As Bitcoin’s quick stint under $40,000 induced fairly a stir out there, one might anticipate that its restoration to $42,000 would have induced a spike in retail buying and selling exercise. With short-term holders making up nearly all of what we name “retail” merchants, a fast soar in Bitcoin’s worth would often trigger a notable spike in exercise among the many cohort.

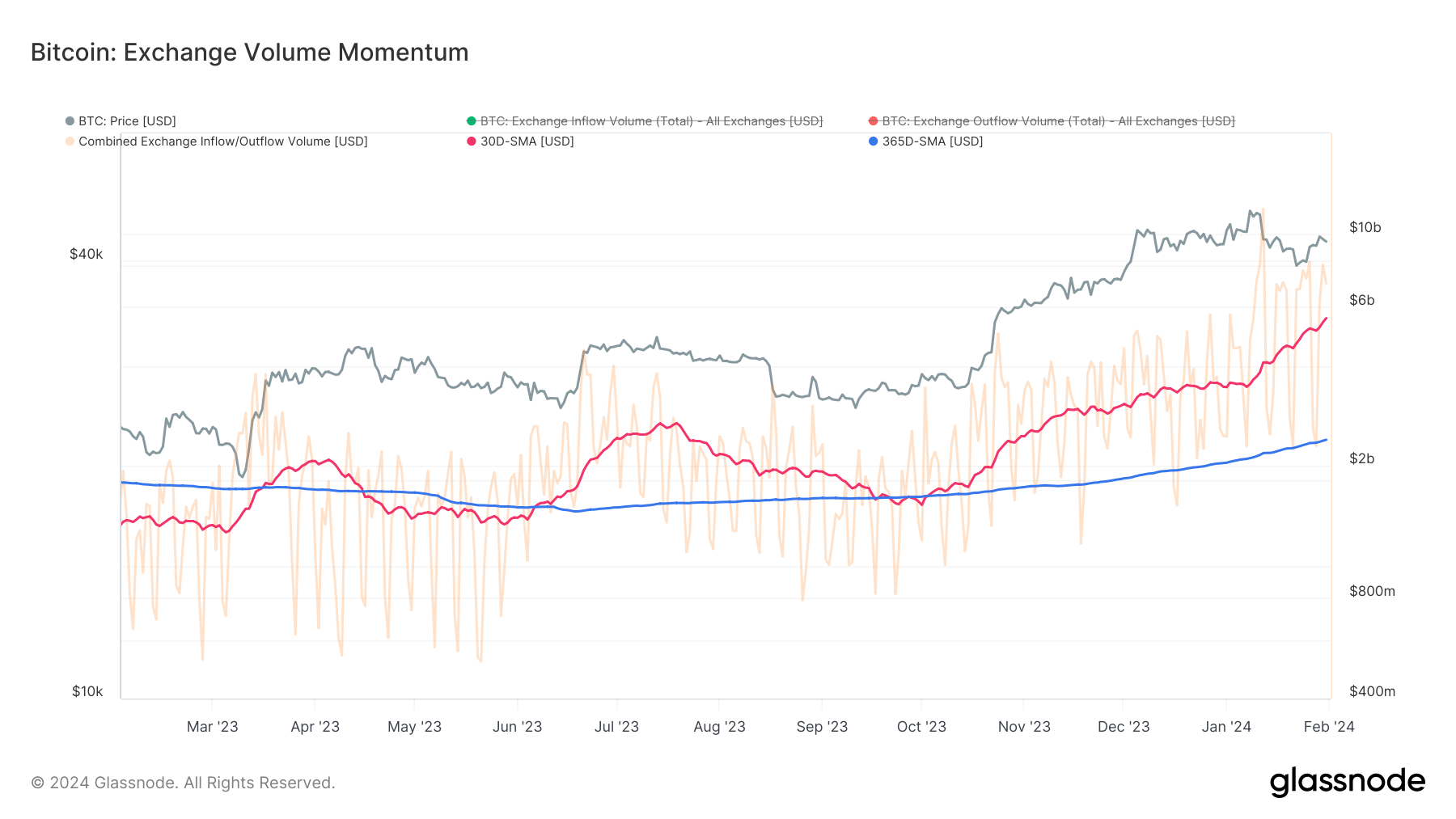

In keeping with information from Glassnode, alternate deposit and withdrawal volumes crossed $8 billion on Jan. 30. Whereas that is decrease than the 31-month excessive of $11.86 billion recorded on Jan. 12, it nonetheless represents considerably excessive volumes for this a part of the market cycle.

The 30-day easy transferring common (SMA) of alternate quantity reached $5.65 billion on Jan. 30 — ranges beforehand seen throughout the 2021 bull market when Bitcoin’s worth hovered between $60,000 and $64,000.

Diving deeper into on-chain information permits us to grasp higher the place the quantity is coming from.

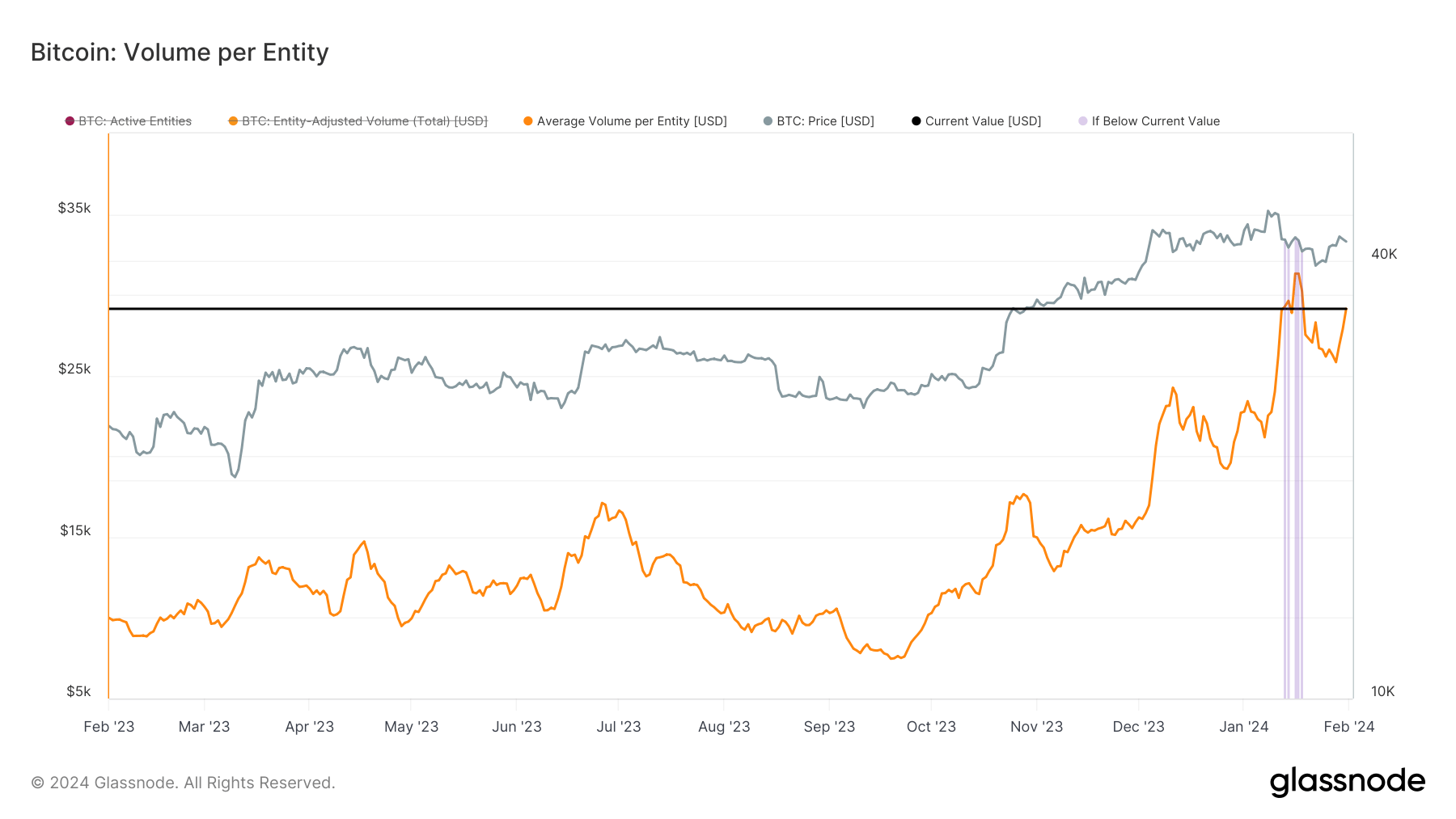

Glassnode’s information confirmed a rising variety of massive entities out there. Its information tracks the entity-adjusted quantity of Bitcoin transactions and divides it by the variety of lively entities on the Bitcoin community to get a mean quantity per lively entity.

The declining variety of lively entities out there has led to a major spike within the common quantity per entity since September 2023, peaking at $31,318 on Jan. 16. As of Jan. 31, the typical quantity per entity stands at $29,136.

Whales, addresses holding over 1,000 BTC, have additionally seen a burst of exercise this yr, with switch volumes to exchanges considerably larger than final yr’s common volumes. Whale deposits to exchanges peaked on Jan. 12 with 79,228 BTC, a day after ETF buying and selling started within the U.S. On Jan. 31, whales deposited 43,556 BTC to exchanges.

The rising spot Bitcoin ETF quantity and inflows within the U.S. definitely added to this improve in common quantity, because the creation and redemption mechanism for ETF contracts depends on massive transactions from APs.

This reveals a rising presence of enormous gamers within the area, with establishments and whales on the helm.

The submit Whales and establishments lead the cost in Bitcoin’s alternate quantity surge appeared first on CryptoSlate.