After a brutal sequence of occasions led to the collapse of a number of crypto-related corporations in 2022, FTX’s chapter dealt a large blow to public belief in centralized crypto entities.

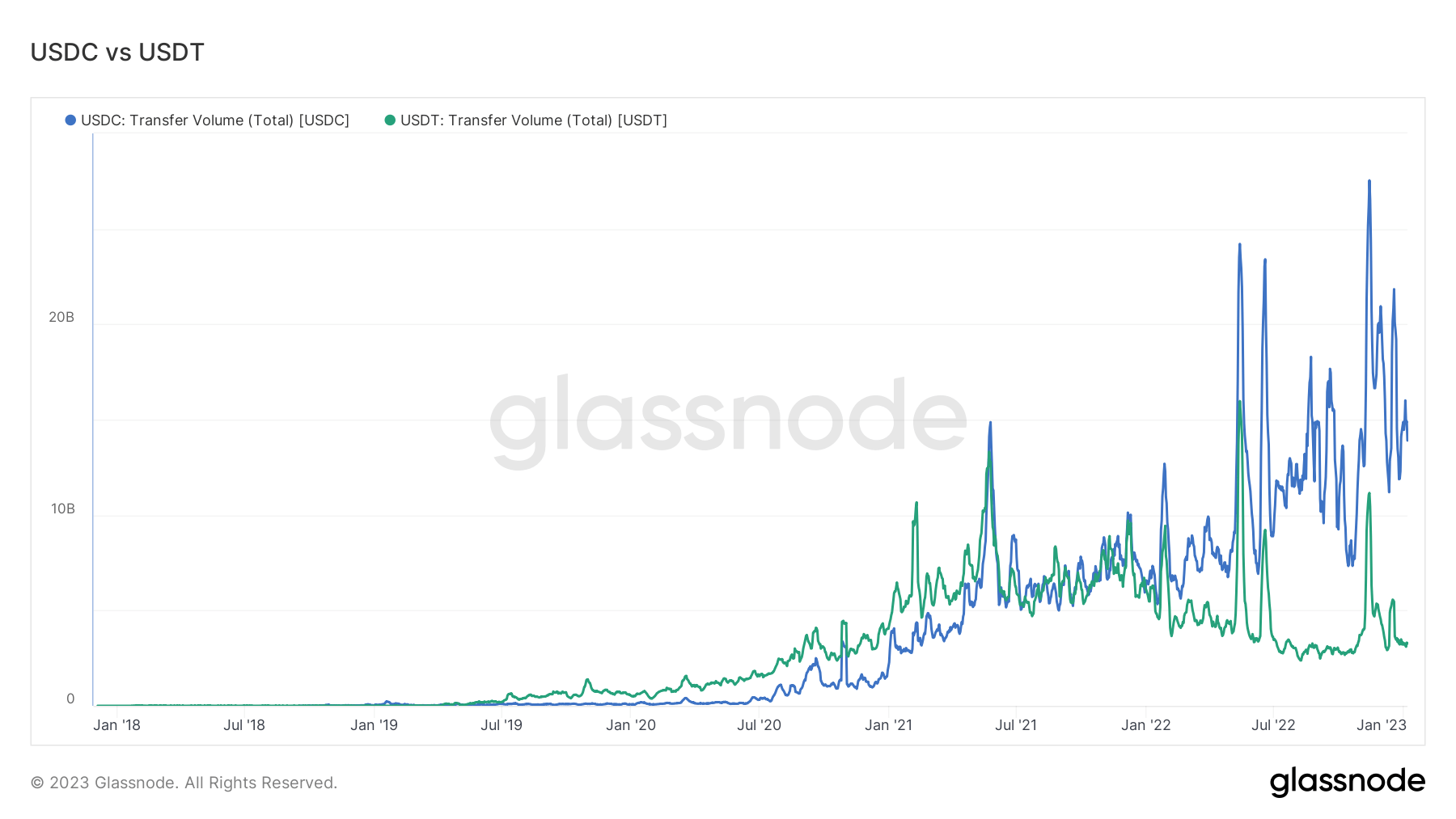

Throughout this era of heightened market volatility, crypto traders most popular Circle’s USD Coin (USDC) to Tether’s USDT. In response to Glassnode’s information, whereas USDT is the biggest stablecoin by market cap, USDC has extra switch quantity.

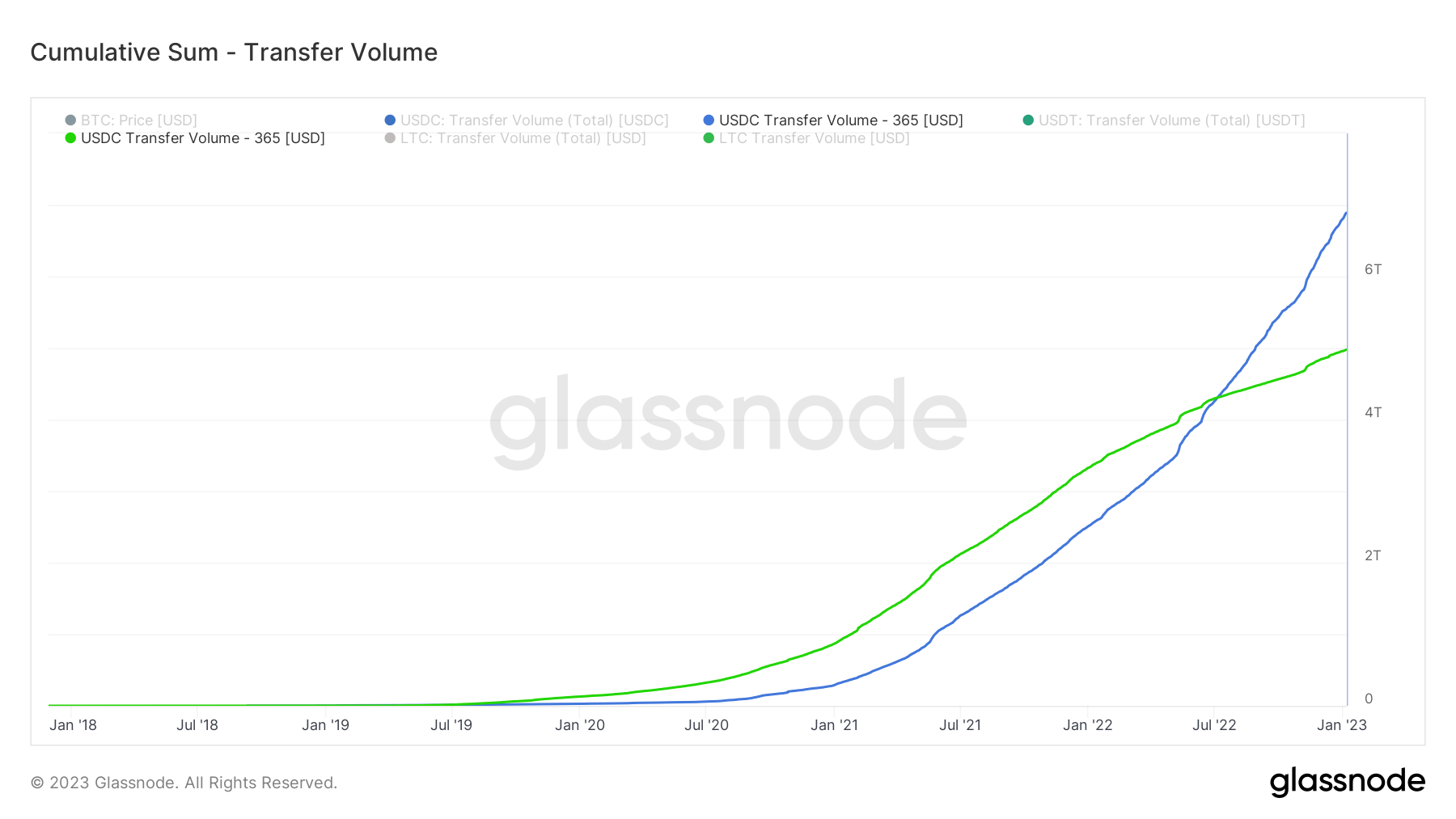

In response to the info, USDC has a switch quantity of $15 billion, whereas USDT’s quantity is $3 billion. Cumulatively, USDC outpaces USDT by $7 trillion.

In the meantime, the Glassnode chart under reveals that the disparity in switch quantity was not at all times like this. USDT’s quantity outperformed that of USDC in 2020 and early 2021. However that modified in 2022 when the Circle-backed stablecoin’s quantity began rising.

On the time, USDT started to face elevated regulatory scrutiny about its reserves coupled with Terra’s LUNA collapse, which birthed fears of whether or not the stablecoin wouldn’t lose its Greenback peg.

USDC’s stability on exchanges attain $5 billion

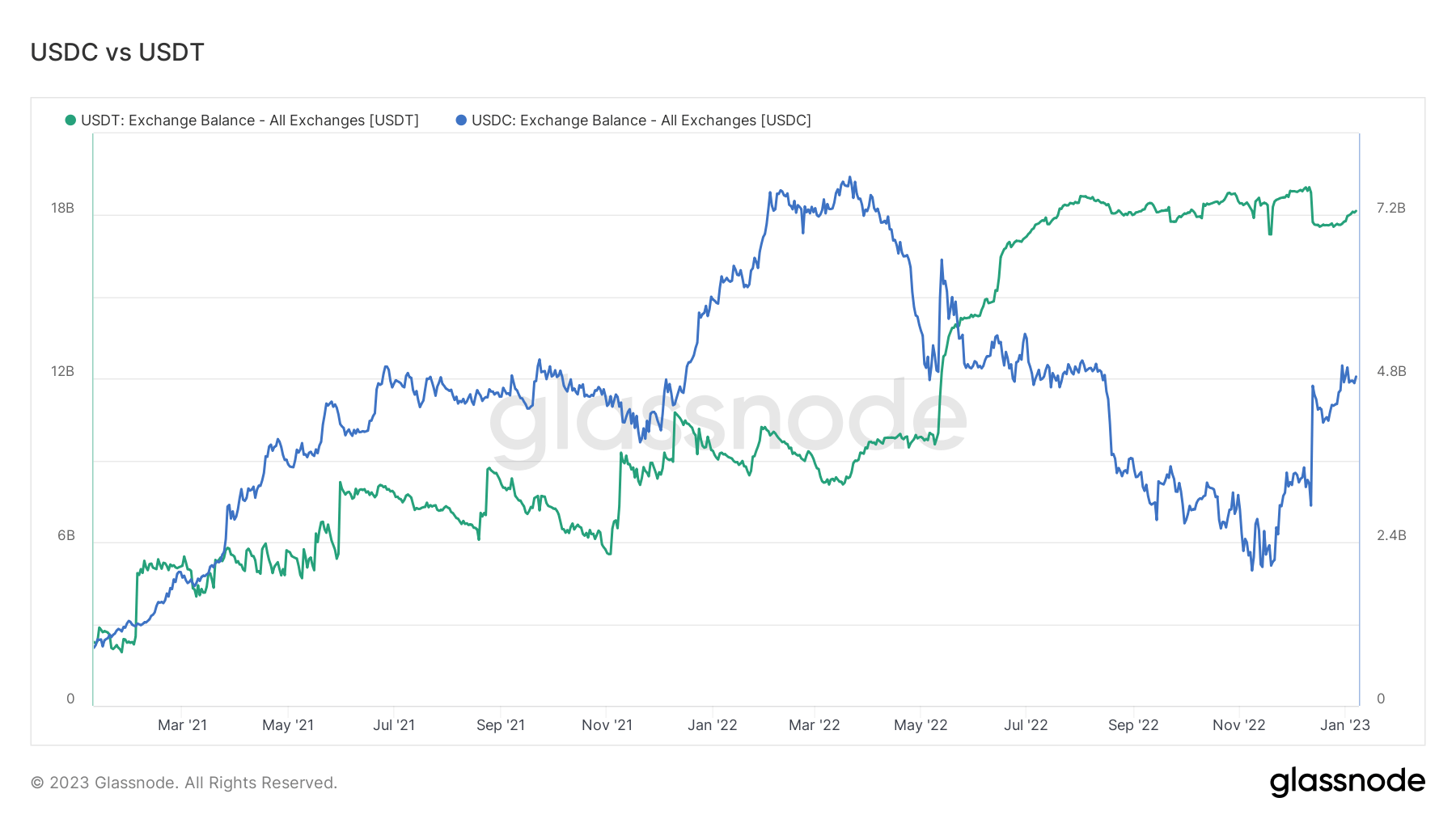

When it comes to trade balances, Glassnode information reveals that USDC is starting to get pleasure from extra adoption post-FTX collapse. In response to the info, the USDC on exchanges is approaching $5 billion.

Beforehand, USDC’s adoption in 2022 had declined due to Binance’s choice to transform its customers’ balances in USDC and different stablecoins to its BUSD. Nevertheless, with the FTX collapse birthing FUD that led to document withdrawals from Binance, USDC’s adoption started to see an uptrend in direction of the top of the 12 months.

Apart from that, Coinbase additionally urged its customers to transform their USDT to USDC without cost.

Alternatively, USDT’s stability on exchanges stayed flat all through the interval –it even noticed a slight decline in early January 2023.

Publish FTX’s crash, USDT has seen extra questions raised about its reserves, with a number of hedge funds shorting the stablecoin. Nevertheless, its issuer mentioned Tether would proceed to point out resilience even within the face of uncertainty.

With 2023 set to be a risk-off 12 months, the market may probably see additional progress amongst stablecoins. This might set the stage for a struggle for dominance between USDT and USDC.