Fast Take

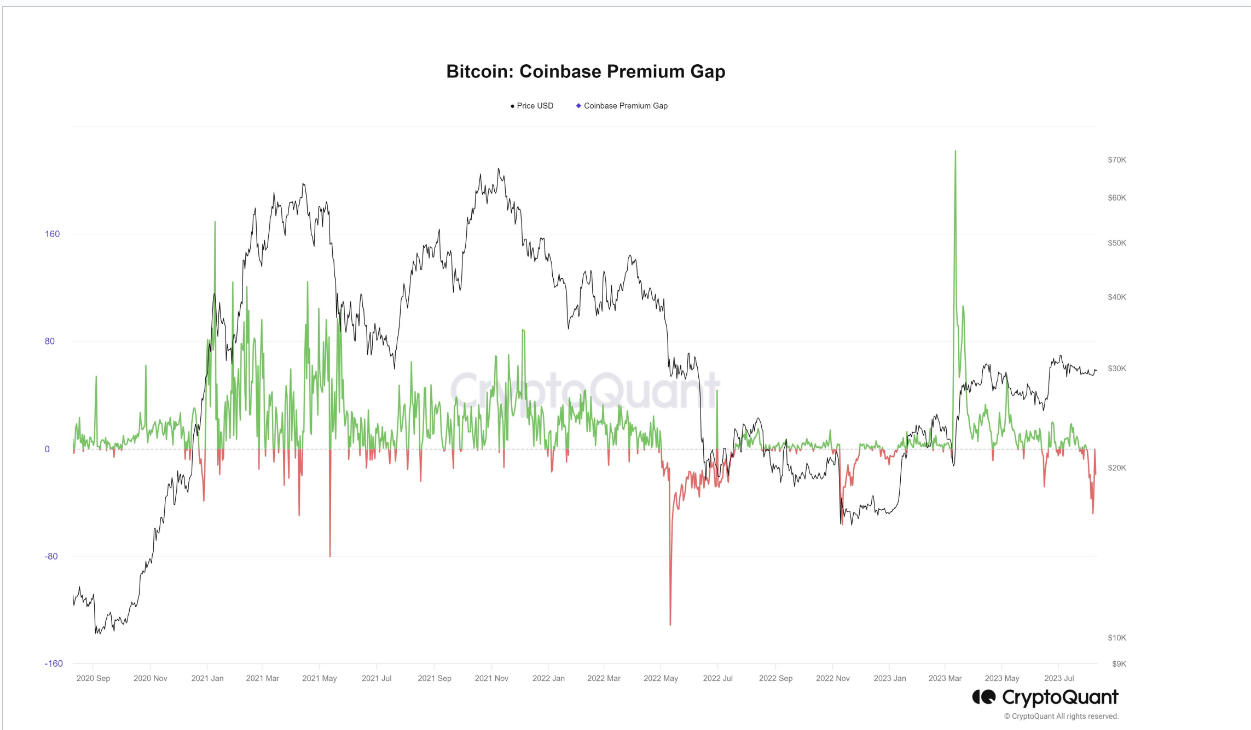

The summer season’s finish is ushering in continued sideways worth motion for Bitcoin, as essential indicators level to a lackluster spot demand. The Coinbase premium index, a barometer of US buyers’ shopping for stress gauged by CryptoQuant, has taken a nosedive. This metric delineates the % disparity between the Coinbase Professional worth (USD pair) and the Binance worth (USDT pair).

A surge in premium values usually alerts sturdy shopping for stress. Nevertheless, the latest plunge aligns with Bitcoin’s fall under the $29,000 mark, mirroring the earlier low within the aftermath of the FTX collapse. This implies that the sell-off stress primarily stems from Coinbase, normally championed by US buyers.

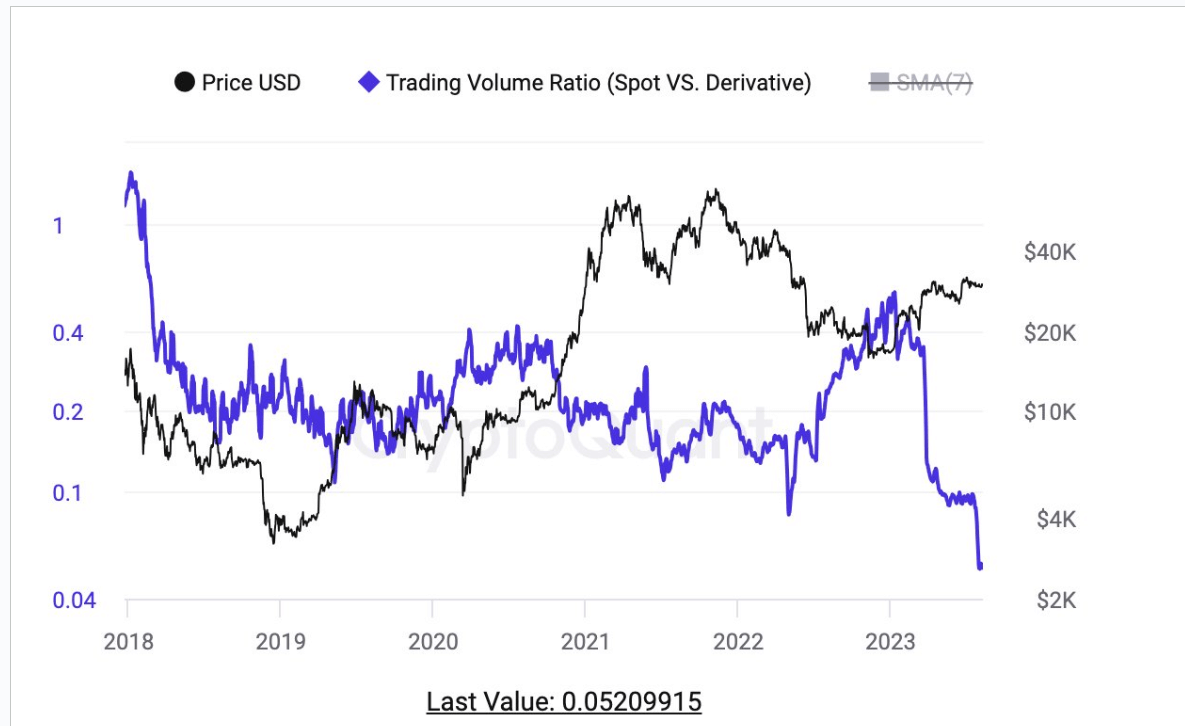

Additional corroborating the absence of spot demand is the anomalously low spot-to-futures ratio, touching a five-year low. Dylan LeClair, a Bitcoin Journal analyst, underscores that by-product merchants have overtaken the market, a speculation buttressed by the year-to-date excessive in open curiosity.

In line with LeClair, the spot bears have largely exhausted their coin reserves. In distinction, spot bulls are both solely invested or biding their time in conventional finance (TradFi) pending the approval of an ETF.

The put up Troubling indicators for Bitcoin as U.S. buyers pull again appeared first on CryptoSlate.