Fast Take

Latest information evaluation has proven that Bitcoin miners’ share costs have undergone vital fluctuations over the previous few years. In accordance with analyst Dylan Le Clair’s evaluation of an equal-weight public miner index, the shares are at the moment down by a staggering 54.5% from their mid-July peak.

This follows a sequence of dramatic swings: an increase of 6,213% from the 2020 low to the 2021 excessive, a pointy fall of 95% from the 2021 excessive to the 2022 low, a restoration of 487% from the 2022 low to the 2023 excessive, and one other 54% dip from the 2023 excessive to immediately in accordance with Le Clair.

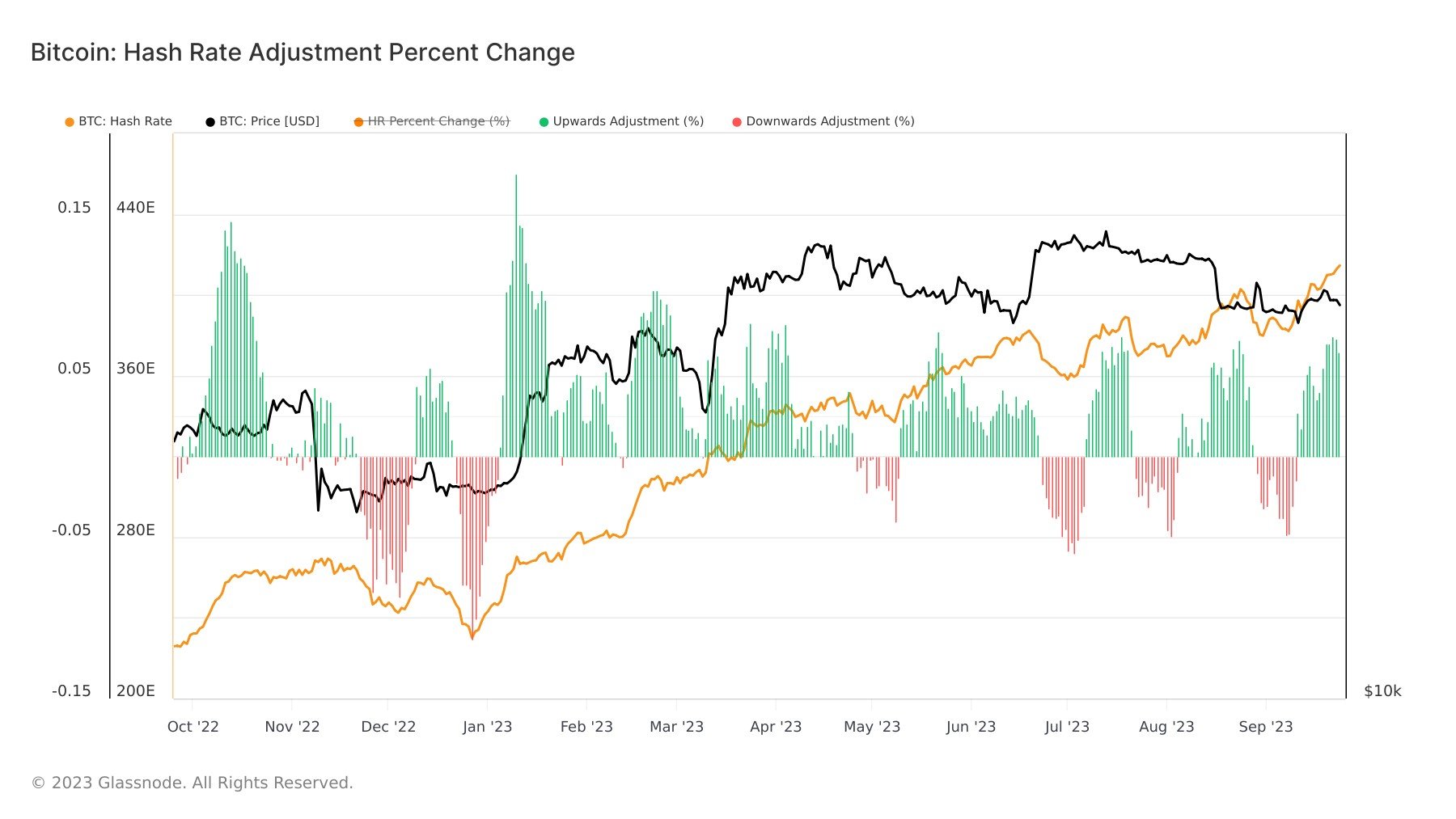

Regardless of these drastic share value actions, there are indicators of resilience throughout the Bitcoin mining business. The Bitcoin hash price, a key indicator of miners’ profitability, continues to climb to all-time highs, suggesting that mining actions stay worthwhile. Over the previous two weeks alone, the hash price noticed a rise of 8%, indicating that miners are usually not in monetary misery regardless of the falling share costs.

The submit Unshaken Bitcoin mining business navigates fluctuating share costs appeared first on CryptoSlate.