The U.S. Treasury yields have not too long ago been flashing warning indicators. These yields, representing the return on funding for U.S. authorities bonds, function a vital barometer of market sentiment and total financial vitality.

An space of explicit curiosity on this context is the unfold between the 10-year Treasury yield and the 3-month Treasury yield. This unfold, representing the distinction between the returns on long-term and short-term investments, is a big indicator of future financial prospects.

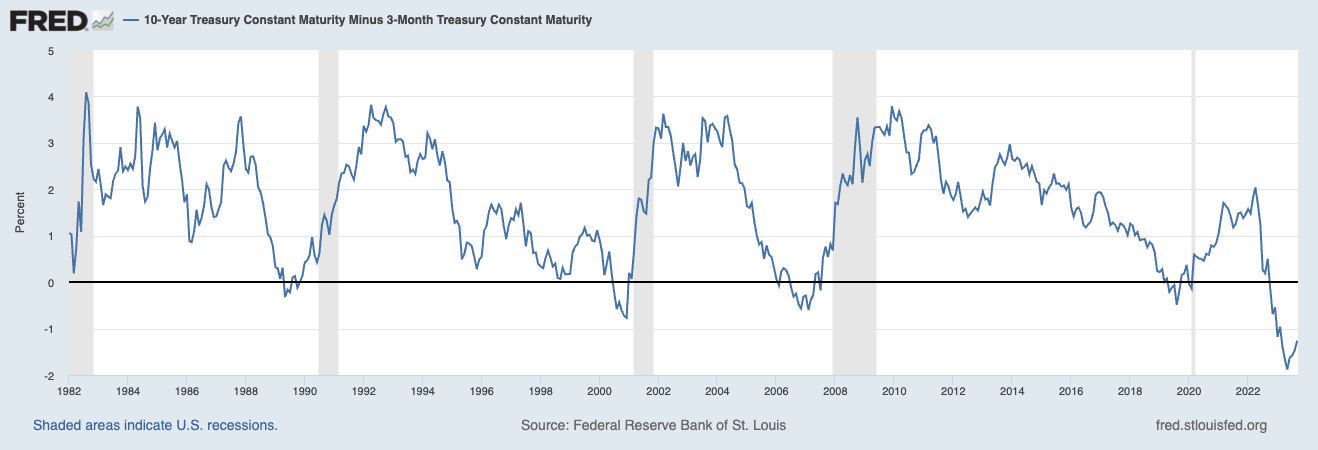

Traditionally, the unfold between the 10-year and 3-month Treasury yields has been a dependable harbinger of financial downturns.

A optimistic unfold sometimes signifies investor confidence within the financial system’s long-term prospects, whereas a unfavourable unfold, or an “inverted yield curve,” usually precedes recessions. This inversion means that buyers are extra assured within the short-term outlook than the long-term, prompting them to hunt longer-term securities regardless of the decrease yields.

Previous cases of this inversion have constantly correlated with financial recessions. The phenomenon was evident earlier than the recessions of the early Nineteen Eighties, Nineties, the early 2000s dot-com increase, and, notably, the 2007-2008 monetary disaster. The predictive energy of this unfold, rooted in a long time of monetary knowledge, underscores its significance in financial forecasting.

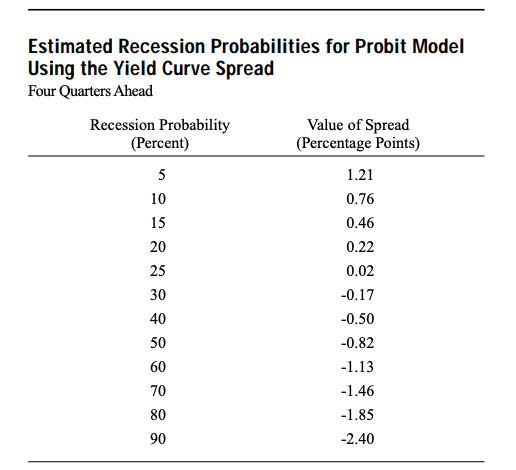

Along with its predictive energy, the yield unfold has been employed to calculate the likelihood of impending recessions. In line with a 1996 analysis paper from the Federal Reserve Financial institution of New York, the unfold between the 10-year and 3-month Treasury yields can derive a model-based likelihood of a recession in the US over the following 12 months. This mannequin, traditionally aligned intently with precise recessions, presents a quantitative strategy to gauging financial downturn dangers.

By inputting the present unfold worth into the mannequin, analysts can receive a share chance of a recession occurring inside the following 12 months.

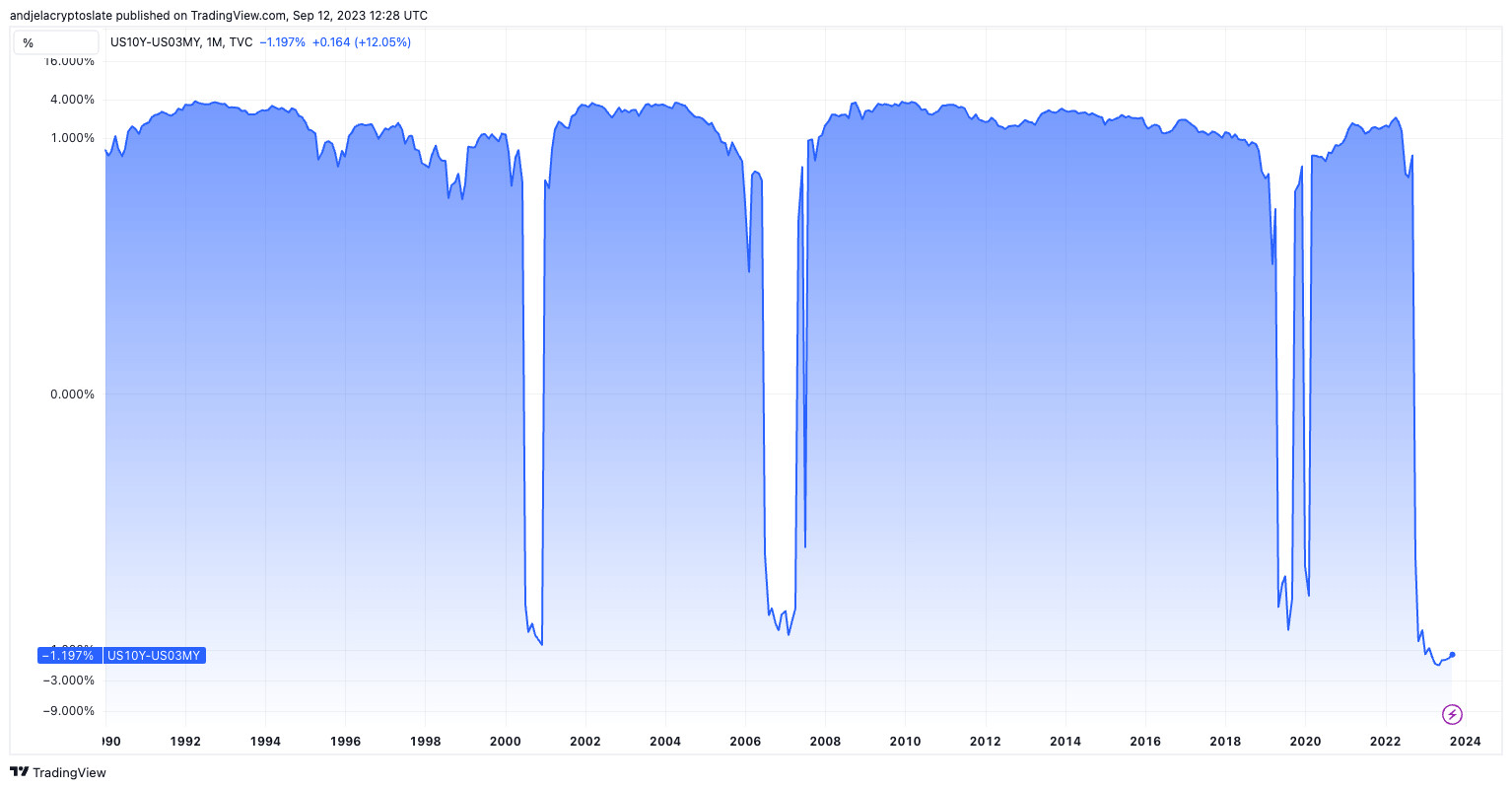

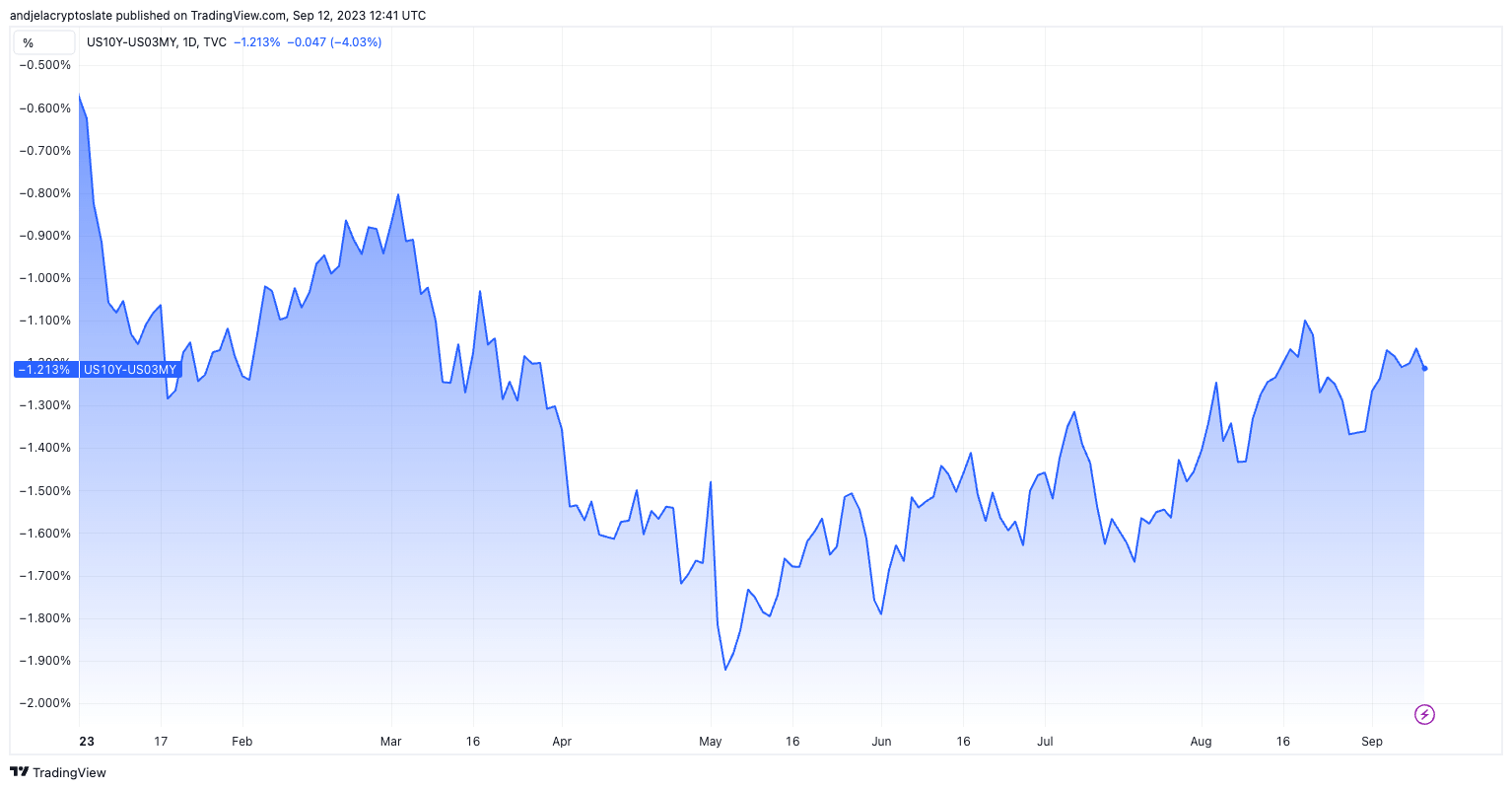

October 2022 noticed the unfold turning unfavourable, a growth that raised eyebrows in monetary circles. By Could 2023, this unfold plummeted to an all-time low of -1.88%. As of Sep. 10, it stands at a regarding -1.26%, with market analysts and buyers on excessive alert. The Federal Reserve’s recession likelihood mannequin suggests a heightened recession likelihood, starting from 60% to 70%.

A very giant unfavourable unfold, similar to the present one, signifies a insecurity within the long-term financial outlook. Traders, cautious of future prospects, are flocking to longer-term securities, even when it means settling for decrease returns. This conduct suggests a collective anticipation of financial headwinds within the not-so-distant future.

The put up U.S. Treasury yield unfold dips to historic lows signaling financial warning appeared first on CryptoSlate.