular development for the token.

Nonetheless, some tokens fail to observe this sample.

The above-mentioned pattern is most frequently seen in large-cap tokens, the place a token unlock creates a community impact that places the undertaking on the map and attracts new customers. It’s additionally evident in tasks that distribute a major amount of its tokens to customers.

Tasks that distribute numerous their tokens to personal traders and inside groups are those that see their value lower following main unlocks. With most unlocks being clear to the general public, the market often anticipates an enormous dump and tries to outpace the downward value motion.

Some unlocks additionally come at an unlucky time for a token and its holders. For instance, STEPN’s GMT reward distribution got here after the protocol’s heyday and coincided with a broader downturn brought on by FTX.

There’s additionally the issue of timing. The sooner in a undertaking’s life the unlock occurs, the larger impact it is going to have on its token’s value. Giant-cap, highly-liquid tasks equivalent to Polygon are sometimes unfazed by unlocks, as their big community shortly absorbs any value volatility.

For many tokens, unlocks deliver elevated liquidity and create a extra secure value surroundings. Within the months following an unlock, most tokens stabilize their value with vital beneficial properties.