Macro Overview

Financial institution of Japan makes an attempt to rescue the Yen

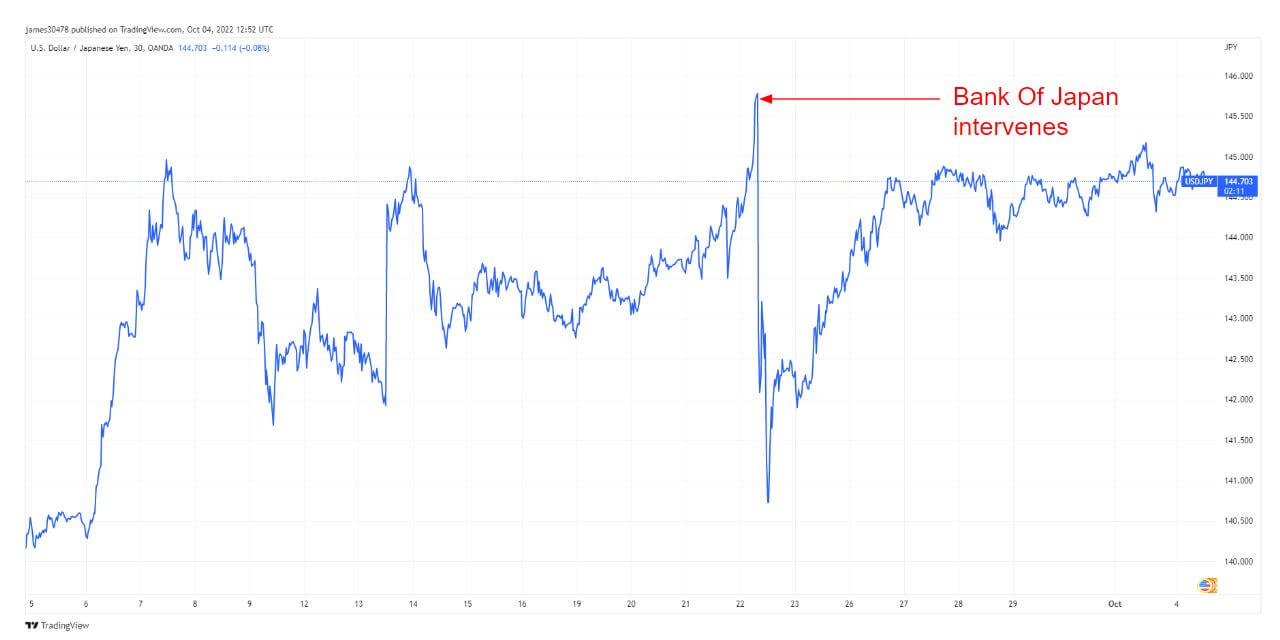

On Sept. 22, the Financial institution of Japan (BOJ) turned the primary central financial institution to intervene with their forex to stop a forex collapse by way of FX intervention. A number of days later, the Financial institution of England turned the second financial institution to intervene.

Reuters reported that the BOJ spent as much as $20 billion to prop up the Japanese Yen, which was the primary fx intervention in nearly 25 years.

The yen was crashing in opposition to the U.S. greenback and briefly hit 146 to the greenback; after the intervention, the yen went right down to 140, a 4% drop. The $20 billion intervention price nearly 15% of the funds that the BOJ has out there. Since Sept. 22, the yen has been creeping upwards and again at 145. What occurs if the yen breaches 146? Will the BOJ intervene as soon as once more?

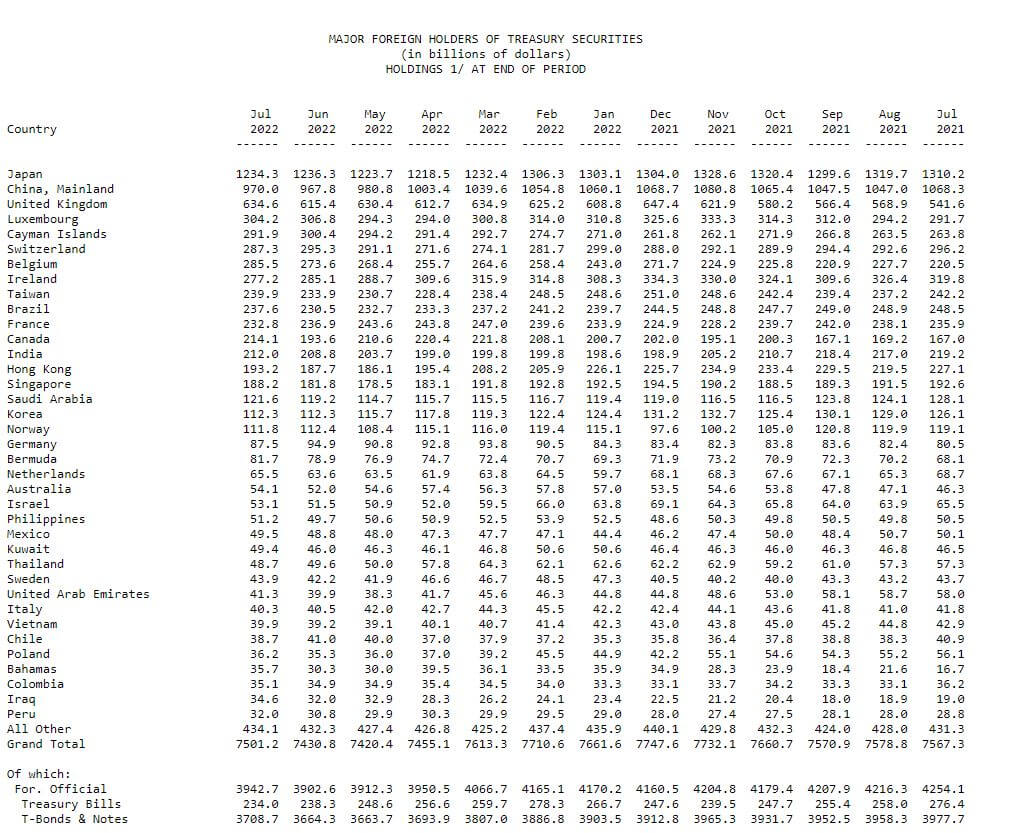

Japan holds roughly $1.2 billion in reserves and is the primary international holder of US debt; China is the second largest holder, in accordance with the chief economist at Totan Analysis.

“Even when it had been to intervene once more, Japan seemingly wouldn’t must promote U.S. Treasury payments and as an alternative faucet this sediment in the meanwhile,” – Izuru Kato.

As soon as the deposits have been used, BOJ might be pressured to promote U.S. treasuries, immediately correlating with U.S treasury yields going greater (which is unhealthy for U.S bonds). The foremost international holders of treasury securities are Japan (17%) and China (12%), who personal 29% of all foreign-held US Treasuries and are chargeable for 99% of 2022’s promote strain.

US treasury yields will quickly rise sharply as international governments promote USTs to get extra U.S. {dollars} to pay for greater vitality prices over the approaching months. As well as, to quantitative tightening from the federal reserve, which can be promoting treasuries, placing additional strain on yields.

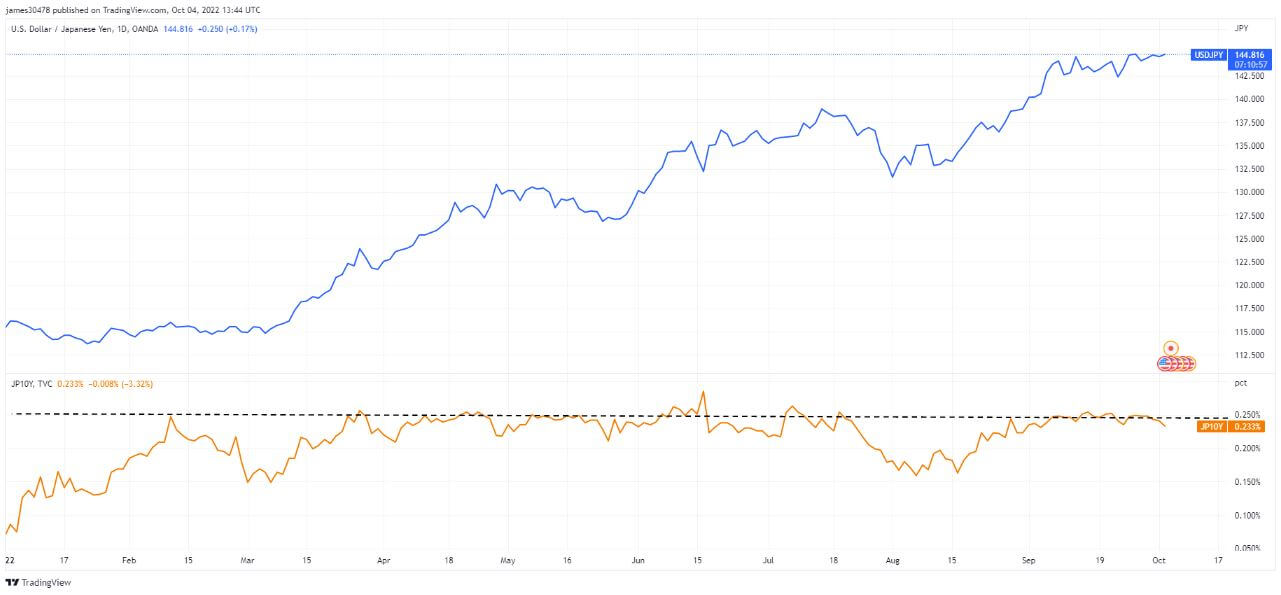

As this is occurring, the BOJ maintains its agency stance on its yield curve management, maintaining its 10-year rates of interest at 0.25%; the Yen will act as a launch valve going greater and better in opposition to the united statesdollar.

Correlations

Bitcoin is one of the best horse within the race

Since Bitcoin’s inception, it has confronted criticism from all completely different angles. It’s solely utilized by criminals, has no intrinsic worth, makes use of an excessive amount of vitality, and so on. Nonetheless, whichever means it’s checked out, Bitcoin has outperformed all conventional property, with a 2-year time horizon or longer.

A ratio used to measure threat and volatility is the Sharpe ratio. It’s a technique to measure a return of an funding primarily based on threat and volatility over a particular interval. The chart beneath tracks the Sharpe ratio of BTC vs. conventional property throughout a two-year time horizon. It has included the typical of the 30-day U.S treasury invoice, which is benchmarked because the risk-free price.

Bitcoin has made important features over the previous decade vs. USD, Gold, and S&P 500. The Sharpe ratio identifies if the returns are well worth the volatility to endure as an investor. The chart beneath exhibits that holding BTC over a protracted interval is well worth the volatility and notably has a a lot greater Sharpe ratio than different property.

Equities & Volatility Gauge

The Commonplace and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 massive corporations listed on exchanges in the USA. S&P 500 3,639 -0.62% (5D)

The Nasdaq Inventory Market is an American inventory change primarily based in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Trade. NASDAQ 11,039 -1.15% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, concern, or stress out there when making funding selections. VIX 31 -4.82% (5D)

Bear Market Rally

Oct. 3 and 4 noticed the S&P 500 rip 5.7% greater, one of the best two-day development since April 2020. Nonetheless, as a result of a powerful U.S. jobs report on Oct. 7, the S&P 500 has retraced greater than .618 of that acquire.

Equities have barely bounced from their year-to-date lows, with some information that the fed could also be nearing the top of its mountaineering schedule. Markets are forward-looking, and August noticed essentially the most important month-to-month drop in U.S. job openings since April 2020, whereas Australia raised rates of interest by a smaller-than-expected 25 bps.

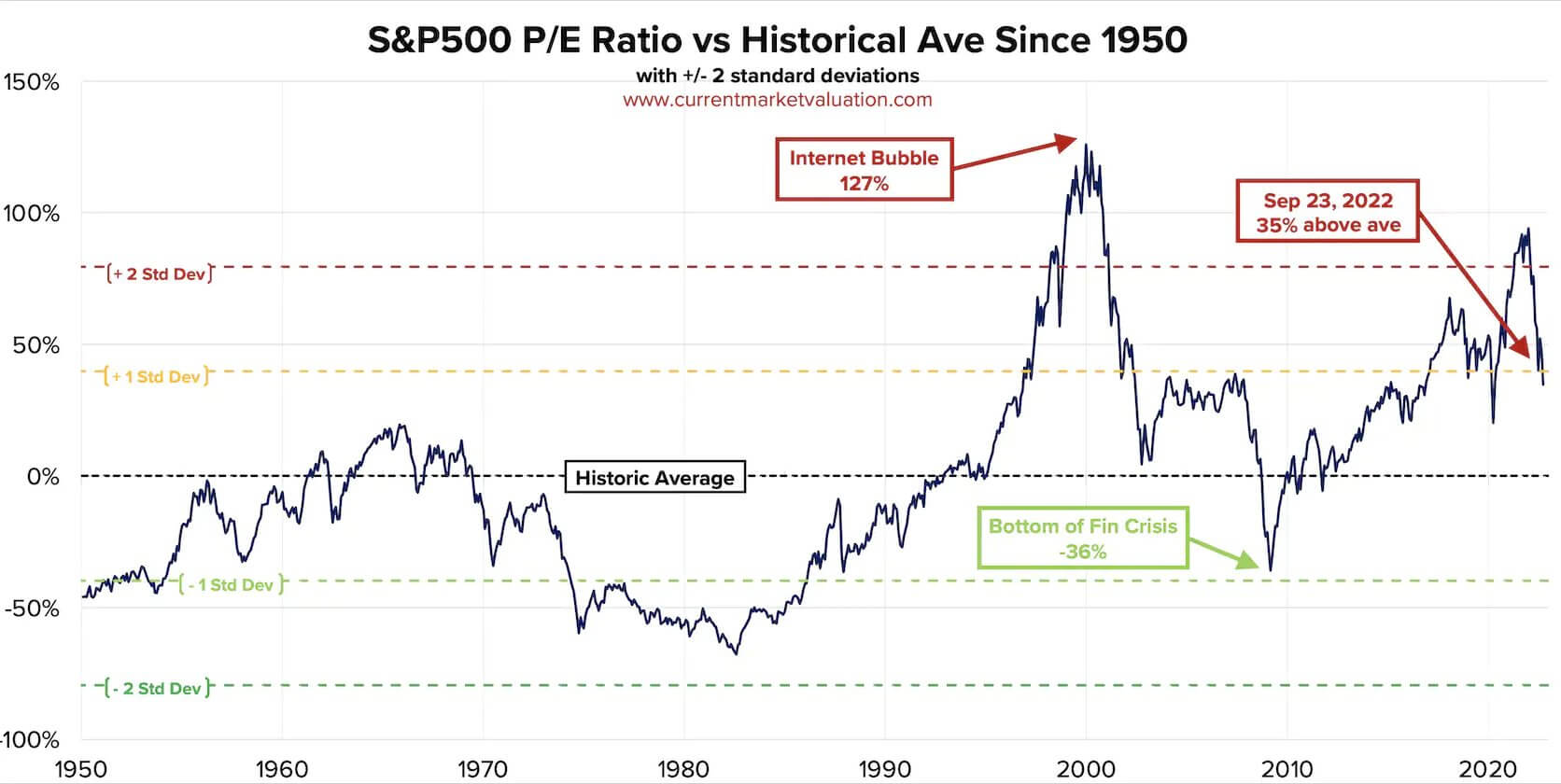

Nonetheless, the fairness market P/E ratio continues to be significantly overvalued when trying again on historical past. At present, the market continues to be one commonplace deviation above the historic imply, coupled with essentially the most strong greenback in 20 years and credit score threat seeing new highs in 2022. Inflation continues to be operating riot, so additional ache is anticipated.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge in opposition to inflation and forex devaluation, all assist drive the value of the dear metallic. Gold Worth $1,695 1.84% (5D)

Just like most commodities, the silver value is set by hypothesis and provide and demand. It is usually affected by market situations (massive merchants or traders and quick promoting), industrial, industrial, and client demand, hedge in opposition to monetary stress, and gold costs. Silver Worth $20 5.34% (5D)

The value of oil, or the oil value, typically refers back to the spot value of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $99 12.34% (5D)

Commodities are operating sizzling

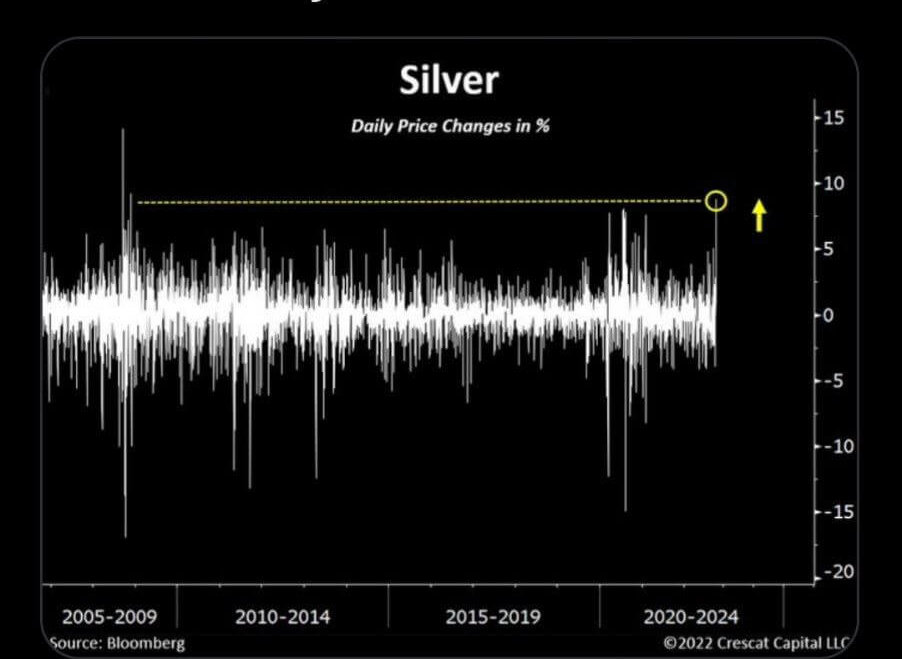

There appears to be an expectation that the fed is nearing the top of its tightening schedule within the fund’s price, whereas the U.N. is asking on the fed and different central banks to halt rate of interest will increase. This has seen an enormous rally in commodities, most notably silver. Silver was up over 7% on Oct. 3, and the final time silver was up as a lot as 7% was November 2008, which was the underside out there, and over the following two years, it rallied over 400%.

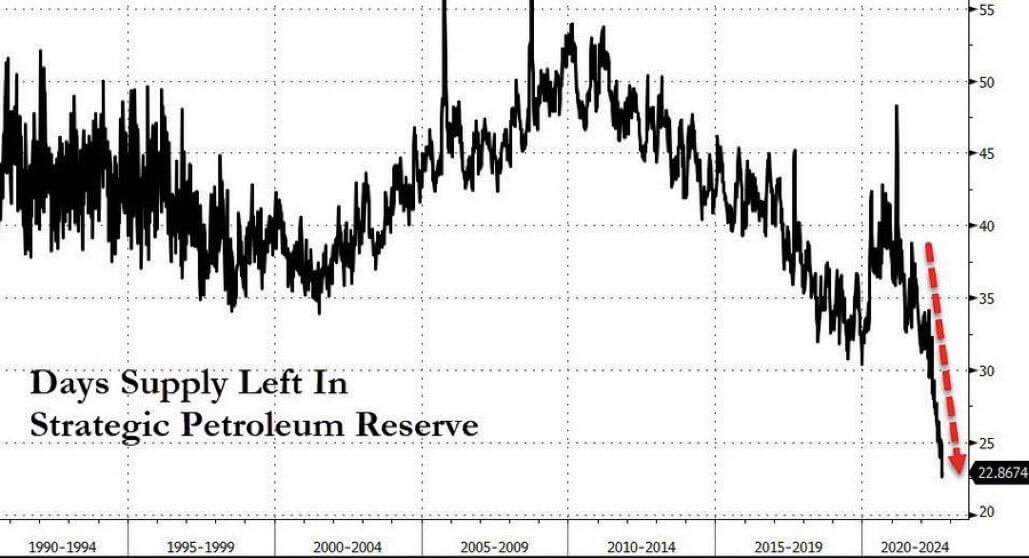

The place’s all of the petroleum reserve gone?

The US Strategic Petroleum Reserve is down -35% because the begin of final 12 months, to ranges not seen since 1984. The 5 most important drawdowns in SPR historical past have occurred within the earlier 5 months, with September’s 34M barrels (-7.5%) being essentially the most important single draw ever.

After the OPEC+ and President Biden choice, the united stateswould have burnt by way of their Strategic Petroleum Reserve, with solely 23 days of provide left, to cut back oil costs forward of the mid-term elections.

Charges & Foreign money

The ten-year Treasury word is a debt obligation issued by the USA authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury word pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.88% 1.36% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign exchange. DXY 112.7 0.53% (5D)

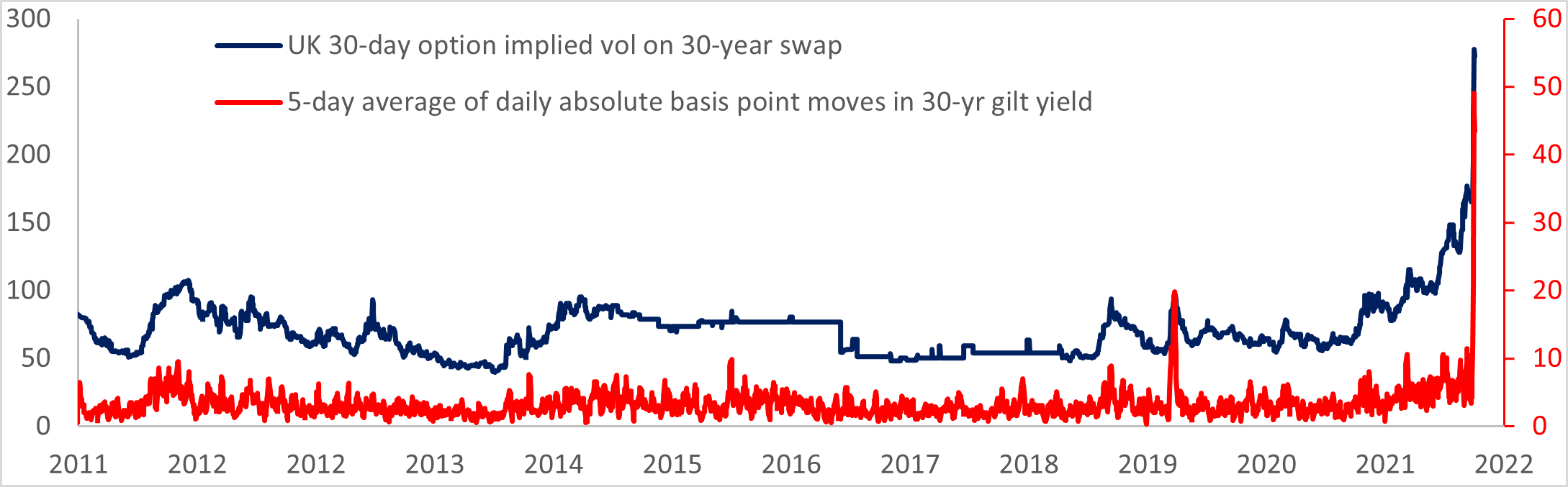

Severe market dislocation

Within the final week of September, numerous chaos occurred within the fixed-income market because the lengthy finish of the gilt curve was not the obvious place to discover a blow-up in extra derivatives publicity. In the UK, pension funds confronted margin calls that noticed the gilt market face pandemonium and a fast sale of gilts.

The BOE stepped in with a bailout (the place have we heard that earlier than?) that noticed the benchmark 30-year value on the gilt leap over 25%. The lengthy finish of the yield curve historically strikes round 5 foundation factors every day; the present volatility in charges resembles meme shares blowing up throughout the mania of 2021.

The basic problem is the UK is experiencing nearly double-digit inflation with a BOE that’s refusing to tighten financial coverage meaningfully. Subsequently long-term inflation will keep elevated. As well as, the BOE was offloading gilts on their steadiness sheet; now, on the first signal of systematic threat, they’re shopping for once more whereas elevating rates of interest. The date to be careful for is Oct. 14, because the gilt gross sales will finish, however this might contribute to a a lot larger rate of interest hike than first thought.

Bitcoin Overview

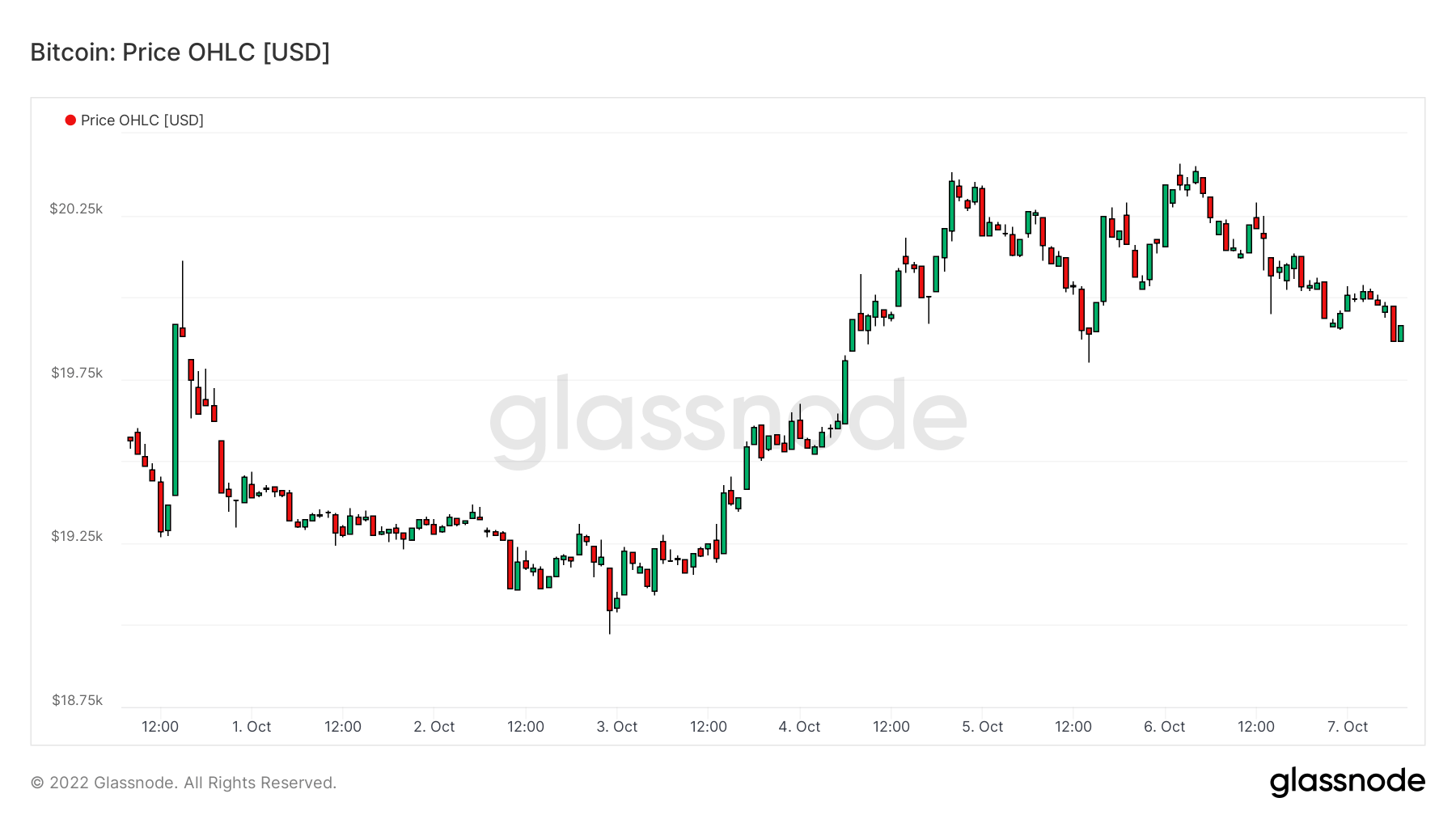

The value of Bitcoin (BTC) in USD. Bitcoin Worth $19,560 1.75% (5D)

The measure of Bitcoin’s complete market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 41.28% 0.03% (5D)

- Hash price hits all-time excessive – 248.64 EH/s

- Lightning capability surpasses 5k BTC

- Futures contracts denominated in BTC hit an all-time excessive

- Whales promoting BTC on the third most aggressive price in historical past

- Shrimps proceed to stack amid macro uncertainty

- Asia commerce premium is at its highest level in 2022

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that had been lively within the community both as a sender or receiver. Solely addresses that had been lively in profitable transactions are counted. Energetic Addresses 889,323 3.09% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 2,856,153 2.94% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 905,374 0.11% (5D)

The variety of distinctive addresses holding at the least 1k BTC. Addresses with Stability ≤ 1k BTC 2,117 -0.09% (5D)

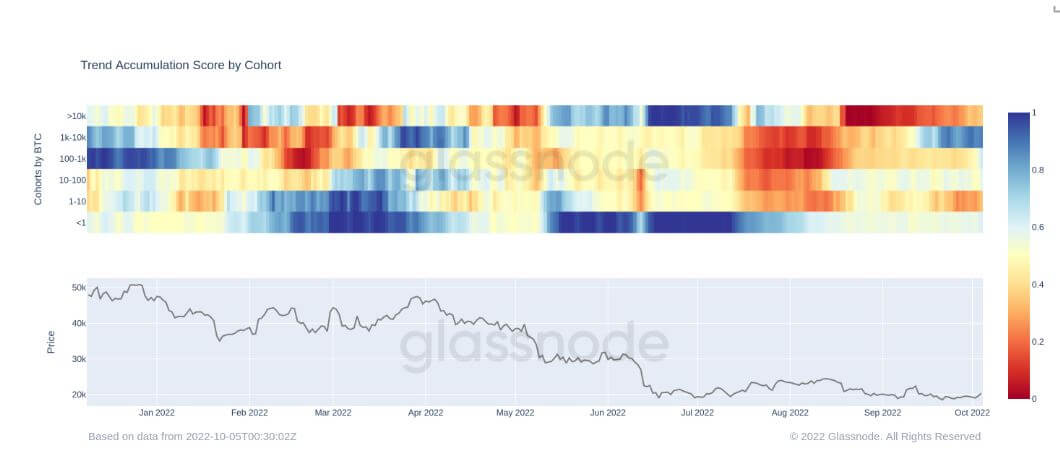

Heavy distribution from a variety of cohorts

This metric breaks down the Accumulation Development Rating into the relative conduct of varied entity pockets cohorts.

The relative power of the buildup for every entity steadiness is measured by each the dimensions of the entities and the quantity of cash they’ve acquired over the past 15 days. For extra particulars on calculation methodology, please see this Academy entry.

- A price nearer to 1 signifies that contributors in that cohort are accumulating cash.

- A price nearer to 0 signifies that contributors in that cohort are distributing cash.

- A listing of entities, together with exchanges and miners, is excluded from the calculation.

For the previous three months, from July to September, there was a comparatively small quantity of accumulation from many alternative cohorts. In July, shrimps and whales had been accumulating at probably the most aggressive charges in historical past. Nonetheless, since then, all cohorts have began to be web distributors.

As we enter a worldwide recession, liquidity dries up, and unemployment begins to spike. Bitcoin turns into essentially the most liquid asset to promote to pay for any debt obligations; on this surroundings, it will be encouraging to see smaller cohorts at 0.5 to represent no distribution however holding onto their Bitcoin.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to supply a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that had been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which are managed by the identical community entity and are estimated by way of superior heuristics and Glassnode’s proprietary clustering algorithms. Energetic Entities 275,303 -0.88% (5D)

The variety of BTC within the Goal Bitcoin ETF. Goal ETF Holdings 23,596 0% (5D)

The variety of distinctive entities holding at the least 1k BTC. Variety of Whales 1,686 -0.41% (5D)

The whole quantity of BTC held on OTC desk addresses. OTC Desk Holdings 3,975 BTC 31.62% (5D)

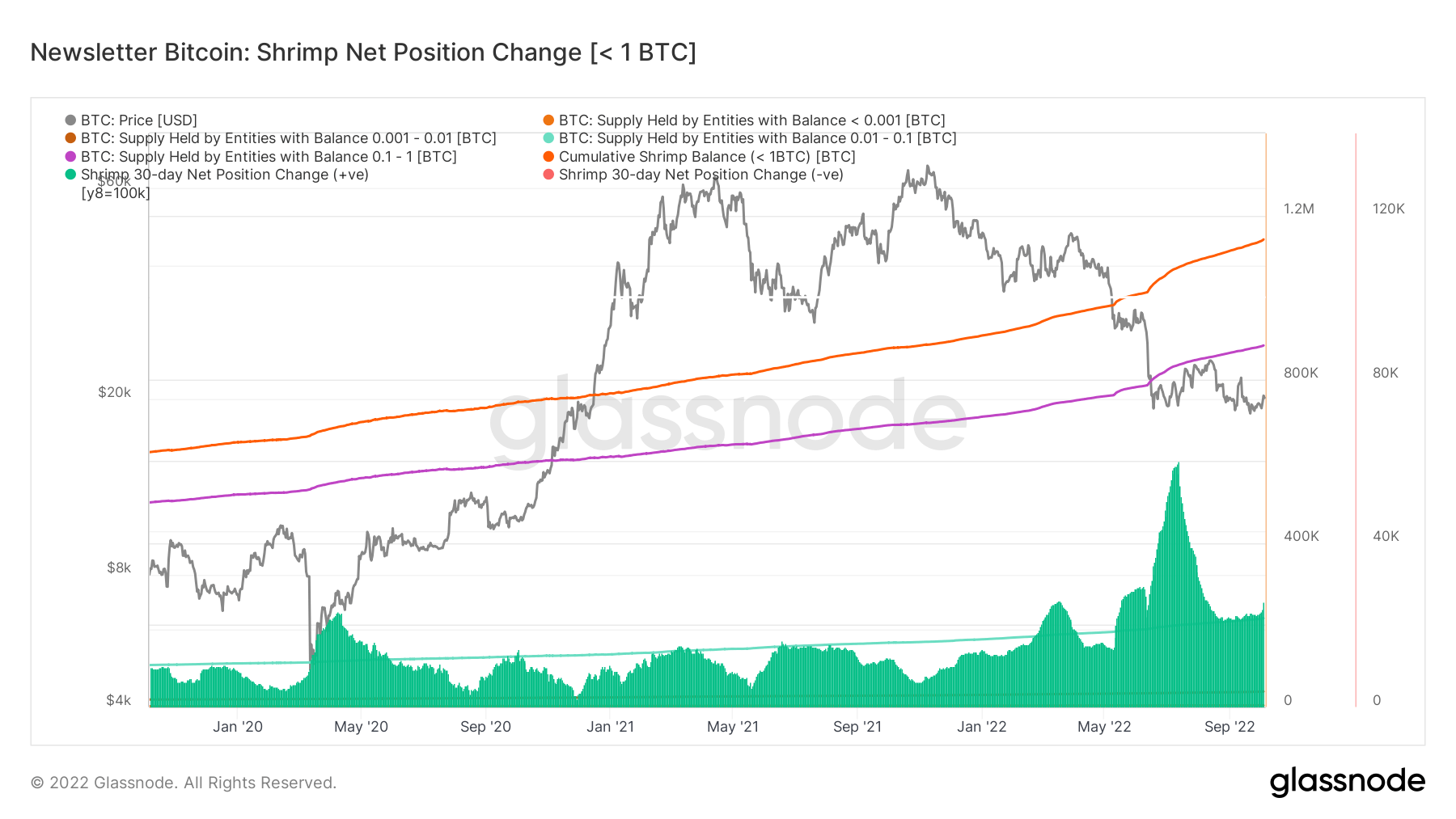

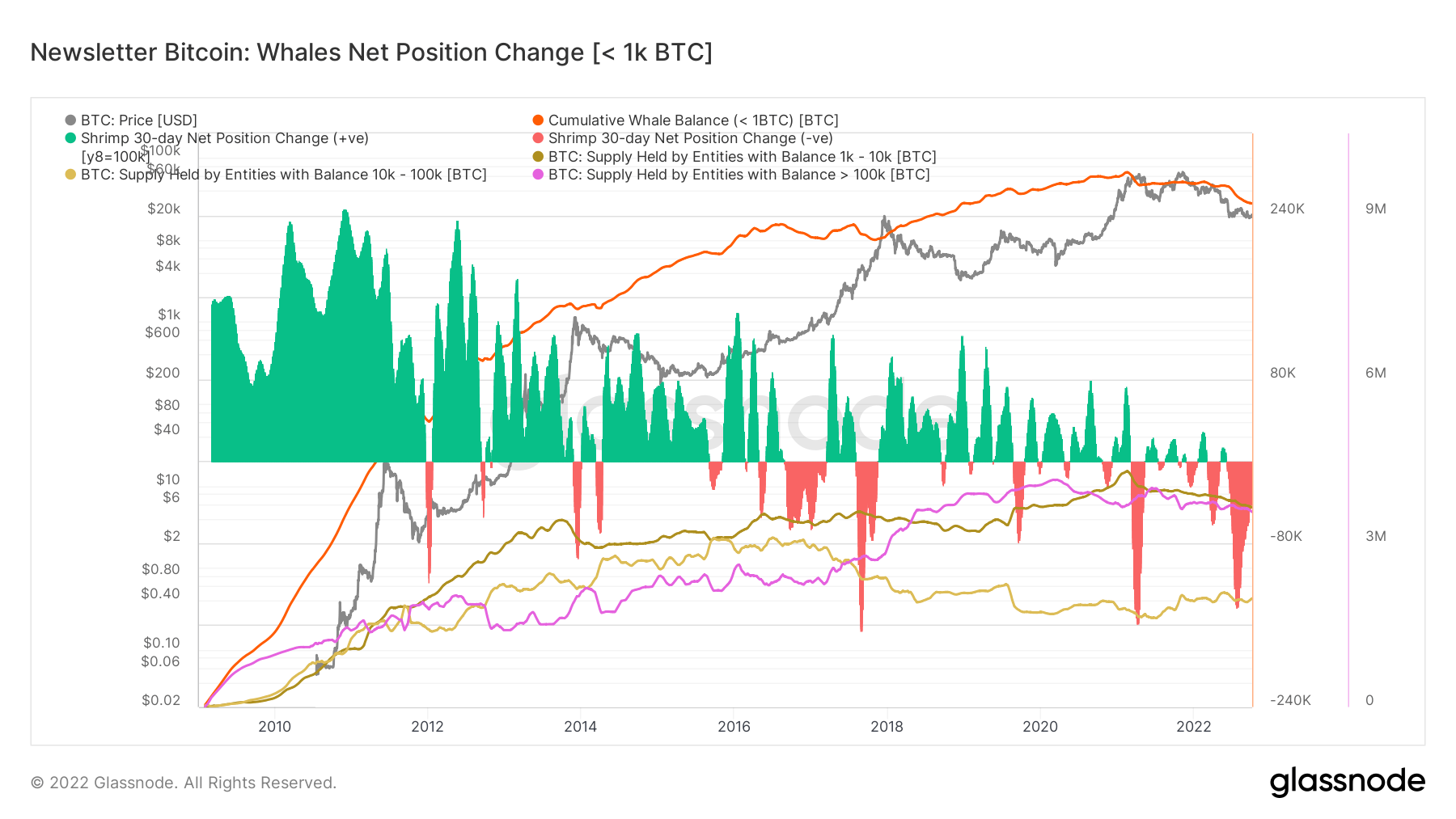

Whales vs. shrimps

An additional deep dive into whale and shrimp holdings might be summarized beneath. Shrimps are a cohort for those who maintain one or much less Bitcoin, and their holdings have risen since covid dramatically. The 30-day web place change has at all times remained constructive, exhibiting that this cohort accumulates greater than they distribute and has elevated their bullishness as time passes.

Nonetheless, whales holding 1K BTC or extra have been on a distinct journey. They’re thought-about the good cash of the ecosystem, and throughout the 2017 and 2021 bull run, they distributed essentially the most BTC reaping huge quantities of revenue. At present, they’re in one in all their most prolonged promoting intervals on the third most aggressive quantity, and contemplating BTC is buying and selling for round $20,000, it doesn’t bode nicely within the quick time period.

Dervatives

A by-product is a contract between two events which derives its worth/value from an underlying asset. The most typical varieties of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/value from the underlying property.

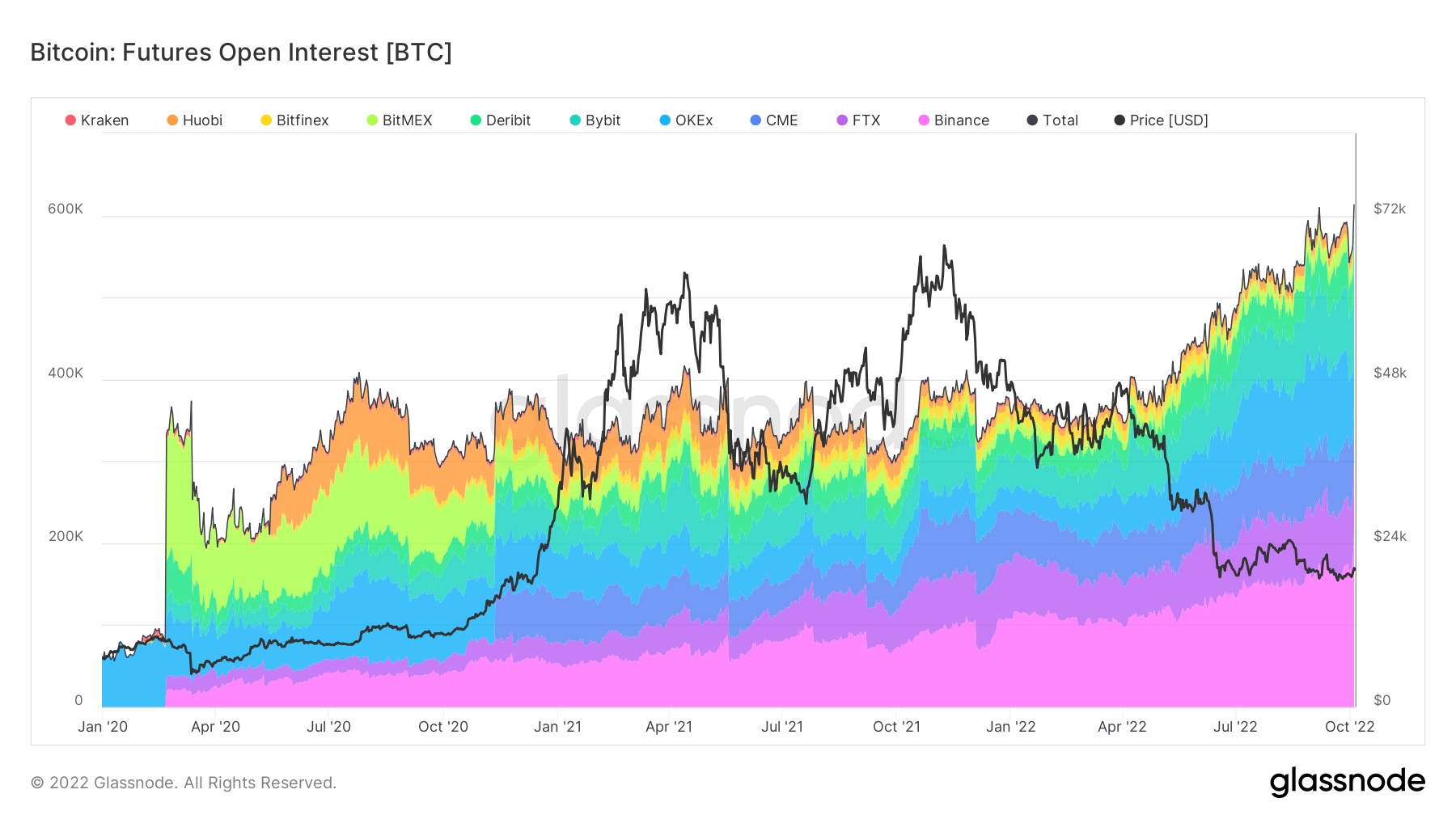

The whole quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $12.05B 5.94% (5D)

The whole quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $34.38B $-26.09 (5D)

The sum liquidated quantity (USD Worth) from quick positions in futures contracts. Complete Lengthy Liquidations $42.01M $0 (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Brief Liquidations $42.01M $0 (5D)

Merchants piling into futures

Bitcoin surpassed $20k this week, with an enormous serving to hand in a rally in equities however most grateful to merchants piling into futures.

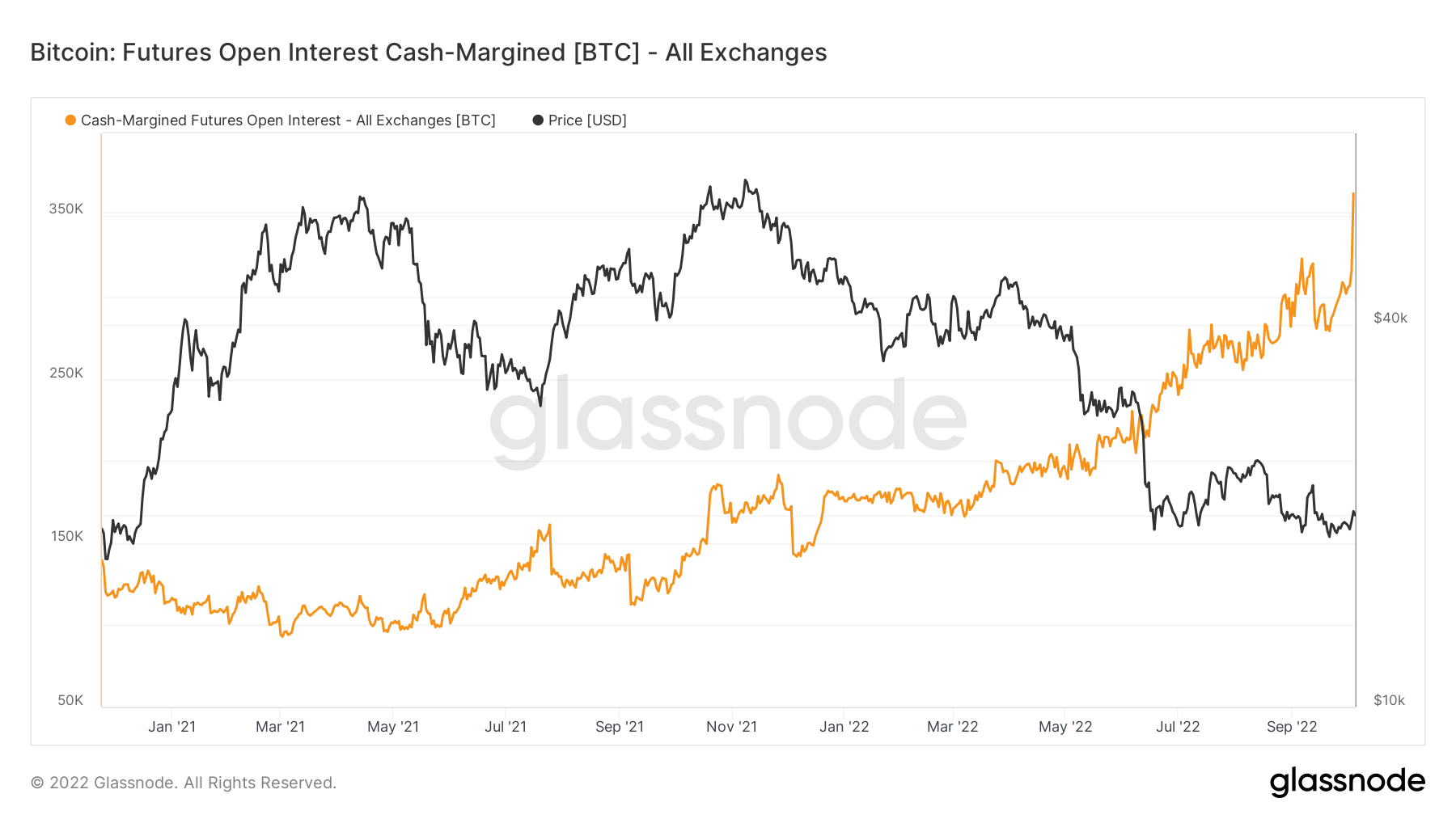

Futures open curiosity money margined is the overall quantity of futures contracts open curiosity that’s margined in USD or USD-pegged stablecoins. Stablecoins embody USDT and BUSD. On Oct. 4, it went to an all-time excessive, surpassing 350k, with little spot shopping for exercise occurring, which isn’t sustainable.

With open Curiosity build up, there’s potential for a liquidation cascade (on both shorts or longs) if the value deviates far sufficient from this vary. Roughly $450 million of Bitcoin open curiosity was opened above $19,500 value ranges on Oct. 4 — assuming the bulk is aggressive longs are actually underwater.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

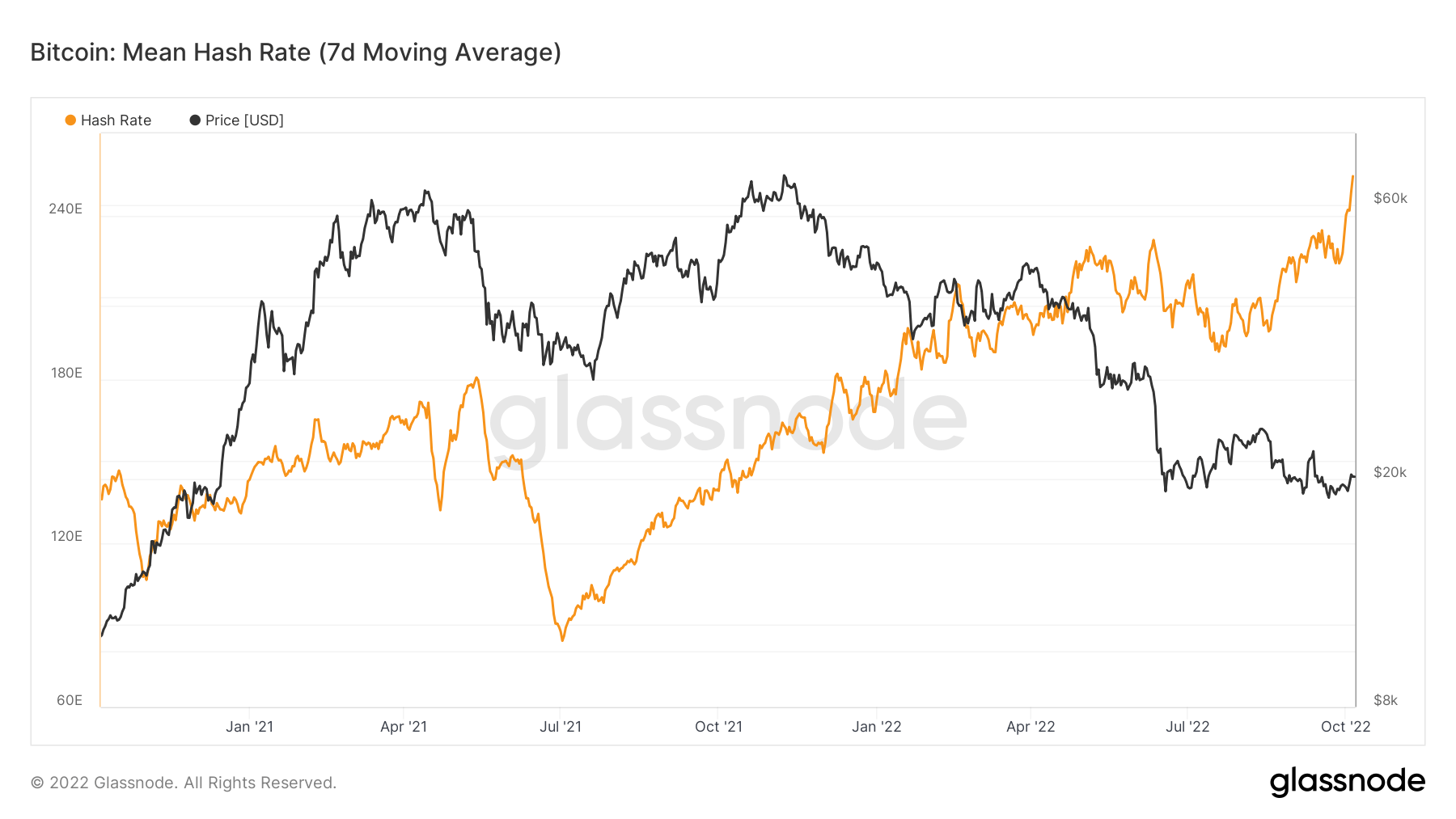

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 273 TH/s 23.53% (5D)

The whole provide held in miner addresses. Miner Stability 1,834,077 BTC -0.04% (5D)

The whole quantity of cash transferred from miners to change wallets. Solely direct transfers are counted. Miner Web Place Change -14,396 BTC 9,551 BTC (5D)

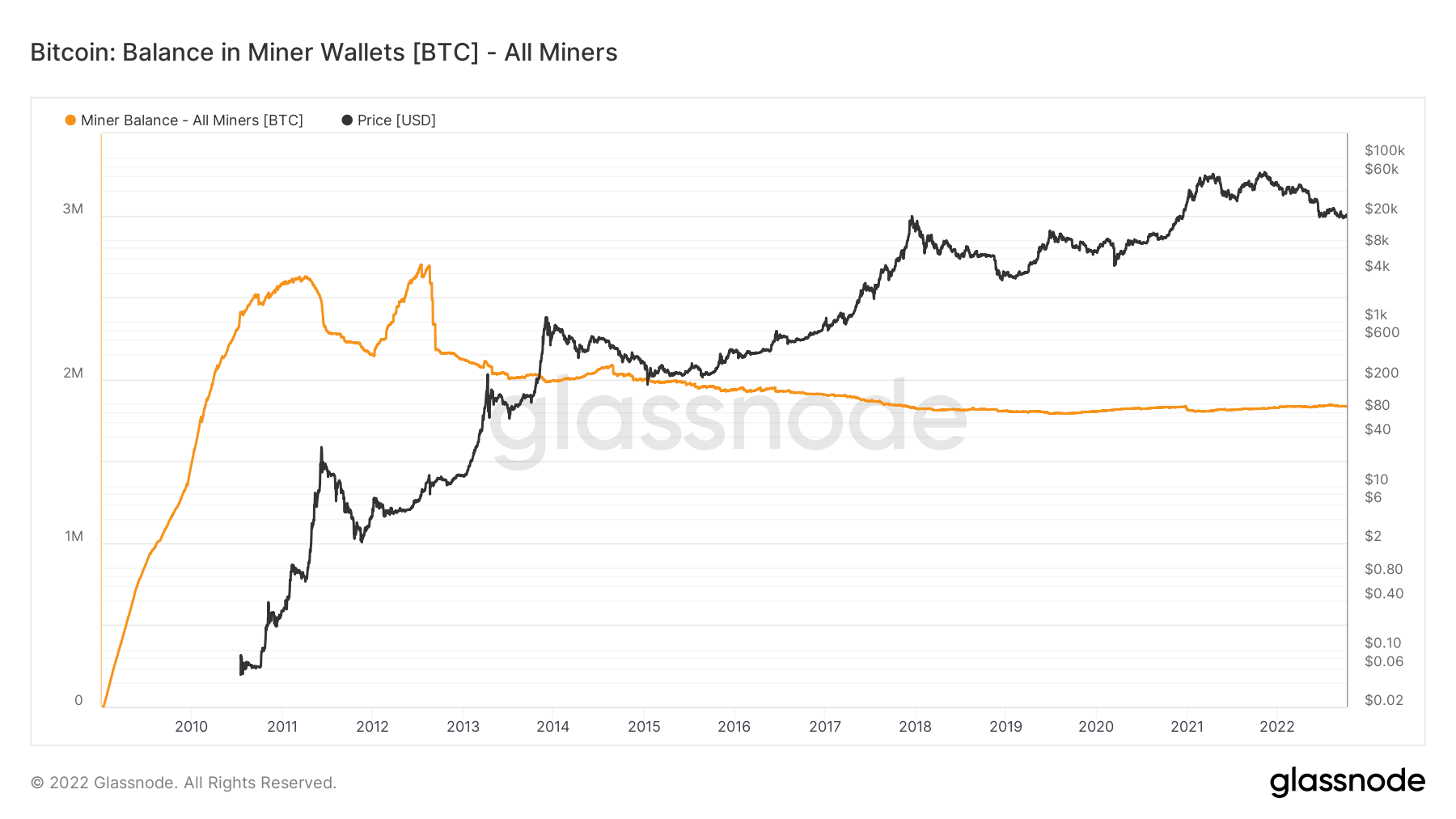

Proof of labor is the fairest consensus

Miner steadiness is at its lowest level in Bitcoin phrases since 2010. That is the ability that proof of labor offers, steadily creating an equal distribution of the forex throughout time.

Miner steadiness has seen massive outflows since costs had been rejected from the native prime of $24,500. This means miner profitability continues to be beneath stress, as over 8k BTC had been offered in September to cowl USD-denominated prices.

Hash price hits all-time excessive

Bitcoin’s hash price has soared to new all-time highs of 248.64 EH/s, now 3X from the lows reached throughout the China mining ban. With an anticipated issue adjustment of over 10% on Oct. 10, miners proceed to get squeezed when it comes to income, however the community is stronger than ever.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized change exercise.

The whole quantity of cash held on change addresses. Trade Stability 2,382,098 BTC -31,430 BTC (5D)

The 30 day change of the availability held in change wallets. Trade Web Place Change 281,432 BTC -325,248 BTC (30D)

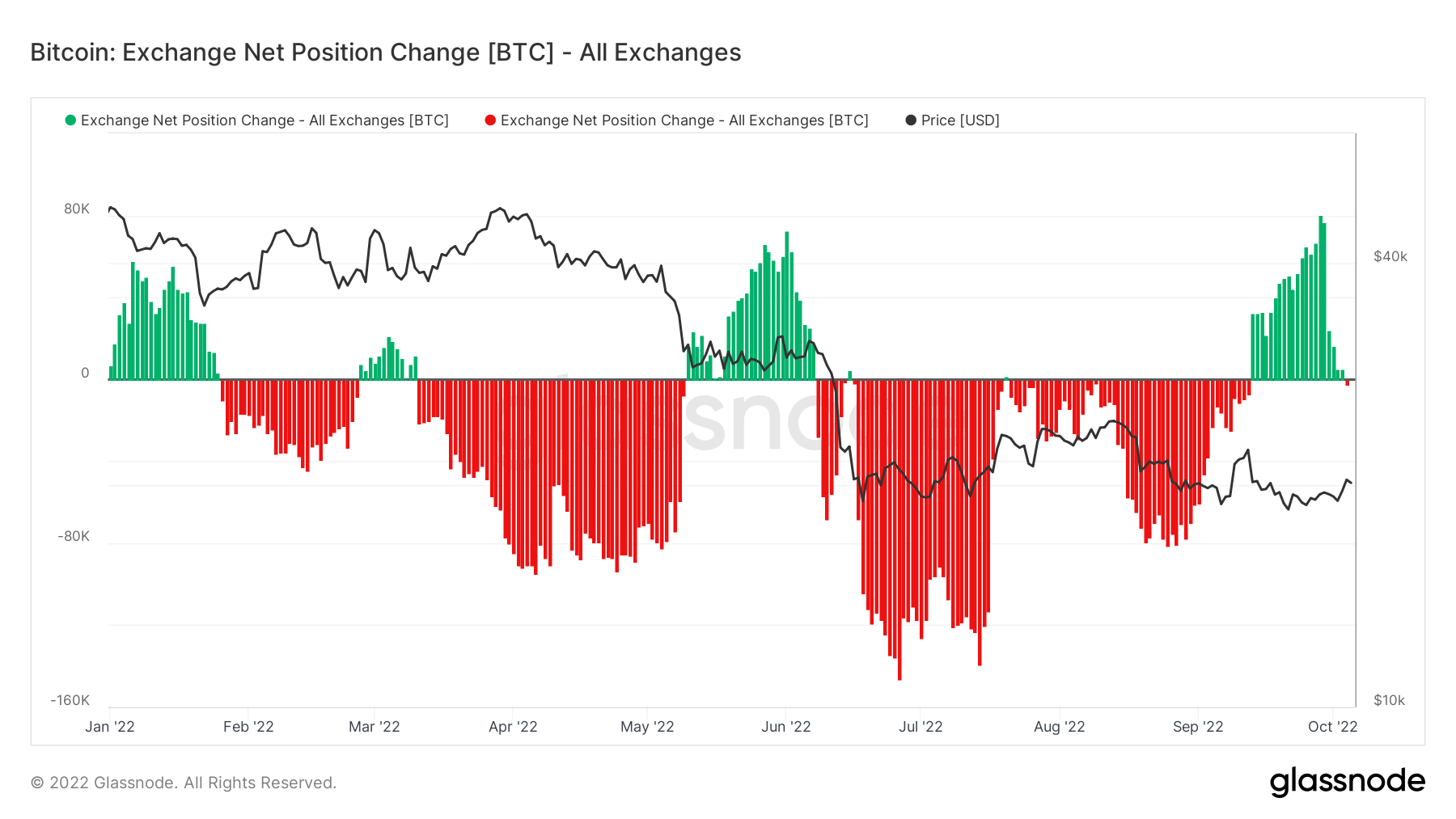

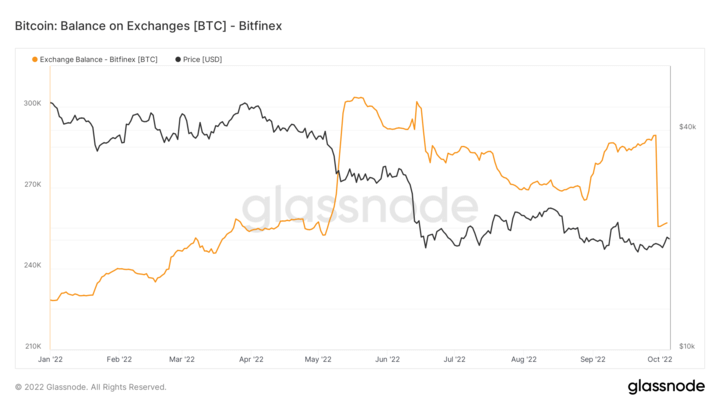

Outflows from exchanges, first time in nearly a month

2022 has seen intervals of inflows and outflows from exchanges, and looking out on the metric change web place change; it’s straightforward to grasp traders’ rationale.

When the Russian invasion came about, the Luna collapse and the macro uncertainty being at excessive ranges in September all noticed intervals of inflows to exchanges. Traders had been fearful and offered. Nonetheless, the opposite intervals of 2022 have seen aggressive outflows. As many as 100k BTC had been leaving exchanges, which was bullish.

Bitfinex noticed a major quantity of BTC being withdrawn from their exchanges in the beginning of October, over 30k BTC ($6 billion). This has contributed to decreasing inflows to exchanges over 30 days; for a extra constructive narrative, Bitcoin outflows want to stay to indicate investor urge for food continues to be there.

Geo Breakdown

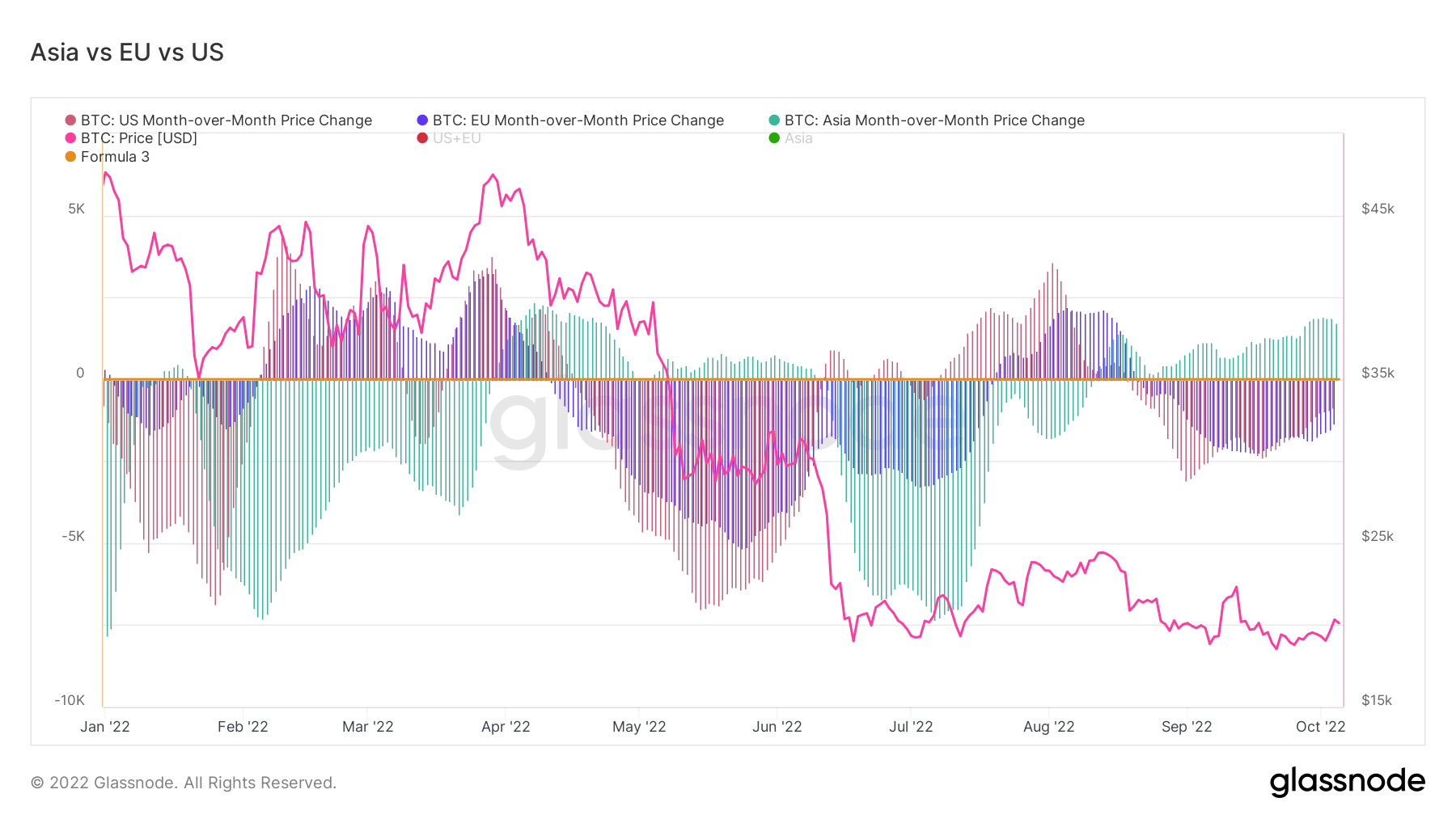

Regional costs are constructed in a two-step course of: First, value actions are assigned to areas primarily based on working hours within the US, Europe, and Asia. Regional costs are then decided by calculating the cumulative sum of the value modifications over time for every area.

This metric exhibits the 30-day change within the regional value set throughout Asia working hours, i.e. between 8am and 8pm China Commonplace Time (00:00-12:00 UTC). Asia 11,601 BTC -987 BTC (5D)

This metric exhibits the 30-day change within the regional value set throughout EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer season Time (06:00-18:00 UTC). Europe -8,172 BTC 4,785 BTC (5D)

This metric exhibits the 30-day change within the regional value set throughout US working hours, i.e. between 8am and 8pm Jap Time (13:00-01:00 UTC), respectively Jap Daylight Time (12:00-0:00 UTC). U.S. -5,466 BTC 4,756 BTC (5D)

Asia commerce premium approaching 2022 highs

For the previous three months, CryptoSlate has been addressing that Asia is the good cash of the BTC ecosystem over the EU and the US. Asia purchases BTC when the value is low or being suppressed, which is exactly what has been occurring for the final three months; Asia’s bullishness has solely elevated, however the EU and US proceed to be in concern and promote their BTC holdings.

Provide

The whole quantity of circulating provide held by completely different cohorts.

The whole quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.73M BTC 0.27% (5D)

The whole quantity of circulating provide held by quick time period holders. Brief Time period Holder Provide 3.01M BTC 0.04% (5D)

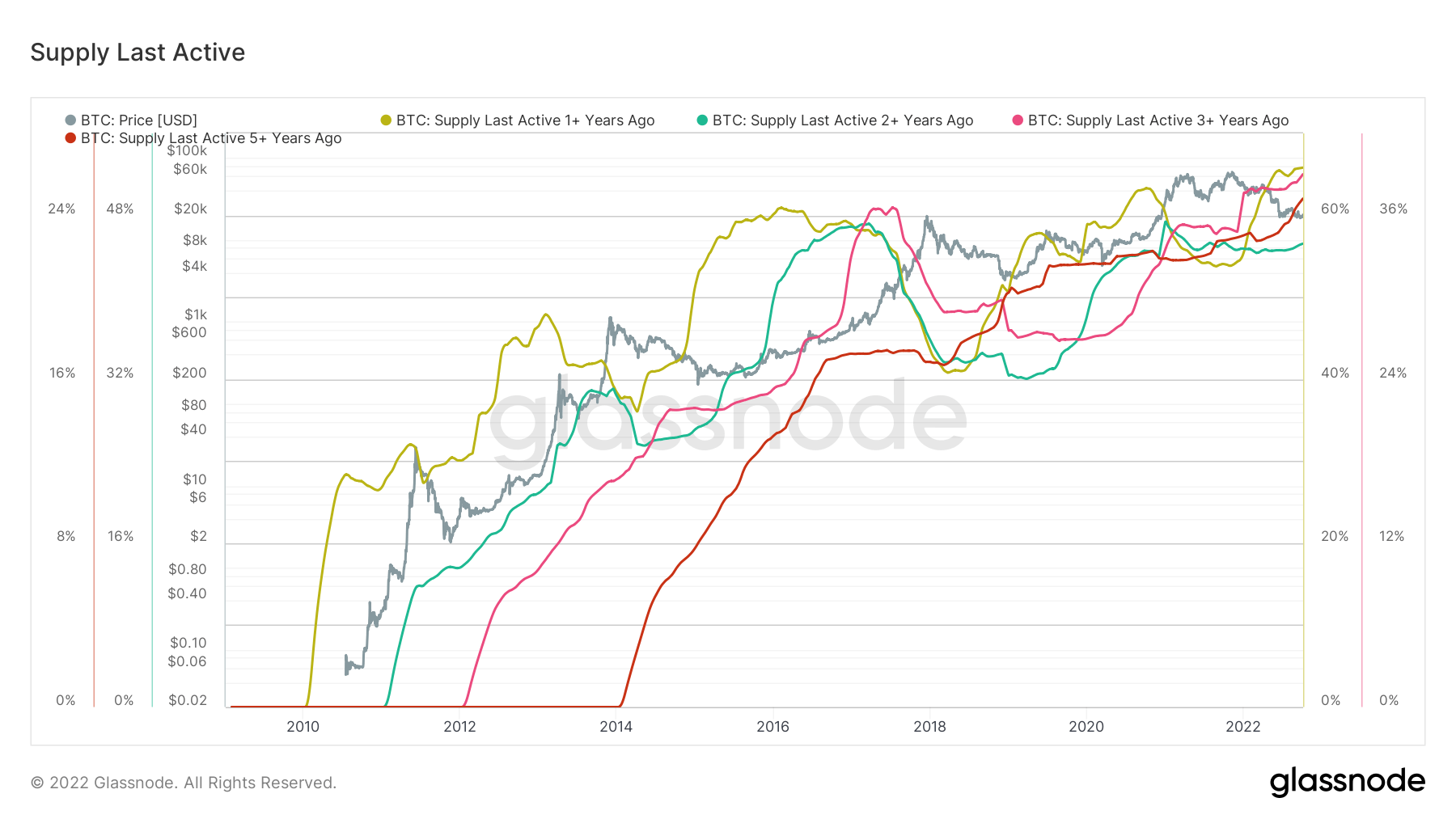

The % of circulating provide that has not moved in at the least 1 12 months. Provide Final Energetic 1+ Yr In the past 66% 0% (5D)

The whole provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.82M BTC 0.27% (5D)

Diamond arms continue to grow

The % of circulating provide that has not moved in at the least one 12 months is 66%; that is an all-time excessive. Sure, the quantity has plateaued, nevertheless it’s encouraging to see that it’s holding these excessive ranges. A lot of the holdings can be considerably underwater as we strategy the time Bitcoin hit nearly $69,000 in November 2021.

As well as, provide final lively 2,3 and 5 + years are additionally trending to all-time highs. Holders refuse to promote and maintain onto their property throughout essentially the most unstable and unsure instances.