Glassnode information analyzed by CryptoSlate means that traders are assured holding Bitcoin and Ethereum, over stablecoins, throughout the present risk-off atmosphere

As beforehand talked about, billions in stablecoins have been redeemed for fiat in latest months. A major issue on this was the Binance insolvency FUD, which sparked a run on the alternate.

Nevertheless, because the FUD died down, on-chain metrics present Bitcoin and Ethereum’s shopping for energy, relative to stablecoins, is on the up.

BTC & ETH buying energy on the up

Stablecoins fulfill a number of features, together with facilitating on/off ramping and as a retailer of worth, notably in Southern Hemisphere international locations that usually expertise excessive inflation.

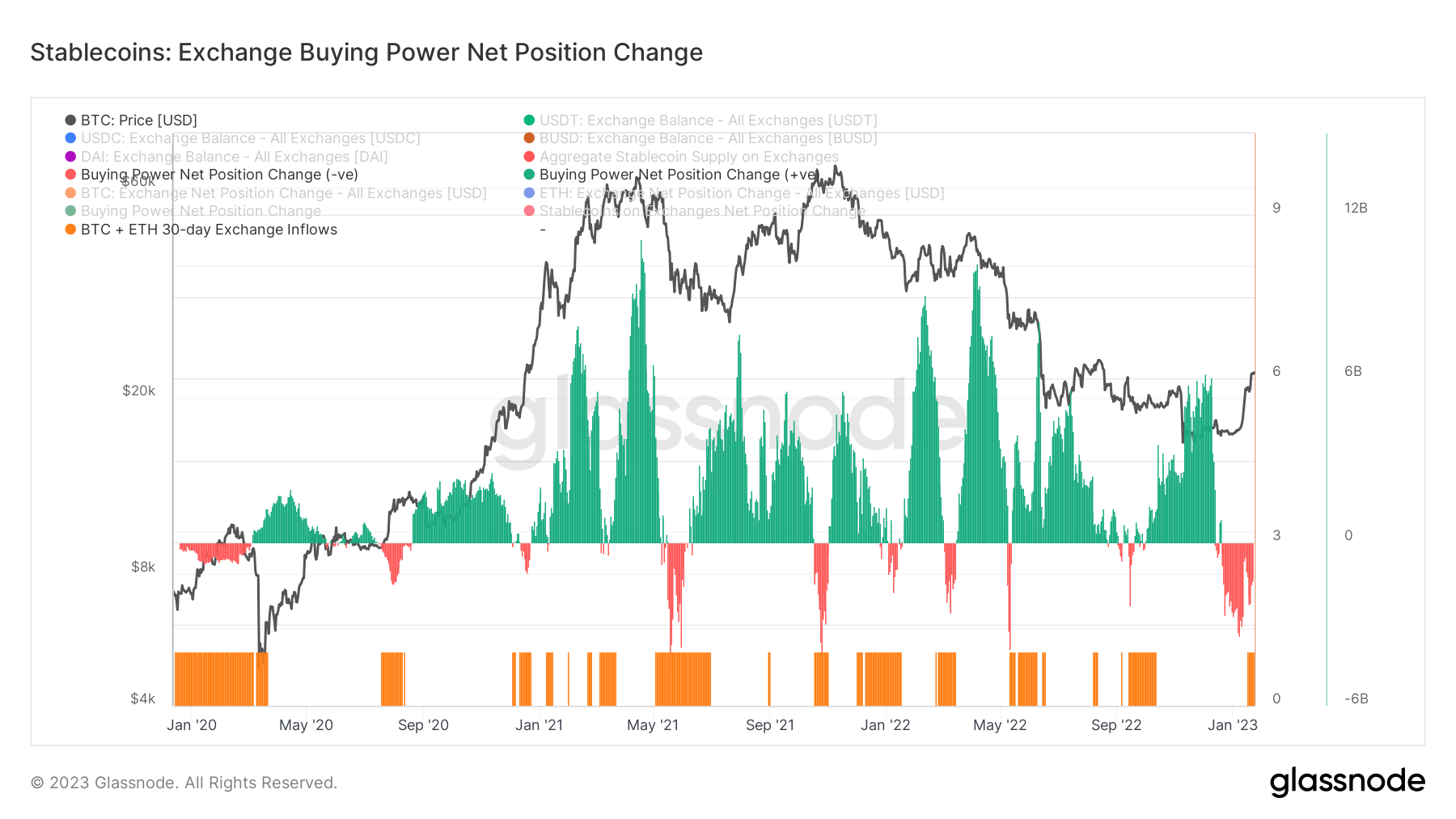

The chart beneath reveals the 30-day change in stablecoin shopping for energy on exchanges. It really works by considering the provision of the highest 4 stablecoins, USDT, USDC, BUSD, and DAI, then subtracting the USD-denominated change in BTC and ETH alternate flows over the interval.

Charting in inexperienced denotes a rise in stablecoin quantity flowing into exchanges relative to BTC and ETH flows. This means there’s higher stablecoin-denominated shopping for energy in proportion to BTC and ETH shopping for energy.

Against this, the crimson charting signifies a lower in stablecoin quantity relative to BTC and ETH. In different phrases, BTC and ETH-denominated shopping for energy is bigger relative to stablecoin shopping for energy.

The orange bars seek advice from the 30-day USD quantity of BTC and ETH being optimistic, i.e. when stablecoins are transformed to BTC and ETH reasonably than USD.

Sometimes, throughout risk-off sentiment, stablecoins improve in quantity as traders transfer to attenuate the impacts of worth volatility. But the chart beneath reveals traders are performing opposite to expectations by growing BTC and ETH inflows to exchanges.

The final time this occurred was in October, for a quick interval. Notably, the present dominance of BTC and ETH alternate quantity over stablecoins has prolonged for about seven weeks at this level. This means confidence within the prime two tokens holding present worth ranges.

Bitcoin Stablecoin Provide Ratio

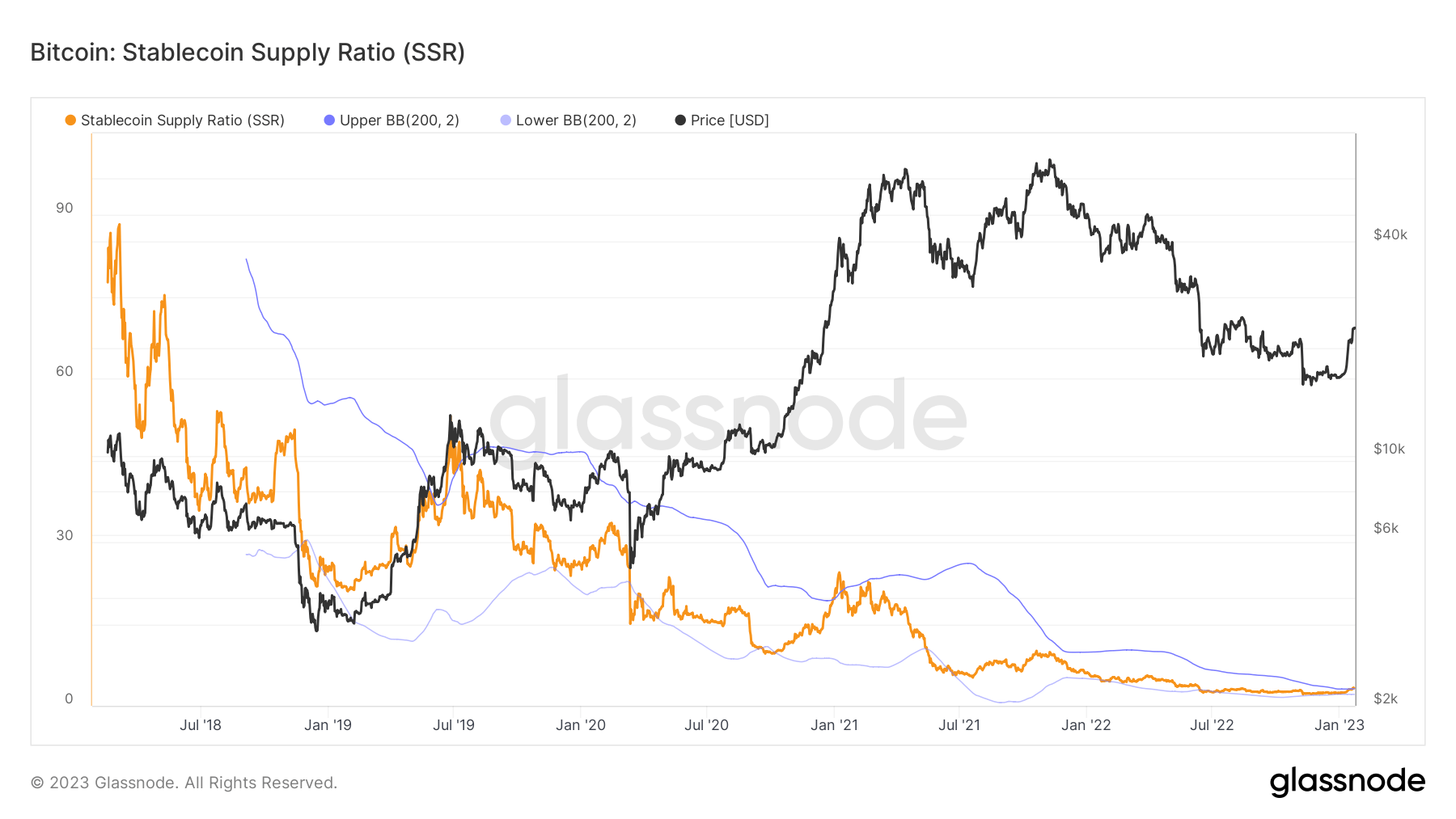

The Stablecoin Provide Ratio (SSR) metric refers back to the proportion of Bitcoin provide in opposition to stablecoin provide, denoted in BTC.

A excessive SSR signifies low potential shopping for stress and is taken into account bearish. Conversely, a low SSR means excessive potential shopping for stress making this example bullish. When the SSR is low, the present stablecoin provide has extra “shopping for energy” to buy BTC.

The chart beneath reveals SSR breaching the higher certain line for the primary since Jan 2021, which coincided with BTC’s run to $65,000. The earlier occasion of breaking the higher certain line was in July 2019, as BTC spiked to $14,000 after the $3,300 market backside.

The above signifies bullish tailwinds, regardless of the present risk-off atmosphere.