TL;DR

- U.S. CPI sparks upward revision to the anticipated fed-funds price

- U.Ok. stays prime of the G7 inflation league, with precise CPI year-over-year of 9.9%

- GBP noticed new lows in opposition to the usdollar, similar ranges as 1985

- There’s a 30% chance of a 100bps price hike within the subsequent FOMC assembly

- Ethereum’s extremely anticipated merge happened on Sept. 15 and was profitable

- Goldman Sachs prepares for layoffs as deal-making slows

- FedEx CEO says he expects the economic system to enter a ‘worldwide recession’ as a result of an enormous miss in earnings

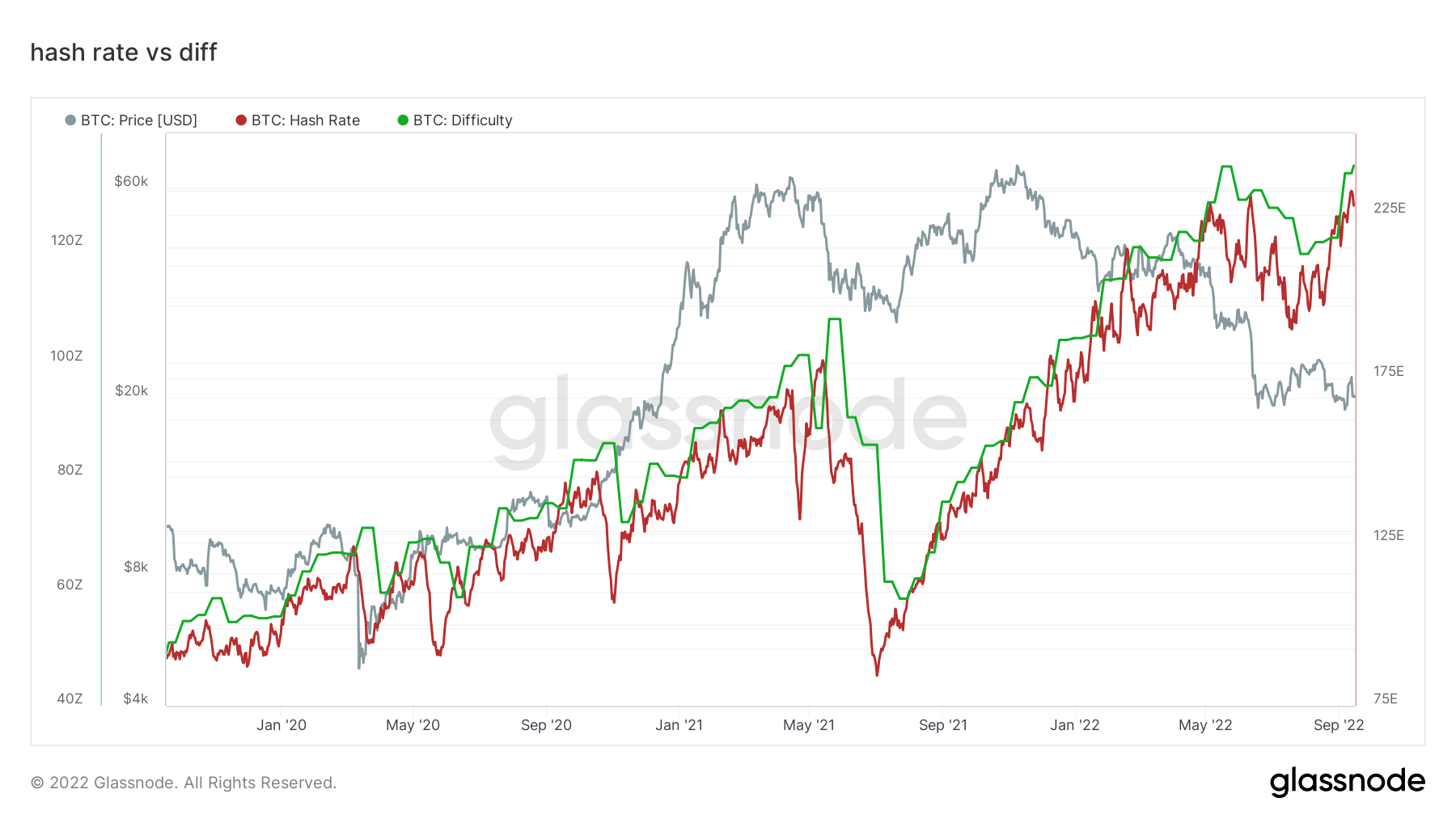

- Bitcoin’s hash price hits an all-time excessive

- Bitcoin problem adjustment hits all-time excessive

Macro Overview

CPI sparked a revision upwards to the anticipated fed-funds price

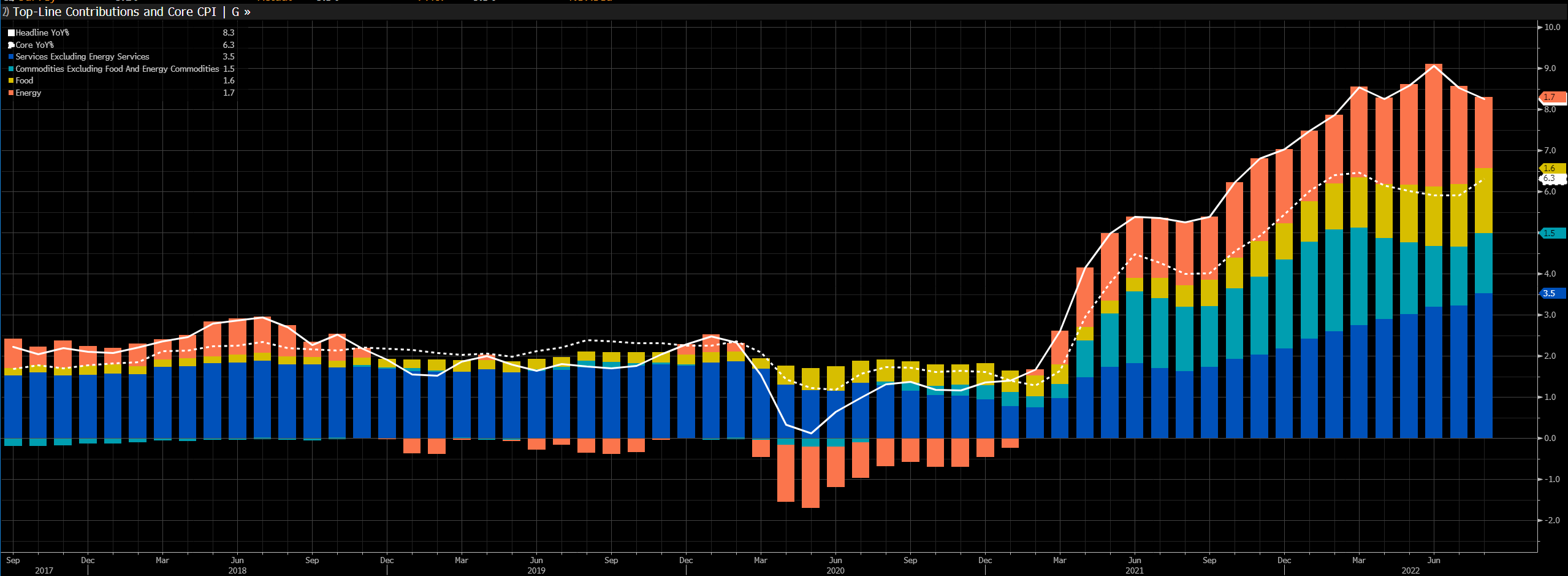

One other upside U.S. inflation report sank hopes of the tempo of coverage tightening, which despatched fixed-income yields and the greenback hovering. U.S. equities plunged within the worst one-day loss since mid-2020, with the expectation now on the fed to hike 75 bps subsequent week. Core and headline inflation exceeded forecasts which brought on traders to desert earlier assumptions of a 50 bps hike.

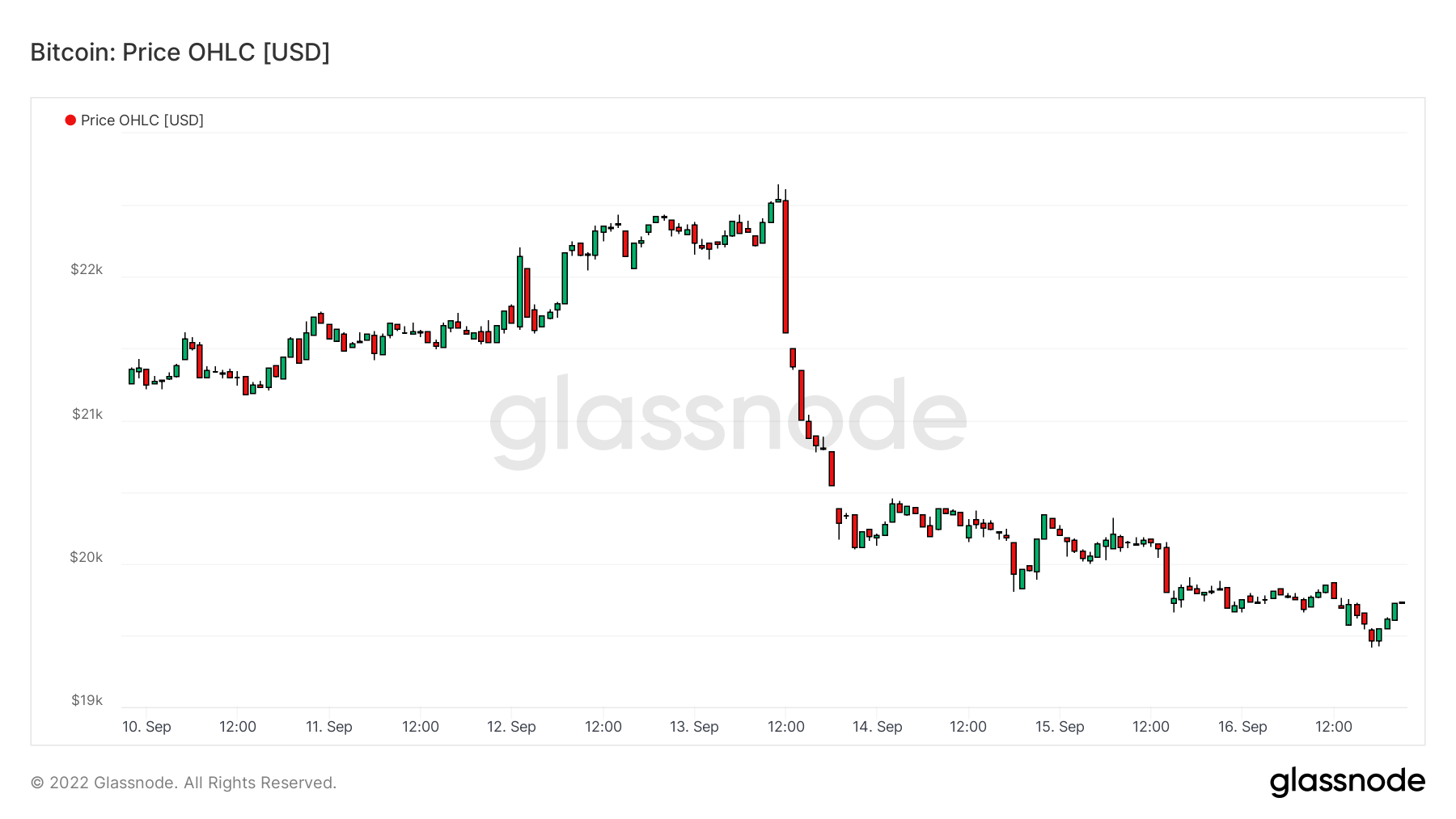

Shopper Worth Index (CPI) is the index of the variation in costs for retail items and different gadgets. Headline CPI got here in hotter than anticipated, as merchants have been satisfied we have been at ‘peak inflation,’ which despatched markets into turmoil. Nasdaq closed 5.5% decrease, Bitcoin fell beneath $20,000, and gold traded 1% beneath the earlier shut.

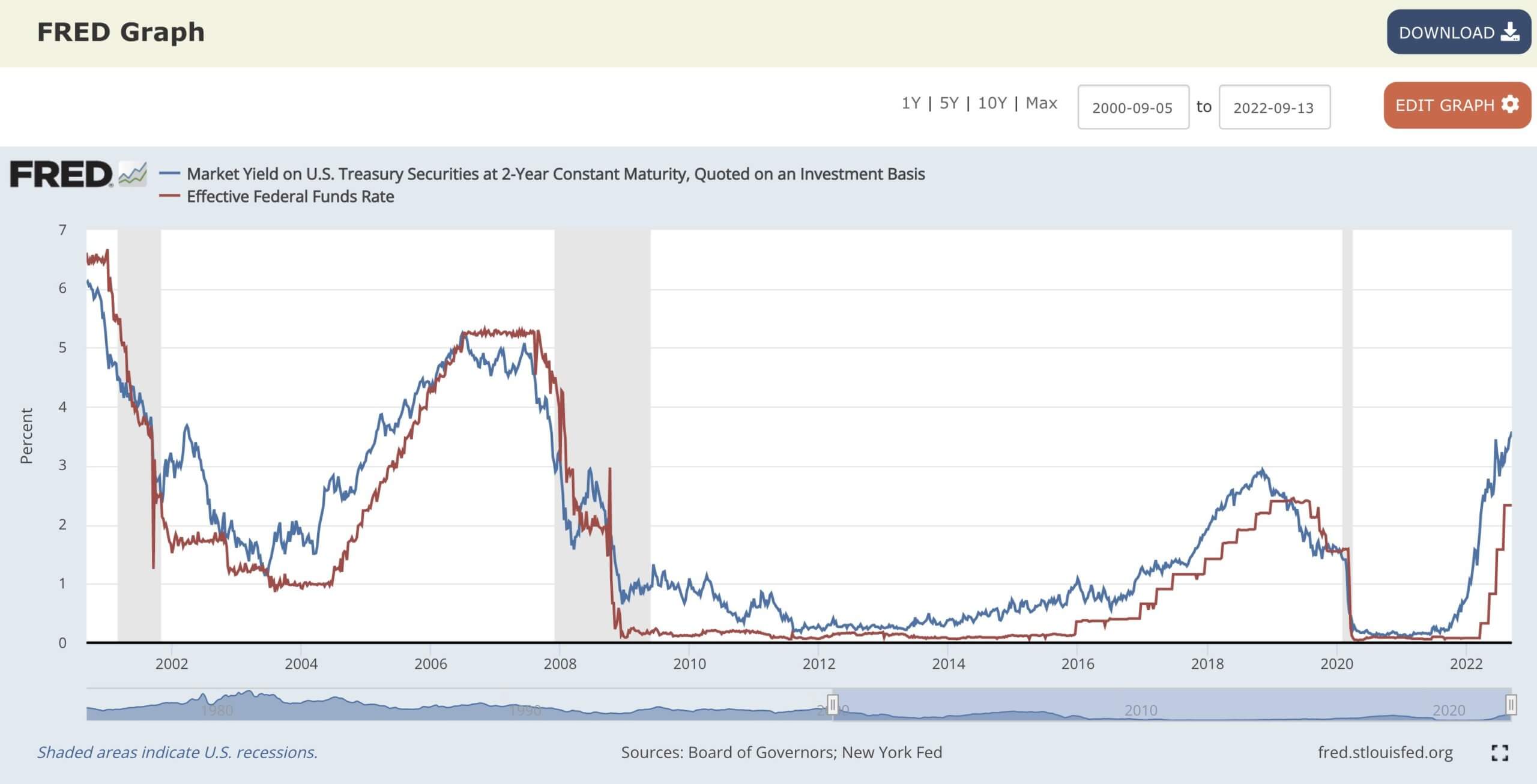

The 2-year treasury price is the yield acquired for investing in a U.S. government-issued safety with a maturity of two years. The 2-year yield is included within the shorter yield curve, which is a crucial indicator when observing the useconomy. An enormous sell-off occurred in treasuries weighted to the entrance finish that noticed the two-year treasury attain its highest level since November 2007.

Headline inflation slowed from 8.5% to eight.3% because of a ten.6% month-to-month decline in gasoline, whereas different indexes additionally fell, together with airline festivals and used automobiles. Nonetheless, this was offset by an increase in meals, shelter, and medical companies.

The inflation wasn’t simply provide chain points but in addition the fiscal and financial elements. Flooding the system with broad cash resets mixture costs greater completely, making the fed’s job to tame inflation that a lot tougher.

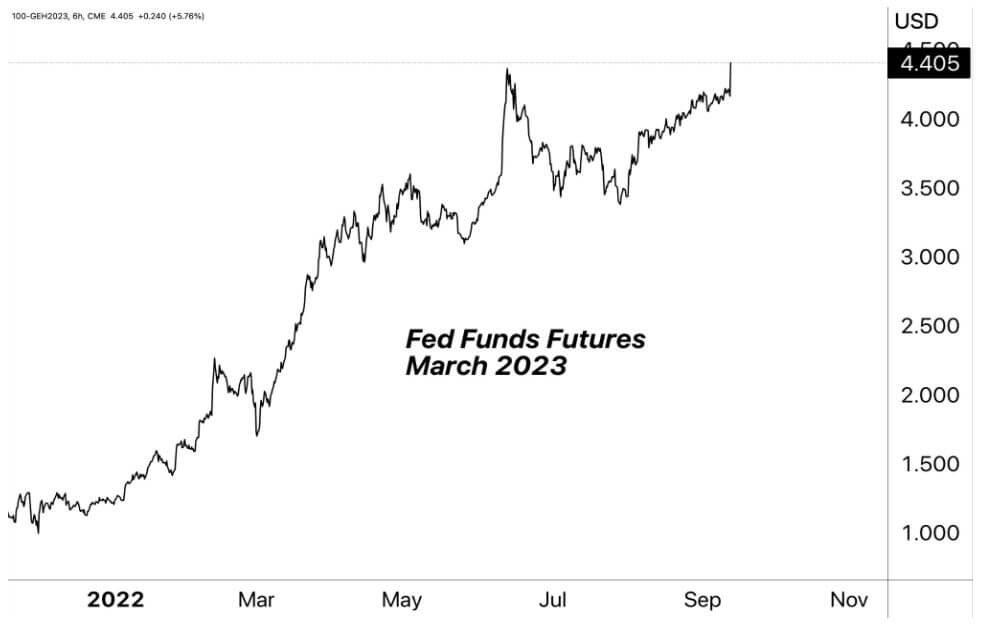

Fed funds futures exceed 4%

Inflation has been climbing for over two years, to be precise, 27 months of rising inflation. The meals index had elevated 11.4% YOY. Nonetheless, most notably, the vitality value was up virtually 25% YOY, essentially the most vital 12-month improve since Might 1979.

On account of a hotter-than-expected CPI print, the fed funds futures (derivatives primarily based on the federal funds price, the U.S. in a single day interbank lending price on reserves deposited with the Fed). Is now pricing in a 70 % likelihood of a 75 bps price hike and a 30 % likelihood of a 100 bps hike for Sept. 21. Moreover, the fed funds price is projecting a terminal velocity of 4.5% to be reached by the primary quarter of 2023 after the U.S. CPI information was launched. Threat belongings will proceed to endure as charges rise and liquidity dries from quantitative tightening (QT).

Correlations

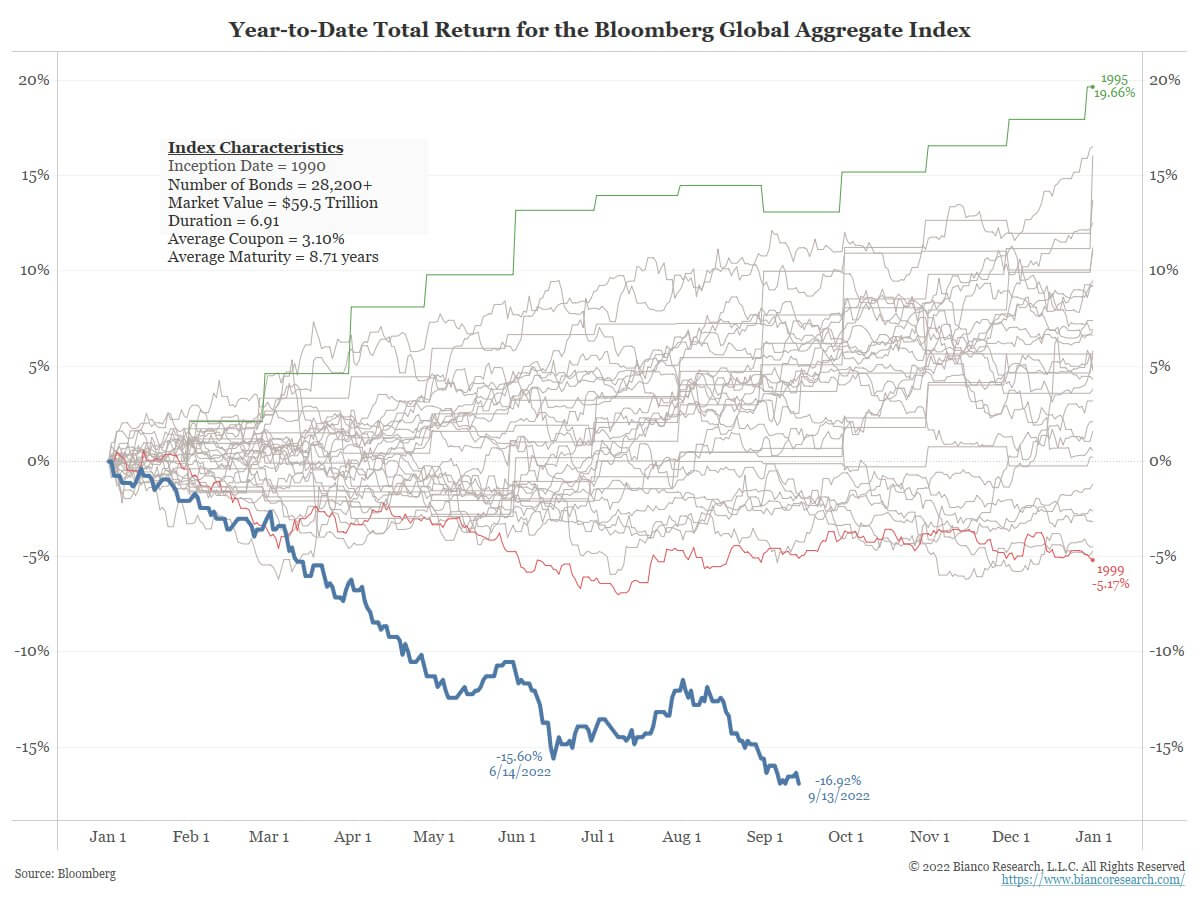

The 12 months of the bear

The bears have been dominant for almost all of 2022. Sept. 13, Dow Jones plummeted greater than 1,250 factors and is buying and selling decrease than it was after Biden’s first full day in workplace (January 2021). The bond market has seen absolute carnage; the overall return for the Bloomberg International Combination Index set a brand new low on Sept. 13, down 16.93%, since its inception date again in 1990.

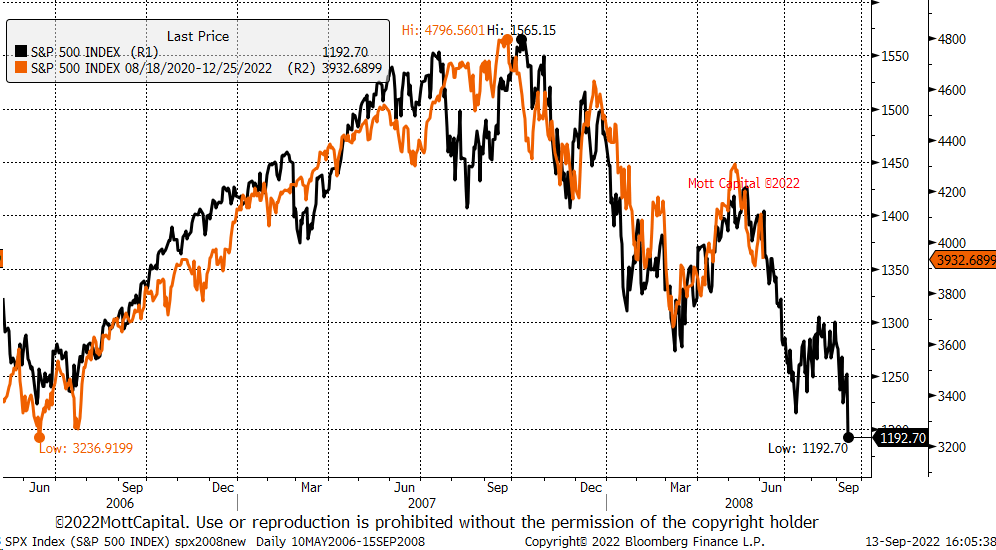

Wall Road has had its worst day since June 2020, because the S&P is flirting with bear market territory. The correlation chart exhibits the 2008 S&P efficiency (black) in opposition to the 2022 S&P efficiency (orange). A good and symmetrical correlation with each other, and the worst is but to come back, in accordance with the info.

Equities & Volatility Gauge

The Commonplace and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant firms listed on exchanges in the USA. S&P 500 3,873 -4.2% (5D)

The Nasdaq Inventory Market is an American inventory trade primarily based in New York Metropolis. It’s ranked second on the checklist of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Change. NASDAQ 11,855 -4.3% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Buyers use the VIX to measure the extent of threat, concern, or stress out there when making funding selections. VIX 26 13.7% (5D)

Stonks

Yr-to-date, Nasdaq is down 26%, S&P 500 is down 18%, and Dow is down 14%. Sept. 13, the Nasdaq had its greatest crash since march 2020 and will count on to see this pattern proceed till the top of the 12 months because the fed continues to hike charges.

Traditionally in conventional markets, -20% is taken into account bear market territory. Bottoms in market cycles often end across the similar time the fed funds price begins reducing or pausing of their climbing cycle. Because the fed continues on the trail of destruction, it could be naïve to suppose the underside is in for equities.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge in opposition to inflation and forex devaluation, all assist drive the worth of the valuable steel. Gold Worth $1,676 -2.46% (5D)

Just like most commodities, the silver value is set by hypothesis and provide and demand. It is usually affected by market situations (giant merchants or traders and brief promoting), industrial, business, and shopper demand, hedge in opposition to monetary stress, and gold costs. Silver Worth $20 5.66% (5D)

The value of oil, or the oil value, usually refers back to the spot value of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $85 2.88% (5D)

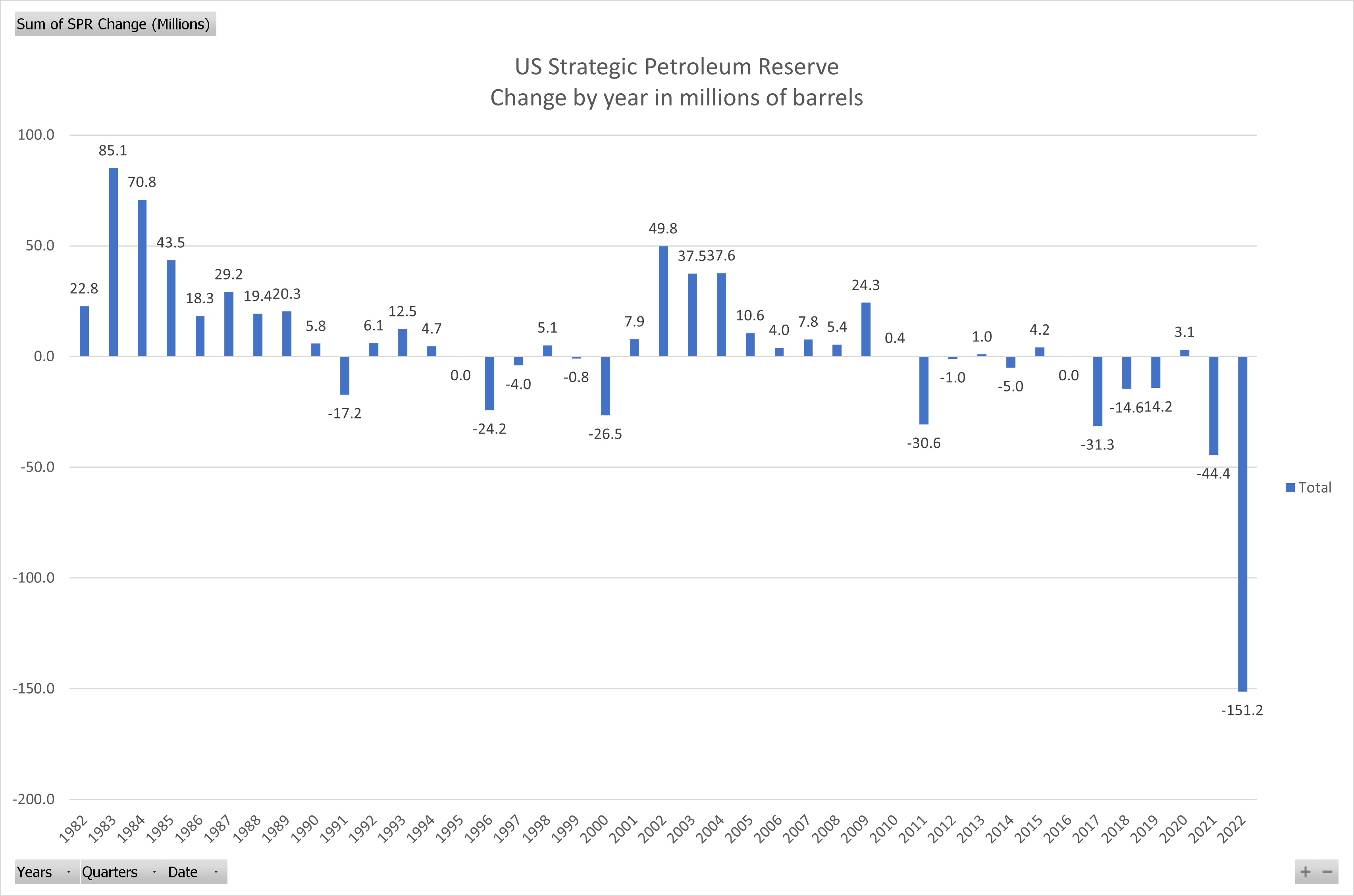

SPR continues to get drained forward of the mid-term elections

The Strategic Petroleum Reserve (SPR), one of many world’s largest suppliers of emergency crude oil, was launched to assist disruption in petroleum provides for the USA below the worldwide vitality program.

The SPR continues to get drained to ease short-term inflation pressures; the SPR carried out the largest-ever weekly oil launch on Sept. 12, injecting into the market 8.4 million barrels. The SPR is now at its lowest since October 1984.

Nonetheless, studies are the Biden administration has deliberate to refill the SPR when crude oil costs start to drop beneath $80 a barrel; it’s at present buying and selling round $90 a barrel.

Charges & Forex

The ten-year Treasury observe is a debt obligation issued by the USA authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury observe pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.451% 4.13% (5D)

The Shopper Worth Index (CPI) measures the month-to-month change in costs paid by U.S. shoppers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted common of costs for a basket of products and companies consultant of mixture U.S. shopper spending. CPI Inflation 8.3% 0.1% (30D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign currency echange. DXY 109.6 0.54% (5D)

Fed is behind the curve, in accordance with the bond market.

As talked about, the two-year treasury broke out to highs final seen since November 2007 at 3.7%. Since early 2000, the fed funds price and two-year treasury yield have been in tandem with each other. The present unfold signifies the Fed has extra room to boost charges because the fed funds price is at present round 2.5%. A 100bps price hike remains to be not sufficient to achieve the “impartial price,” in accordance with the bond market. The Fed remains to be behind the curve.

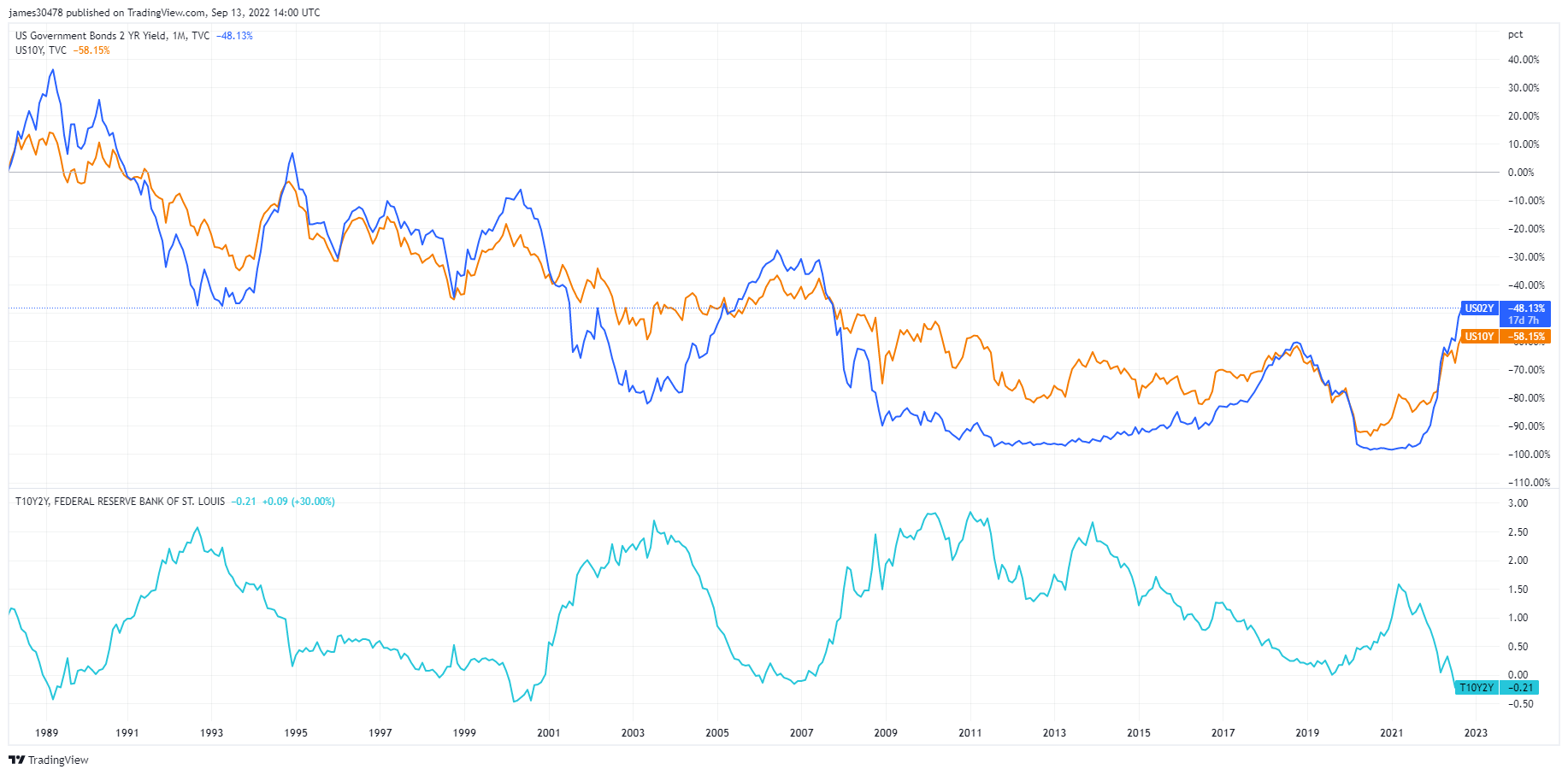

10-2 12 months treasury deeply inverted

Nonetheless, the ten-year to two-year treasury observe unfold is mostly thought of a warning of extreme financial weak spot. In distinction, the credit score spreads widen throughout monetary stress and trigger a flight to safe-haven belongings just like the DXY or the instant want for greenback redemptions to fulfill funds.

The ten-2 12 months treasury has been inverted twice this 12 months, and its significance is a dependable main indicator of an impending recession. In August, it virtually tagged -50bps, which is worse than the worldwide monetary disaster and the 2000 recession. A number of extra foundation factors decrease, and it’ll be the deepest inversion since 1981.

Many macro consultants are ready for one more indicator to invert: the 10-year-3-month unfold. The unfold is at present at 14bps; consultants imagine that is the correct recession sign. The inversion of every yield curve has presaged each recession going again greater than 40 years, and a recession often happens inside the subsequent six-twelve months.

Bitcoin Overview

The value of Bitcoin (BTC) in USD. Bitcoin Worth $19,740 -10.44% (5D)

The measure of Bitcoin’s complete market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 40.85% -0.05% (5D)

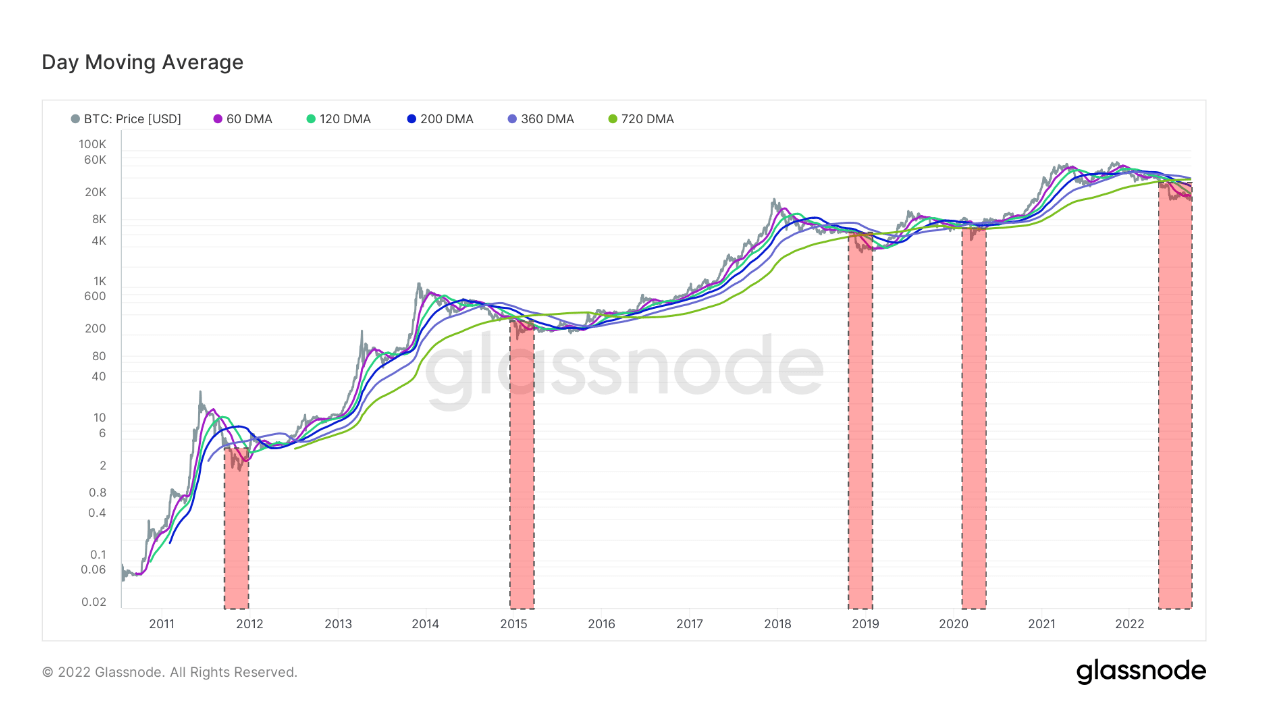

- Week commencing Sept. 12, Bitcoin spent most of its time below its realized value (value foundation, $21,400)

- Bitcoin is at present below all key transferring averages fifth time in its historical past.

- Bitcoin’s hash price hits an all-time excessive

- Bitcoin problem adjustment hits all-time excessive

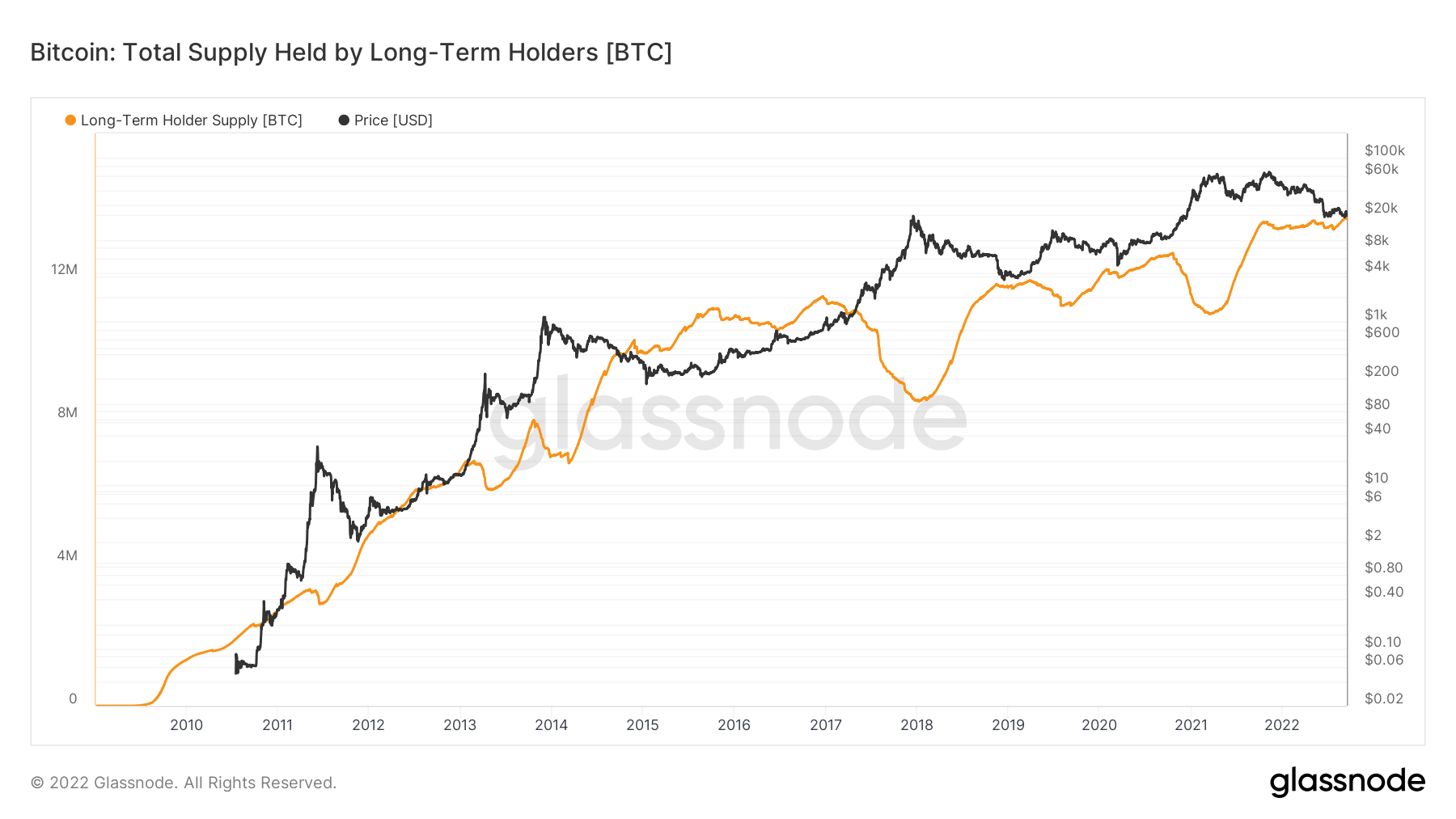

- The full Provide Held by Lengthy-Time period Holders has reached a brand new ATH.

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that have been lively within the community both as a sender or receiver. Solely addresses that have been lively in profitable transactions are counted. Energetic Addresses 953,634 -7.73% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 438,005 -3.50% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 902,250 0.08% (5D)

The variety of distinctive addresses holding a minimum of 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,134 -0.19% (5D)

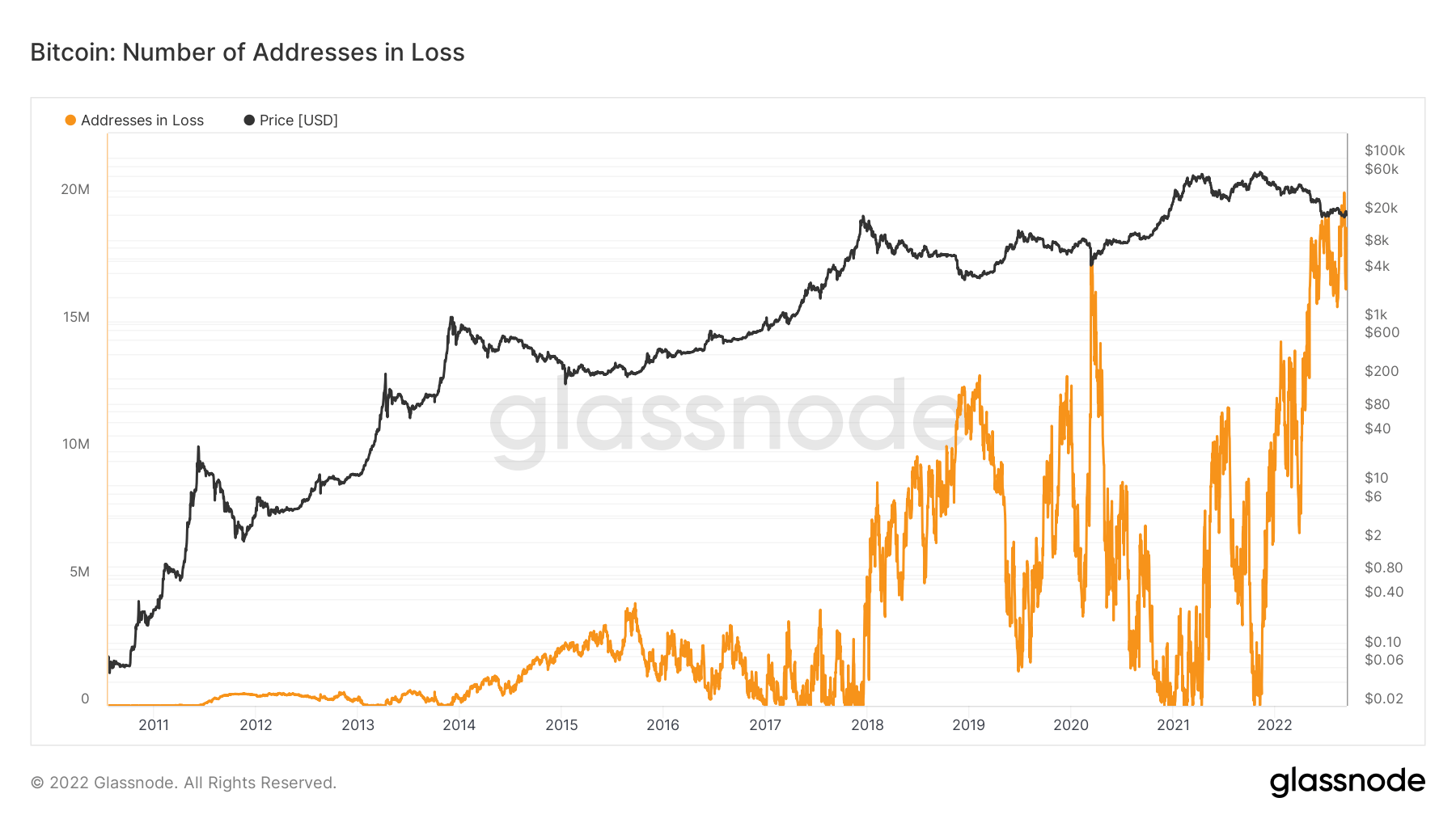

Over 20M addresses in loss

The variety of distinctive addresses whose funds have a median purchase value greater than the present value. “Purchase value” is outlined as the worth when cash are transferred to an handle.

Sept. 5 noticed addresses in loss surpass 20 million for the primary time since Bitcoin’s inception, exhibiting how deep the 2022 bear market has been. All through 2022, addresses in loss began at below 10 million. It has doubled since January, which exhibits the severity of this bear market, as Bitcoin was over $45,000 at first of January, simply over a 50% drop in value.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to offer a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that have been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated by superior heuristics and Glassnode’s proprietary clustering algorithms. Energetic Entities 283,087 11.80% (5D)

The variety of BTC within the Goal Bitcoin ETF. Goal ETF Holdings 23,679 -0.10% (5D)

The variety of distinctive entities holding a minimum of 1k BTC. Variety of Whales 1,703 0.18% (5D)

The full quantity of BTC held on OTC desk addresses. OTC Desk Holdings 4,031 BTC -2.14% (5D)

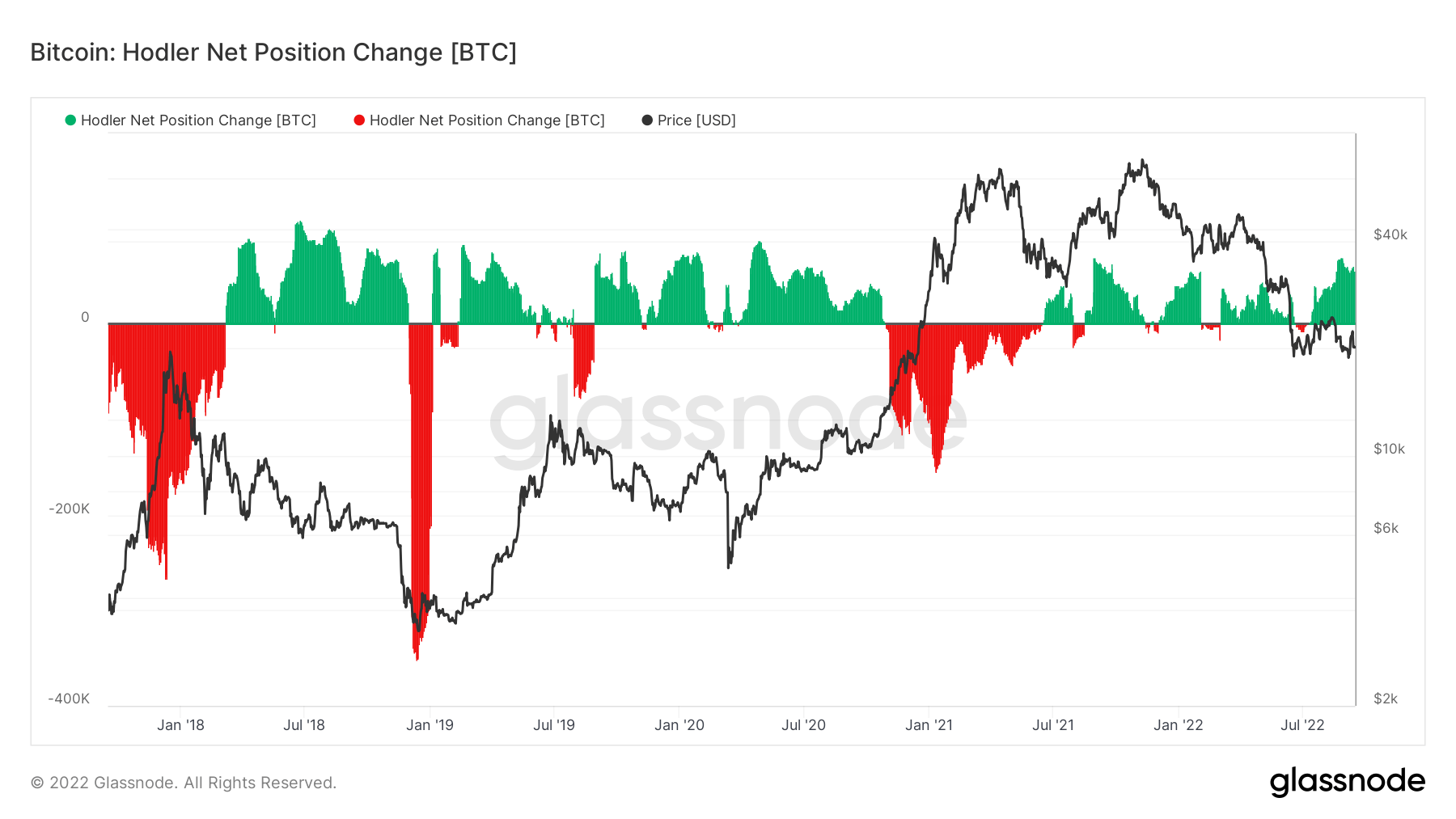

Bitcoin HODLers are unfazed by macro uncertainty

Assessing the degrees of accumulation and distribution is important to understanding over a long-term time-frame. HODLers are an entity that has unwavering help and perception in Bitcoin.

Internet place change appears to be like on the provide dynamics and exhibits the month-to-month place change of long-term traders (HODLers). It signifies when HODLers money out (detrimental) and when HODLers accumulate web new positions.

Trying on the interval between November 2020 and March 2021, Bitcoin’s value appreciation grew dramatically. Nonetheless, this noticed an unlimited quantity of HODLer distribution, with this cohort distributing on the prime of the bull run in 2021, virtually distributing over 200,000 cash to lock in income.

Nonetheless, since then, HODLers’ web place change has seen a dramatic improve in accumulation, at present witnessing over 70,000 BTC per thirty days, one of the crucial vital quantities of accumulation since covid.

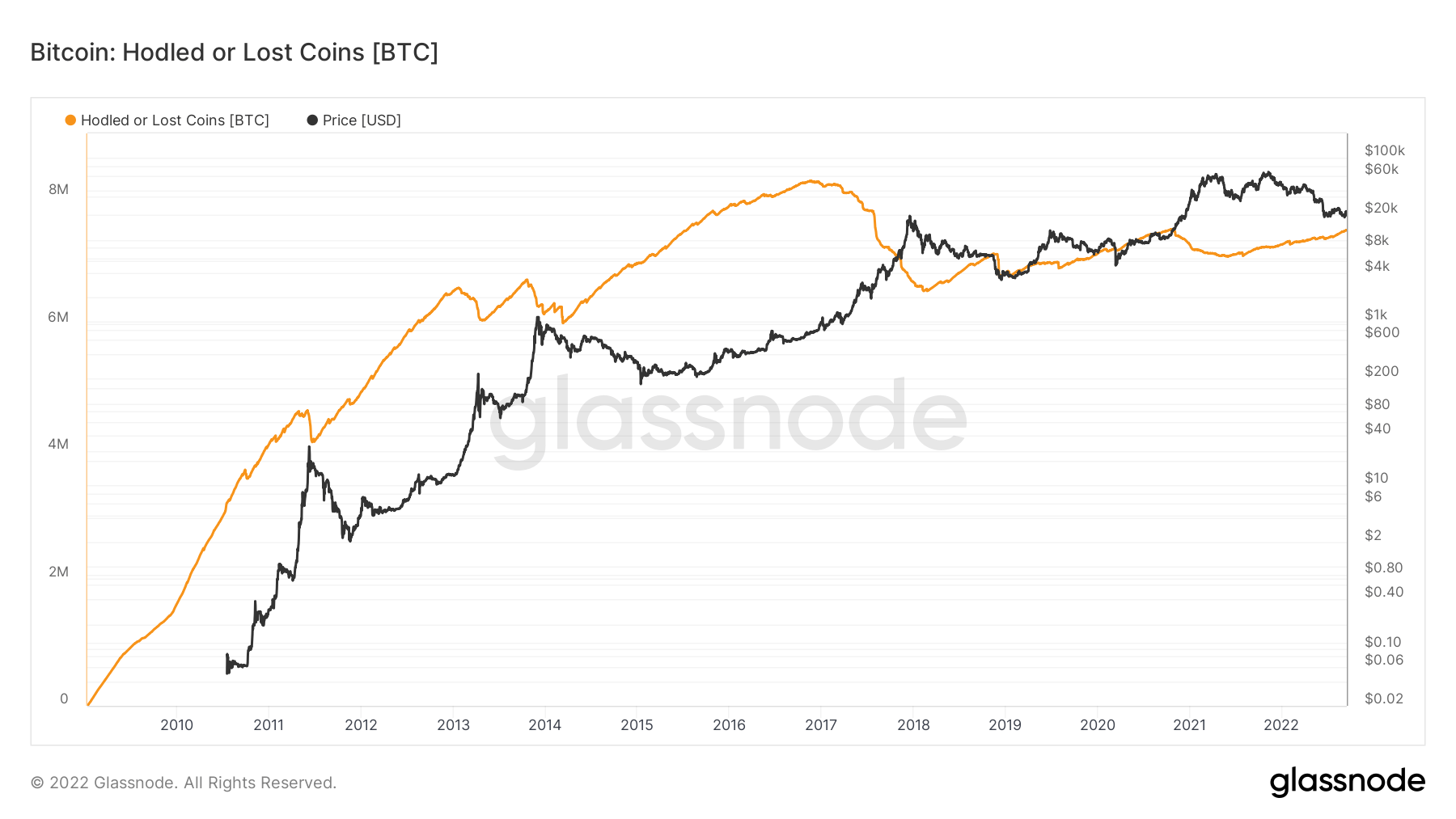

Glassnode estimates that nearly 7.5 million cash (40% of the circulating provide) are being hodled or misplaced over time; they outline misplaced or HODLed Bitcoins as strikes of enormous and previous stashes. It’s calculated by subtracting Liveliness from 1 and multiplying the end result by the circulating provide.

Dervatives

A spinoff is a contract between two events which derives its worth/value from an underlying asset. The commonest kinds of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/value from the underlying belongings.

The full quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $10.95B -12.86% (5D)

The full quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $33.29B $-38.48 (5D)

The sum liquidated quantity (USD Worth) from brief positions in futures contracts. Complete Lengthy Liquidations $145.03M $35.61M (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Brief Liquidations $141.78M $105.8M (5D)

The dominant regime of places all through 2022

The Choices 25 Delta Skew metric appears to be like on the put vs. name choices ratio expressed in Implied Volatility (IV). Places are the precise to promote a contract at a selected value, and calls are the precise to purchase.

For choices with a selected expiration date, 25 Delta Skew refers to places with a delta of -25% and calls with a delta of +25%, netted off to reach at a knowledge level. In different phrases, this can be a measure of the choice’s value sensitivity given a change within the spot Bitcoin value.

The actual intervals discuss with choice contracts expiring one week, one month, three months, and 6 months, respectively.

Beneath 0 signifies calls are pricier than places. This example has occurred solely six instances this 12 months. Throughout Bitcoin’s latest bottoming, merchants scrambled for places after which reverted to calls on the native prime.

Calls are pricier than places for less than the sixth time this 12 months. Everybody scrambled for places on the vary backside after which began to take a position on calls on the native prime.

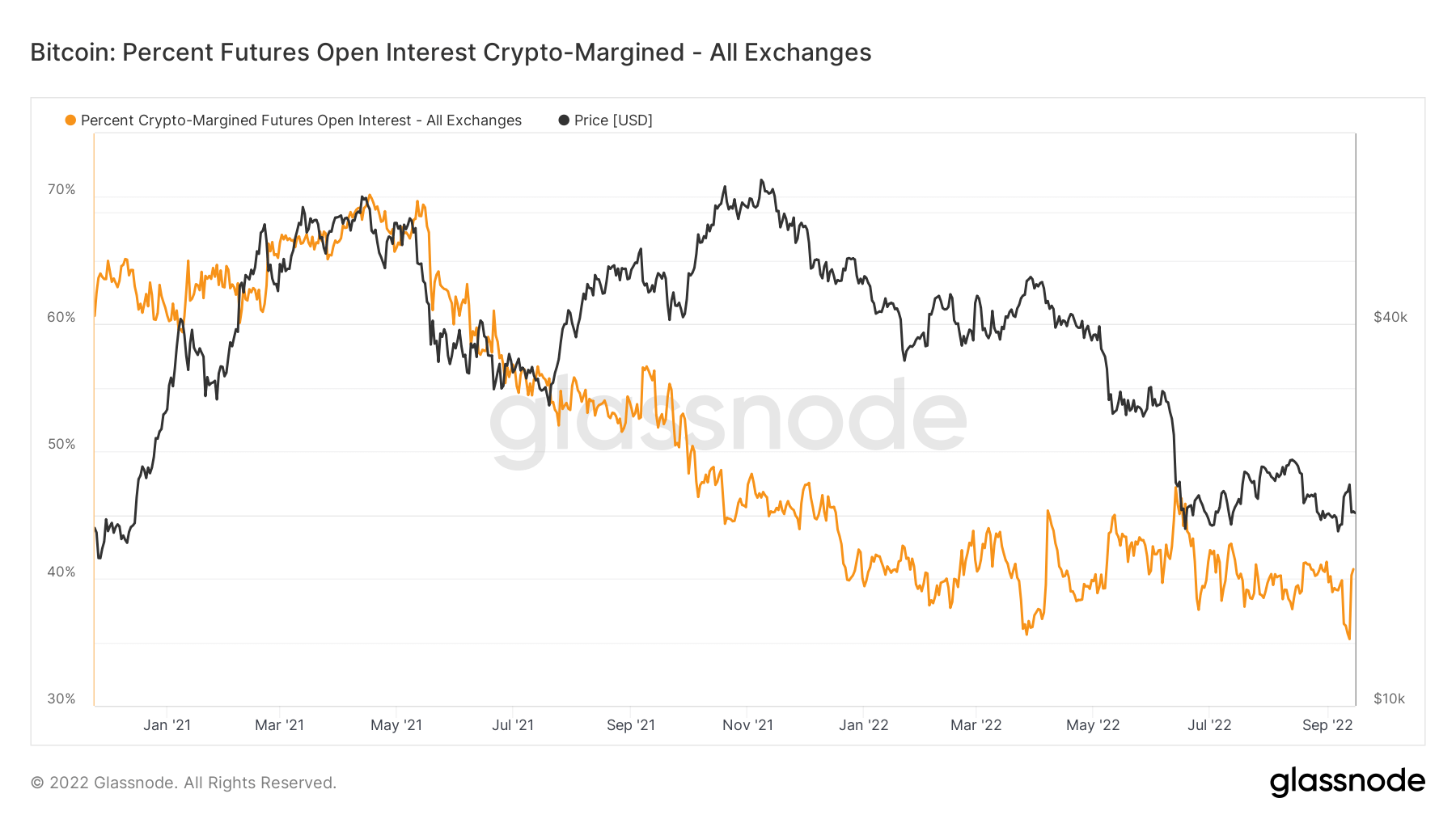

Obvious structural change in coin-backed margin

An specific dynamic shift is happening for crypto-margined futures open curiosity, which is the proportion of futures contracts open curiosity that’s margined within the native coin (e.g., BTC), and never in USD or a USD-pegged stablecoin.

In Might 2021, the coin-backed margin was at an all-time excessive of 70%; it’s now at a mere 40%, a transparent structural distinction with traders taking a lot much less threat in 2022. The opposite aspect of the coin is roughly 60% of the futures margin makes use of stablecoins or money, which incurs so much much less volatility because the collateral worth doesn’t change alongside the futures contract. Because the margin is extra steady, the worth is comparatively extra steady. A theme that will be anticipated to stay this 12 months.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The common estimated variety of hashes per second produced by the miners within the community. Hash Charge 235 TH/s 3.98% (5D)

The present estimated variety of hashes required to mine a block. Be aware: Bitcoin problem is usually denoted because the relative problem with respect to the genesis block, which required roughly 2^32 hashes. For higher comparability throughout blockchains, our values are denoted in uncooked hashes. Problem 137 T 103.01% (14D)

The full provide held in miner addresses. Miner Steadiness 1,833,511 BTC -0.07% (5D)

The full quantity of cash transferred from miners to trade wallets. Solely direct transfers are counted. Miner Internet Place Change -40,559 BTC 18,947 BTC (5D)

Hash price and problem hit an all-time excessive

For almost all of September, CryptoSlate has mentioned the repercussions of accelerating problem for miners. On account of rising manufacturing prices and mining problem reaching an all-time excessive, miners noticed falling revenues which might see unprofitable miners change off from the community.

It’s unbelievable to see the community’s resilience from a hash price perspective; solely 16 months in the past, the hash price collapsed by over 50%; nevertheless, a few weeks later, it elevated three-fold.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized trade exercise.

The full quantity of cash held on trade addresses. Change Steadiness 2,397,444 BTC 25,462 BTC (5D)

The 30 day change of the availability held in trade wallets. Change Internet Place Change -117,735 BTC 262,089 BTC (30D)

The full quantity of cash transferred from trade addresses. Change Outflows Quantity 538,545 BTC 122 BTC (5D)

The full quantity of cash transferred to trade addresses. Change Inflows Quantity 569,151 BTC 125 BTC (5D)

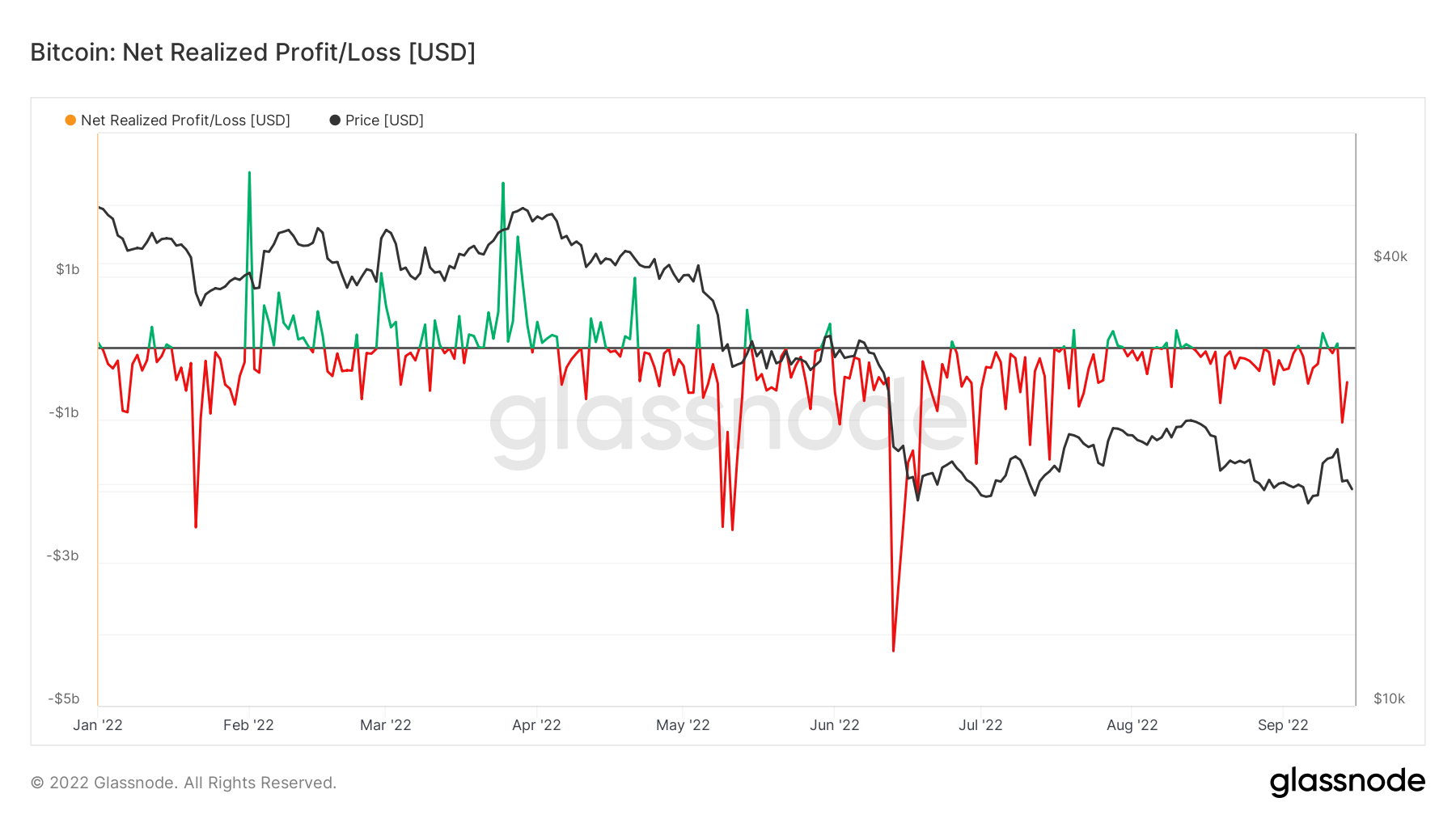

Over $1B of realized losses on Sept. 13

Internet Realized Revenue/Loss is the online revenue or lack of all moved cash, and it’s clear to see a regime of web losses for the second half of 2022 as a result of an unprecedented bear market. In mid-June, Bitcoin dipped beneath $18k, which noticed a web realized lack of over $4 billion, essentially the most ever.

Nonetheless, on Sept. 13, Bitcoin dropped 10% to only below $20,000, which noticed over $1 billion of realized losses. Buyers are nonetheless treating Bitcoin as a tech inventory and a risk-on asset, which has contributed to a big quantity of realized losses this 12 months.

Provide

The full quantity of circulating provide held by completely different cohorts.

The full quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.61M BTC 0.01% (5D)

The full quantity of circulating provide held by brief time period holders. Brief Time period Holder Provide 3.1M BTC -0.77% (5D)

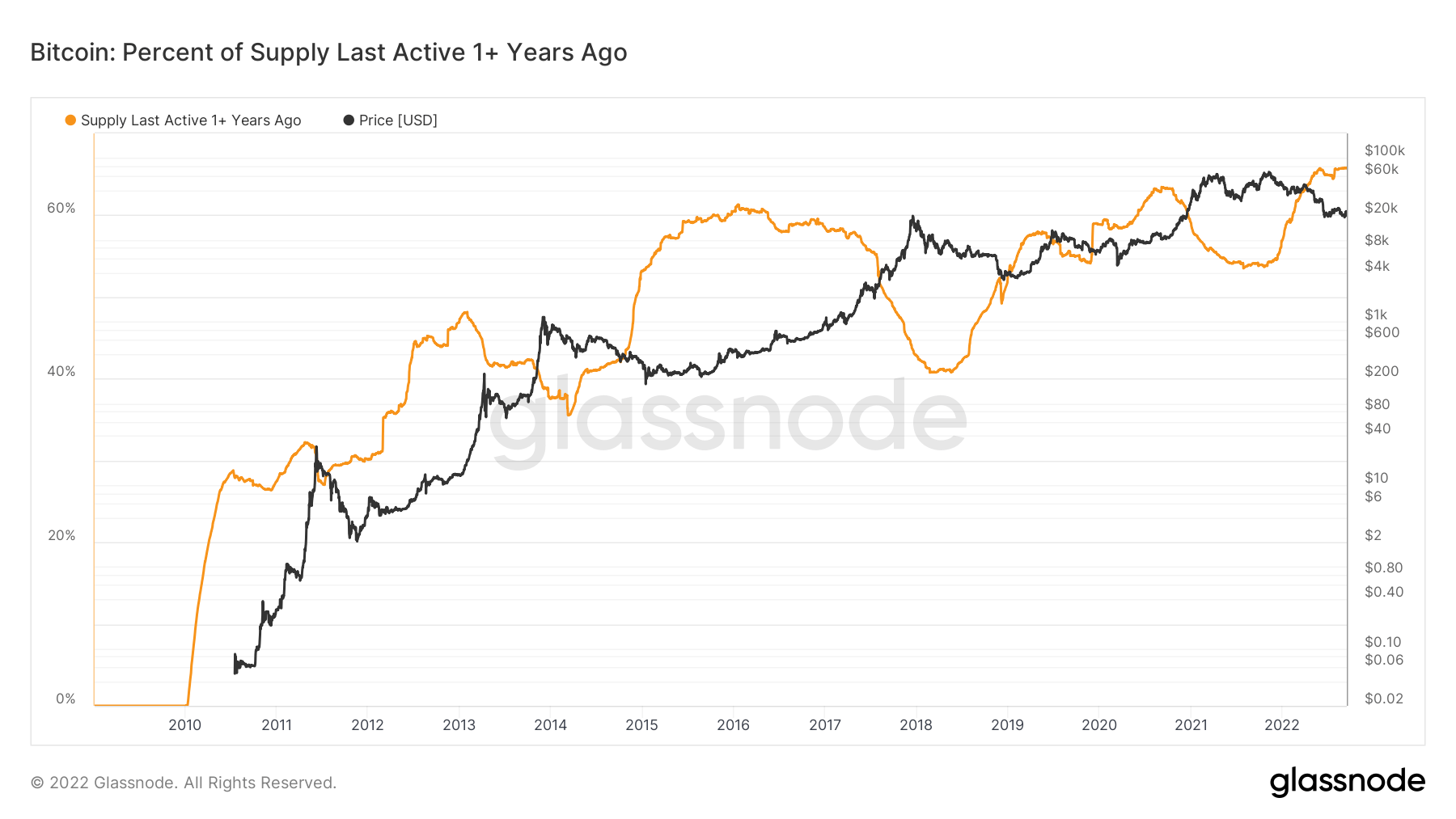

The p.c of circulating provide that has not moved in a minimum of 1 12 months. Provide Final Energetic 1+ Yr In the past 66% 0.08% (5D)

The full provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.81M BTC -0.13% (5D)

Diamond fingers for long-term traders

Provide final lively 1+ 12 months in the past is outlined because the p.c of circulating provide that has not moved in a minimum of one 12 months. Since Bitcoin’s inception, this cohort has elevated its provide possession, holding over 65.8% of the availability.

Lengthy-term holders are thought of the sensible cash inside the Bitcoin ecosystem; it’s obvious that in bear markets, this cohort will accumulate aggressively whereas the worth is suppressed and distributed into bull markets. This present cycle isn’t any completely different than any of the others, as this cohort is at present accumulating, as their share of provide has elevated this 12 months, which is an encouraging signal.

That is additional supported by the metric, complete provide held by LTHs, at present holding over 13.6 million BTC, which can also be at an all-time excessive. LTHs see huge worth at these present BTC value ranges including to their provide throughout this bear market.

Cohorts

Breaks down relative conduct by varied entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value offered / value paid. Lengthy-term Holder SOPR 0.45 -26.23% (5D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes under consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of brief time period traders. Brief-term Holder SOPR 0.98 -2.97% (5D)

The Accumulation Development Rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain when it comes to their BTC holdings. The size of the Accumulation Development Rating represents each the scale of the entities steadiness (their participation rating), and the quantity of latest cash they’ve acquired/offered during the last month (their steadiness change rating). An Accumulation Development Rating of nearer to 1 signifies that on mixture, bigger entities (or an enormous a part of the community) are accumulating, and a worth nearer to 0 signifies they’re distributing or not accumulating. This gives perception into the steadiness dimension of market individuals, and their accumulation conduct during the last month. Accumulation Development Rating 0.300 76.47% (5D)

The evolution of a HODLer

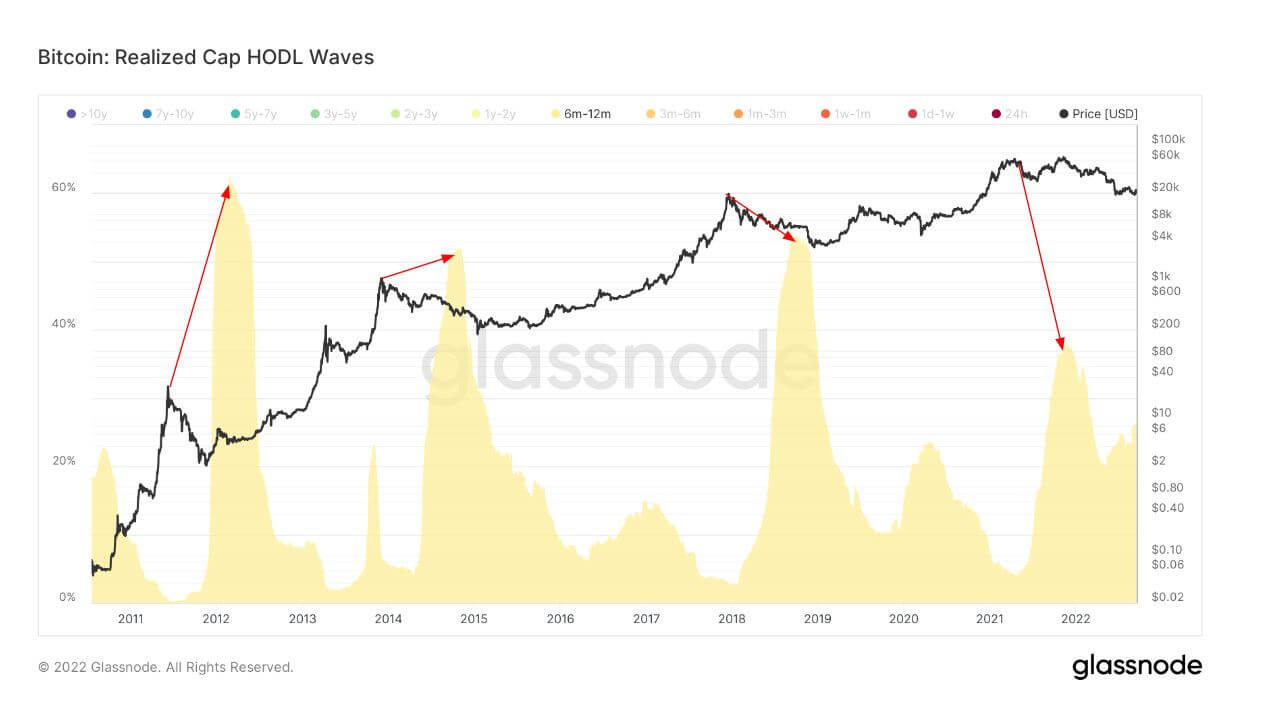

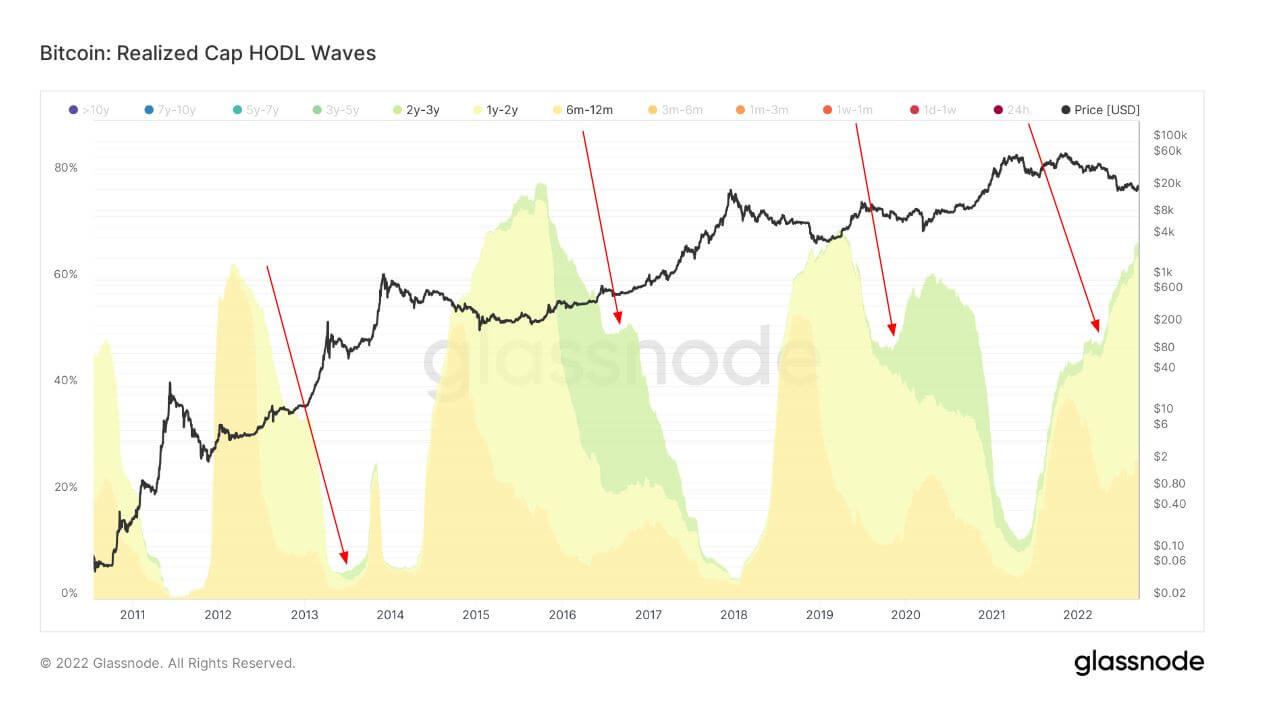

Bundle of all lively provide age bands, aka HODL Waves. Every coloured bar exhibits the proportion of Bitcoin that was final moved inside the interval denoted within the legend.

To know the minds of LTHs, it’s important to grasp their accumulation strategies. LTHs are traders who’ve held BTC for greater than six months. The primary graph exhibits six months to twelve-month holders.

The purple arrows present the height of this cohort’s holdings, which happens roughly six months after the height bull runs, as they’ve been drawn in by BTC’s exponential value appreciation; every cycle, this cohort holds round 40-60% of the BTC provide.

Because the cohorts expertise and information grew inside the BTC ecosystem, so did the availability of mature cash. The purple arrows present the cohort from 6 to 12 months maturing into 1 to 2-year holders, weathering a minimum of one bear market and vital value depreciation. Once more, this cohort is roughly a 12 months away from the height of the bull run.

Lastly, the unique cohort that purchased the height of the bull run ultimately was 2-3 12 months holders who grow to be consultants inside the ecosystem incomes the precise to be referred to as “diamond fingers.” This cohort doesn’t develop to the extent of the earlier age bands, as not all traders make it that far however what will be deciphered is that this present cycle isn’t any completely different from the earlier ones. The two- 3 12 months holders are beginning to emerge on this cycle slowly, which is encouraging to see; it will likely be important to keep watch over this cohort to see in the event that they mature as time passes.

Stablecoins

A kind of cryptocurrency that’s backed by reserve belongings and subsequently can provide value stability.

The full quantity of cash held on trade addresses. Stablecoin Change Steadiness $40.02B 6.92% (5D)

The full quantity of USDC held on trade addresses. USDC Change Steadiness $2.17B -11.56% (5D)

The full quantity of USDT held on trade addresses. USDT Change Steadiness $17.56B 6.92% (5D)

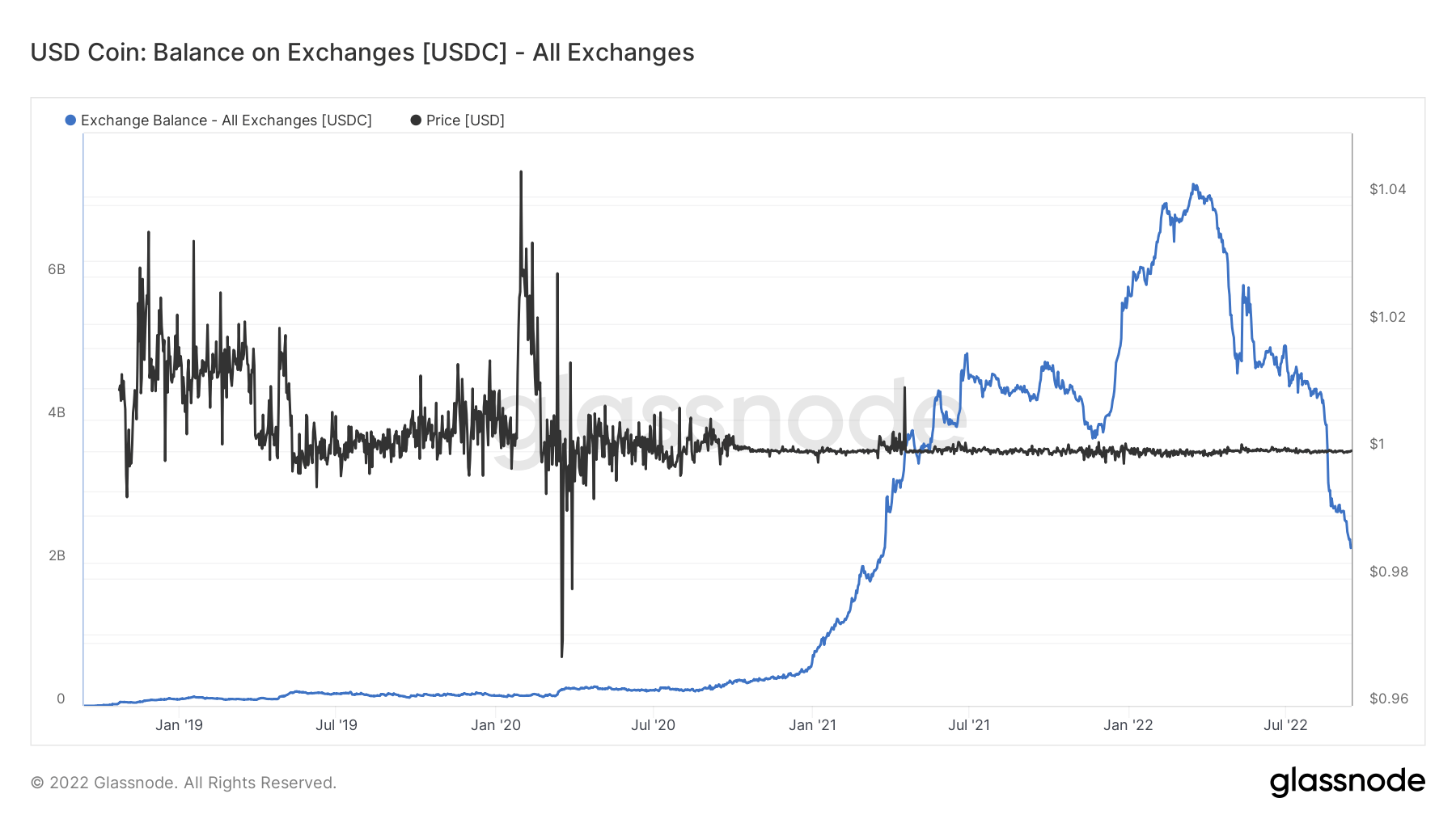

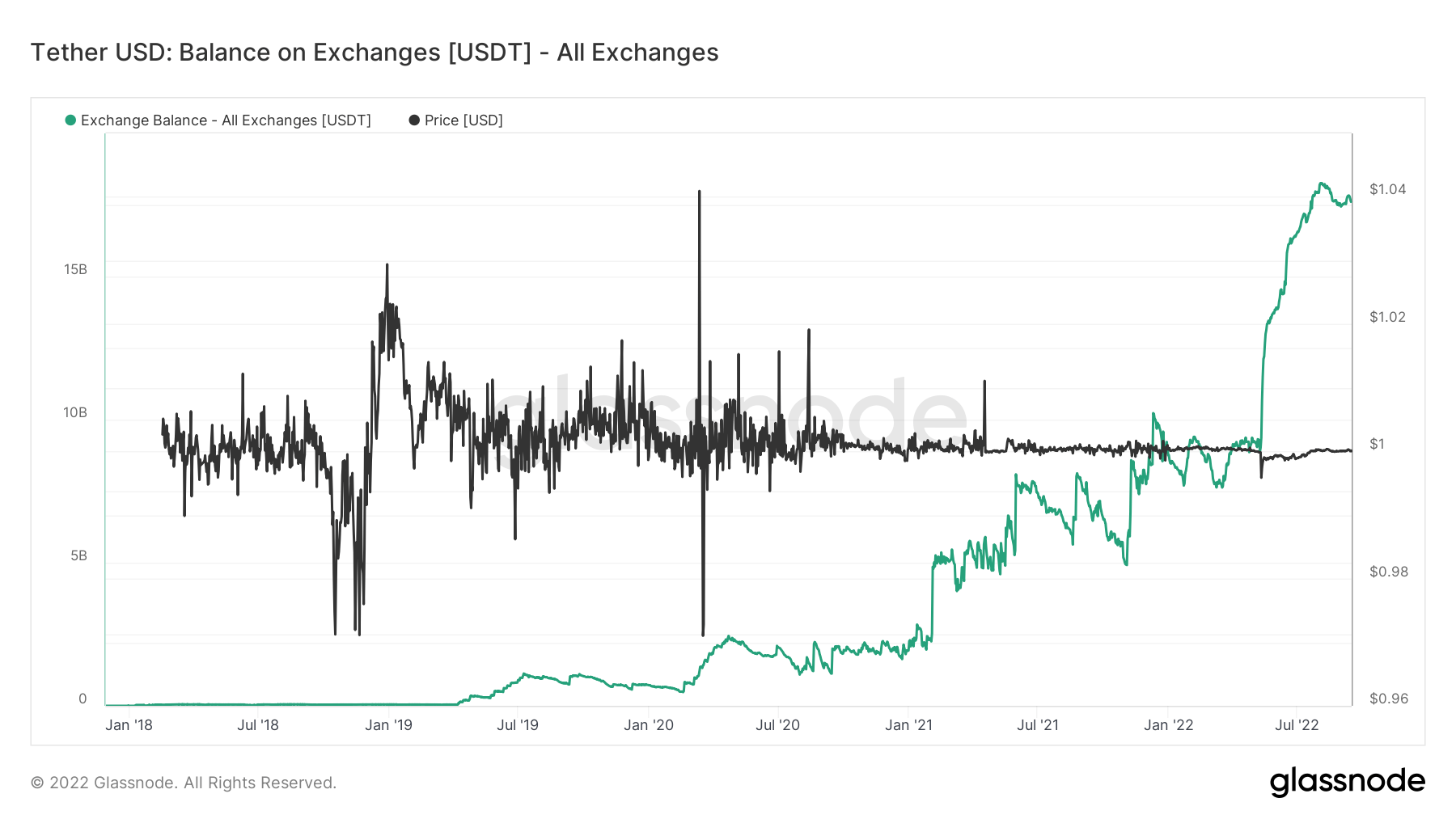

The divergence between USDC and USDT

“Dry powder” refers back to the variety of stablecoins accessible on exchanges held by traders who’ve acquired tokens corresponding to USDC or USDT. The overall assumption is excessive ranges of stablecoins held on gross sales are a bullish signal for BTC because it exhibits a willingness to maintain capital within the crypto markets till situations change.

Important divergence with steadiness on exchanges is happening between USDC and USDT. USDC has come below some scrutiny not too long ago, as Binance suspended withdrawals of USDC. A substantial quantity of outflows occurred in 2022, simply as USDC peaked in January with round $7 billion value of stablecoins on exchanges.

Nonetheless, USDT has solely gone from power to power and has surpassed over $17 billion value of stables on exchanges. Contemplating the quantity of detrimental press USDT has acquired, it’s nonetheless clearly the primary stablecoin in the intervening time.