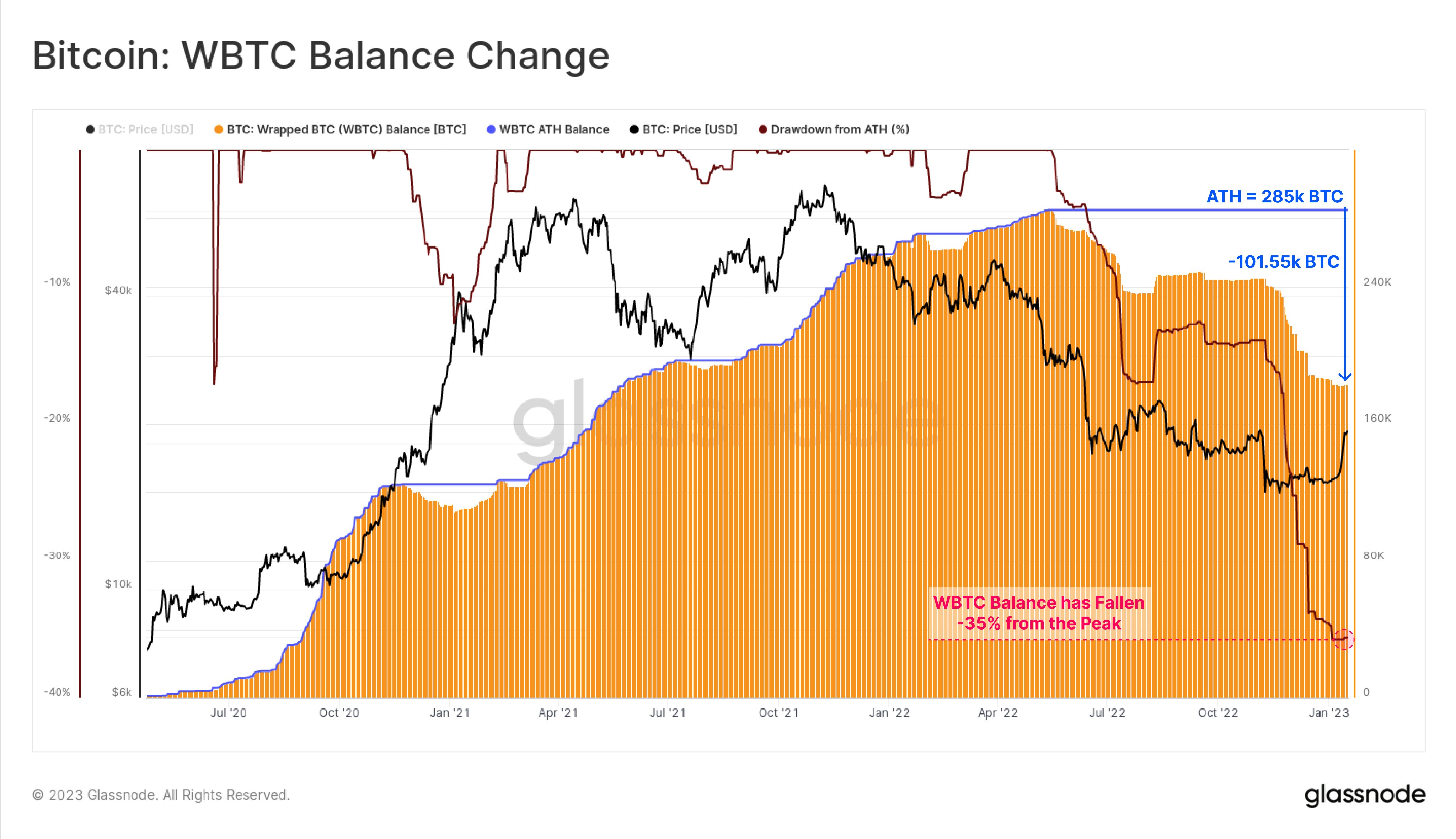

Wrapped Bitcoin (WBTC) provide on Ethereum (ETH) plunged by over 35% to 183,450 since Terra (LUNA) collapsed in Could 2022, in response to Glassnode information.

WBTC’s market cap fell to as little as $3.10 billion in December 2022 from a peak of $13.03 billion in April 2022, in response to CryptoSlate information.

The chart above exhibits that WBTC’s provide peaked at 285,000 in April 2022, when the flagship digital asset was buying and selling at round $48,000. Throughout this era, demand for the asset was comparatively excessive as traders discovered a use for it of their Decentralized finance (DeFi) trades.

Nonetheless, LUNA’s collapse led to a contagion unfold throughout a number of crypto companies and resulted in record-high liquidations amongst traders. On the time, whales like Celsius Community had been reportedly redeeming their WBTC holdings — sending 9,000 WBTC to FTX in a potential OTC deal to fulfill its rising redemption requests.

The state of affairs was additional exacerbated when prime WBTC retailers — Alameda Analysis and FTX —confronted a liquidity disaster in November 2022.

WBTC began to de-peg underneath the belief that its reserves had been incomplete or held on the collapsing crypto empire — the disparity between BTC and WBTC costs falling to 0.9774 on Nov. 25, 2022.

In the meantime, the hole has since closed with relative calm returning to the market, however demand for BTC on the ETH blockchain has remained muted.

The asset’s order e book exhibits 180,447.6213 WBTC towards 180,455.0500 BTC in custody as of press time.