As rumors about Argo’s doable chapter proceed to unfold, extra details about what induced the corporate’s troubles are unraveling.

The U.S.-based Bitcoin mining firm has seen its shares plummet within the second half of the yr because it struggled to maintain a optimistic money movement. In October, Argo failed to safe a $27 million strategic funding that was supposed to enhance its liquidity place.

On the time, the corporate stated it was persevering with to search for an answer to its money drawback, however famous that it might fail to resolve its points. In the beginning of December, Argo unintentionally revealed a petition for chapter.

A screenshot of a particular announcement for Argo’s stakeholders was reportedly leaked, exhibiting that the corporate may be making ready to file for chapter.

In keeping with a latest report, Argo’s failure to safe a fixed-price PPA earlier this yr could possibly be what induced its issues.

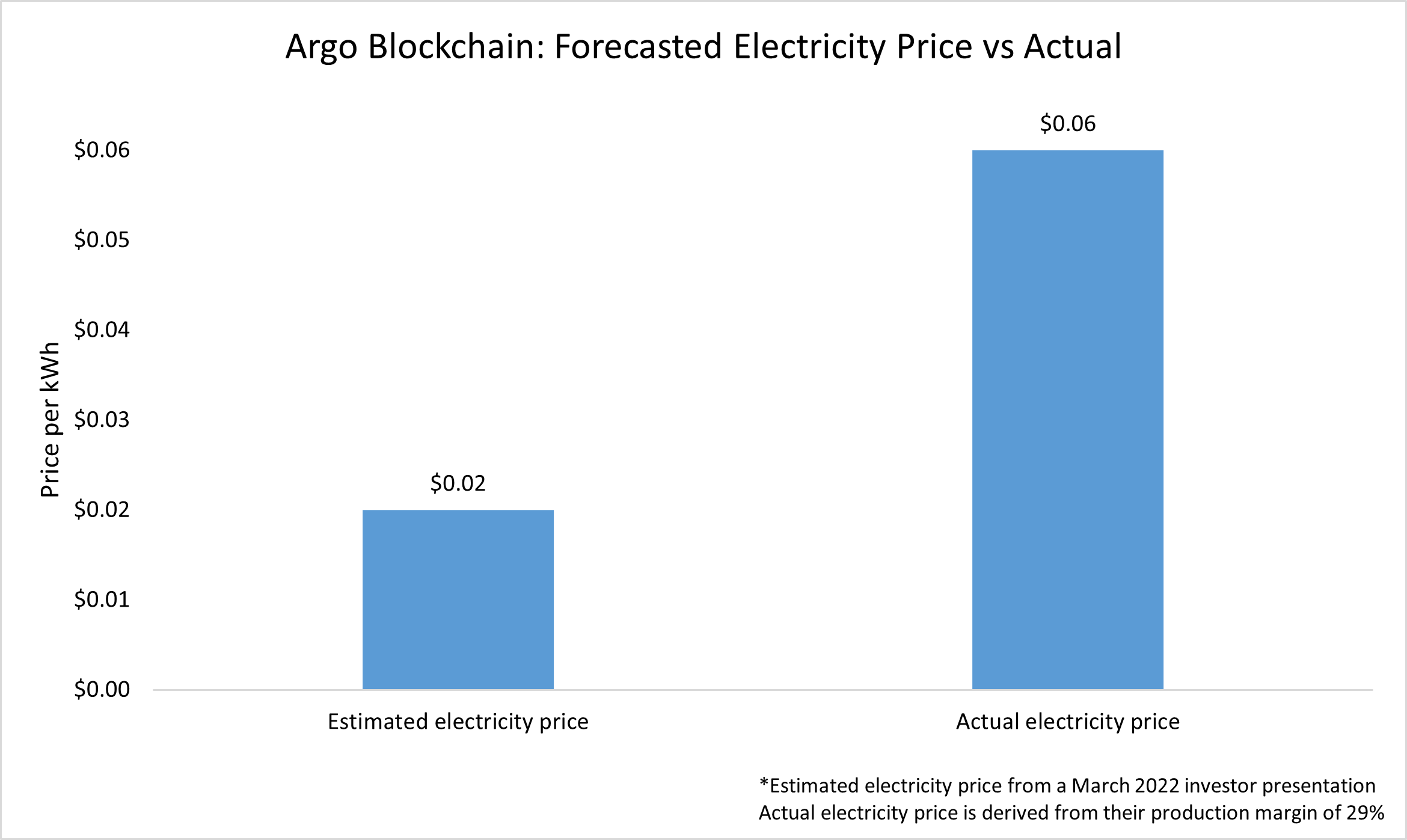

Jaran Mellerud, a analysis analyst with the Hashrate Index, famous that Argo said they’d entry to electrical energy priced at $0.02 per kWh. The quantity was reportedly shared in a March 2022 investor presentation.

That is from Argo’s investor presentation from March 2022. Their said electrical energy value of $0.02 per kWh grew to $0.06 per kWh. pic.twitter.com/dcObBxAj1n

— Jaran Mellerud (@JMellerud) December 12, 2022

Nonetheless, analyzing Argo’s November manufacturing report confirmed that the electrical energy value the corporate pays is definitely $0.06 per kWh. The precise electrical energy is derived from Argo’s reported manufacturing margin of 29%.

The threefold improve in electrical energy price led to a considerably larger improve in manufacturing price. In keeping with the report, Argo’s electrical energy price of mining 1 BTC is round $12,400. If the corporate paid $0.02 per kWh because it said in its investor pitch, the price of mining 1 BTC can be round $4,000.

Rising the electrical energy value from $0.02 to $0.06 per kWh leads to an enormous improve in manufacturing price.

Argo’s electrical energy price of mining 1 BTC is $12.4k. It will solely be $4k in the event that they paid $0.02 per kWh. pic.twitter.com/Vm4vhHs1eH

— Jaran Mellerud (@JMellerud) December 12, 2022

Nearly all of Argo’s mining operation is positioned in Texas. The Electrical Reliability Council of Texas (ERCOT), the group working Texas’s electrical grid, has seen its electrical energy value skyrocket because the starting of the summer season. This meant that the $0.02 per kWh value Argo touted to buyers was short-lived.

Bitcoin miners are recognized to safe fixed-price energy buy agreements (PPAs), a contract between vitality consumers and sellers that ensures a set value for each kilowatt of vitality. These contracts present Bitcoin miners with much-needed value stability as they take away one of many largest variables from their manufacturing prices.

It now appears that Argo didn’t safe a fixed-price PPA when increasing to Texas and skilled huge losses when the worth of electrical energy started growing.