In a speedy flip of occasions, Tether’s stablecoin dominance has surged to its highest level in a 12 months and a half, a feat crypto watchers attribute to difficulties surrounding rival stablecoins USDC and BUSD.

Tether USDT now stands at its highest dominance over the stablecoin sector in 18 months.

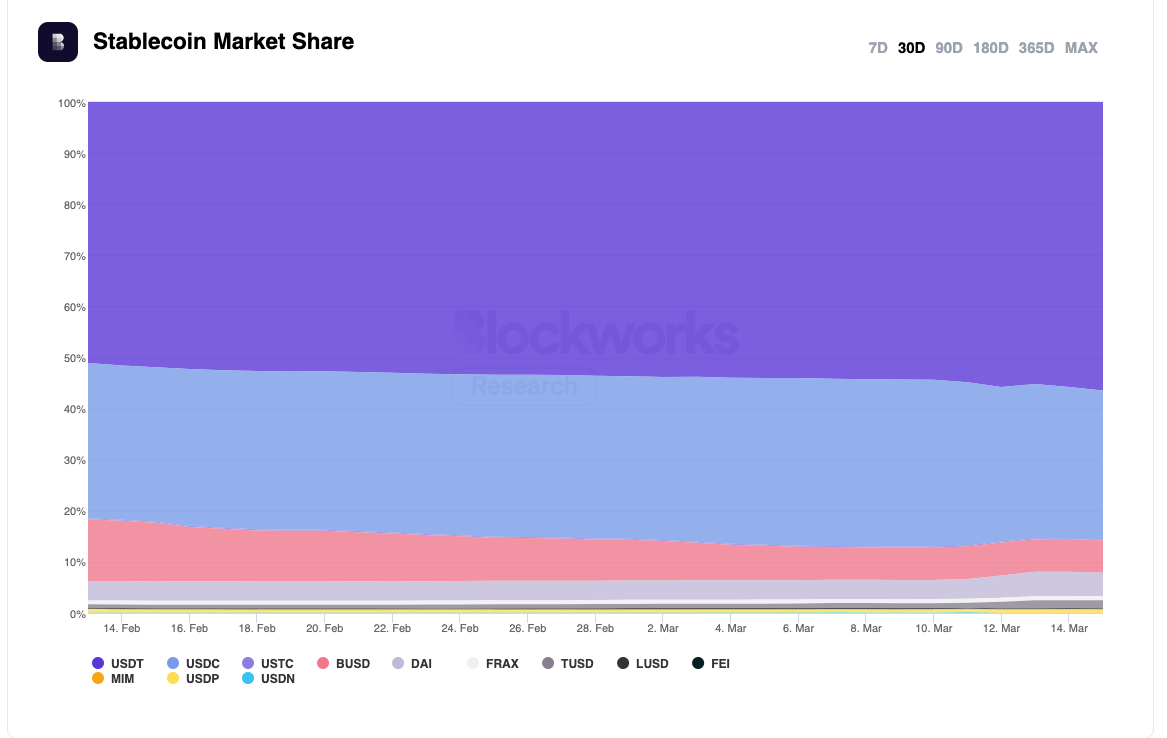

In keeping with Blockworks’ knowledge evaluation of stablecoin provide composition, USDT’s property complete market share has risen to its highest level since at the least July 12, 2021, at present sitting at 56.4%, after growing by 5.4% previously 30 days.

The surge in market share comes after a busy weekend on this planet of stablecoins, with two of the trade’s different high 5 tokens — USDC and DAI — each shedding appreciable floor after briefly shedding their $1.00 peg.

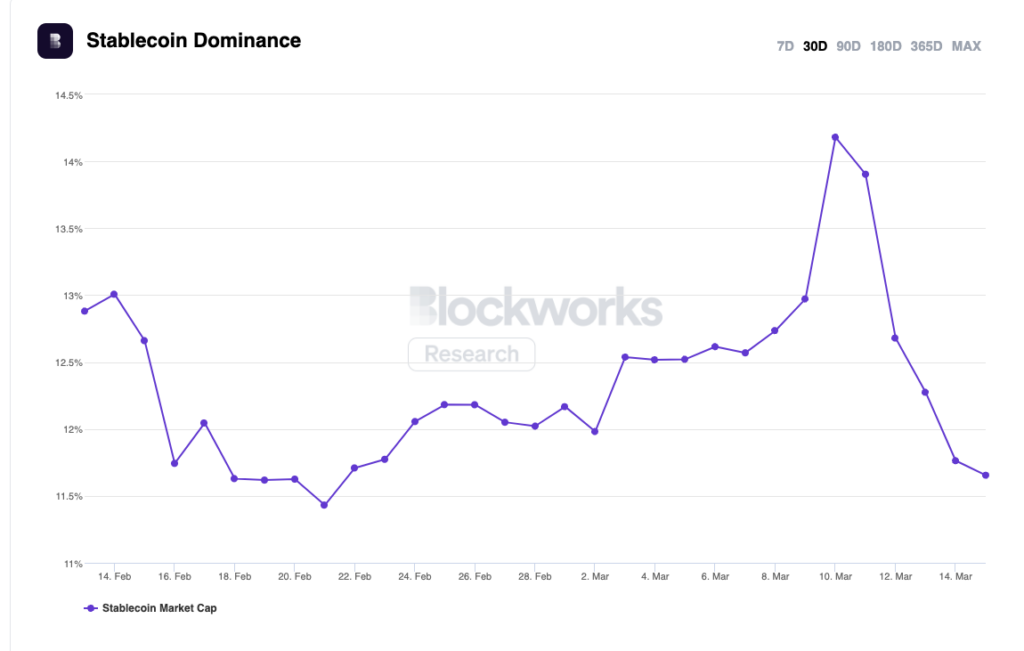

On-chain evaluation of aftershocks from the SVB financial institution run that started on March 8 exhibits that stablecoin quantity surged as traders moved out and in of USDC. A pockets belonging to long-time crypto entrepreneur Justin Solar was discovered to have made $3.3 million, flipping USDT into USDC.

Stablecoin marketshare

Because the market chief, Tether appears to be weathering the storm of the broader financial downturn stemming from the collapse of three U.S. banks, which led to the transient depegging of one other stablecoin, USDC, on March 1.

Learn extra: USDC depeg – Every little thing we all know as far as contagion spreads from TradFi banking

Regardless of going through scrutiny over the validity, high quality, and certainty of its reserves, USDT holds the place of the world’s third-largest digital asset, with a complete market capitalization of roughly $73 billion, trailing solely bitcoin (BTC) and ether (ETH). Tether, USDT’s issuer, maintains that its property surpass its liabilities, as reported within the newest quarterly assurance report.

In the meantime, USDT’s closest rivals, USDC and BUSD, have encountered vital challenges in latest weeks. Circle, USDC’s issuer, disclosed that roughly 8% of its stablecoin reserves, roughly $3.3 billion, have been held by troubled Silicon Valley Financial institution, which triggered instability in USDC over the weekend.

Stablecoin dominance

This information could have spooked a small portion of institutional traders, main them to diversify their funds into different stablecoins or fiat USD, in response to Danny Chong, co-founder of DeFi platform Tranchess. US officers shortly intervened to guard depositors of SVB and grant them entry to their cash, however the extreme market response triggered USDC’s worth to drop to a low of $0.8726 on March 11 earlier than recovering to $0.99 two days later.

In distinction, Binance’s stablecoin, BUSD, has confronted regulatory actions within the US, inflicting market contributors to hunt out different fiat-backed choices and boosting USDT’s demand. After the New York Division of Monetary Providers instructed Paxos to halt producing new BUSD final month and the SEC issued a Wells Discover, BUSD’s market cap has proven observable indicators of decline.