TL;DR

- Liz Truss grew to become the U.Okay. Prime Minister on Sept. 6 because the nation prepares for a attainable recession in This autumn.

- European Central Financial institution has elevated rates of interest by 75bps, a report, however they’re nonetheless approach behind the inflation curve at 9.1%

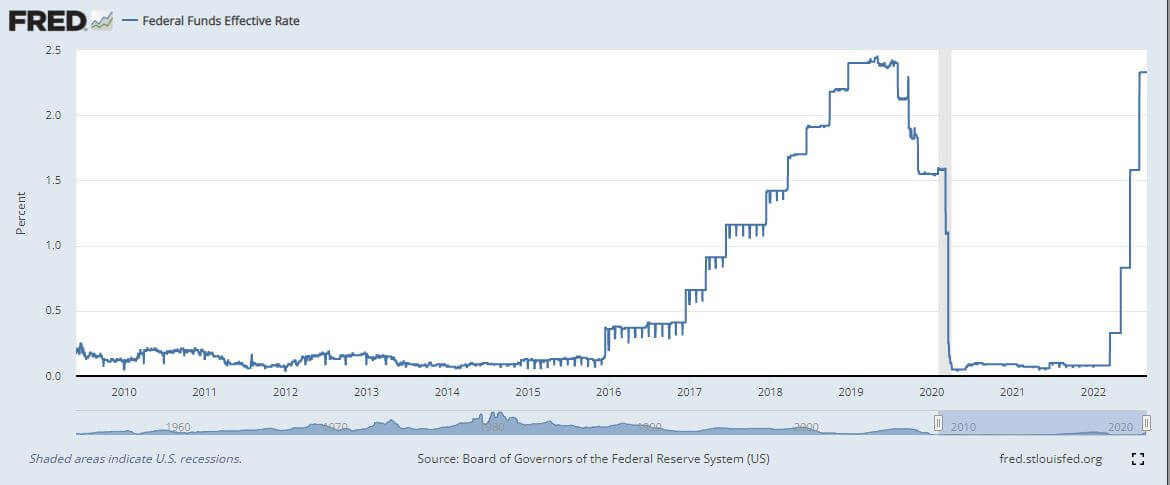

- The market is pricing in a 75bps charge hike within the September FOMC assembly because the almost definitely final result as a result of tight labor market

- Russia indefinitely suspends Nord Stream gasoline pipeline to Europe

- Gazprom and CNPC agree on the transition to creating funds for gasoline provides to China in Rubles and Yuan

- Bitcoin dropped beneath $20,000 for the primary time since early July

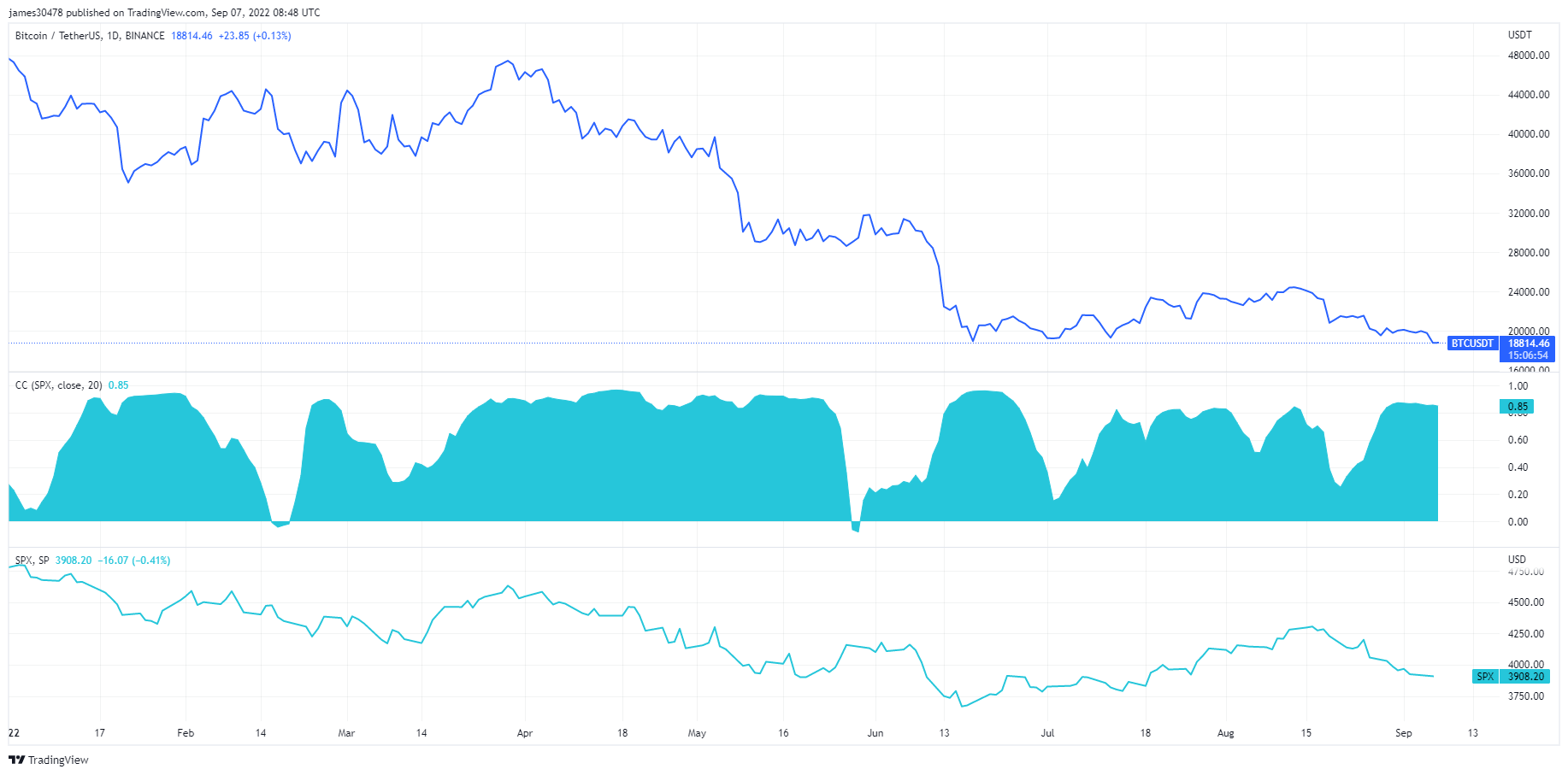

- Bitcoin’s correlation to the S&P 500 stays robust

- Russia is working with a number of pleasant international locations on cross-border settlements in stablecoins

Macro Overview

Financial system in peril

Liz Truss took cost as prime minister amid a possible recession from double-digit inflation and report will increase in the price of dwelling. She is on the helm of a authorities with deteriorating funds, partly as a result of sterling at a 37-year low and hovering funds on index-linked gilts.

Truss has promised tax cuts and extra stimulus checks — a £130 billion plan to freeze U.Okay. energy payments and choke inflation, almost definitely resulting in increased long-term inflation.

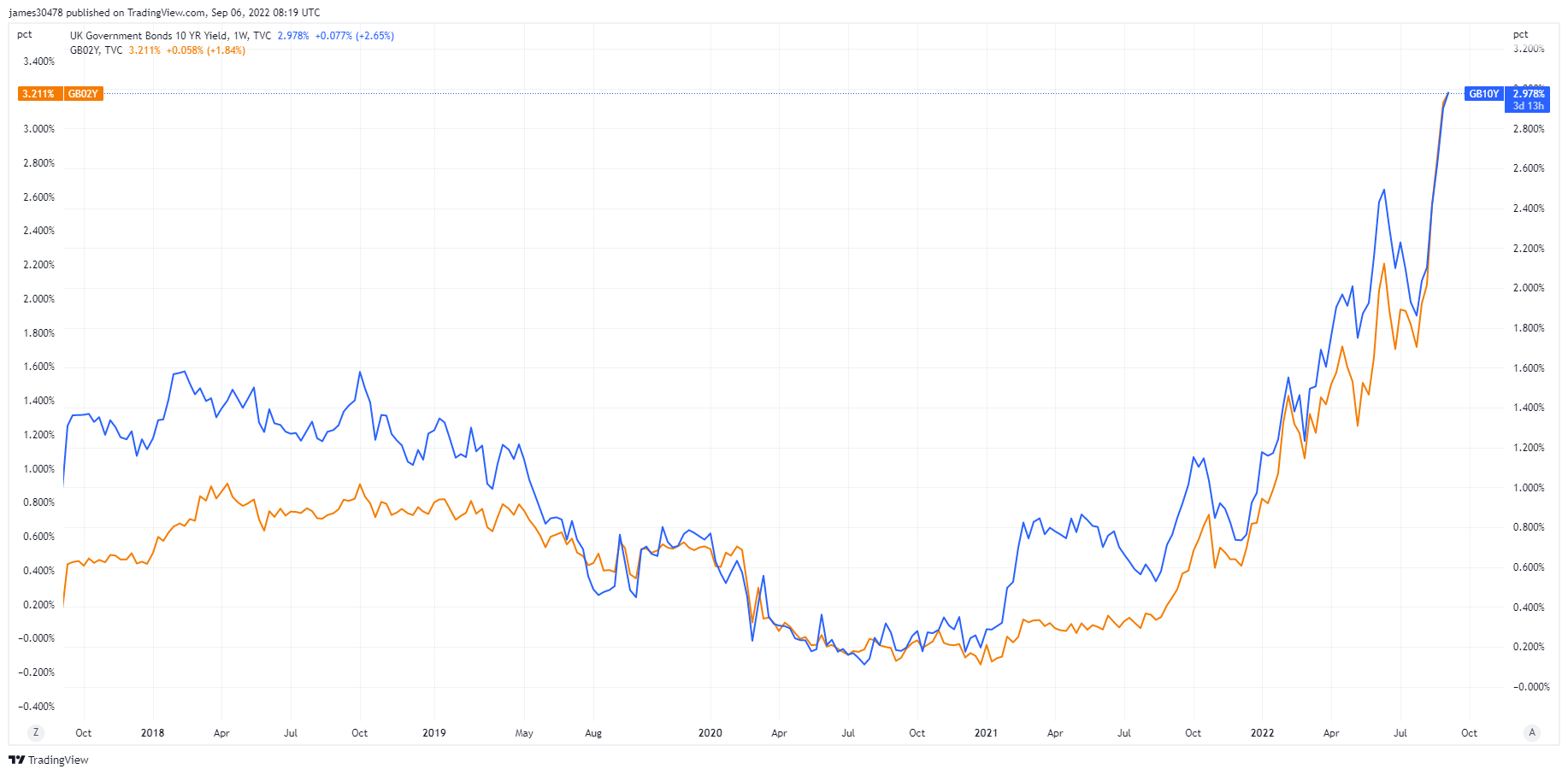

As gilt yields continued to climb increased on the entrance finish, the 2-year gilt rose to a 14-year excessive, and the 10-year gilt climbed previous 3% for the primary time since 2014.

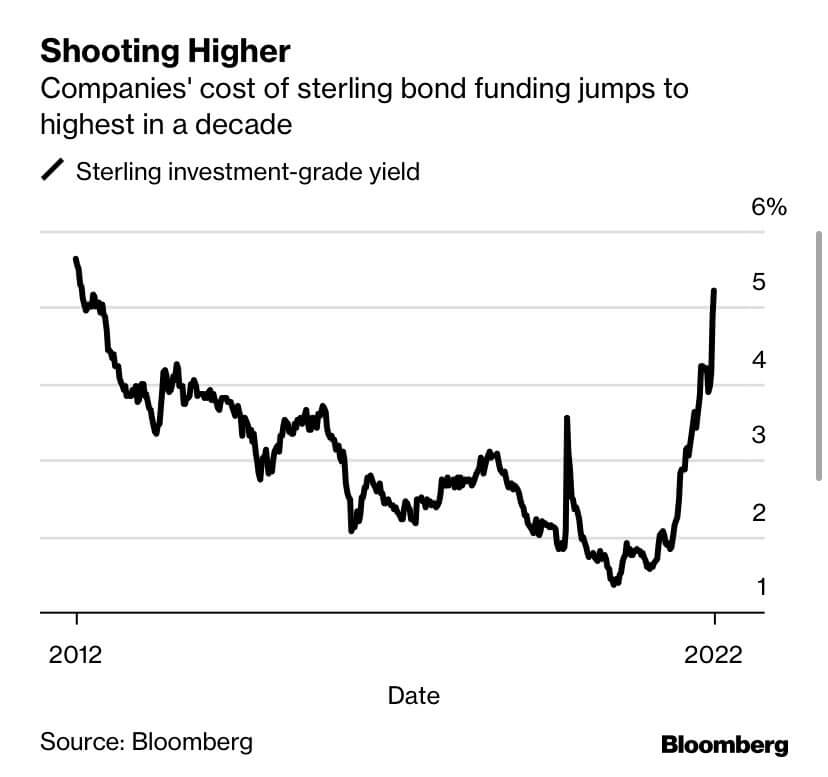

A subsidy of £130 billion to maintain family vitality payments beneath £2,500 equals roughly 5% of the U.Okay. GDP. Such a hefty subsidy will probably improve vitality costs, drive up enterprise sectors’ prices, and trigger company debt yields to soar.

Europe struggles on

Europe continues to limp on following the ECB’s newest 75 bps rate of interest hike. The euro is battling to get above parity towards the U.S. greenback.

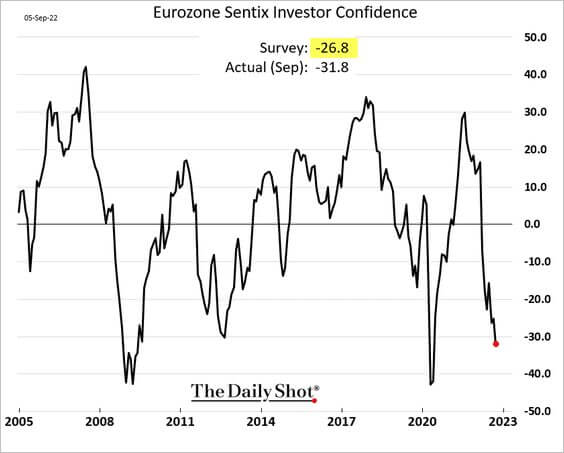

Investor confidence within the eurozone confirmed little to no enchancment, because the Sentix survey reveals a decline of virtually 7 factors to -31.8 — comparable ranges seen through the covid pandemic and the 2008 monetary disaster.

Leaders across the eurozone are discussing help packages; Germany is making ready a $65 billion inflation reduction bundle, which requires huge debt monetization from the ECB to include spreads and ease circumstances, resulting in extra debasement.

Correlations

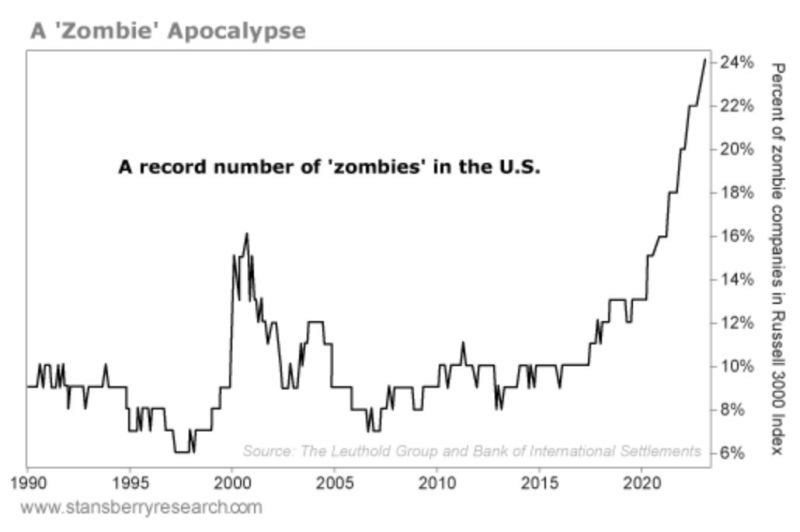

A zombie apocalypse

Almost 25% of U.S. companies are “zombie firms.” The earlier report for zombies was 17%, set again in 2001. These firms have survived off near-zero rates of interest and don’t generate money to pay curiosity on their money owed. They’re a results of artificially low yields within the U.S.

It might be fairly onerous for these firms to outlive in a rising yield atmosphere, which might find yourself triggering mass unemployment.

At the moment, the unemployment charge is 3.7%. A double-digit unemployment charge was final seen through the recessions brought on by the 2008 housing crash and covid.

In accordance with Jim Walker, chief economist at Aletheia Capital:

“If the markets decided the rates of interest you then would have by no means gone to the degrees of zero rates of interest that central bankers have been pushing that ended ensuing zombie firms.”

Equities & Volatility Gauge

The Commonplace and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 massive firms listed on exchanges in america. S&P 500 4,067 4% (7D)

The Nasdaq Inventory Market is an American inventory trade based mostly in New York Metropolis. It’s ranked second on the record of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Alternate. NASDAQ 12,681 4% (7D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Buyers use the VIX to measure the extent of danger, worry, or stress out there when making funding choices. VIX 23 -9% (7D)

S&P and Bitcoin tied on the hip

Fed audio system tried to speak the equities market down through the week commencing Sept. 5 and solely made issues worse as equities marched increased.

The FOMC assembly slated for late September at present has an 86% likelihood of a 75 foundation level hike charge.

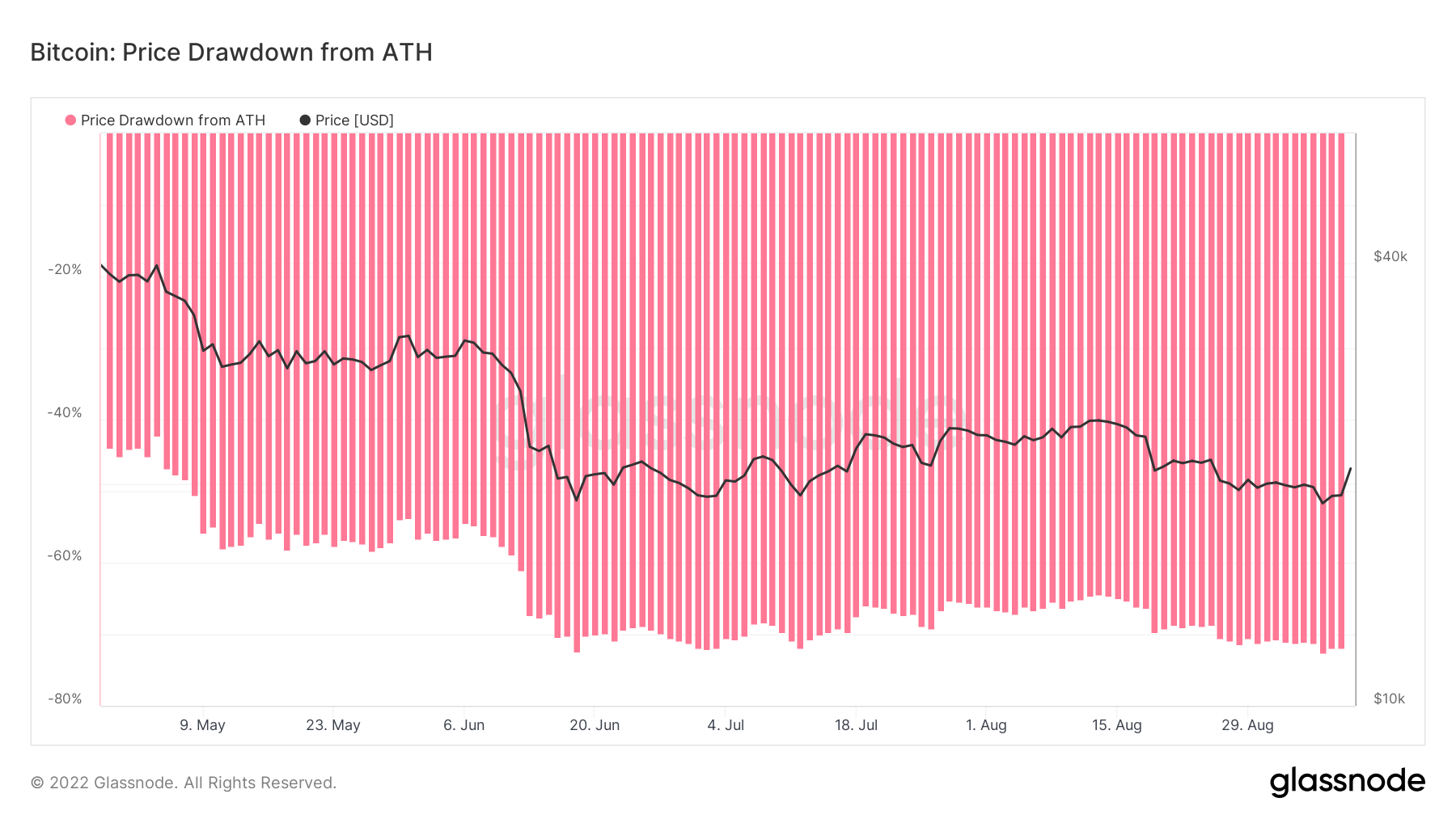

U.S. equities proceed to stay tightly correlated with BTC. For many of 2022, Bitcoin and the S&P500 have been in a good correlation with each other. At the moment, the S&P500 is nineteen% off its all-time excessive, but when shares fall, we count on to see new lows for Bitcoin.

Commodities

The demand for gold is decided by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the need to carry gold as a hedge towards inflation and forex devaluation, all assist drive the worth of the dear steel. Gold Value $1,724 1.0% (7D)

Much like most commodities, the silver value is decided by hypothesis and provide and demand. It is usually affected by market circumstances (massive merchants or traders and brief promoting), industrial, business, and shopper demand, hedge towards monetary stress, and gold costs. Silver Value $19 5.8% (7D)

The worth of oil, or the oil value, typically refers back to the spot value of a barrel (159 litres) of benchmark crude oil. Crude Oil Value $87 -1.5% (7D)

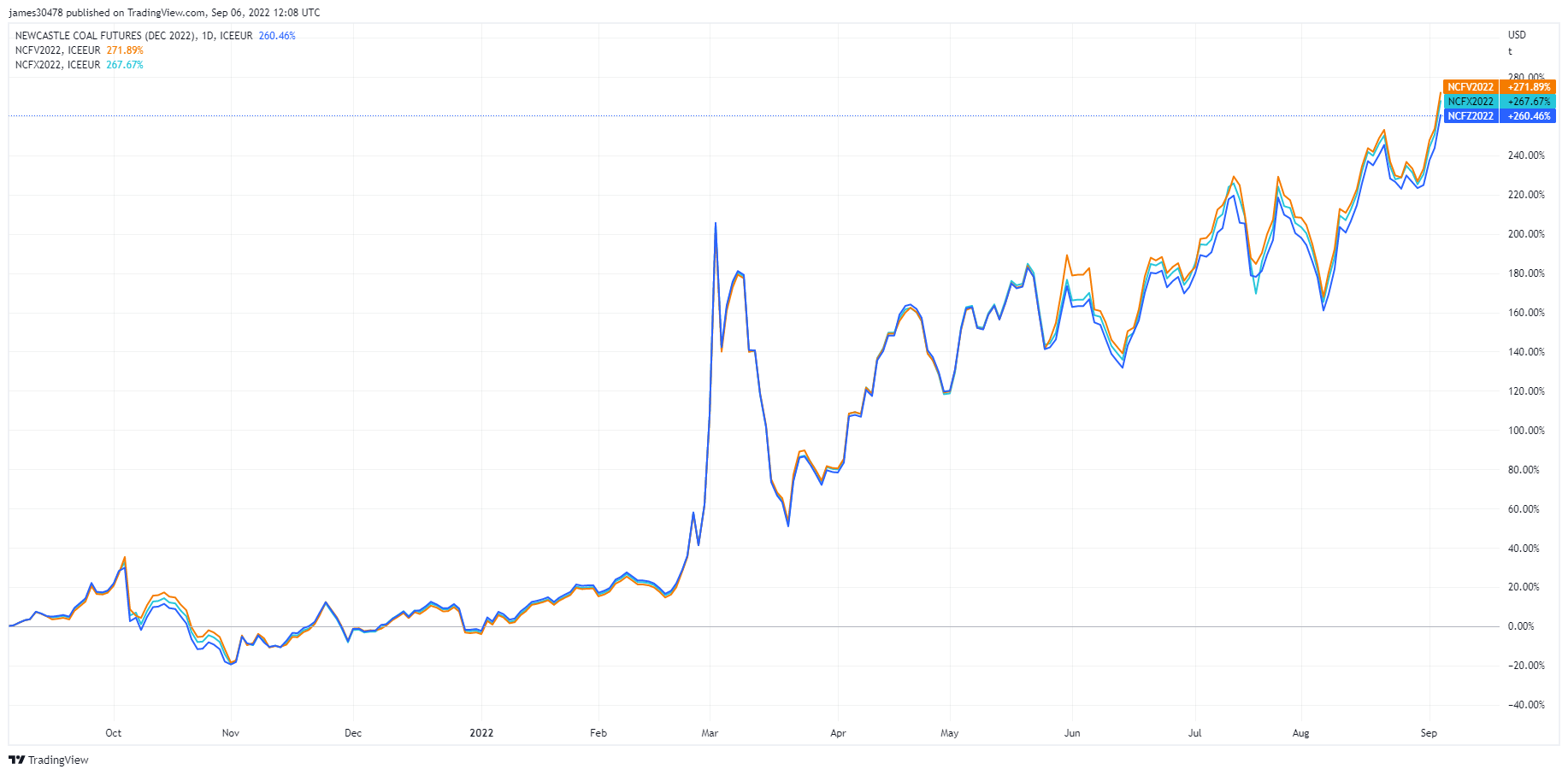

Transfer over ESG, demand for coal is hovering

Asia Coal Futures. (Supply: TradingView)Final week, we noticed the vitality futures market, this week it’s coal futures. The worth of coal in Asia (spot Newcastle benchmark) surged to an all-time excessive of $440 per metric tonne. The graph observes the longer term value for October, November and December 2022. Coal costs in Asia rally to a report as the worldwide hunt for gas escalates. Utilities look to coal to exchange liquified pure gasoline which has change into too costly to acquire.

The information

- Spot bodily coal loaded at Australia’s Newcastle port was priced at $436.71/ton, a report. That’s practically triple the worth this time final yr.

- Newcastle futures for October jumped 5% to $463.75/ton Monday, the very best value in knowledge stretching again to January 2016

How a lot have vitality costs increaased within the final yr:

- European pure gasoline futures: +335%

- Asian LNG spot: +255%

- European coal futures: +180%

- Asian coal spot: +157%

Charges & Foreign money

The ten-year Treasury word is a debt obligation issued by america authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury word pays curiosity at a set charge as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.3% 3% (7D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign exchange. DXY 107.8 -1.65% (7D)

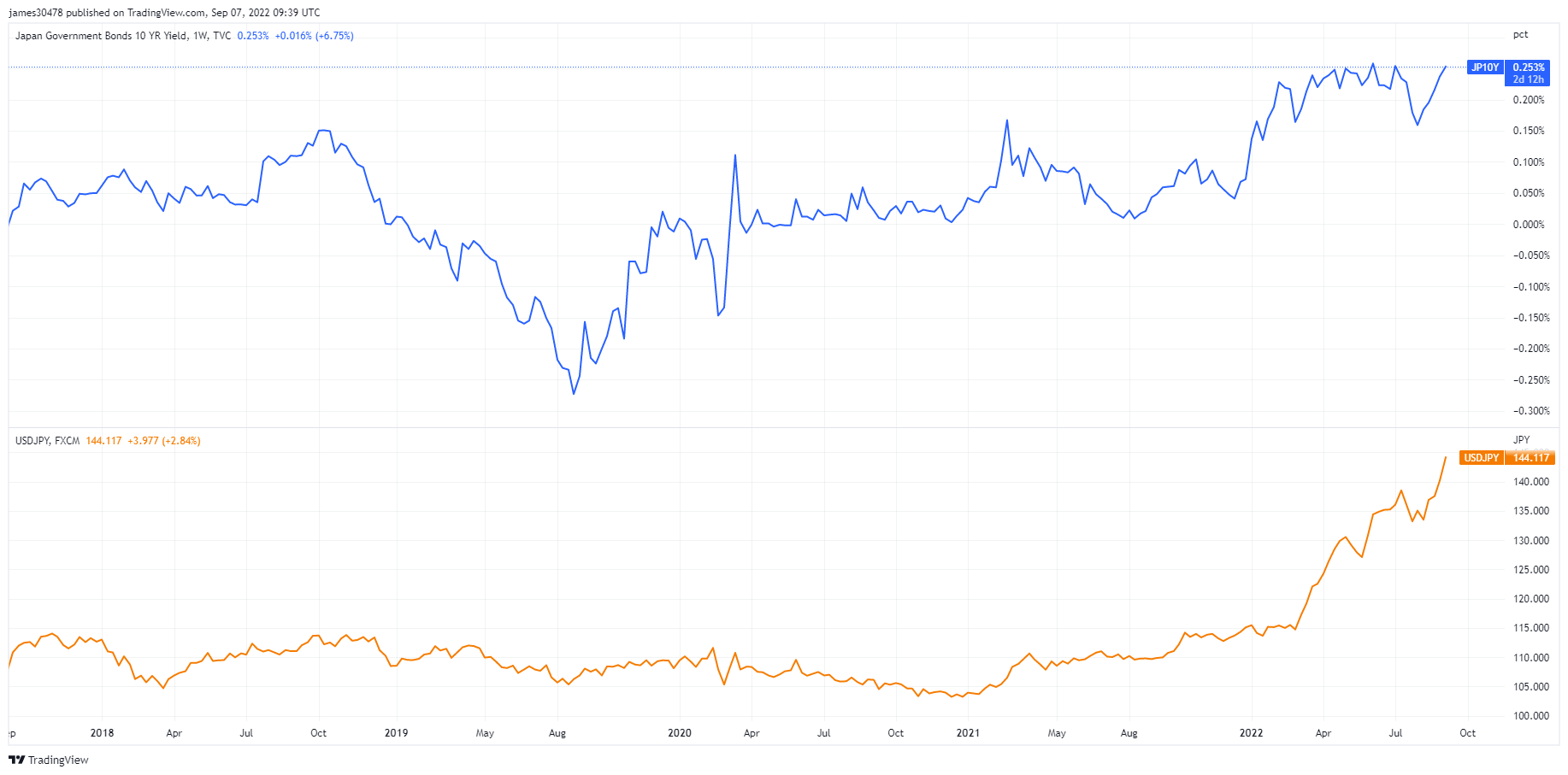

USDJPY chart in focus

The USD/JPY chart continues to make multi-decade highs, at present at 142 and climbing. The Financial institution of Japan (BOJ) is at present at 230% debt to GDP and a 9% deficit, and the hammer blow is that the BOJ owns 50% of presidency debt.

Japan is the world’s largest overseas holder of U.S. treasuries ($1.2 trillion); with a weakening yen, Japan has an extra incentive to promote U.S. treasuries to defend the yen, and people gross sales are made to pay for vitality. The yield curve management by the BOJ, not permitting the 10-year treasury to yield greater than 0.25% (25bps), is inflicting further stress on the Yen.

As of Sep. 7, the 10-year yield went above 0.25%, and BOJ is pressured to purchase bonds with freshly printed yen to pay for provides. Buyers should promote bonds to keep away from being paid again in depreciating yen, all whereas yields proceed to go up additional as bonds sell-off.

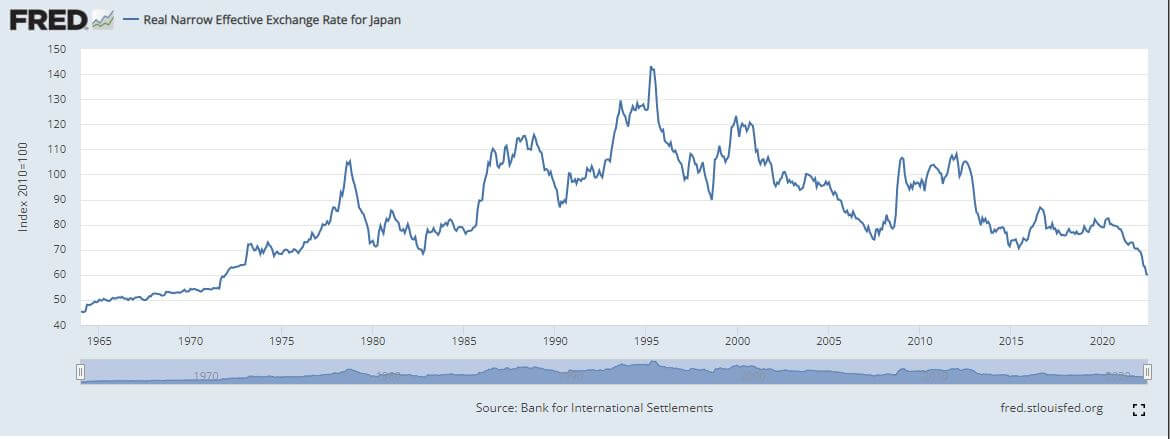

The decline within the Yen could have ripple results all through the worldwide economic system, as Japan is the fourth largest exporter on the planet. The Actual Slender Efficient Alternate Fee for Japan is at ranges not seen since 1973. These types of strikes take time to point out up in asset pricing.

What’s the impact, and does it have an effect on Bitcoin?

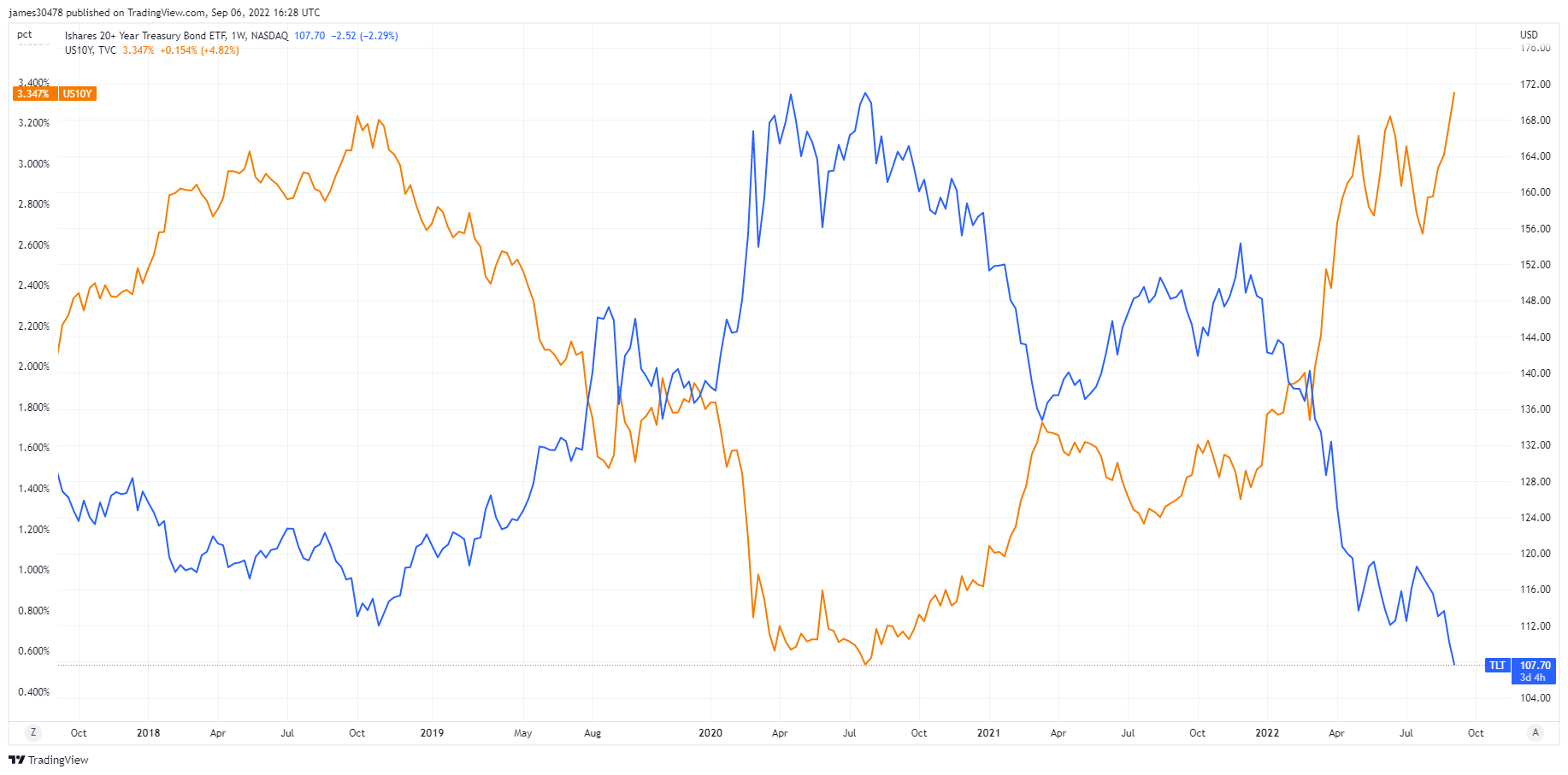

September is the primary month of full-scale quantitative tightening by the fed, which suggests decrease demand for U.S. treasuries, coinciding with Japan and Asia FX being down. Decrease demand for USTs will equal increased U.S. bond yields and danger property struggling.

Because of rising bond yields, this might doubtlessly drive the Fed to think about yield curve management. Nonetheless, one other approach is for the Fed to buy Japanese authorities bonds to take stress off the BOJ.

Bond bulls trapped, debt spiral accelerates

In accordance with Investopedia, TLT is a high-quality ETF, due to a low expense ratio and liquidity. Nonetheless, throughout this world deleveraging occasion that’s occurring, bonds have been slaughtered. Because the fed continues to ramp up Q.T. and the 10-year treasury pushes up in the direction of 4%+. This interprets to a debt service substitute value of $1.2 trillion — 3x the present annual curiosity expense. Subsequently, the U.S. is working in a deficit because the federal debt to GDP is at 137%.

The Fed has two choices, pivot and decrease charges and resume quantitative easing — kicking the can down the proverbial street — or proceed to let inflation hotter than 2%, increase GDP and monetize the debt.

The timeframe is unknown how lengthy this may final however politicians and governments will all the time decide to kick the can down the street till the chickens come dwelling to roost.

Bitcoin Overview

The worth of Bitcoin (BTC) in USD. Bitcoin Value $22,040 10.60% (7D)

The measure of Bitcoin’s whole market cap towards the bigger cryptocurrency market cap. Bitcoin Dominance 39.29% 1.28% (7D)

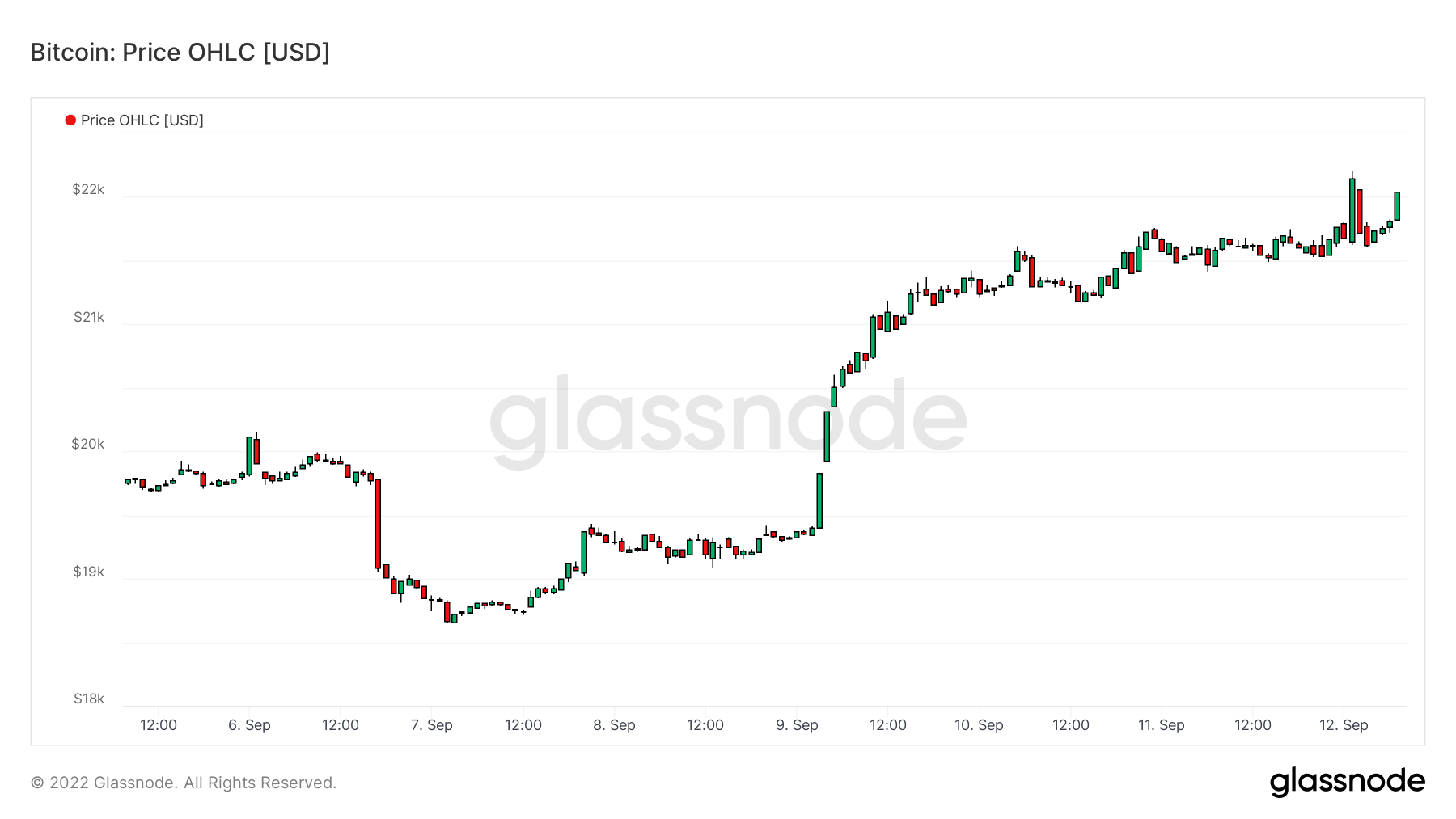

From Sept. 5 onwards, Bitcoin has been buying and selling beneath the realized value which is $21,500

Russia is working with a number of pleasant international locations on cross-border settlements in stablecoins

Beijing-based mining pool Poolin has suspended withdrawals from its pockets citing liquidity points. At the moment, 10% of the bitcoin hash charge factors to the Poolin mining pool.

On Sep. 8, the Local weather and vitality implications of crypto-assets within the U.S. received launched by the white home

Bitcoin closed Sept. 6 at $18,849 down 72.6% drop from its all-time excessive and the bottom shut of a day in 2022

Addresses

Assortment of core deal with metrics for the community.

The variety of distinctive addresses that had been lively within the community both as a sender or receiver. Solely addresses that had been lively in profitable transactions are counted. Lively Addresses 934,803 0.64% (7D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 2,868,464 3.28% (7D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 901,681 0.18% (7D)

The variety of distinctive addresses holding at the very least 1k BTC. Addresses with Stability ≤ 1k BTC 2,140 -0.28% (7D)

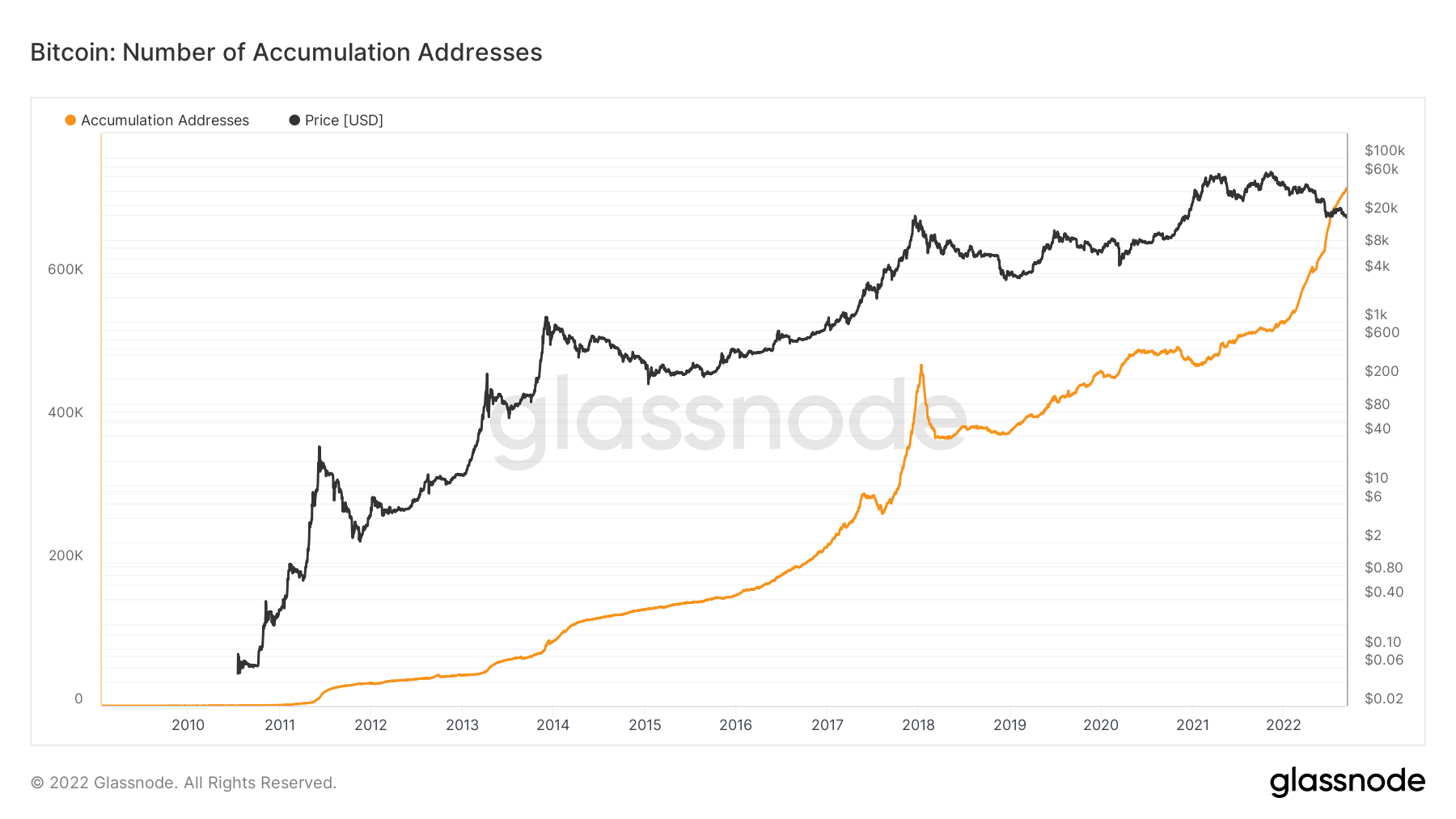

Accumulation addresses proceed its vertical trajectory

The variety of distinctive accumulation addresses continues to succeed in all-time highs. Accumulation addresses are addresses with at the very least 2 incoming non-dust transfers and by no means spent funds. Alternate addresses and addresses acquired from Coinbase transactions (miner addresses) are discarded. To account for misplaced cash, addresses that had been final lively greater than 7 years in the past are omitted as properly.

Through the 2017 bull run, accumulation addresses went parabolic, with a rise of over 200,000 addresses. Nonetheless, an analogous development is happening for 2022, with a rise of 200,000 addresses. However, the worth has regressed for the reason that begin of the yr. Addresses proceed accumulating BTC by way of extreme macro uncertainty and plenty of unfavorable value motion, however what’s encouraging to see that many various cohorts are accumulating albeit at totally different ranges. This yr, plenty of promoting has occurred primarily from liquidations and capitulation from short-term holders, which will probably be defined later within the publication.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to supply a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that had been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated by way of superior heuristics and Glassnode’s proprietary clustering algorithms. Lively Entities 253,203 5.23% (7D)

The variety of BTC within the Function Bitcoin ETF. Function ETF Holdings 23,679 -0.37% (7D)

The variety of distinctive entities holding at the very least 1k BTC. Variety of Whales 1,700 -0.64% (7D)

The overall quantity of BTC held on OTC desk addresses. OTC Desk Holdings 4,119 BTC 8.80% (7D)

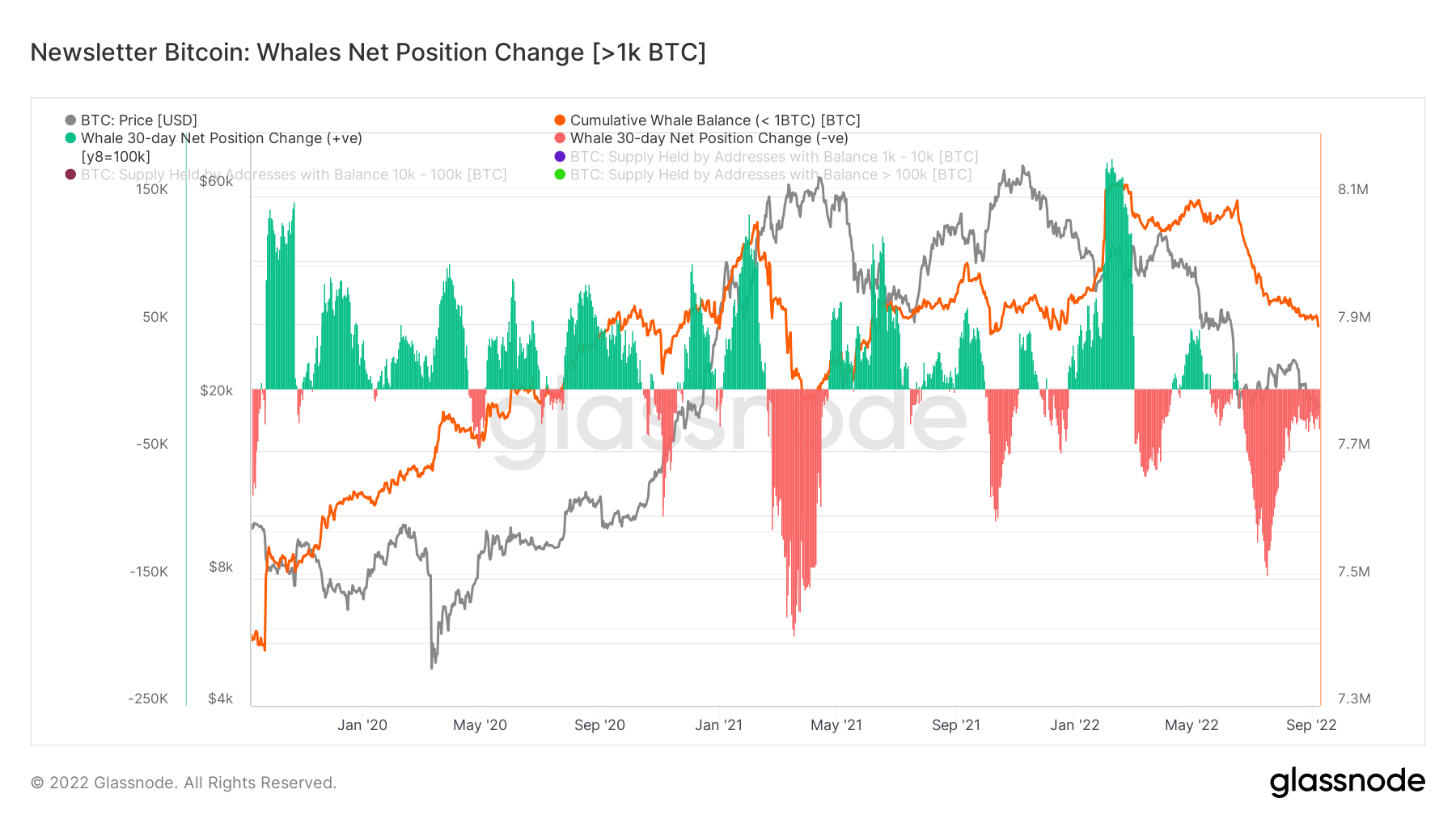

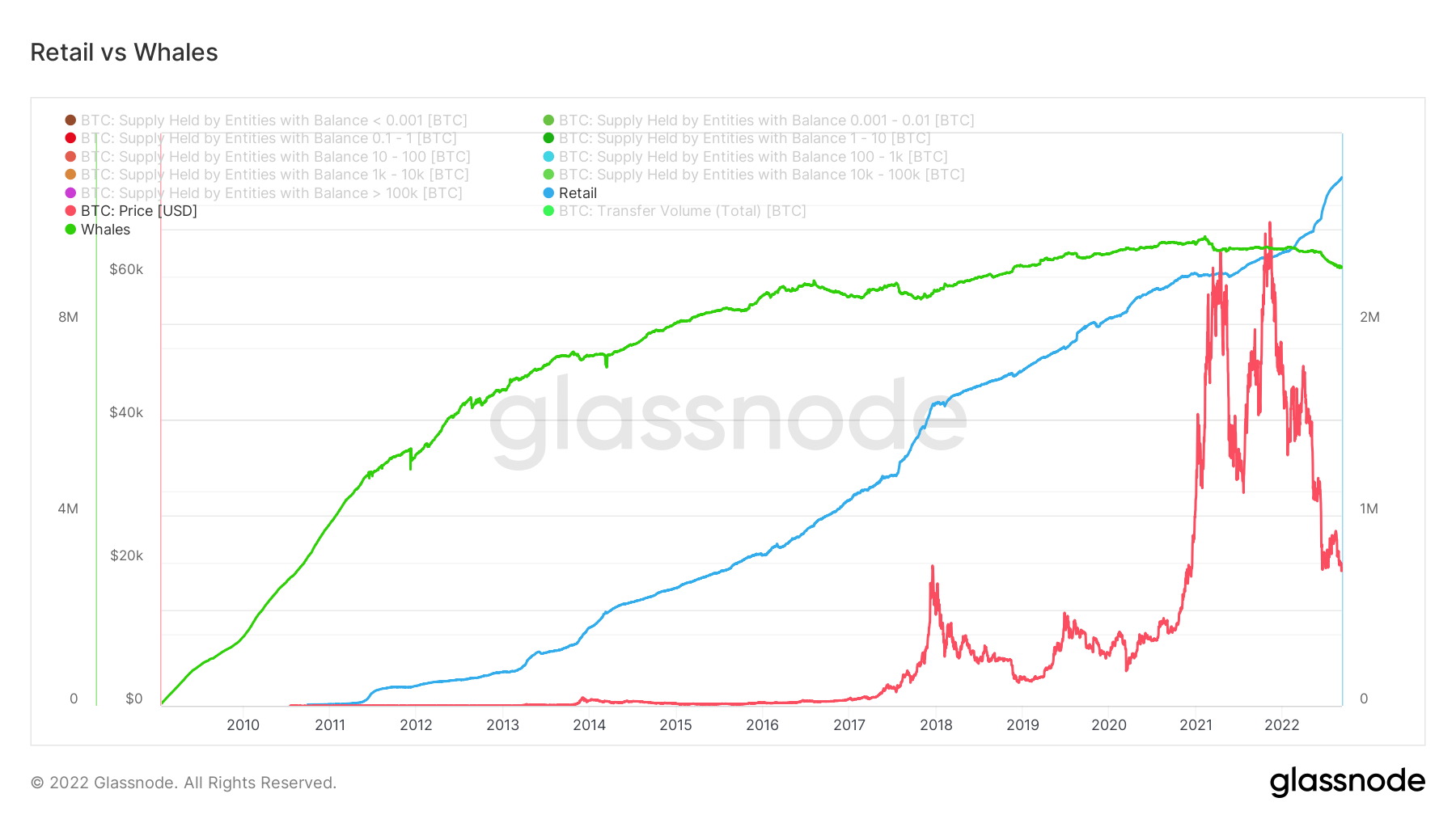

Whales proceed to promote, whereas retail accumulates

Whales are outlined by glassnode as an entity that holds 1,000 BTC or extra. The graph beneath depicts the online place change of whales — when whales purchase and promote. You possibly can see when whales bought (crimson) in Could 2021 and Could 2022, the worth dropped considerably. Conversely, when whales buy BTC, it additionally has a major relationship with value appreciation. Nonetheless, a lot of 2022 has seen whales distribute closely, most notably after the Terra Luna collapse.

As whales proceed to promote their BTC holdings, retail is among the predominant entities persevering with to build up. Retail holds nearly 3 million BTC in comparison with whales’ 9 million BTC. Nonetheless, we will see a transparent development of exponential progress of retail holdings, which is a web optimistic for the adoption and distribution of BTC because it’s concentrated in fewer fingers which is among the many criticisms of Bitcoin.

Dervatives

A spinoff is a contract between two events which derives its worth/value from an underlying asset. The most typical varieties of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/value from the underlying property.

The overall quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $12.56B 9.36% (7D)

The overall quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $21.8B $23.49 (7D)

The sum liquidated quantity (USD Worth) from brief positions in futures contracts. Complete Lengthy Liquidations $129.34M $65.39M (7D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Brief Liquidations $112.77M $75.77M (7D)

The all-time excessive for futures and perpetual open curiosity – brace for volatility

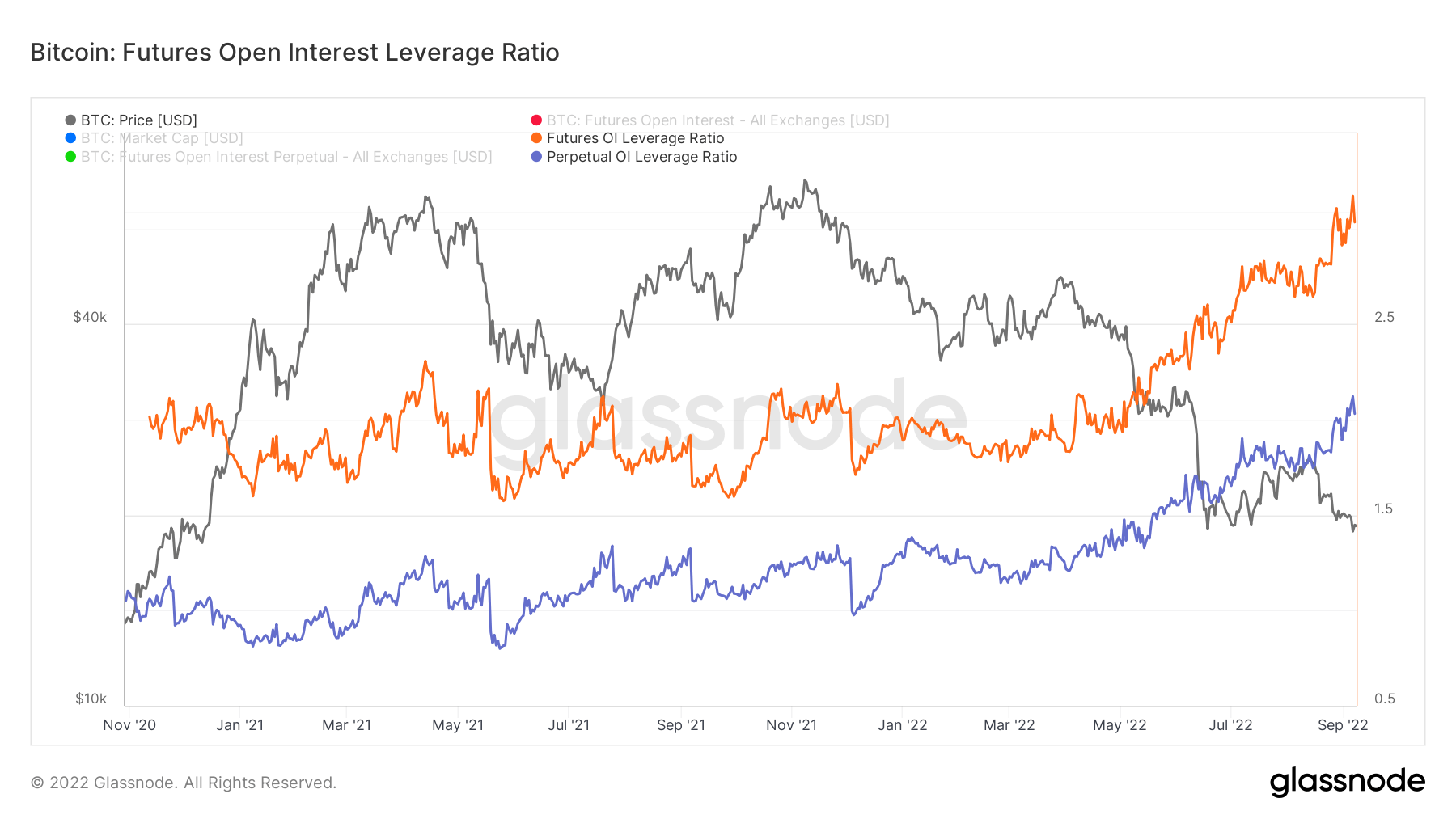

The Futures Open Curiosity Leverage Ratio is calculated by dividing the market open contract worth by the asset’s market cap (introduced as %). This returns an estimate of the diploma of leverage that exists relative to market dimension as a gauge for whether or not derivatives markets are a supply of deleveraging danger.

- Excessive Values point out that futures market open curiosity is massive relative to the market dimension. This will increase the danger of a brief/lengthy squeeze, deleveraging occasion, or liquidation cascade.

- Low Values point out that futures market open curiosity is small relative to the market dimension. That is typically coincident with a decrease danger of derivative-led pressured shopping for/promoting and volatility.

- Deleveraging Occasions similar to brief/lengthy squeezes or liquidation cascades may be recognized by fast declines in OI relative to market cap and vertical drops within the metric.

At the moment, each futures and perpetual OI are at all-time highs, which will increase the probabilities of a extra unstable market, as we’ve seen over the previous few weeks of an rising quantity of liquidations and deleveraging occasions.

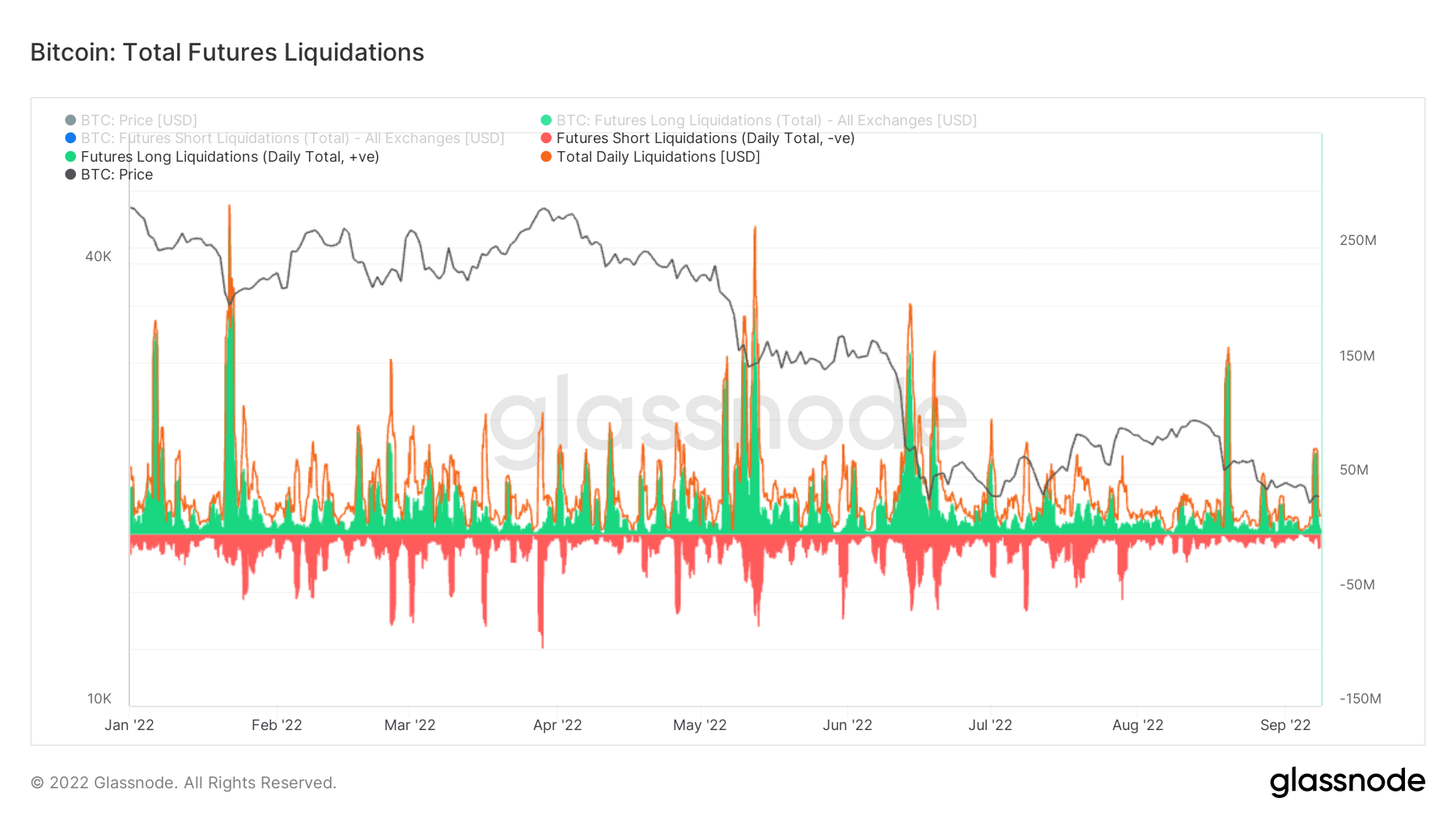

Over $300m of longs liquidated

As leverage will increase within the ecosystem, so does the likelihood of liquidation. That is supported by the metric Complete Futures Liquidations, which has seen a substantial quantity of liquidations in current weeks, on Sep. seventh we noticed round $70m of longs liquidated, plus $145m of longs liquidated on Aug nineteenth. Two of probably the most quantity of longs liquidated this yr as traders had been making an attempt to purchase the bear market rally.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The common estimated variety of hashes per second produced by the miners within the community. Hash Fee 282 TH/s 8.05% (7D)

The overall provide held in miner addresses. Miner Stability 1,834,866 BTC 0.05% (7D)

The overall quantity of cash transferred from miners to trade wallets. Solely direct transfers are counted. Miner Internet Place Change -51,751 BTC -4,170 BTC (7D)

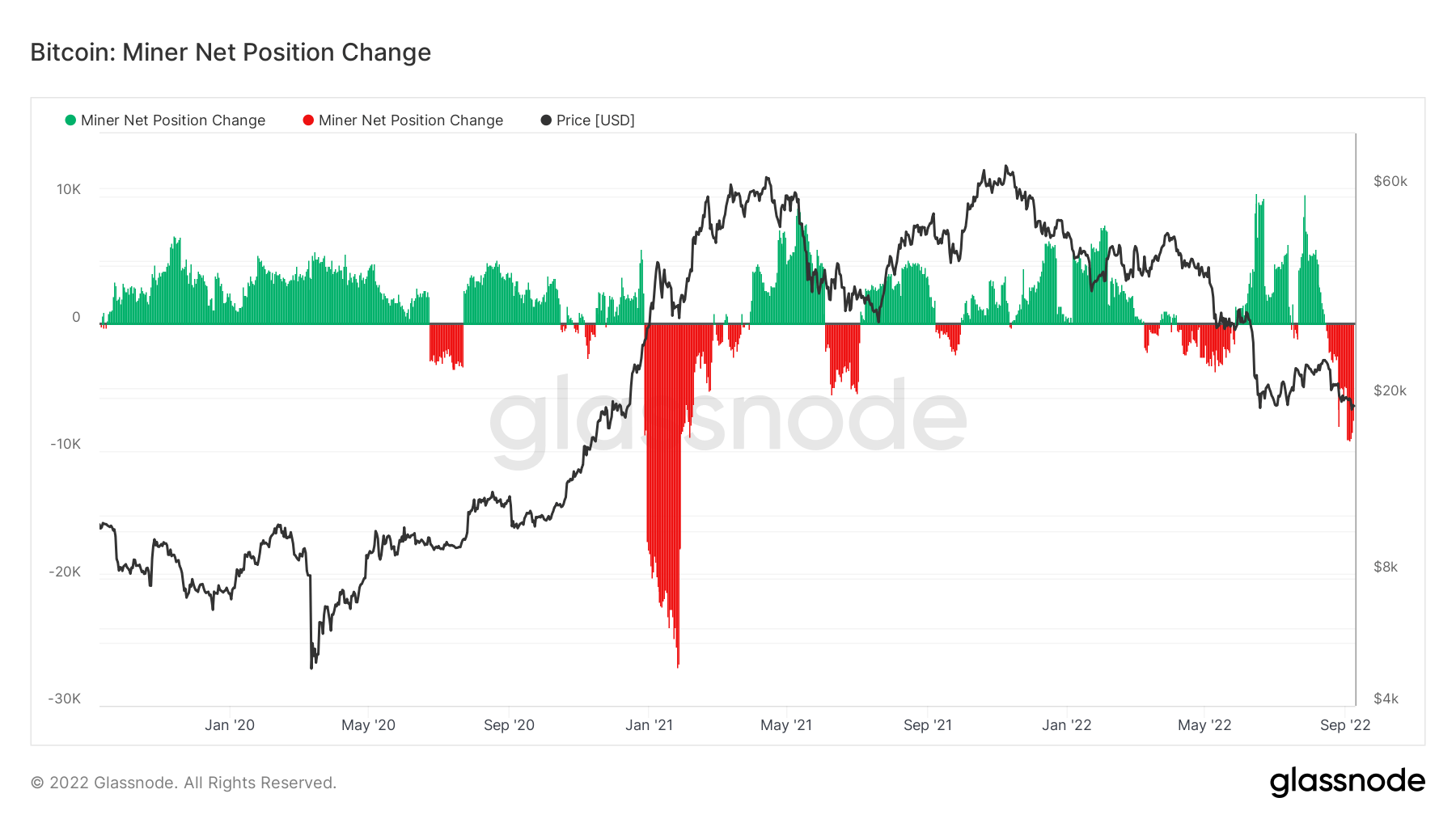

Miner capitulation isn’t over

Because of rising manufacturing prices and a mining issue of 1% off its all-time excessive we’re witnessing revenues fall for miners which can see unprofitable miners swap off from the community. The hash ribbon metric is at present signalling mining capitulation is over nevertheless, Cryptoslate aren’t believing this for the time being.

With this intensive monetary stress on miners, outflows have reached peaks of virtually 10,000 BTC, which is comparable with the 2018/19 bear market however not as vital because the early 2021 promoting. Stability in miner wallets continues to unload from its peak (round 15,000 BTC), nevertheless, as soon as CryptoSlate see a significant reversal in miner behaviour we will change into extra bullish on a BTC backside forming.

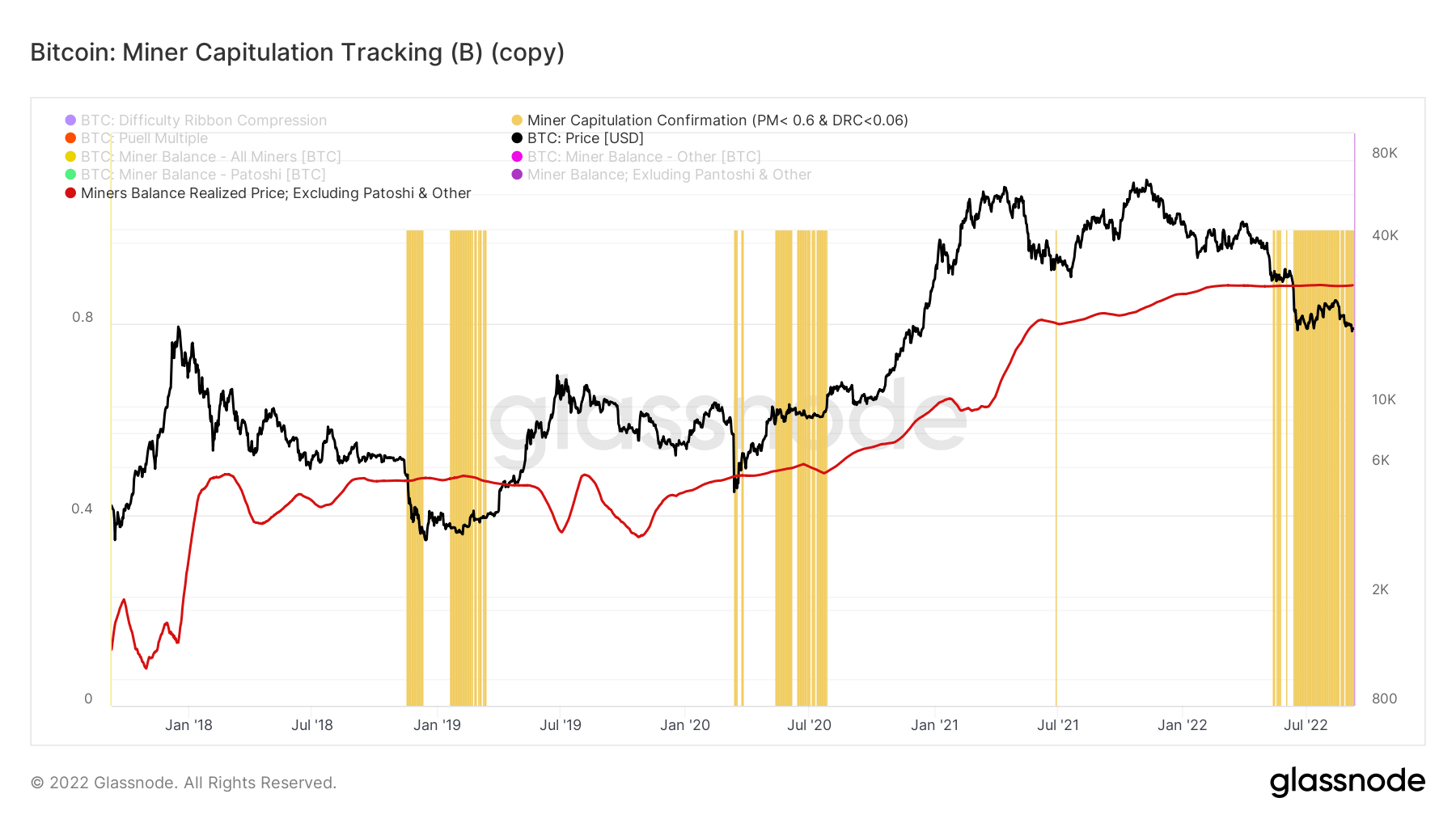

To verify the capitulation from the miners isn’t over. The miner capitulation monitoring device assesses the likelihood of a capitulation inside miners, while it seeks a confluence between a Pull A number of < 0.6 and issue ribbon compression <0.06. in addition to taking the realized value for miners (excluding patoshi cash) which acts as a gauge for the mined steadiness value foundation, at present stands at $27,775.

The place CryptoSlate has highlighted zones in yellow reveals capitulation the place Bitcoin has traded beneath the realized value for miners. As you may see for a lot of the second half of 2022, we have now been buying and selling beneath the realized value, this tracing device additionally confirmed capitulation throughout 2014-15, 2018-2019, and the 2020 bear market.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized trade exercise.

The overall quantity of cash held on trade addresses. Alternate Stability 2,371,982 BTC 27,173 BTC (7D)

The 30 day change of the availability held in trade wallets. Alternate Internet Place Change -117,735 BTC 262,089 BTC (30D)

The overall quantity of cash transferred from trade addresses. Alternate Outflows Quantity 247,259 BTC 12 BTC (7D)

The overall quantity of cash transferred to trade addresses. Alternate Inflows Quantity 257,063 BTC 5 BTC (7D)

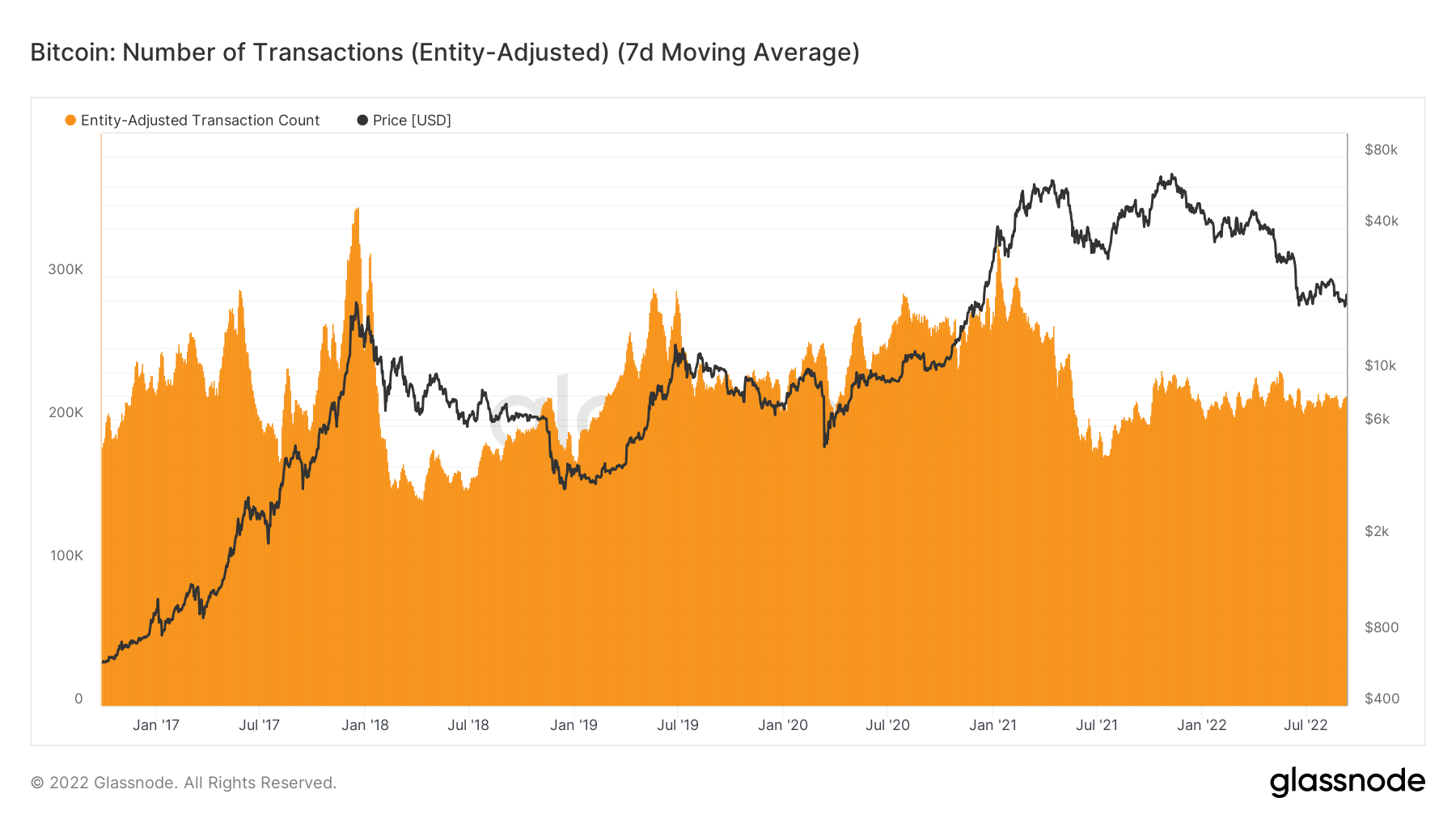

The variety of transactions signifies a bear market

The variety of transactions sheds additional perception into the demand for community utilization and block house. Restricted obtainable block house limits transactional capability, and charges are used to generate a transaction. Low charges, no clear signal of site visitors congestion.

Through the bull runs of 2017 and 2021, it’s clear to see an enormous spike within the variety of transactions, surpassing 300,000. Nonetheless, as bull market cycles end and bear markets start, transactions begin to fall off a cliff which is noticeable in 2018 and starting to mid-2021. After a couple of months of restoration in 2021, demand has stagnated for the previous twelve months, indicating this can be a HODLers atmosphere. This flooring turns into the brand new regular till the following bull market resumes.

Geo Breakdown

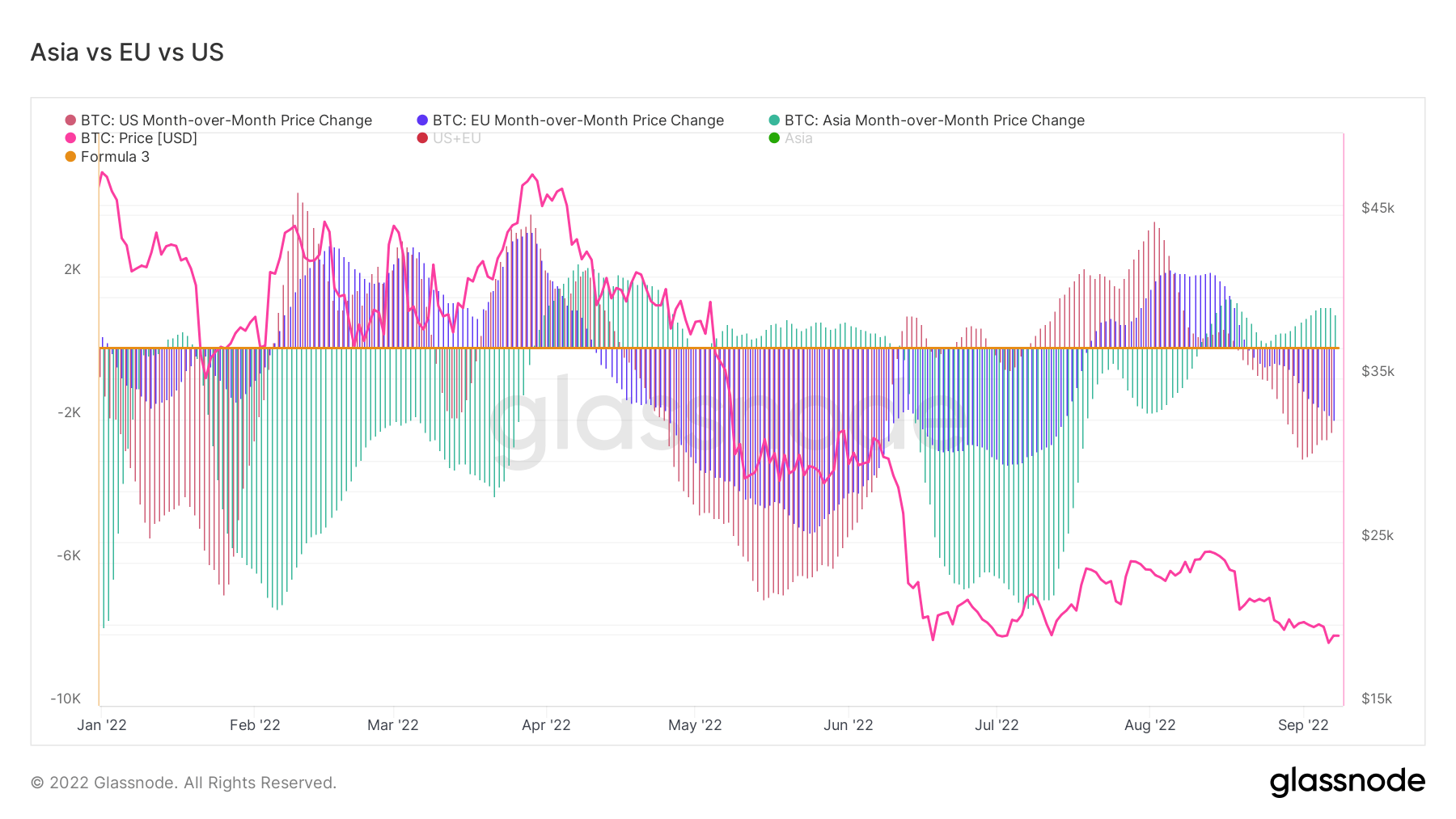

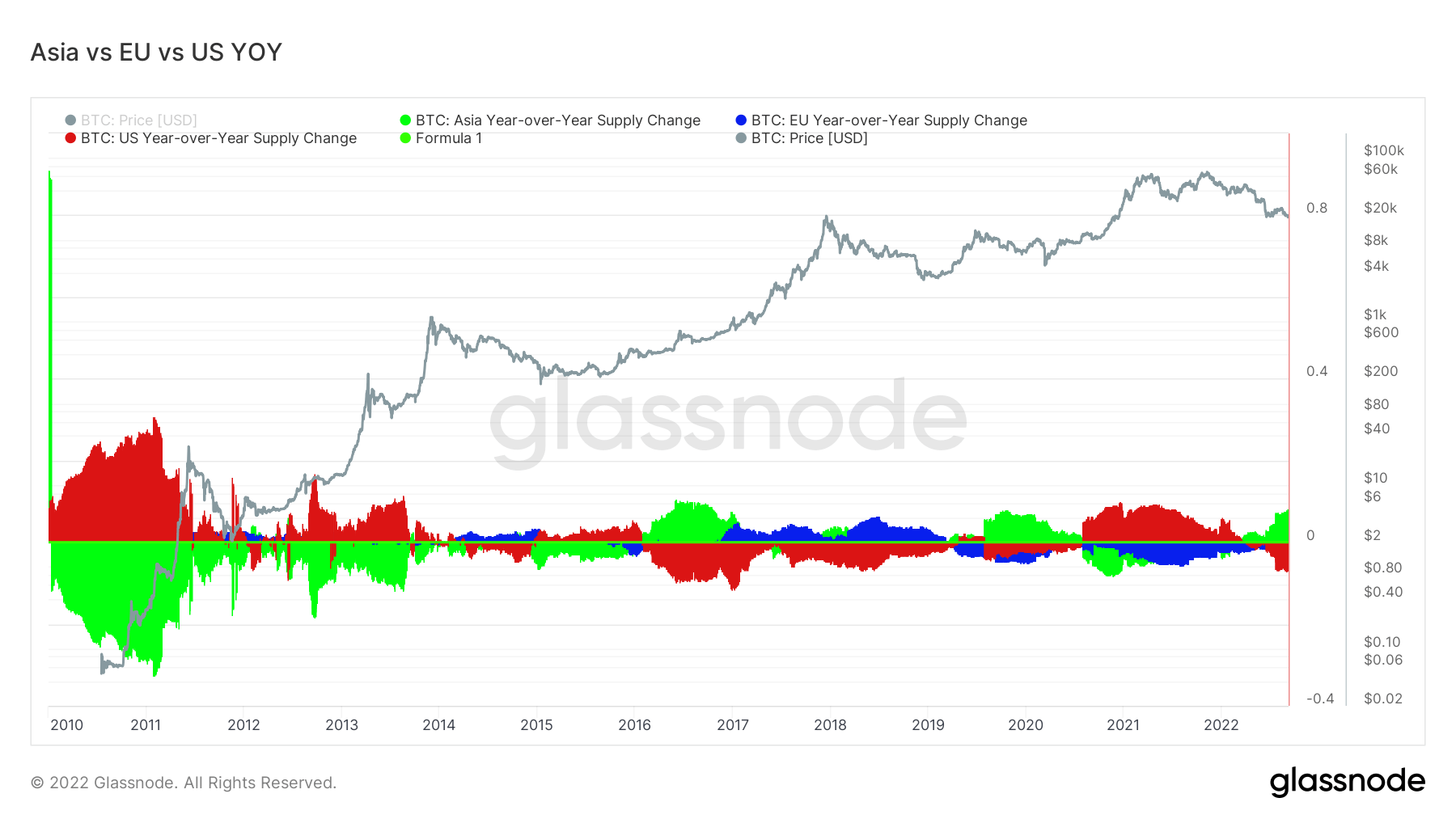

Regional costs are constructed in a two-step course of: First, value actions are assigned to areas based mostly on working hours within the US, Europe, and Asia. Regional costs are then decided by calculating the cumulative sum of the worth modifications over time for every area.

This metric reveals the 30-day change within the regional value set throughout Asia working hours, i.e. between 8am and 8pm China Commonplace Time (00:00-12:00 UTC). Asia 4,762 BTC -3,260 BTC (7D)

This metric reveals the 30-day change within the regional value set throughout EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer season Time (06:00-18:00 UTC). Europe -15,070 BTC -3,617 BTC (7D)

This metric reveals the 30-day change within the regional value set throughout US working hours, i.e. between 8am and 8pm Jap Time (13:00-01:00 UTC), respectively Jap Daylight Time (12:00-0:00 UTC). U.S. -12,827 BTC 6,027 BTC (7D)

Asia extends bullishness

Asian traders, that are thought of “sensible cash,” have continued to build up for the reason that begin of September. In the meantime, worry continues to develop within the U.S. and EU.

The year-over-year provide continues to increase with Asia, and their bullishness is at present in step with the 2016-17 and 2020 bear markets. Asia is selecting up low cost BTC throughout macro uncertainty.

Layer-2

Secondary layers, such because the Lightning Community, exist on the Bitcoin blockchain and permits customers to create cost channels the place transactions can happen away from the primary blockchain

The overall quantity of BTC locked within the Lightning Community. Lightning Capability 4,749 BTC 1.41% (7D)

The variety of Lightning Community nodes. No. of Nodes 17,459 -0.11% (7D)

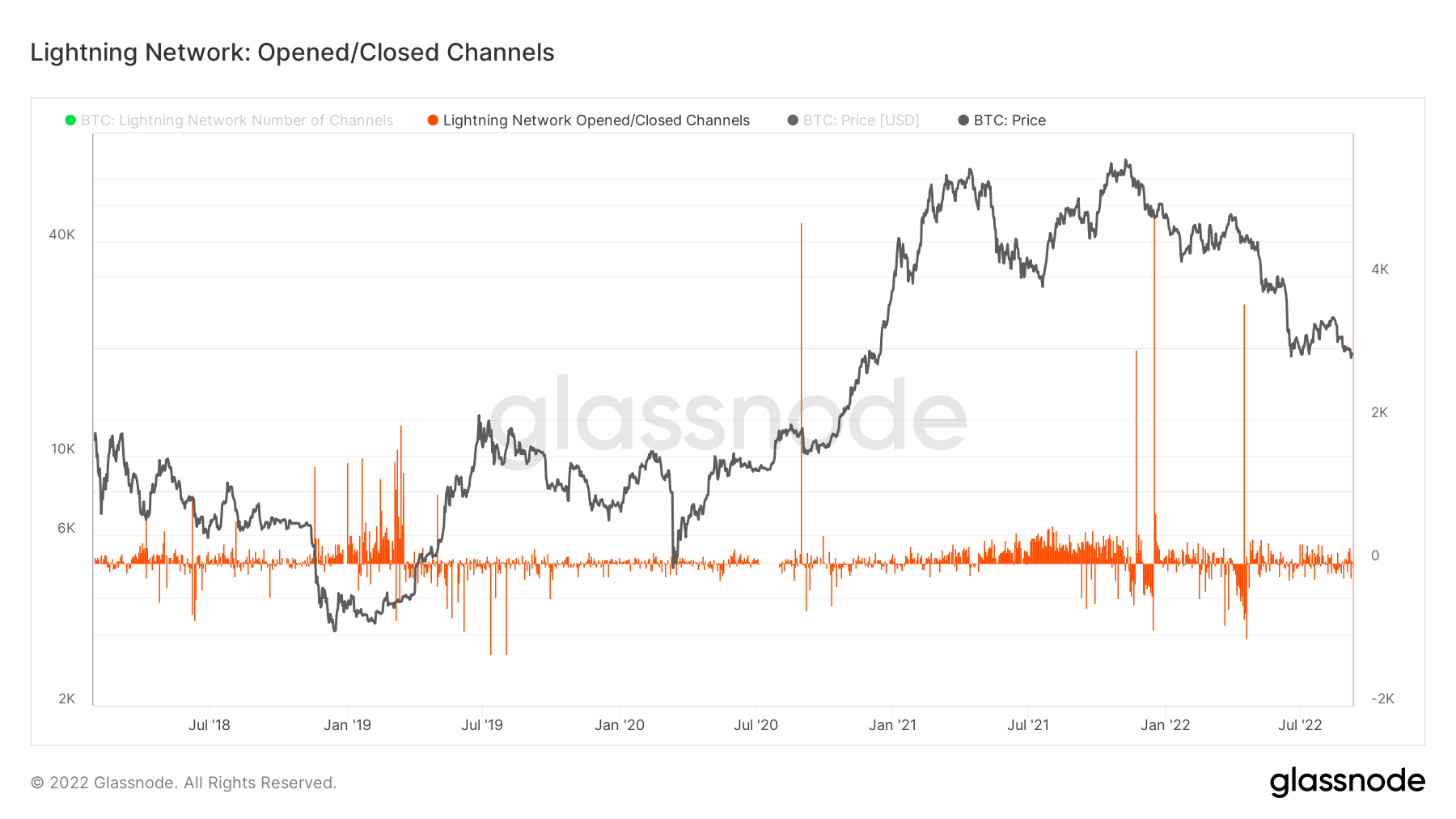

The variety of public Lightning Community channels. No. of Channels 85,528 -0.50% (7D)

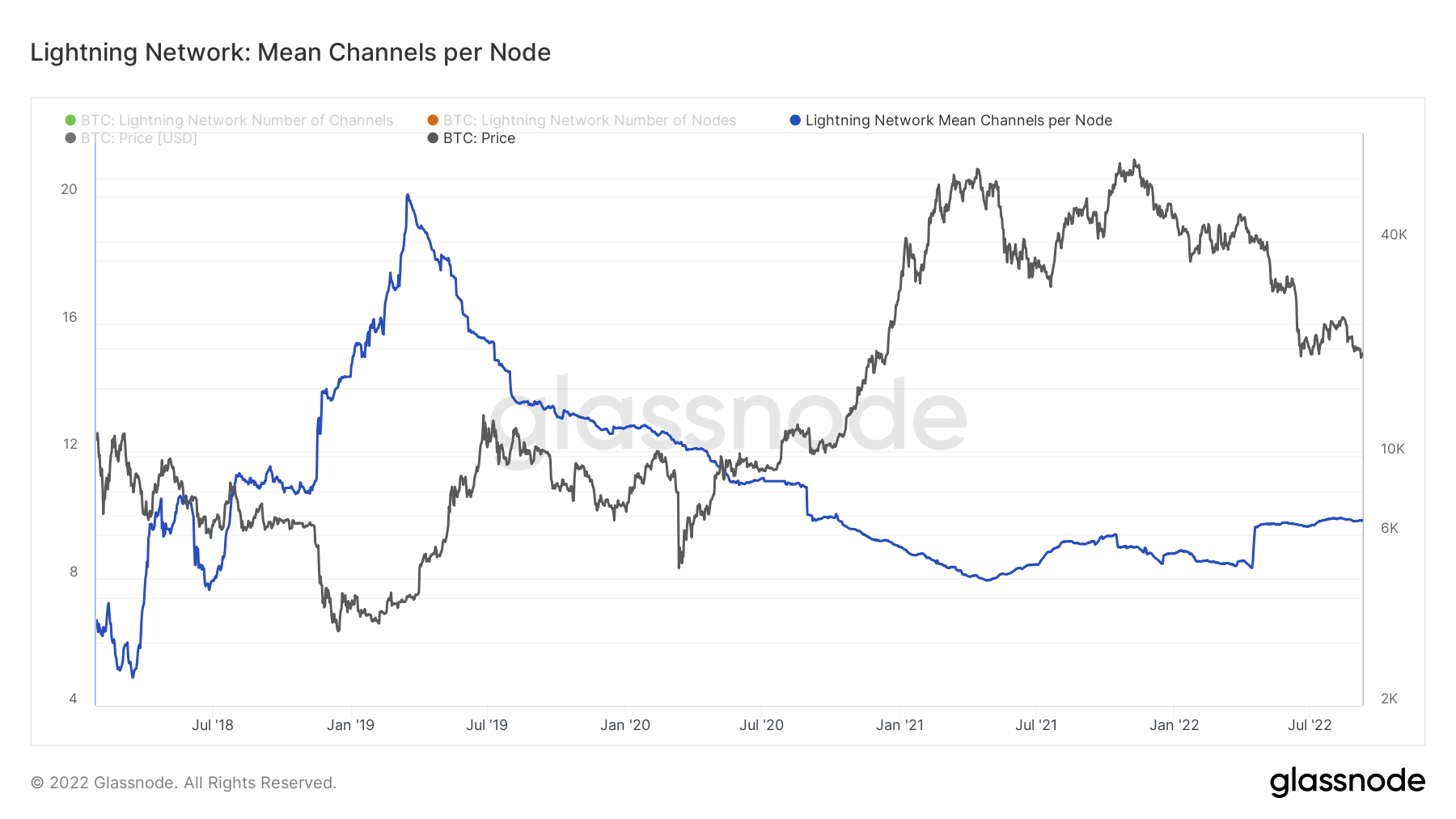

Lightning nodes and channels stay muted

Because the lightning community continues to develop organically and continues to hit all-time highs week after week for August. From a node and channel perspective it stays muted, a median variety of lightning community channels per node has remained flat for nearly 2 years. While lightning community channels opened or closed every day is significantly much less in comparison with the bull market of 2021.

Provide

The overall quantity of circulating provide held by totally different cohorts.

The overall quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.61M BTC 0.29% (7D)

The overall quantity of circulating provide held by brief time period holders. Brief Time period Holder Provide 3.12M BTC -1.93% (7D)

The % of circulating provide that has not moved in at the very least 1 yr. Provide Final Lively 1+ Yr In the past 66% 0.00% (7D)

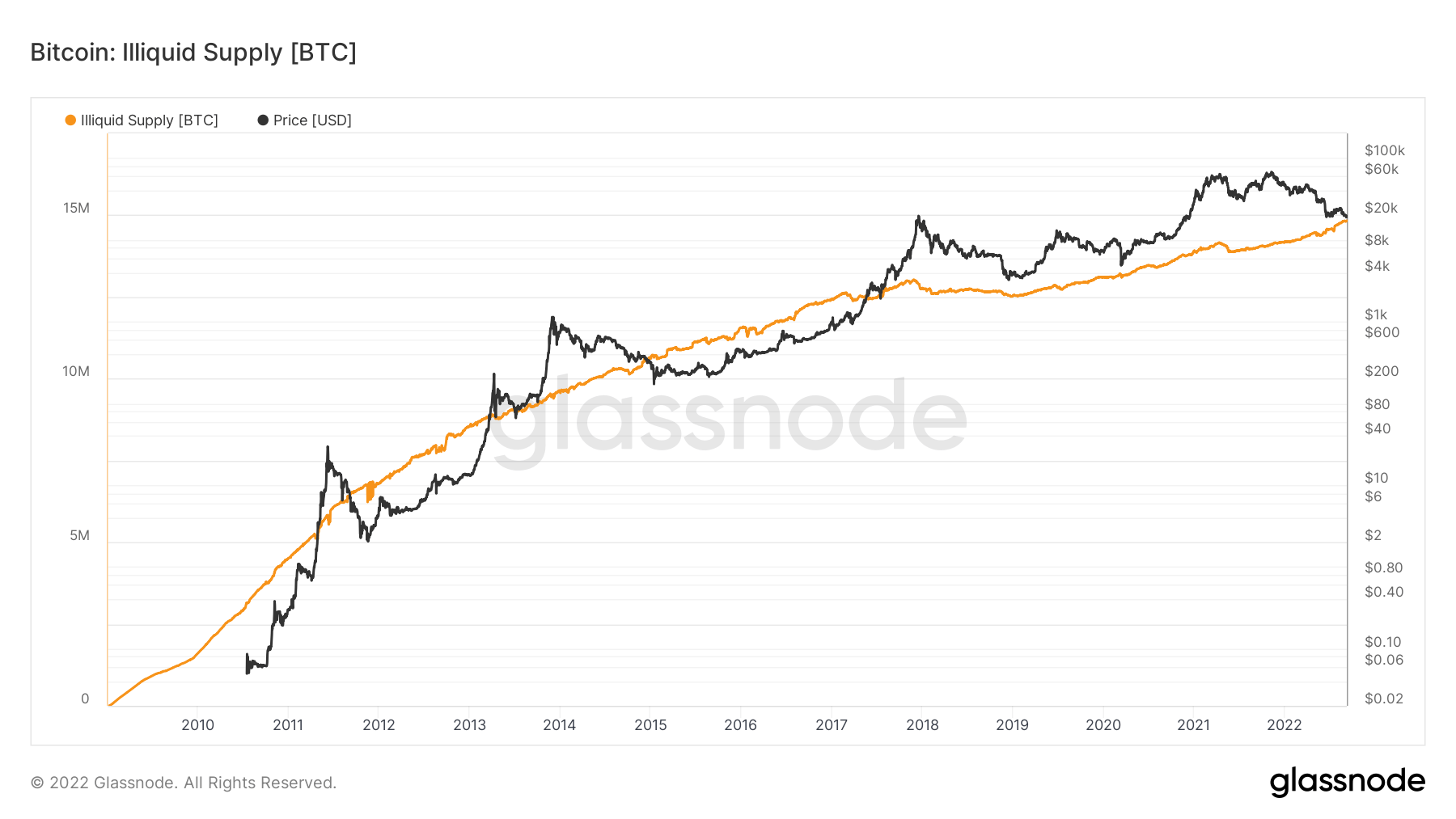

The overall provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.83M BTC 0.14% (7D)

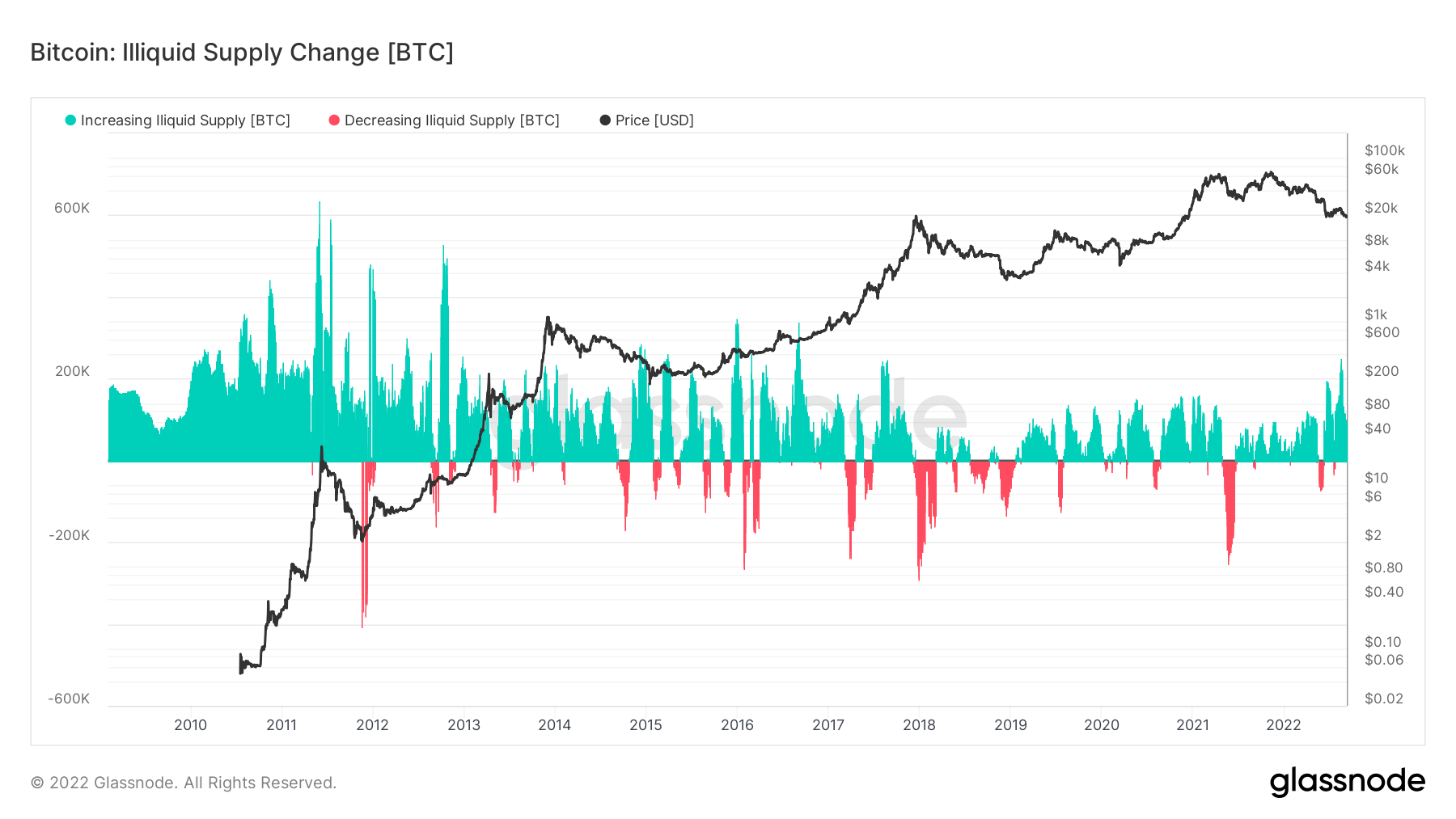

Illiquid provide continues to develop

Illiquid provide is outlined as the whole provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.

Illiquid provide continues to develop by way of a bear market and a world deleveraging occasion occurring within the macro. That is an encouraging signal; even when the client demand just isn’t robust, traders aren’t keen to let go of their BTC. At the moment, 74% of the Bitcoin provide is illiquid. The illiquid provide has grown by nearly 1 million BTC for the reason that starting of the yr, at present at a staggering 14.8 million BTC.

The chart beneath confirms our assumption that the illiquid provide of BTC remains to be rising. Regardless of the numerous drop in value this yr, long-term traders’ web accumulation remains to be optimistic as extra Bitcoin is being put away into “chilly” storage. There was a visual surge in cash turning into extra illiquid over the previous few months — 400,000 BTC — as traders transfer to scoop up the comparatively low cost BTC.

Cohorts

Breaks down relative habits by varied entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value bought / value paid. Lengthy-term Holder SOPR 0.60 -72.48% (7D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes into consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of brief time period traders. Brief-term Holder SOPR 0.99 0.00% (7D)

The Accumulation Pattern Rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain by way of their BTC holdings. The dimensions of the Accumulation Pattern Rating represents each the dimensions of the entities steadiness (their participation rating), and the quantity of recent cash they’ve acquired/bought over the past month (their steadiness change rating). An Accumulation Pattern Rating of nearer to 1 signifies that on combination, bigger entities (or an enormous a part of the community) are accumulating, and a worth nearer to 0 signifies they’re distributing or not accumulating. This gives perception into the steadiness dimension of market contributors, and their accumulation habits over the past month. Accumulation Pattern Rating 0.173 1630.00% (7D)

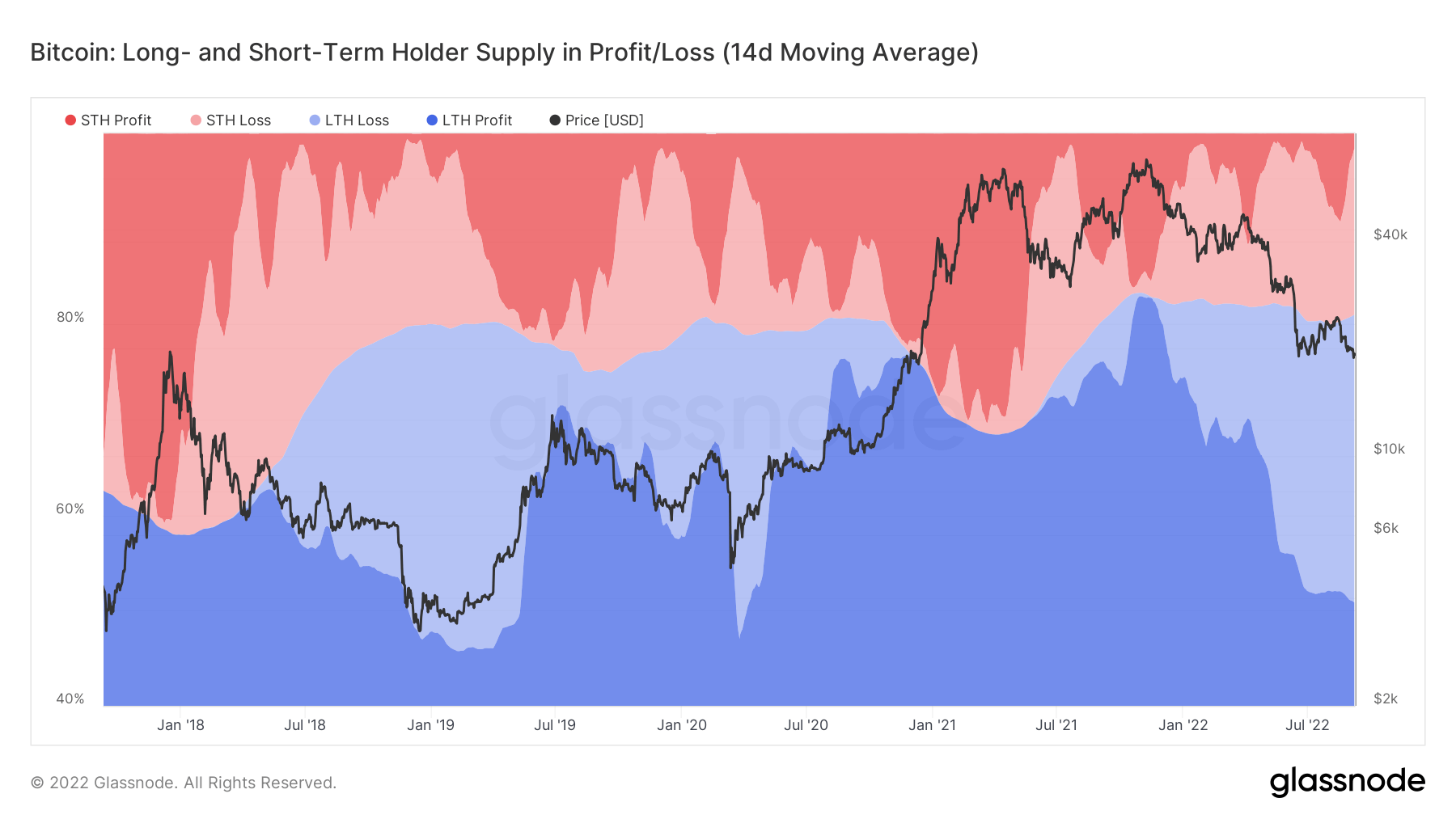

Lengthy-term holders underwater

Lengthy-term holders are outlined as traders who’ve held bitcoin for greater than 155 days. LTHs (blue shading) at present maintain 80% of the availability of BTC, which is analogous to earlier bear market lows similar to 2019 and 2020, as STHs capitulate on account of value correction.

At the moment, over 30% of LTHs are at a loss with their BTC purchases which is probably the most since 2020, and with a excessive diploma of certainty, they purchased through the peak of the 2021 bull run. Nonetheless, this new cohort that got here in through the 2021 bull run just isn’t promoting at these value ranges, which solely strengthens the community for the long run.

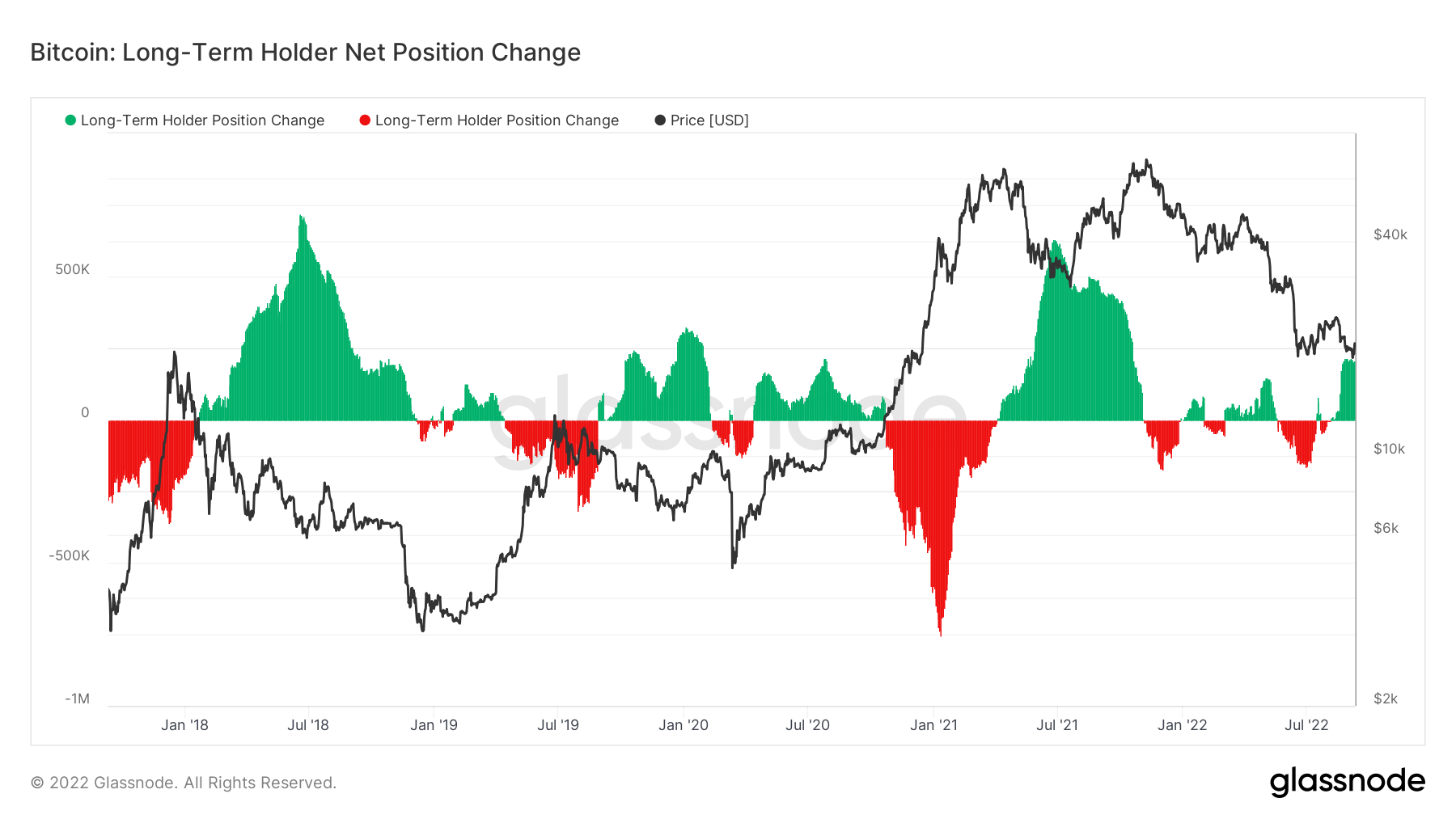

Lengthy-term holders proceed to build up

LTHs are seeing these present value ranges as a time for accumulation throughout this “crypto winter”. LTHs purchase BTC when the worth is suppressed, however contemplating the uncertainty and macro occasions which have taken place this yr, it’s encouraging to see accumulation to this diploma. Because of the significance of uncertainty for LTHs, they’re flipping between distribution and accumulation with significantly smaller portions than in earlier cycles.

Stablecoins

A kind of cryptocurrency that’s backed by reserve property and subsequently can supply value stability.

The overall quantity of cash held on trade addresses. Stablecoin Alternate Stability $37.43B 1.61% (7D)

The overall quantity of USDC held on trade addresses. USDC Alternate Stability $2.46B -12.75% (7D)

The overall quantity of USDT held on trade addresses. USDT Alternate Stability $17.01B 1.61% (7D)

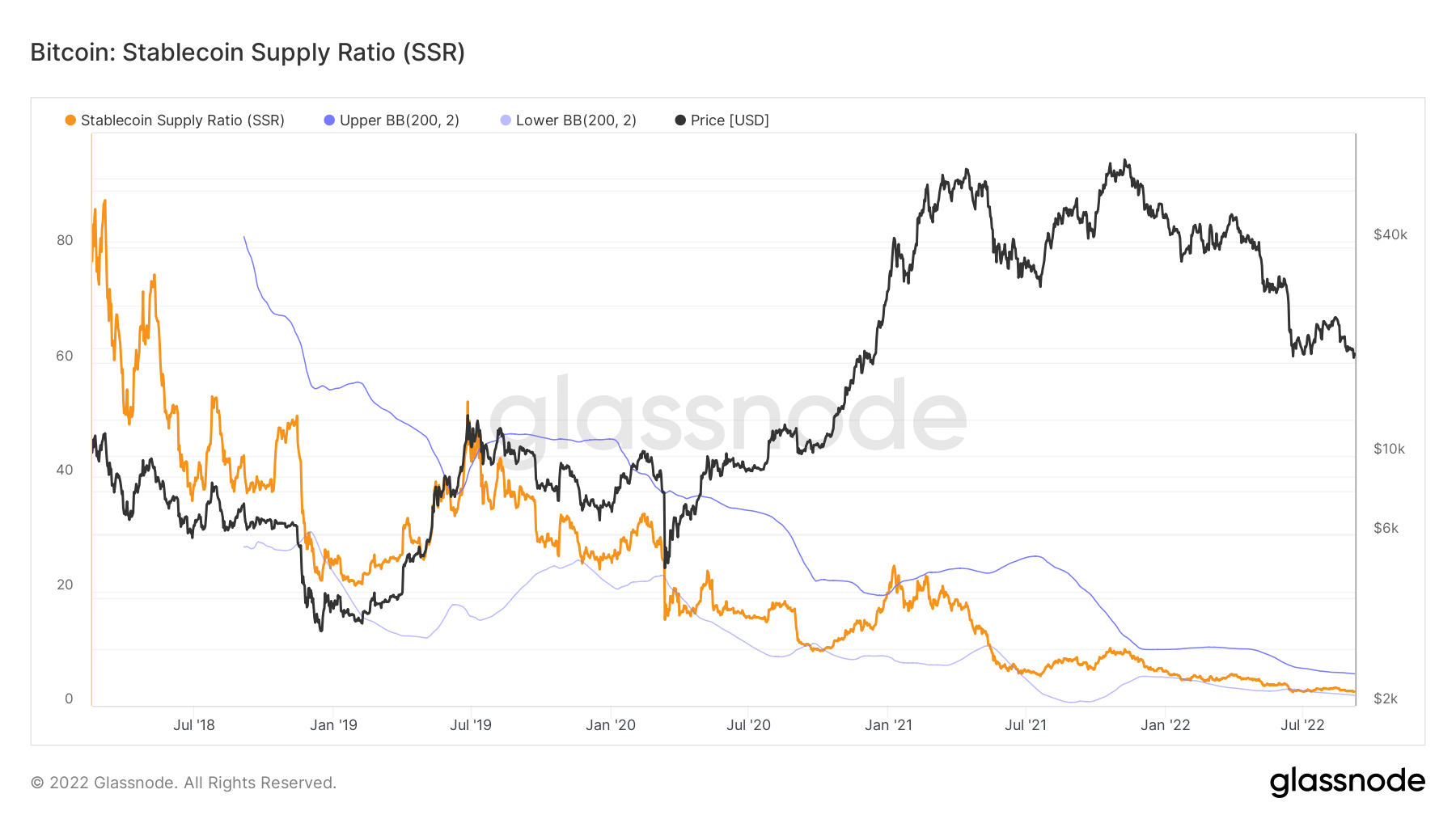

‘Dry powder’

“Dry Powder” refers back to the variety of stablecoins obtainable on exchanges held by traders who’ve acquired tokens similar to USDC or USDT. The final assumption is excessive ranges of stablecoins held on exchanges are a bullish signal for BTC because it reveals a willingness to maintain capital within the crypto markets till circumstances change.

The chart beneath reveals round $40 billion stablecoins ready to be deployed, which is nearly at an all-time excessive as contributors are ready for the macro to vary from danger off to danger on.

(*The chart above solely accounts for the next Stablecoins: BUSD, GUSD, HSUD, DAI, USDP, EURS, SAI, USDD, USDT, USDC)