Be part of Our Telegram channel to remain updated on breaking information protection

Tether USDT, the favored stablecoin pegged to the US greenback, has just lately skilled a depegging phenomenon, inflicting fairly a stir within the cryptocurrency market.

Higher protected than sorry: USDT -> USDC.

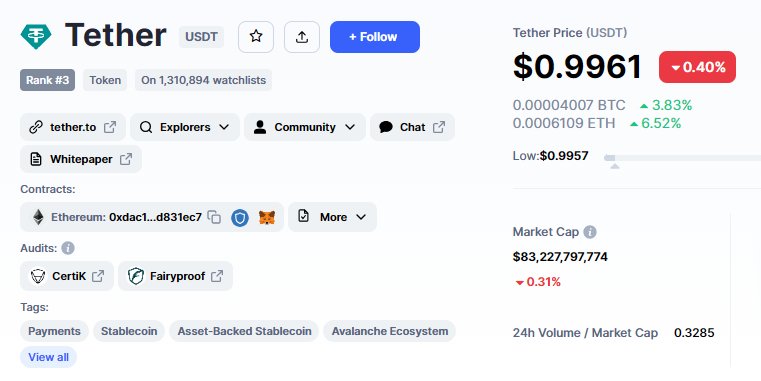

USDT has depegged by 0.4% and will depeg by much more.

Let’s discover what’s happening 🧵 pic.twitter.com/84v5OwOzeX

— defizard (@belizardd) June 15, 2023

One consequence of the depegging is the overflowing liquidity swimming pools on Curve and Uniswap. These have been flooded with USDT sellers. Because of this, USDT briefly traded under its standard parity of $1. The scenario is especially regarding in Curve’s 3Pool, the main liquidity pool for USDT buying and selling, which has grow to be closely imbalanced.

$USDT DEPEG🚨😳

👀 USDT Depegs Once more As Whales Dump Largest Stablecoin.

Tether wobbles as Curve 3Pool turns into imbalanced🤯

🧵👇🏼👇🏼 pic.twitter.com/rXfxZdqttQ

— Budhil Vyas (@BudhilVyas) June 15, 2023

At the moment, the pool contains $57M price of DAI, $56M price of USDC, and a staggering $267M price of USDT. Which means Tether stablecoin constitutes a major 70.26% of the pool. It’s removed from the best distribution of 33.3% every for USDT, USDC, and DAI.

Merchants are actively offloading their USDT holdings in favor of DAI or USDC. This has precipitated USDT’s dominance in Curve 3pool to surpass 50%. The final time this occurred was throughout the collapse of FTX change in November 2022.

The imbalance in Curve 3Pool had occurred many instances prior to now, like in March when USDC and DAI’s balances exceeded 45% every. The same imbalance occurred after the crash of the Terra ecosystem in Could 2022. This precipitated USDT to grow to be unstable and quickly lose its peg.

USDT Depegs -0.4%

At any time when there’s an extra of a selected stablecoin in a pool, it may result in a slight depegging.

Equally, the elevated weightage of Tether stablecoin in Curve’s 3Pool precipitated its depegging by -0.4% to $0.99578.

This raised considerations amongst buyers and merchants who depend on the steadiness of stablecoins for his or her transactions and investments.

The worth is at present hovering round $0.99801, which means the stablecoin has recovered virtually half its value drop.

At the moment, USDT is -0.19% down in 24 hours, with a market cap of $83 billion. The 24-hour Buying and selling quantity is $29 billion with 43.24% features.

Though USDT has sometimes skilled value discrepancies earlier than, it has by no means sustained a chronic depeg from its supposed worth of $1. Due to this fact, market members weren’t panicking and hoped it could rebound.

$USDT depeg really isn’t a foul signal that’s being portrayed, it has marked the underside in historical past!

“Historical past Doesn’t Repeat Itself, however It Typically Rhymes”

— Siddharth Singhal (@sidddearth) June 15, 2023

Arbitragers Benefiting from USDT Depegging

Market members swiftly responded to this de-peg by borrowing a considerable quantity of USDT from the decentralized lending platform Aave.

Debtors took benefit of the devalued Tether stablecoin by promoting it for DAI or USDC. These two maintained their customary 1:1 peg with the US greenback.

One fascinating case concerned an Ethereum deal with referred to as CZSamSun.eth. The deal with used collateral consisting of 17,400 ETH and 14,690 stETH to borrow $31.5M USDT from Aave 2. They then exchanged this USDT for 31.47M USDC at $0.997 on Curve. After making deposits amounting to $10 million in V2 and $21 million in V3, the borrower proceeded to take a mortgage of 12 million USDT from V3 and transferred it to V2.

𝐔𝐒𝐃𝐓 𝐃𝐄𝐏𝐄𝐆 𝐒𝐓𝐎𝐑𝐘 📖📖

👉 A whale CZSamSun borrowed 31.5M USDT and swapped it for #USDC, inflicting $USDT to depeg.

👉 Different huge whales have began to swap USDC for #USDT, which has resulted in USDT slowly coming again in the direction of its peg.

👉 The #FUD within the crypto… pic.twitter.com/EBYY0Ivk95

— Smart Recommendation By Sumit Kapoor (@sumitkapoor16) June 15, 2023

One other deal with, 0xd2, capitalized on the USDT depegging by depositing 52,200 stETH through Aave V2 and borrowing $50M USDC.

This dealer strategically swapped massive quantities of Tether at a reduced fee utilizing borrowed USDC.

USD Coin was nonetheless on its 1:1 peg to the US greenback. They wagered that if USDT ultimately returned to its 1:1 peg, they may promote their USDT for a revenue.

In response to the sudden surge in demand for USDT loans, Aave’s algorithmic mannequin routinely adjusted its rates of interest.

This helped preserve market equilibrium. Consequently, the deposit fee skyrocketed to over 15%, and the borrowing fee surged by greater than 25%.

#usdt depeg comes as its provide annual proportion fee (APR) on Aave protocol rose to virtually 15% from 2.75% in lower than 24 hours.

In line with knowledge supplied by the lending platform, variable and secure borrowing annual proportion yields (APY) have risen considerably. pic.twitter.com/xfISnhEn3B

— B4CRYPTO (@B4CRYPTOTW) June 15, 2023

The USDT depegging and subsequent occasions have highlighted the potential dangers and alternatives throughout the stablecoin market. Whereas stablecoins are designed to take care of a gentle worth, they aren’t resistant to market forces. As demonstrated by the actions of those merchants, fluctuations in stablecoin costs will be exploited for revenue, particularly when there’s a non permanent depegging.

Tether CTO Remarks on USDT Depegging

Tether’s Chief Technical Officer, Paolo Ardoino, took to Twitter to reassure the crypto group that the de-peg scare isn’t a trigger for concern, emphasizing that they’re ready to redeem any quantity of Tether.

Ardoino additionally shared a “FUD meme” addressing the market rumors surrounding Tether’s depeg.

Markets are edgy in as of late, so it’s straightforward for attackers to capitalize on this basic sentiment.

However at Tether we’re prepared as at all times. Allow them to come.

We’re able to redeem any quantity.— Paolo Ardoino 🍐 (@paoloardoino) June 15, 2023

This latest scare of stablecoin depegging comes only a few months after the USDC depegging incident in March 2023, when USD Coin fell under $0.9. Buyers’ portfolios took nice hits on the time. All these occurred after Circle confirmed having over $3 billion caught with Silicon Valley Financial institution.

Circle managed to assemble adequate capital to revive the USDC worth to the greenback inside two days. Nevertheless, the harm had been finished as panic precipitated many merchants to exit USDC at a loss.

Paolo Ardoino, the Tether CTO, expressed that the market is at present tense. He talked about that latest information and different elements are inflicting main teams to withdraw from the crypto markets.

Ardoino highlighted Tether’s function as a gateway for incoming and outgoing liquidity. He defined that when curiosity in crypto grows, they see inflows, however throughout adverse market sentiment, outflows happen. Ardoino additionally acknowledged the potential for a direct assault on Tether, citing incidents from 2022.

Learn Extra:

Wall Road Memes – Subsequent Large Crypto

- Early Entry Presale Dwell Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Finest Crypto to Purchase Now In Meme Coin Sector

- Staff Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection