In a current survey performed by Trezor, almost 75% of respondents expressed issues over the potential management the U.Okay. authorities might have over entry to funds through its proposed Central Financial institution Digital Foreign money (CBDC).

Additional responses urged a powerful diploma of public concern about their implementation, together with worries about imposing deadlines on holdings.

Trezor commissioned market analysis agency Obsurvant to hold out the survey – which was knowledgeable by the responses from 1,037 U.Okay.-based individuals finishing the ballot on-line.

Central Financial institution Digital Foreign money issues

The Financial institution of England (BoE) launched a public session on the digital pound in February, giving Brits the chance to interact with the method. The session closed on June 30.

Though the BoE said that no resolution had been made on rolling out the digital pound, it additionally stated a CBDC is probably going wanted sooner or later.

The overall sentiment in the direction of CBDC, in accordance with survey respondents, is one in all warning. For instance, investor George Gammon lately raised issues over the Financial institution of Worldwide Settlement’s newest financial report, particularly the part titled “Blueprint for the long run financial system: Bettering the previous, enabling the brand new.”

Sharing his take, Gammon stated he had the “horrifying realization” {that a} “unified ledger,” and the tokenization of all non-public property on that ledger, might imply outlawing specific belongings just by refusing so as to add them to the system.

“In order that they don’t should make #bitcoin, gold, silver, money unlawful they simply gained’t switch authorized possession of property until it’s paid for with cash that has been tokenized and operates inside the ecosystem of their unified ledger.“

Equally, former Member of the European Parliament Ben Habib known as CBDCs “the antithesis of Bitcoin and cryptocurrencies,” in that each one transactions inside a CBDC system can be topic to authorities surveillance and potential intervention.

“This Central Financial institution Digital Foreign money is the final word in a regulated foreign money. Each single foreign money unit can be registered in your identify on the BoE, and they’re going to know exactly what you probably did with it, and so they can do with that unit of foreign money no matter they want.”

Nevertheless, Jan3 CEO Samson Mow believes the problem isn’t as draconian as assumed, lately implying that Bitcoin holders could have a selection on whether or not to take part.

Digital pound survey outcomes

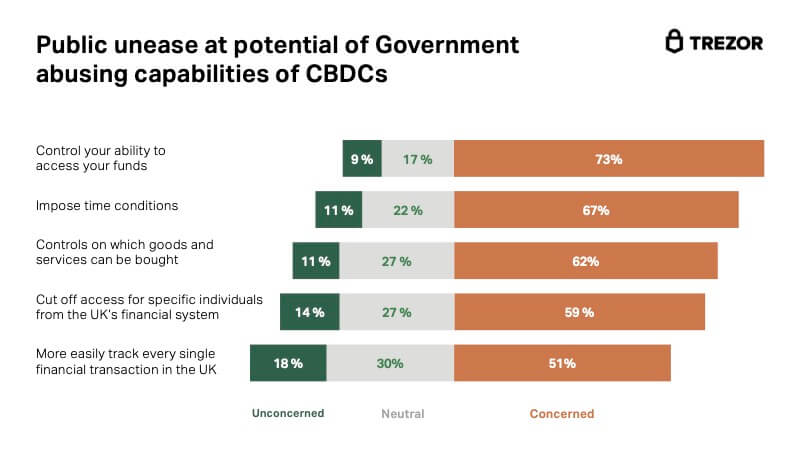

The outcomes of the Trezor-Obsurvant survey echoed the overall apprehension in the direction of CBDCs and their potential misuse by governments and monetary authorities.

It revealed that 73% of respondents are fearful about U.Okay. authorities controlling entry to their funds. As well as, 67% expressed unease over the potential to impose time circumstances on spending, and 59% imagine that U.Okay. authorities would probably use a digital pound to dam particular people from utilizing cash – all of which counsel a powerful diploma of public concern about CBDCs.

The survey additionally revealed that 46% of respondents weren’t assured the U.Okay. authorities might safeguard the pound’s worth and residing requirements over the subsequent three years – whereas 31% imagine authorities might obtain these targets.

Commenting on the findings, an analyst at Trezor, Josef Tětek, stated:

“Earlier than the UK, or another nation for that matter, goes too far down the trail to roll-out, we want a complete, society-wide debate with atypical individuals being made conscious of the long-term implications of what the introduction of programmable, trackable, government-controlled cash might imply.”