Macro Overview

Markets unprepared for a brand new period

The period of economic repression after the GFC that has seen quickly inflated asset values and price expectations of 0 has unraveled for the reason that pandemic ended. Because the Second World Battle, probably the most vital fiscal stimulus bundle has contributed to produce chain failures and surges in items and providers. This has unleashed a wave of demand for providers with labor that is still briefly provide. Fastened revenue yields have surged to multi-year highs, and buyers proceed to flock to the greenback.

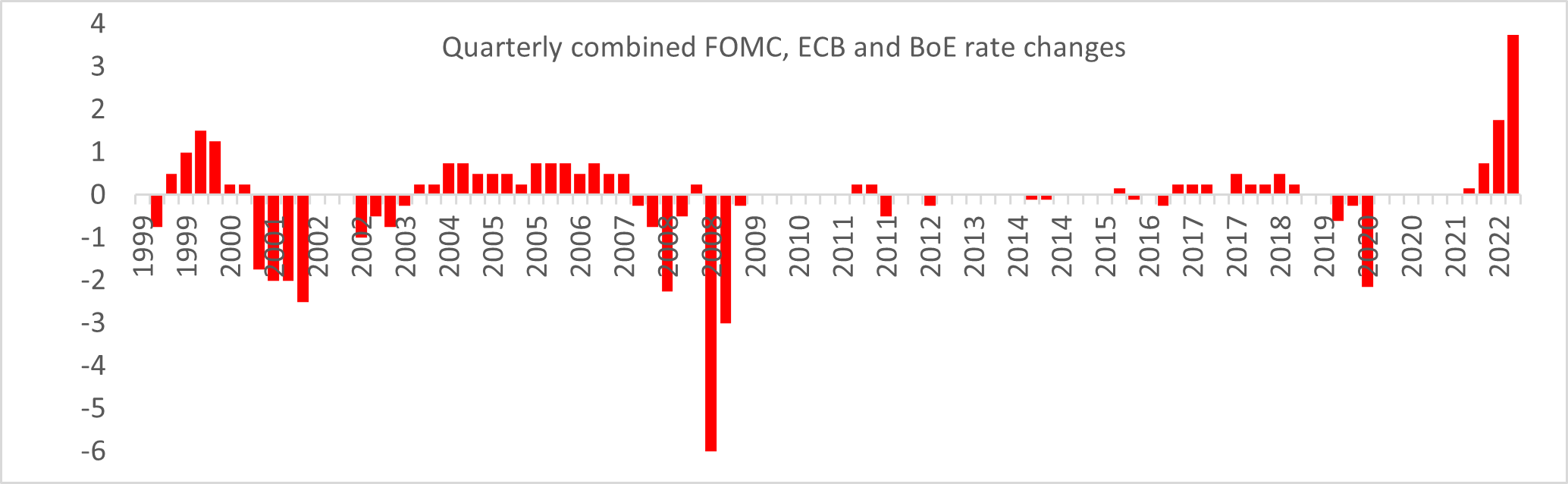

The previous period has ended; central banks have stored rates of interest at all-time lows for the previous twenty years and have been extraordinarily sluggish to hike. Nevertheless, since 1999, the mixed strikes from the FOMC, ECB, and BOE have had a mixed price change of two% for September and three.75% over the quarter. Probably the most for the reason that institution of the ECB.

Is Credit score Suisse the Lehman Brothers of this cycle?

Credit score default swaps (CDS) could appear difficult and heard through the GFC again in 2008, however the CDS market is telling us one thing related could also be occurring in 2022.

Historical past doesn’t repeat, however it usually rhymes.

What are CDS? In layman’s phrases, a swap is a contract between two events agreeing to swap one threat for one more. One celebration purchases safety from one other celebration in opposition to losses from a borrower’s default.

With each swap, there’s a ‘counterparty threat.’ In the course of the housing disaster in 2008, Lehman Brothers went bankrupt and couldn’t pay again the insurance coverage they offered to buyers. The homeowners of the CDS suffered a loss on the bonds that defaulted.

CDS is an effective indicator of potential defaults; when the worth of the CDS rises, the insurance coverage turns into dearer (increased elevated probability of default).

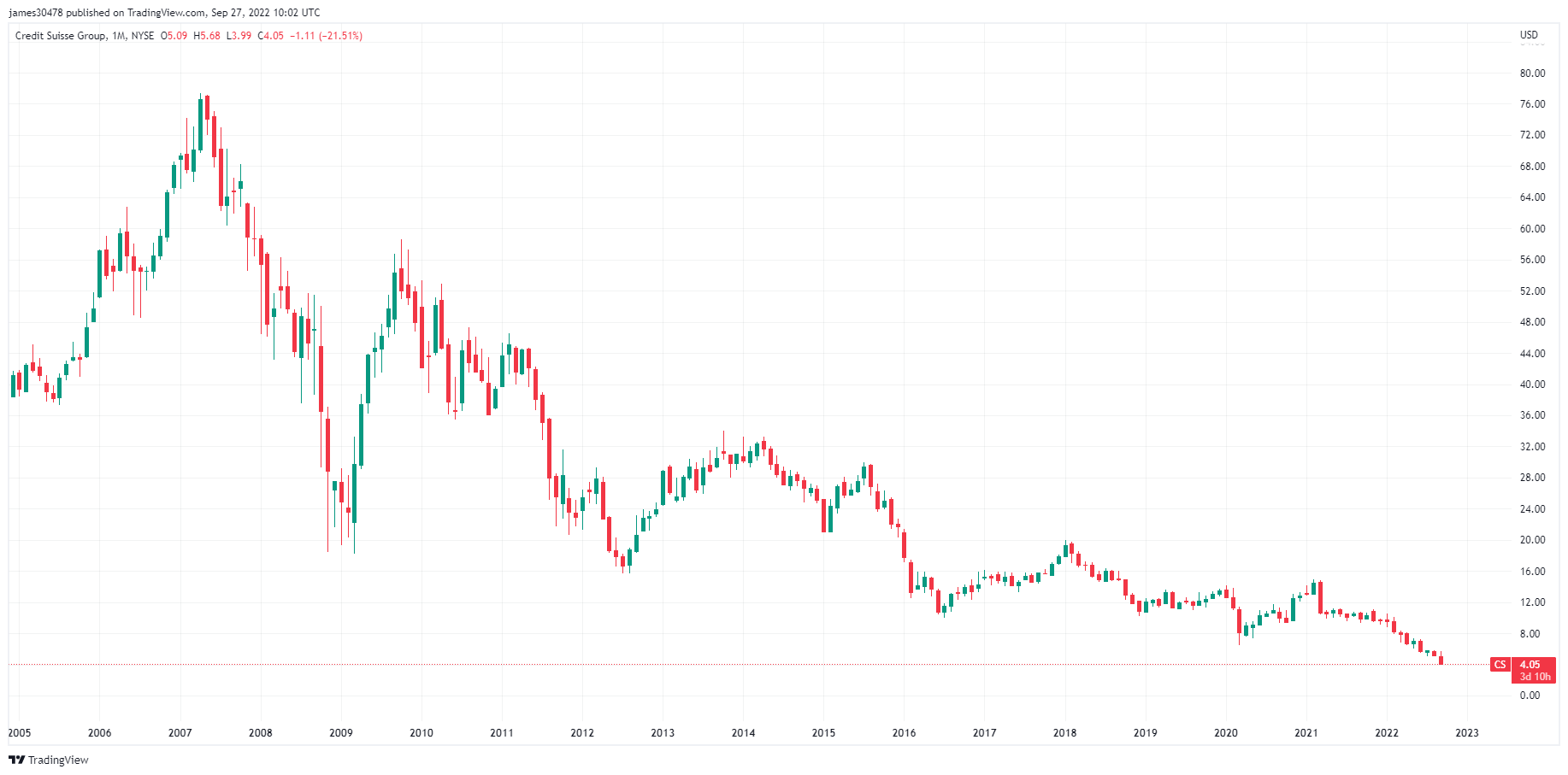

In current occasions it hasn’t been so good for Credit score Suisse (CS), a report buying and selling loss, shuttered funding funds, a number of lawsuits, company scandal, and a brand new CEO. Poor performances have seen greater than 10% of its 45,000 workforce fired whereas leaving the US market and splitting up its funding financial institution.

Default insurance coverage on Credit score Suisse is approaching the identical stage as throughout Lehman Brothers’ collapse.

On account of the above, the share value has tanked from $14.90 in February 2021 to $3.90 at present and is avoiding going to the marketplace for funding attributable to its tumbling share value. CS has dropped beneath 1 / 4 of its e-book worth whereas its market cap is beneath its income.

Must you be involved about your CS pension? Holding USD doesn’t imply so much as a result of all you’ve got is an IOU from the financial institution in the event that they go bancrupt.

Many Bitcoiners imagine BTC is the perfect safety in opposition to fiat failure as a result of lack of counterparty threat. So long as you custody and retailer Bitcoin accurately, the Bitcoin is yours, and there’s no default threat on the insurance coverage you personal. In contrast to CDS, Bitcoin has no expiry choice. As well as, it’s also protected in opposition to hyperinflation attributable to its finite provide.

Correlations

DXY wrecking ball

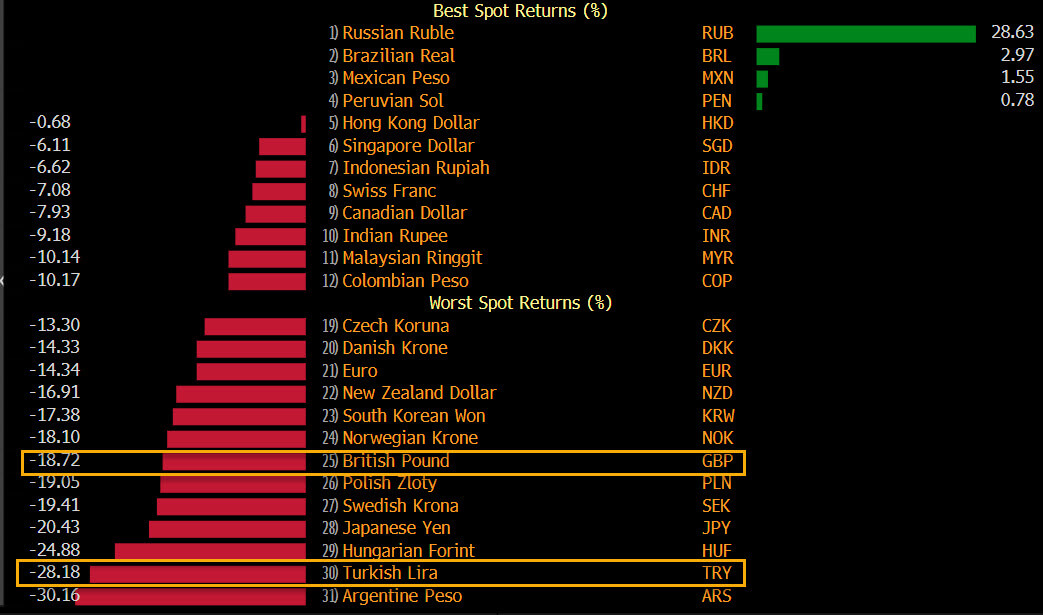

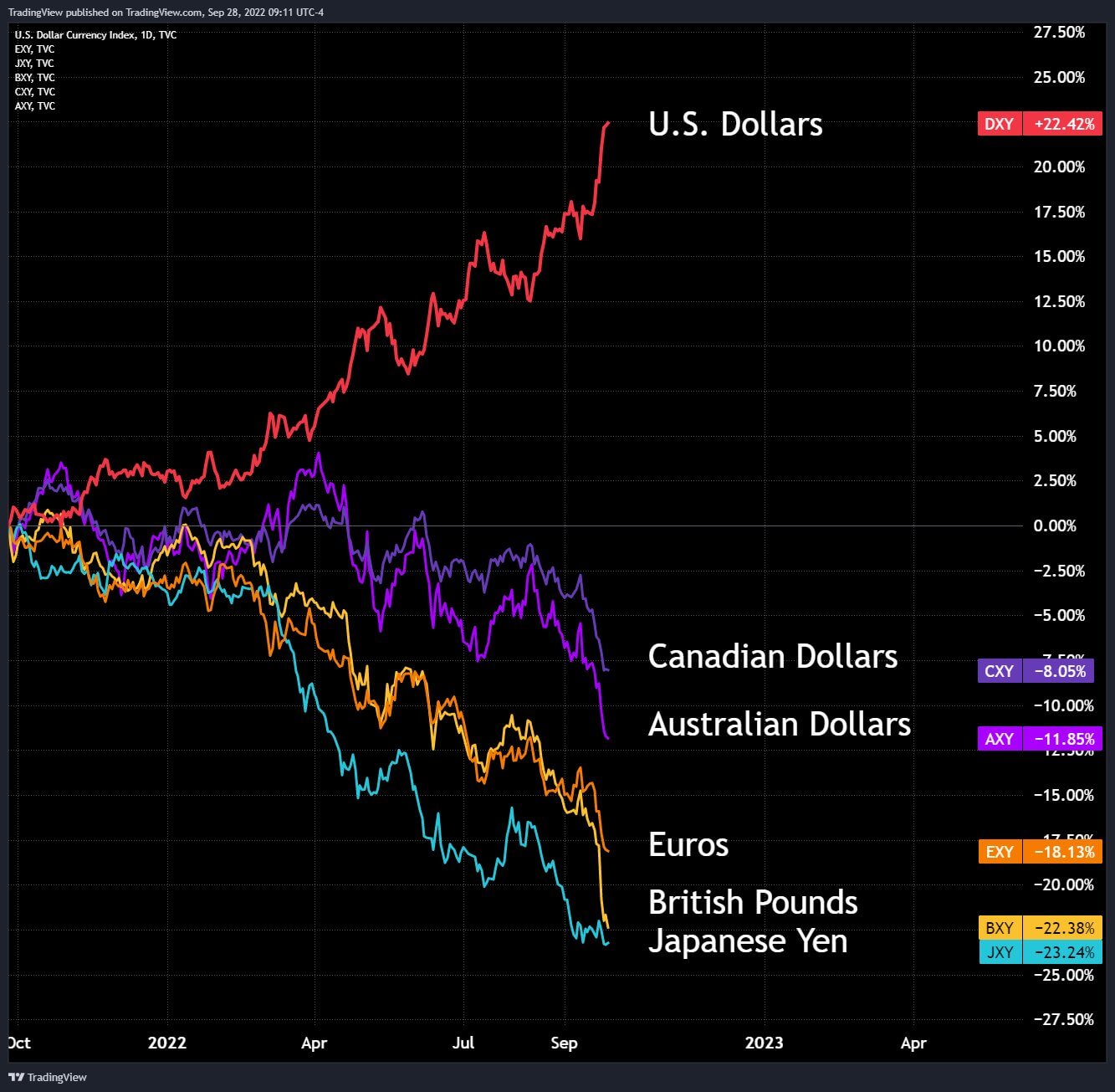

The DXY has been devastating in 2022; it’s up virtually 20%, leaving all main currencies in bother. Canadian and Australian {dollars} are down 8% and 11%, respectively, the Euro down 18%, whereas the British Pound and the Japanese Yen are down over 20% every.

Nevertheless, one foreign money has emerged victorious over the US greenback, the Russian Ruble, which is sort of up a whopping 30% on the DXY.

DXY milkshake concept

Because the DXY strengthens, this places strain on rising market currencies with US dollar-denominated liabilities. Whereas their foreign money weakens comparatively in opposition to the US greenback, it makes it tougher to fulfill the obligations of their funds in USD.

This in the end results in these markets printing extra of their foreign money, almost definitely resulting in hyperinflation (each fiat foreign money that has ever existed has failed with a median life expectancy of 27 years) or adoption of a US greenback normal, which we will see in El Salvador is making an attempt to maneuver away from by adopting Bitcoin.

CEO Santiago Capital Brent Johnson explains the failure of fiat currencies with a concept known as the greenback milkshake concept; the lack of fiat currencies will likely be attributable to an ever-increasing demand for US {dollars}, encompassed with a brief provide of {dollars}, when the Fed stops making new {dollars}, demand for present {dollars} goes up.

Equities & Volatility Gauge

The Commonplace and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant firms listed on exchanges in the USA. S&P 500 3,586 -2.41% (5D)

The Nasdaq Inventory Market is an American inventory alternate primarily based in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Trade. NASDAQ 10,971 -3.05% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, worry, or stress available in the market when making funding selections. VIX 32 -0.91% (5D)

The 2020s will likely be stuffed with volatility; fasten your seatbelts

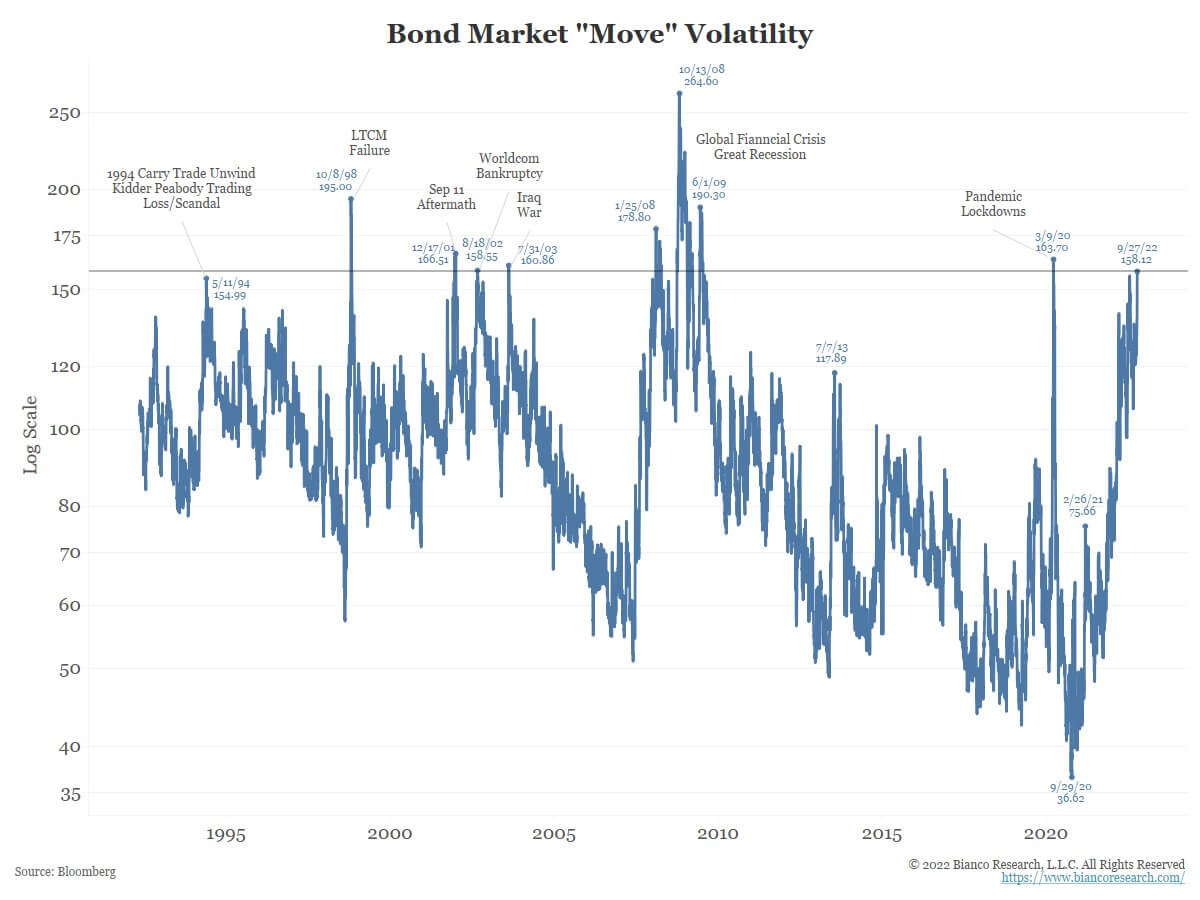

On Sept. 27, The Transfer index (the “VIX of the bond market”) closed at 158.12. That is the second-highest print in 13 years. Because the GFC, the one increased rating was the peak of the pandemic on March 9, 2020.

When the Transfer index exceeds 155, the Fed discusses the potential of chopping rates of interest to 0 or beginning their quantitative easing program. Nevertheless, this isn’t the case, the fed is within the midst of its quantitative tightening program, and the market remains to be pricing 4.25 – 4.5% rates of interest for the top of 2022.

How unhealthy is it on the market?

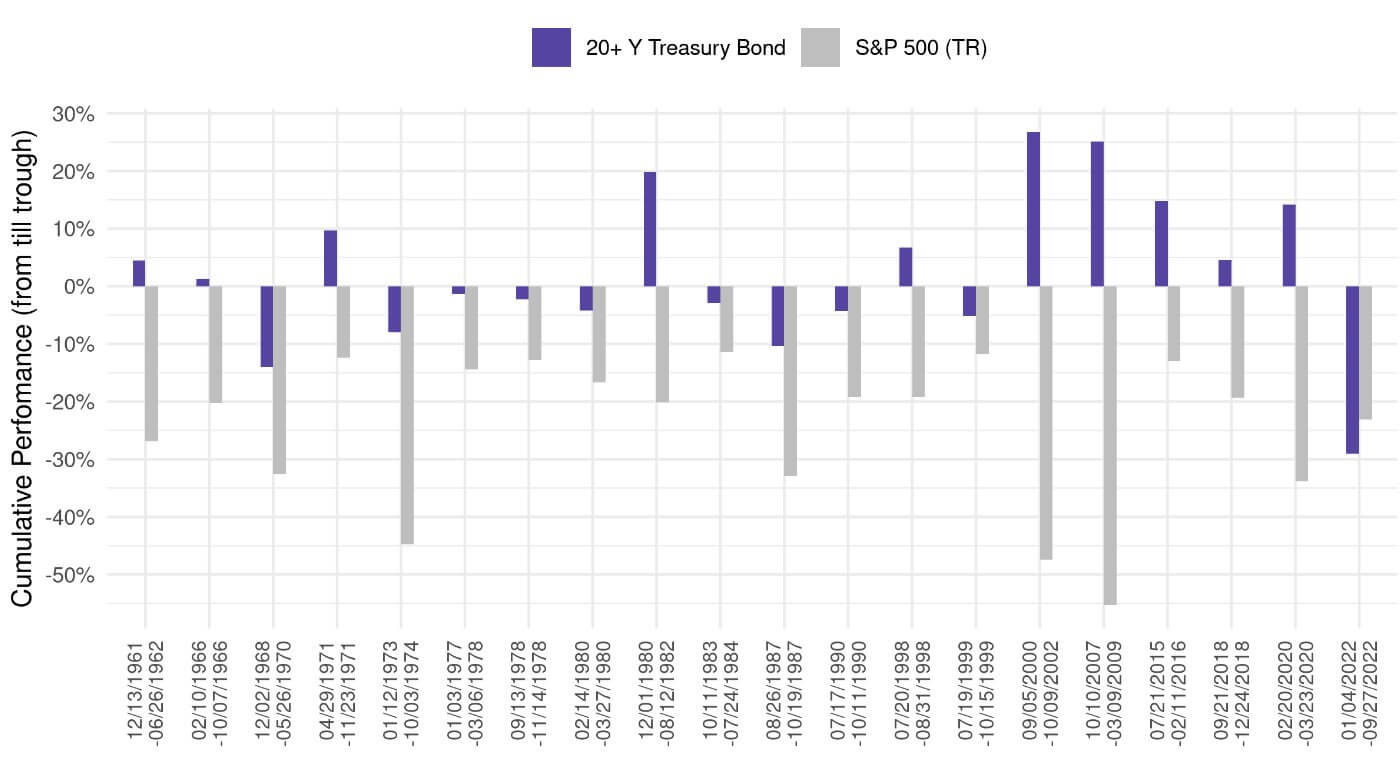

Final week’s report mentioned the the 60/40 portfolio, which had been at its worst efficiency since 1937. Beneath are the highest 20 peak-to-trough drawdowns for the S&P 500 going again to 1961. By no means, in historical past, when witnessing an excessive drawdown of shares, have US treasuries (the danger off asset) plunged greater than shares. If alarm bells aren’t ringing, they need to now.

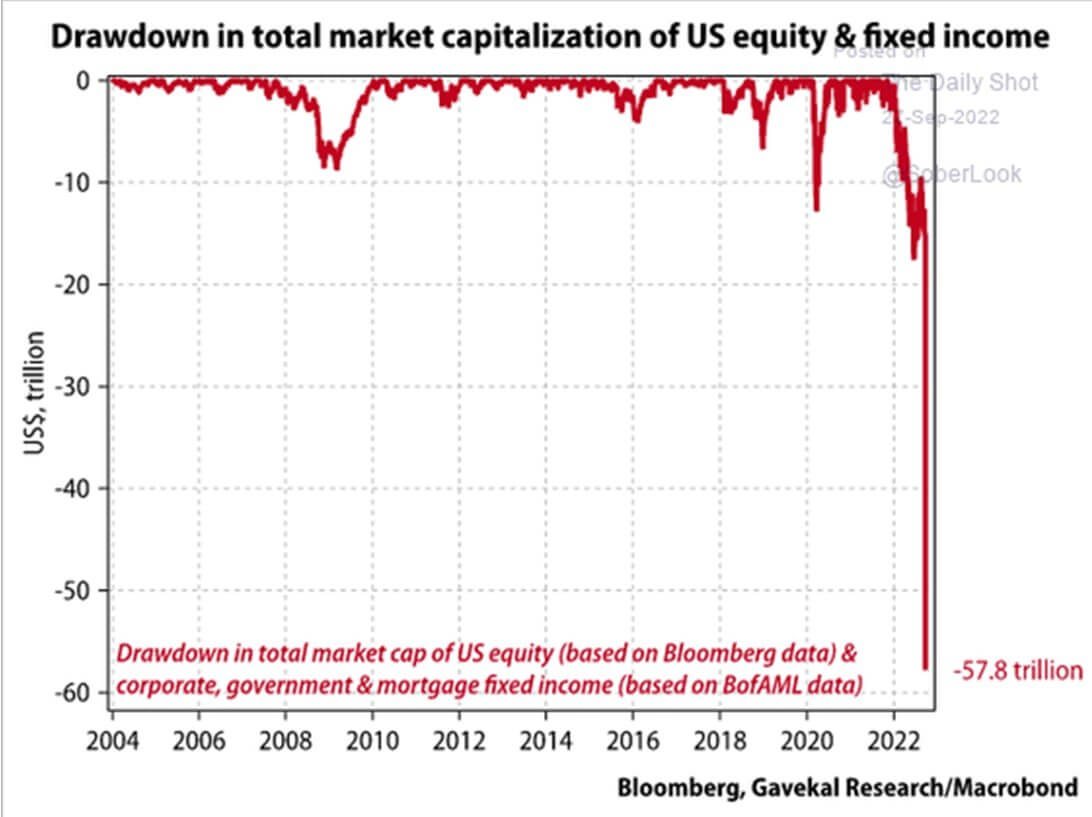

To strengthen the purpose above, virtually $60 trillion has been worn out in US shares and the fastened revenue market.

Commodities

Charges & Foreign money

The ten-year Treasury observe is a debt obligation issued by the USA authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury observe pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.8% 3.85% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign exchange. DXY 112.17 -0.72% (5D)

The UK is in turmoil

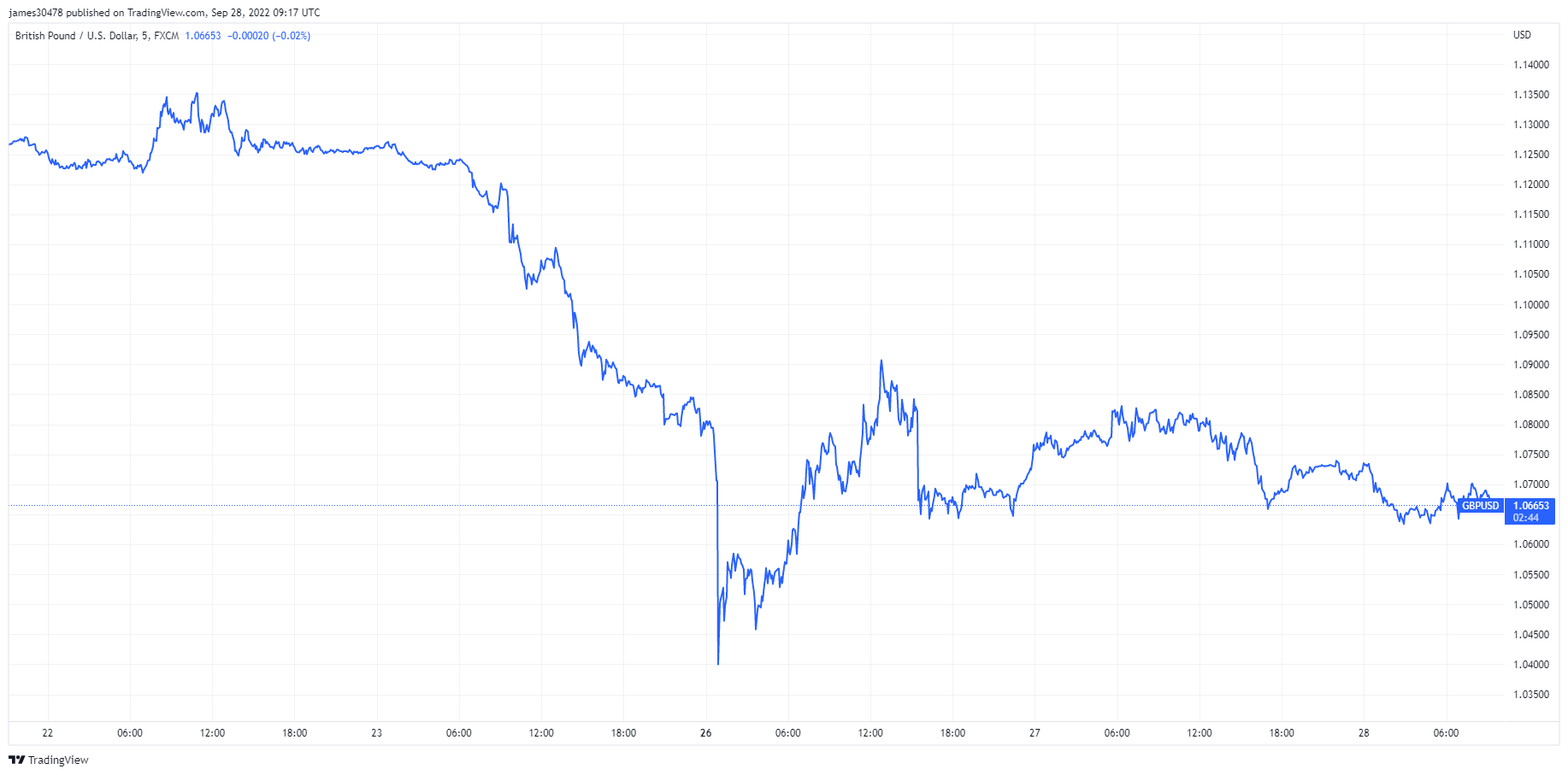

On Sept. 26, the British pound collapsed in opposition to the US greenback to 1.03, sinking to an all-time low. This was on the again of the chancellor unveiling a contemporary fiscal stimulus that may improve the UK’s estimated deficit by £72 billion, including gasoline to the inflation fireplace. The poor efficiency of the sterling was additionally coupled with a mere 50 bps hike by the BOE. Since then, the sterling has continued its collapse together with gilts and FTSE 100.

As the times continued, rumblings have been heard of emergency price hikes from the BOE to include sky-high inflation. Nevertheless, on Sept 28, the BOE carried out the momentary purchases of long-dated UK bonds doing the inverse of controlling inflation. This was a pivot from the BOE; for yields to be contained, quantitative easing needed to proceed, which might solely devalue the pound additional. The BOE is trapped, and all different main central banks might doubtless comply with swimsuit.

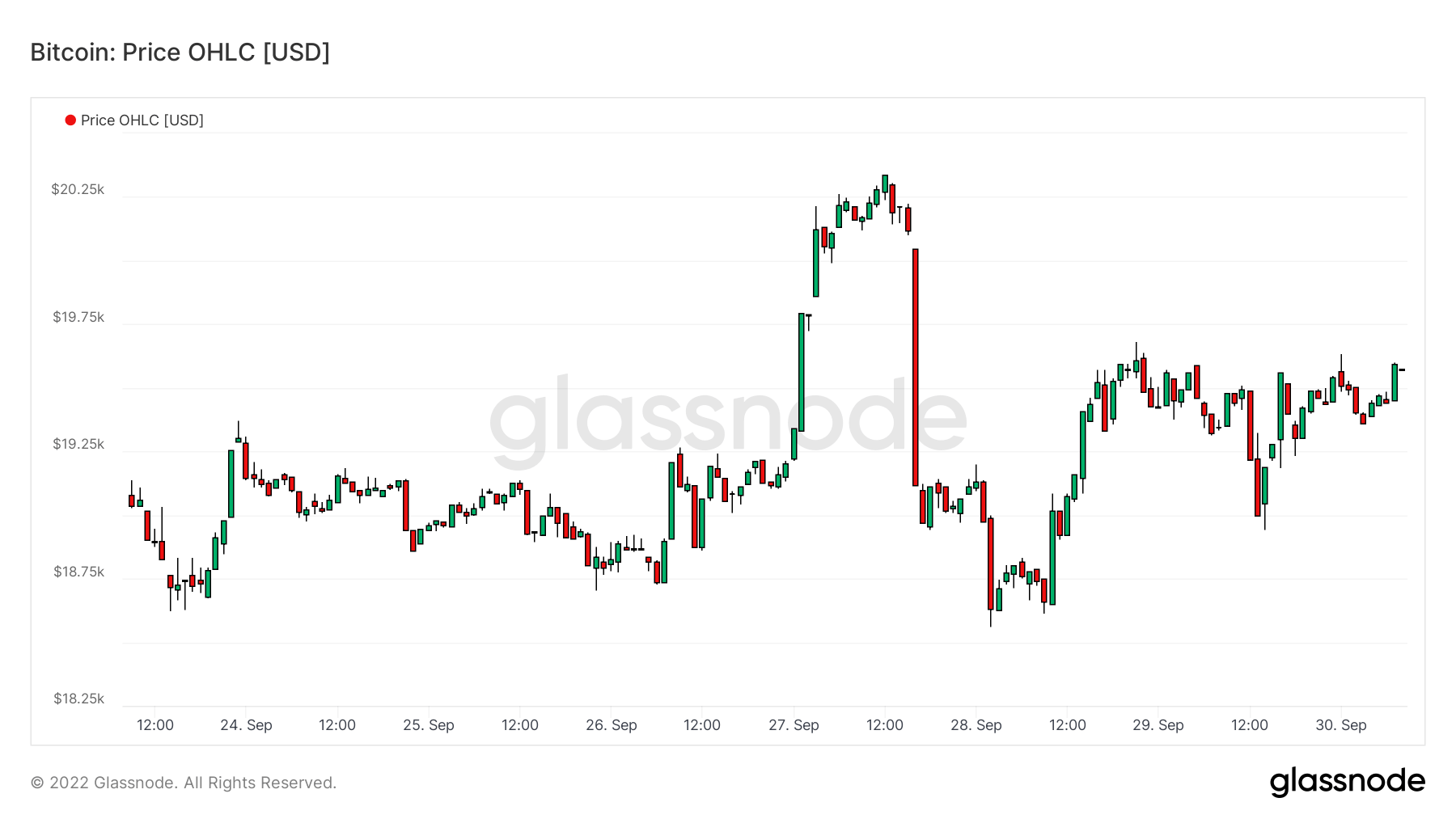

Did UK buyers hedge sterling collapse with Bitcoin?

With the pound plummeting to its 30-year low, folks flocked to exhausting belongings to keep away from main losses. On Sept. 26, the BTC/GBP buying and selling quantity soared over 1,200% as British pound holders started aggressively buying Bitcoin. This stands in sharp distinction to the BTC/USD pair, which has seen a comparatively flat buying and selling quantity on centralized exchanges all through the summer season.

British chancellor Kwasi Kwarteng’s newly imposed tax cuts and borrowing plans additional debased the pound and led to a pointy lower in U.Ok. authorities bonds. To guard their holdings from dangers related to inflation and rising rates of interest, most pension funds make investments closely in long-term authorities bonds. The Financial institution of England’s emergency measures are an try to supply help to hundreds of cash-strapped pension funds which can be in hazard of failing to fulfill margin calls.

Bitcoin Overview

The value of Bitcoin (BTC) in USD. Bitcoin Worth $19,170 -2.37% (5D)

The measure of Bitcoin’s complete market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 41% -0.26% (5D)

- Bitcoin has proven wonderful energy, buying and selling slightly below $20k for the week commencing Sept. 26

- Bitcoin is at present holding onto July lows, and if it have been to interrupt down decrease, a big hole happens right down to $12k

- Choices market is suggesting a constructive outlook for the top of This fall

- Small quantities of accumulation are occurring from long-term holders who’re at present holding the ground

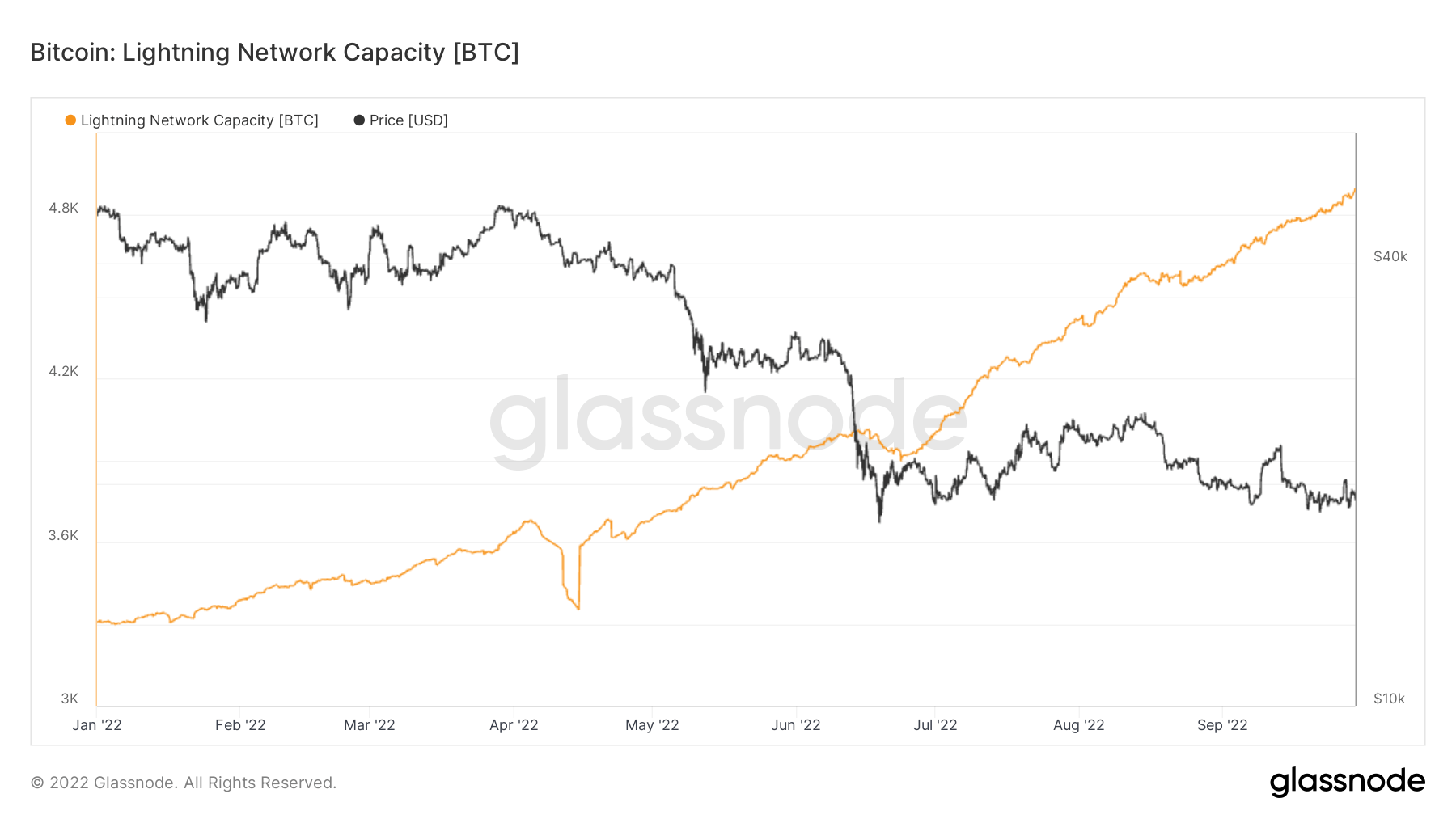

- Lightning community capability closes in on 5,000 BTC

Entities

Entity-adjusted metrics use proprietary clustering algorithms to supply a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that have been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which can be managed by the identical community entity and are estimated by superior heuristics and Glassnode’s proprietary clustering algorithms. Lively Entities 277,748 1.59% (5D)

The variety of BTC within the Objective Bitcoin ETF. Objective ETF Holdings 23,596 -0.07% (5D)

The variety of distinctive entities holding not less than 1k BTC. Variety of Whales 1,693 -0.29% (5D)

The full quantity of BTC held on OTC desk addresses. OTC Desk Holdings 3,020 BTC 25.68% (5D)

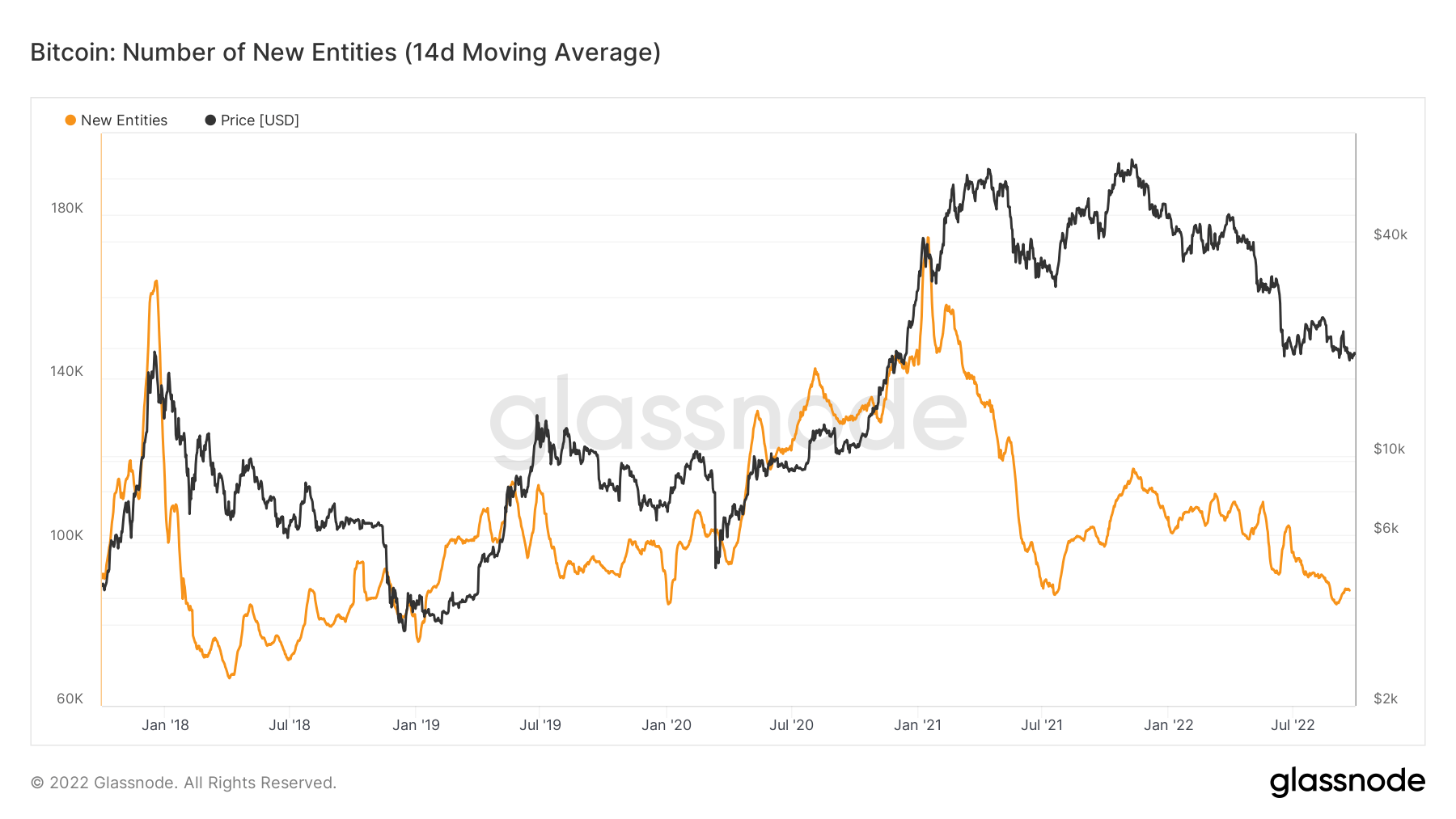

New entities sink to multi-year lows

The variety of distinctive entities that appeared for the primary time in a transaction of the native coin within the community. Entities are outlined as a cluster of addresses which can be managed by the identical community entity.

New entities have sunk to multi-year lows and re-tested a low seen throughout 2020, which tells us there isn’t a brand new inflow of members coming into the ecosystem. Nevertheless, we have been nonetheless increased than the earlier bear market cycle in 2018. From the information, new vacationers are coming in and staying; the community continues to place in the next excessive every cycle.

Dervatives

A by-product is a contract between two events which derives its worth/value from an underlying asset. The most typical forms of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/value from the underlying belongings.

The full quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $11.37B 3.91% (5D)

The full quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $46.51B $39.72 (5D)

The sum liquidated quantity (USD Worth) from brief positions in futures contracts. Complete Lengthy Liquidations $72.47M $0 (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Brief Liquidations $44.06M $0 (5D)

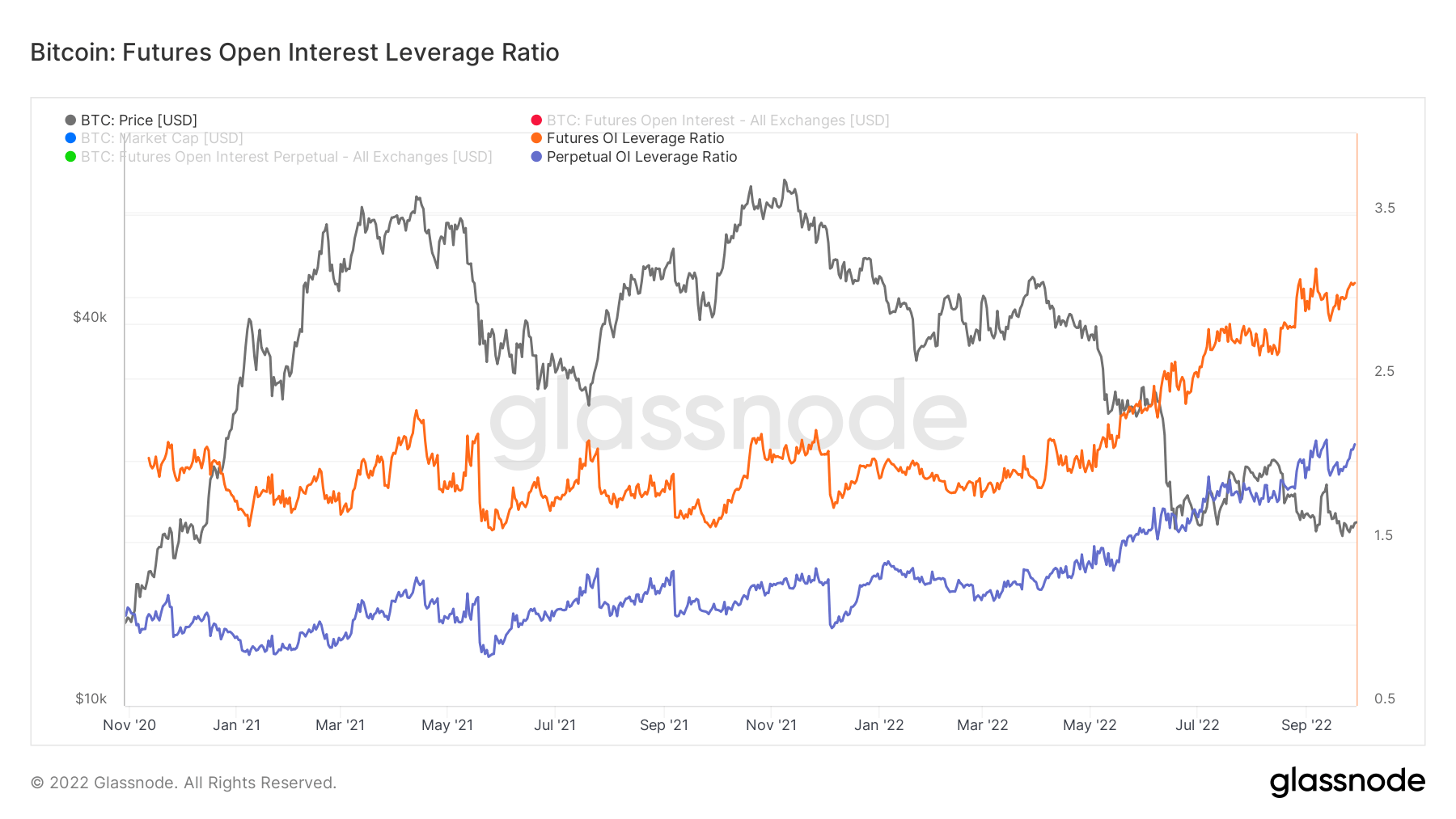

Volatility will proceed as future open curiosity soars

The Futures Open Curiosity Leverage Ratio is calculated by dividing the market open contract worth by the market cap of the asset (introduced as %). This returns an estimate of the diploma of leverage relative to market dimension to gauge whether or not derivatives markets are a supply of deleveraging threat.

- Excessive Values point out that futures market open curiosity is giant relative to the market dimension. This will increase the danger of a brief/lengthy squeeze, deleveraging occasion, or liquidation cascade.

- Low Values point out that futures market open curiosity is small relative to the market dimension. That is typically coincident with a decrease threat of derivative-led pressured shopping for/promoting and volatility.

- Deleveraging Occasions corresponding to brief/lengthy squeezes or liquidation cascades could be recognized by fast declines in OI relative to market cap and vertical drops within the metric.

Futures’ open curiosity leverage ratio is approaching all-time highs; this will increase the possibility of additional deleveraging and liquidations occasions. In the course of the Luna collapse and a number of insolvencies that befell from April – July 2022, a whole lot of leverage has been worn out, however it nonetheless appears a whole lot of threat urge for food exists.

Conventional finance is beginning to see a lot of its leverage unwind; it will likely be essential for Bitcoin to carry this value vary as the worth continues to be worn out in shares and fixed-income.

What’s the outlook for This fall?

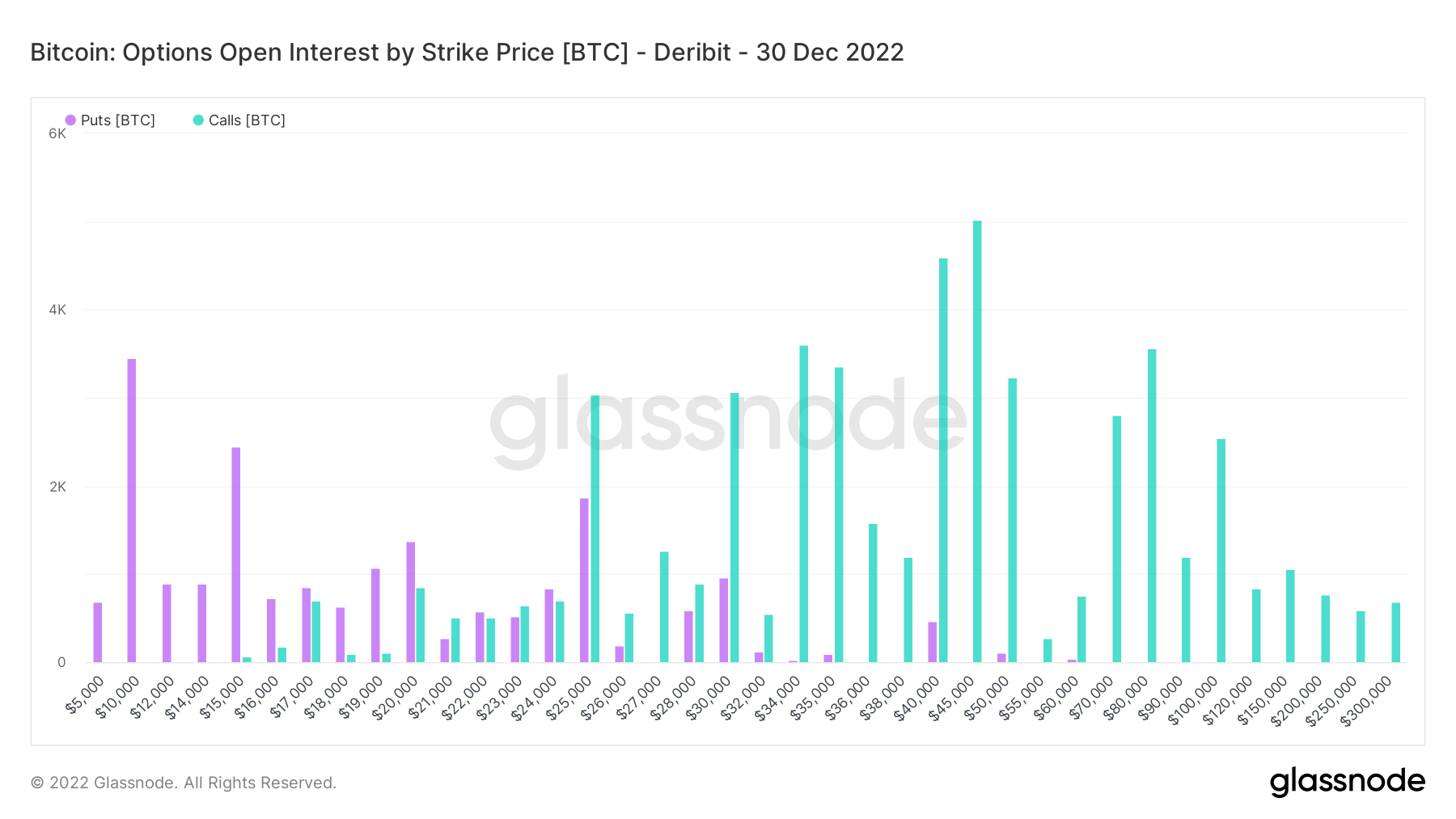

The full open curiosity of name and put choices by strike value for a particular choices contract. A name choice offers the holder the best to purchase a inventory, and a put choice offers the holder the best to promote a inventory.

Zooming into December 30, hundreds of requires over $35,000 a Bitcoin are encouraging. September has been a massacre for conventional finance but Bitcoin is barely down 2.5% and has held $18,000 firmly. Nevertheless, with earnings season on the horizon and bitter winter for Europe, it could be exhausting to see these numbers finish the 12 months.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

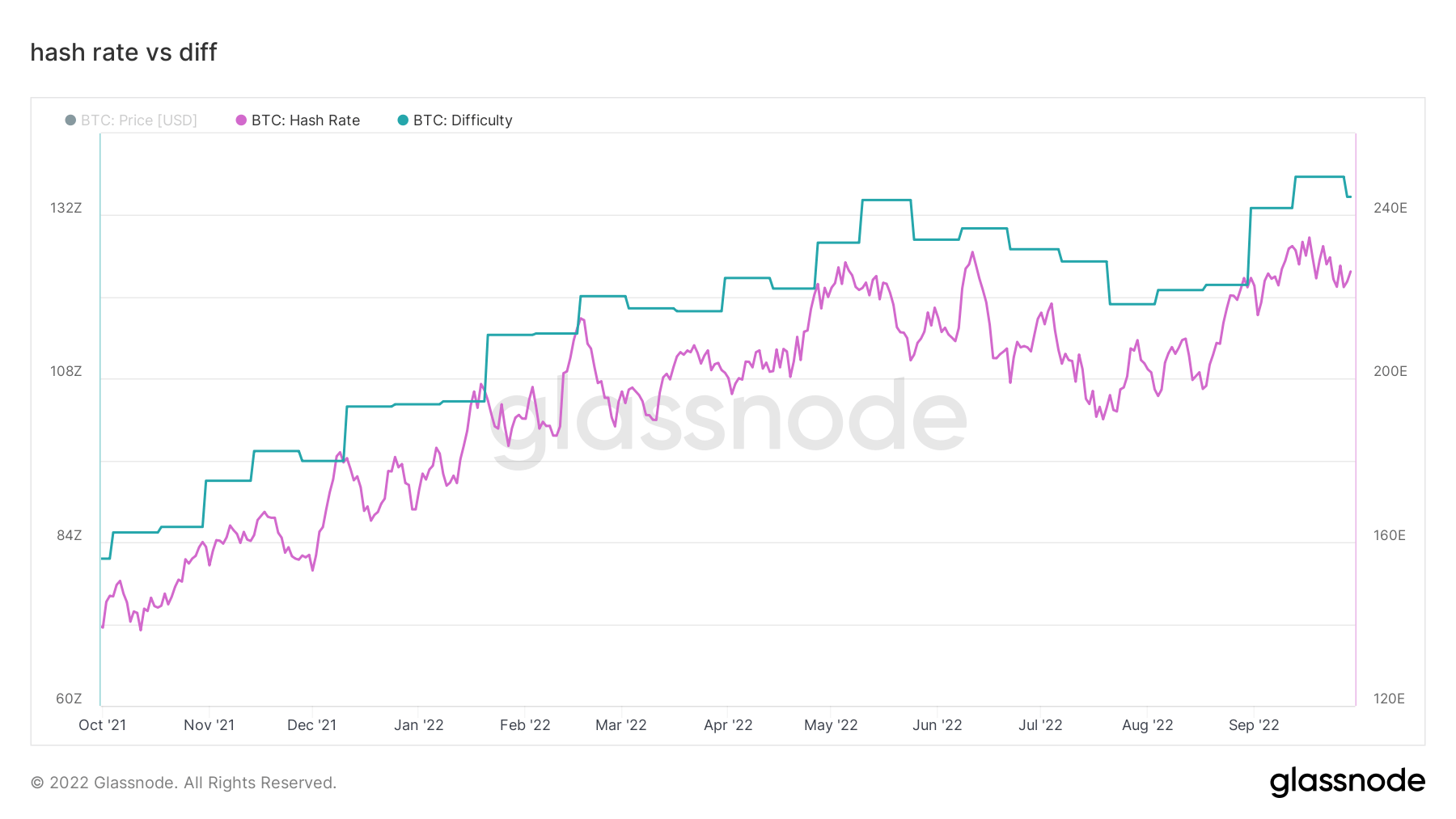

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 221 TH/s -3.91% (5D)

The present estimated variety of hashes required to mine a block. Be aware: Bitcoin problem is usually denoted because the relative problem with respect to the genesis block, which required roughly 2^32 hashes. For higher comparability throughout blockchains, our values are denoted in uncooked hashes. Problem 134 T -2.19% (14D)

The full provide held in miner addresses. Miner Stability 1,834,729 BTC -0.01% (5D)

The full quantity of cash transferred from miners to alternate wallets. Solely direct transfers are counted. Miner Web Place Change -23,635 BTC -5,946 BTC (5D)

Miners are feeling the strain.

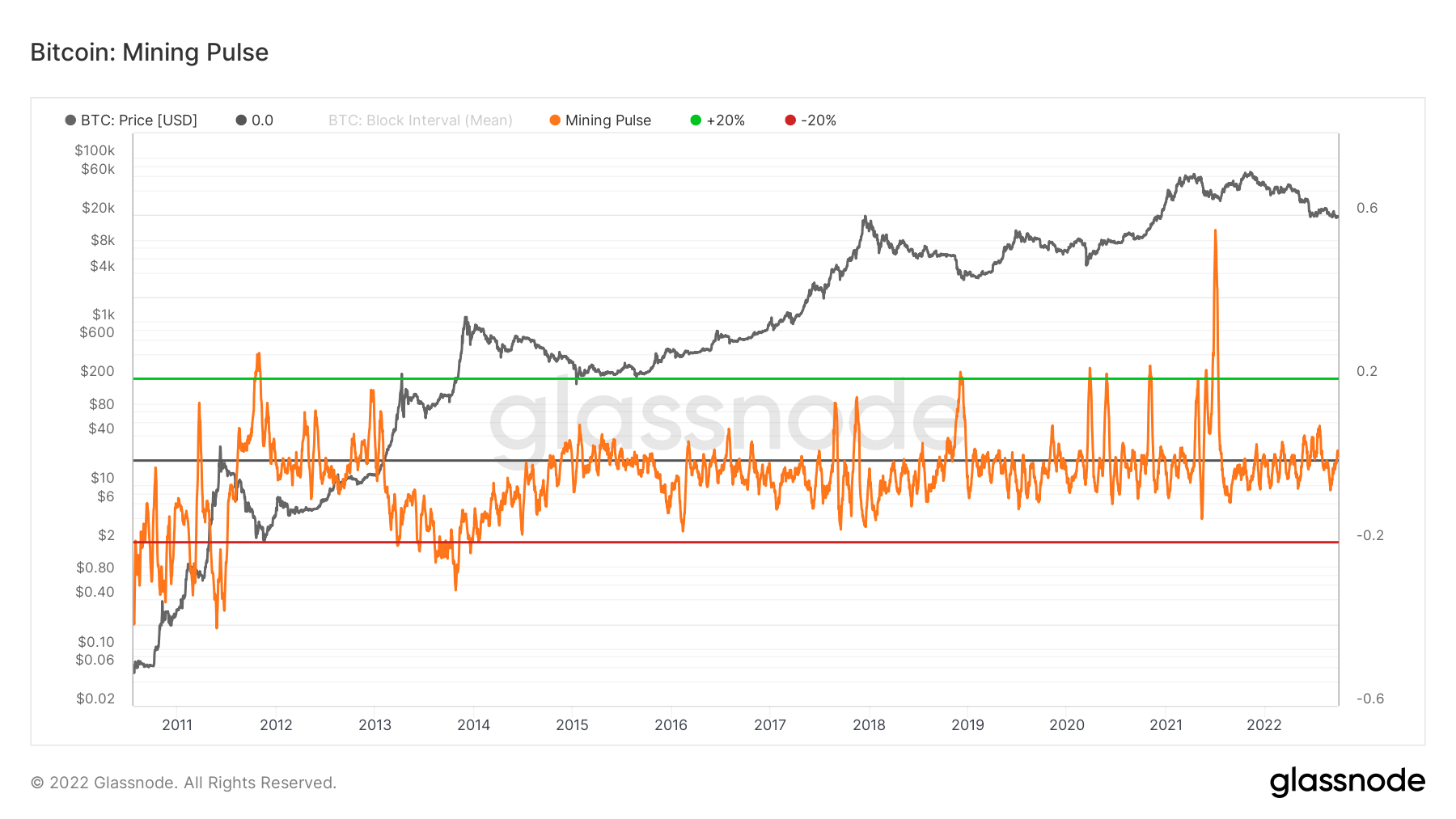

The Mining Pulse reveals the deviation between the 14-day common Block Interval and the goal time of 10 minutes. Values of the oscillator could be thought of as what number of seconds sooner (unfavourable) or slower (constructive) are blocks being mined relative to the goal block-time of 600s.

- Adverse values point out the noticed block time is sooner than the goal block time. This often happens when hash-rate development outpaces upward problem changes and suggests an growth of community hashpower is underway.

- Optimistic values point out the noticed block time is slower than the goal block time. This often happens when the hash price is slowing down greater than downwards problem changes, which means miners are coming offline.

At present, the mining pulse is marginally in constructive territory, which signifies the Bitcoin community is in a slower block time because the hash price hit an all-time excessive lately. Mining problem was additionally at an all-time excessive. Nevertheless, we are actually seeing declines in each. The Hash price has began to return down whereas problem has its first downwards adjustment since July.

As problem stays close to all-time highs, this may proceed to strain miners; anticipate to see problem proceed to drop whereas unprofitable miners proceed to get purged from the community. For the second half of 2022, now we have been above the mining pulse, which has additionally coupled with miner capitulation, miners should not out of the woods for the time being, however it seems to be a lot more healthy than it did in earlier weeks and months.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized alternate exercise.

The full quantity of cash held on alternate addresses. Trade Stability 2,413,528 BTC 22,005 BTC (5D)

The 30 day change of the provision held in alternate wallets. Trade Web Place Change 281,432 BTC 172,348 BTC (30D)

The full quantity of cash transferred from alternate addresses. Trade Outflows Quantity 185,654 BTC -12 BTC (5D)

The full quantity of cash transferred to alternate addresses. Trade Inflows Quantity 173,456 BTC -12 BTC (5D)

Diamond palms for mature holders

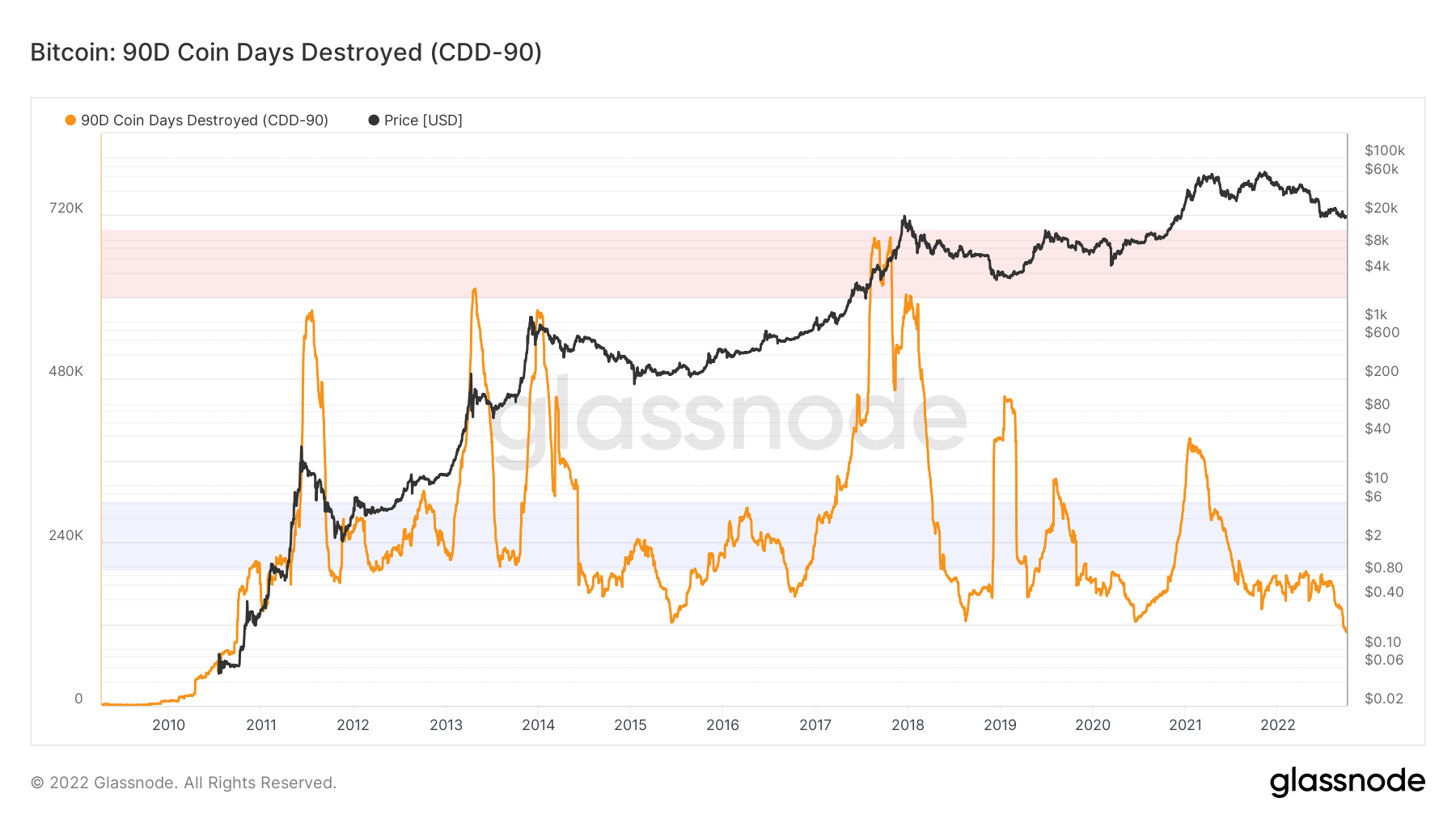

Coin Days Destroyed (CDD) for any given transaction is calculated by taking the variety of cash in a transaction and multiplying it by the variety of days since these cash have been final spent.

90D Coin Days Destroyed is the 90-day rolling sum of Coin Days Destroyed (CDD) and reveals the variety of coin days destroyed over the previous 12 months. This model is age-adjusted, which means that we normalize by time to account for the rising baseline as time goes by.

Coin days destroyed visualize the durations when previous and youthful cash have been spent. The metric is at an all-time low, demonstrating that mature cash are holding on to their Bitcoin and thus being the dominant habits for one of these investor. In the course of the bull runs of 2013, 2017, and 2021, CDD considerably elevated as one of these cohort offered for income. We’re amid bear market accumulation.

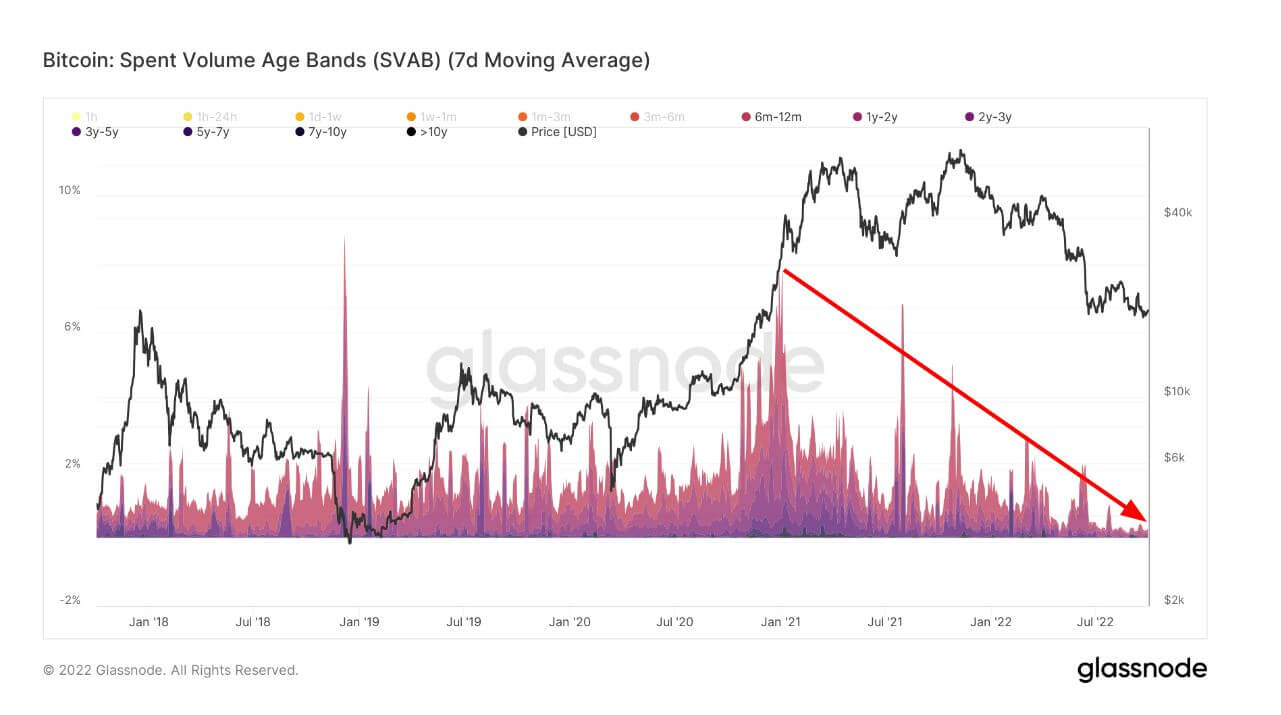

The metric spent quantity age bands help diamond palms from LTHs, separating the on-chain switch quantity primarily based on the cash’ age. Every band represents the proportion of the spent quantity beforehand moved inside the interval denoted within the legend.

LTHs (6+ months) are spending cash at an aggressive price through the peak of the 2021 bull run at the start of January at a excessive of just about 8% of the cohort. Nevertheless, as time goes on and the worth of Bitcoin has constantly dropped into 2022, mature palms are reluctant to promote BTC at this value vary as this HODLing habits has been one of many strongest for a few years.

Layer-2

Secondary layers, such because the Lightning Community, exist on the Bitcoin blockchain and permits customers to create cost channels the place transactions can happen away from the primary blockchain

The full quantity of BTC locked within the Lightning Community. Lightning Capability 4,903 BTC 3.24% (5D)

The variety of Lightning Community nodes. No. of Nodes 17,439 -0.11% (5D)

The variety of public Lightning Community channels. No. of Channels 83,555 -2.79% (5D)

Lightning community capability closes in on 5,000 BTC

One of many higher information tales this cycle is that the lightning community capability retains rising, hitting all-time highs every week, which is all pure natural development. We must always anticipate to cross the 5,000 BTC mark subsequent week.

Provide

The full quantity of circulating provide held by completely different cohorts.

The full quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.69M BTC 0.33% (5D)

The full quantity of circulating provide held by brief time period holders. Brief Time period Holder Provide 3.01M BTC -1.97% (5D)

The % of circulating provide that has not moved in not less than 1 12 months. Provide Final Lively 1+ Yr In the past 66% 0.15% (5D)

The full provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.78M BTC -0.17% (5D)

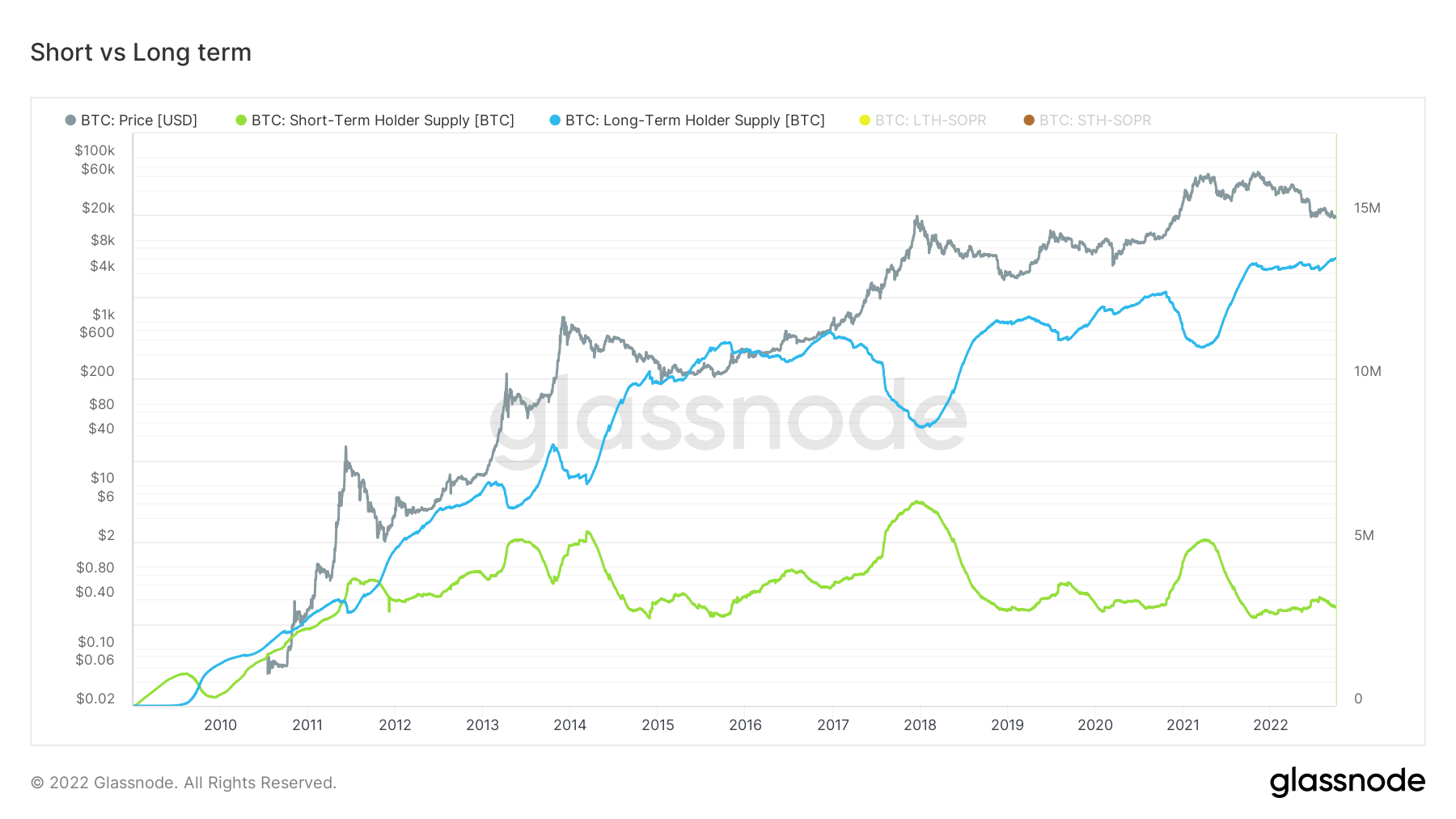

Lengthy vs. short-term holder provide

Lengthy-term holders are outlined as holders of Bitcoin for greater than 155 days and are thought of the good cash of the ecosystem and promote throughout bull runs however accumulate and maintain throughout bear markets. It is a constant method from this cohort, whereas the inverse happens with short-term holders as they’re extra susceptible to greenback worth.

All through BTC historical past, when peak bull runs happen, LTHs promote, however when bear markets come to the fold, they accumulate. That is taking place now, which is encouraging, holding over 13.6 million BTC, whereas STH’s beginning to promote and lowering their place dimension.

Cohorts

Breaks down relative habits by numerous entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value offered / value paid. Lengthy-term Holder SOPR 0.53 -7.02% (5D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes under consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of brief time period buyers. Brief-term Holder SOPR 0.99 1.02% (5D)

The Accumulation Pattern Rating is an indicator that displays the relative dimension of entities which can be actively accumulating cash on-chain when it comes to their BTC holdings. The dimensions of the Accumulation Pattern Rating represents each the dimensions of the entities steadiness (their participation rating), and the quantity of recent cash they’ve acquired/offered during the last month (their steadiness change rating). An Accumulation Pattern Rating of nearer to 1 signifies that on mixture, bigger entities (or a giant a part of the community) are accumulating, and a worth nearer to 0 signifies they’re distributing or not accumulating. This offers perception into the steadiness dimension of market members, and their accumulation habits during the last month. Accumulation Pattern Rating 0.420 -2.33% (5D)

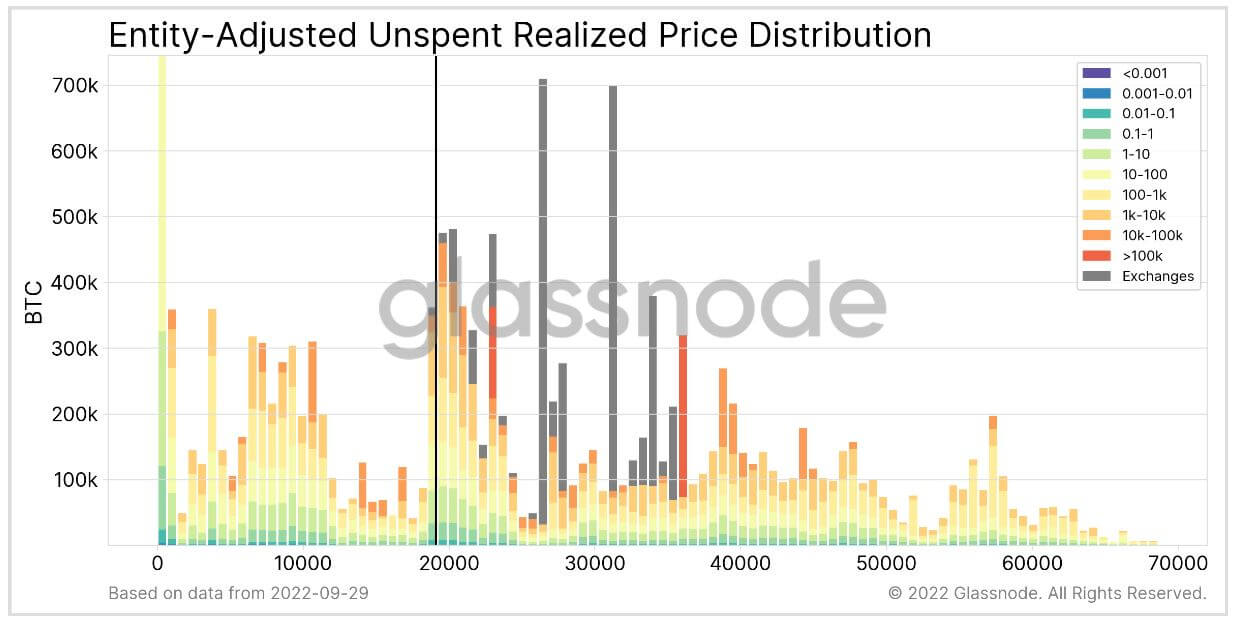

Look down beneath – $12k BTC is feasible

The URPD metric is a instrument that reveals at which costs the present set of Bitcoin UTXOs have been created, i.e., every bar reveals the variety of present bitcoins that final moved inside that specified value bucket. The next metrics are a collection of variants that additional break down the information, taking a look at particular market cohorts.

On this model, the provision is segmented in accordance with the full steadiness of the proudly owning entity. This makes it attainable to differentiate “whales” from “fish.” Exchanges are handled individually (gray). All provide is proven within the value bucket at which the respective entity has (on common) acquired its cash.

The black vertical bar reveals the market value on the chart manufacturing timestamp.

An ample provide hole happens beneath the June low of $17.6k right down to the vary of $10-$12k. Loads of the provision that has been purchased across the $20k are buyers with lower than 1 Bitcoin; this might spell bother if Bitcoin have been to go decrease, and this cohort would expertise an additional unrealized loss which may set off an additional draw back.

Stablecoins

A kind of cryptocurrency that’s backed by reserve belongings and due to this fact can supply value stability.

The full quantity of cash held on alternate addresses. Stablecoin Trade Stability $39.95B -0.16% (5D)

The full quantity of USDC held on alternate addresses. USDC Trade Stability $2.15B -1.11% (5D)

The full quantity of USDT held on alternate addresses. USDT Trade Stability $17.5B -0.16% (5D)

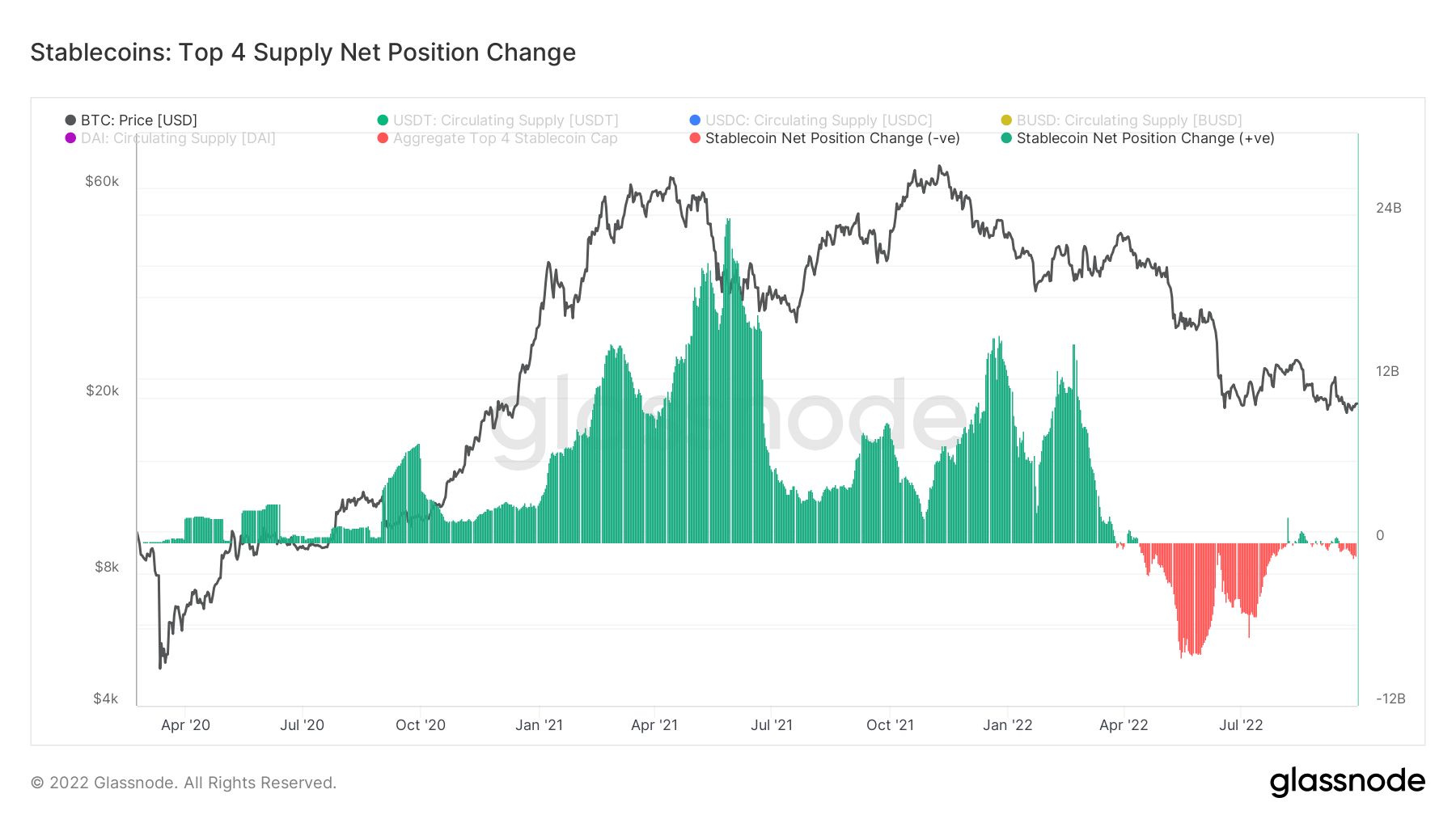

Stablecoin exercise is muted, which is a constructive signal

This chart reveals the 30-day web change within the provide of the highest 4 stablecoins USDT, USDC, BUSD, and DAI. Be aware that the provides of those stablecoins are distributed between a number of host blockchains, together with Ethereum.

2021 was a momentous 12 months for stablecoins particularly, which noticed an enormous quantity of stablecoins flowing onto exchanges as defi took off. Figuring out the highest 4 stablecoins, USDT, USDC, DAI, and BUSD, as much as $24 billion have been flowing on the peak in the midst of 2021.

Nevertheless, 2022 has been a unique story: many withdrawals and uncertainty. This has been coupled with macro uncertainty and the collapse of Luna. Since August, withdrawals have declined dramatically. It is rather a lot muted exercise which is constructive to see on this market atmosphere.